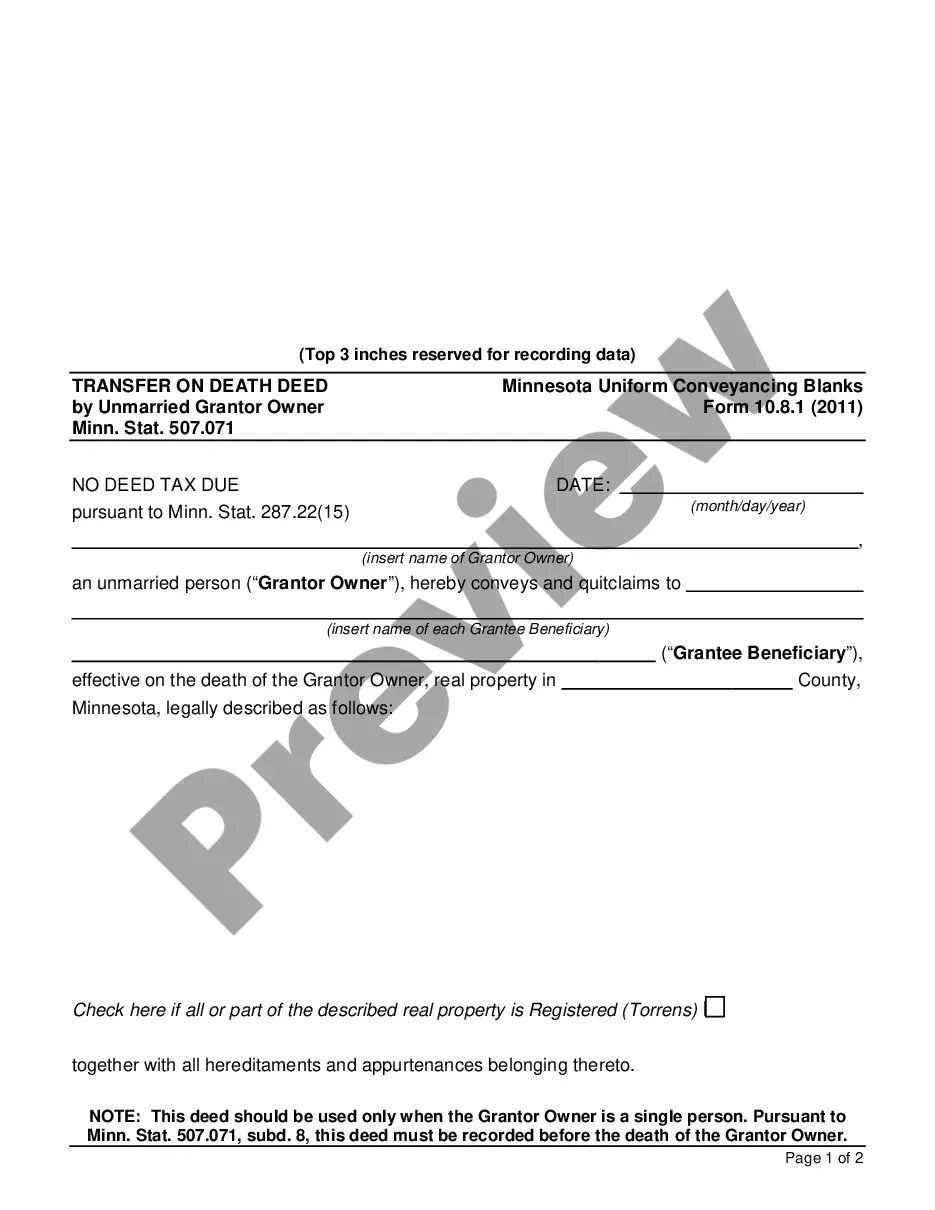

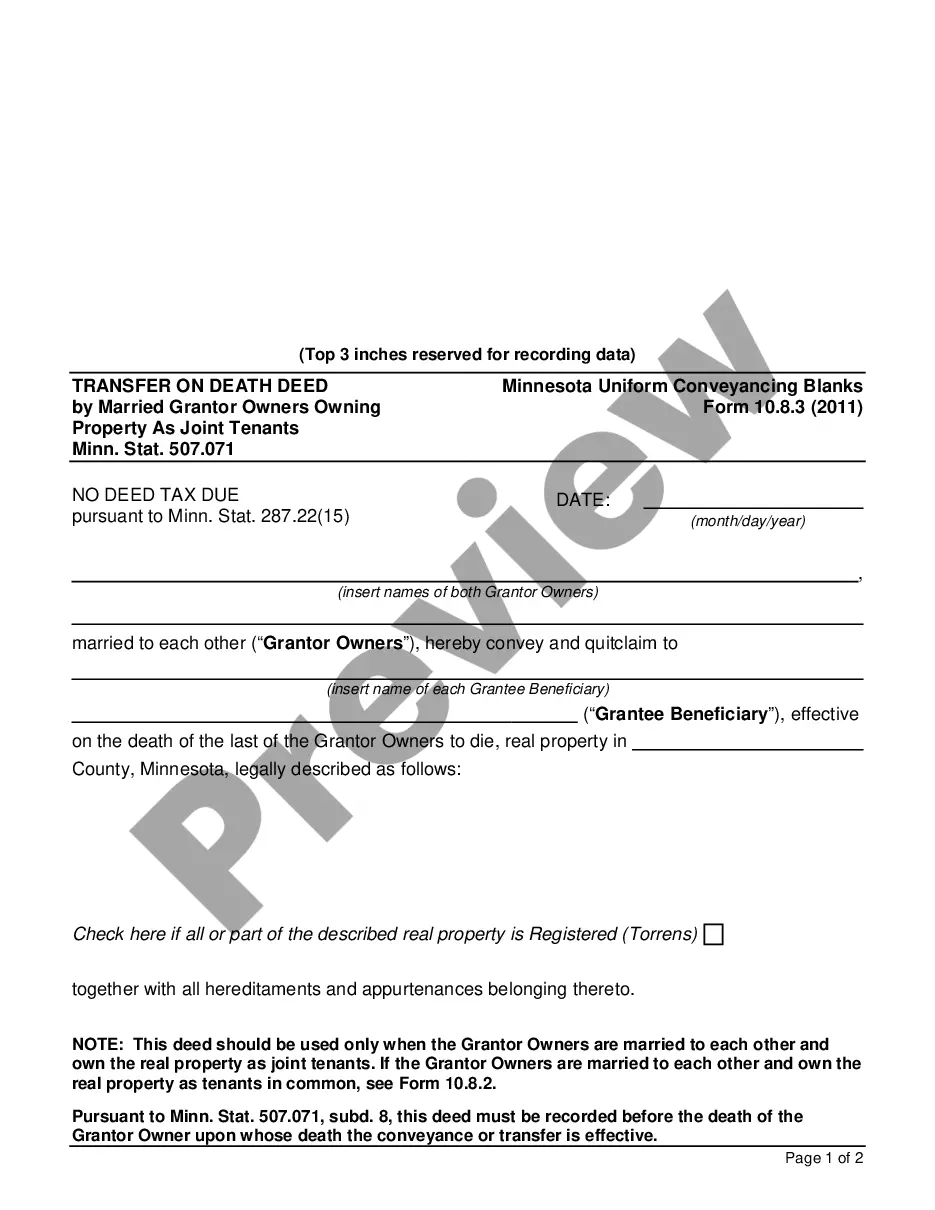

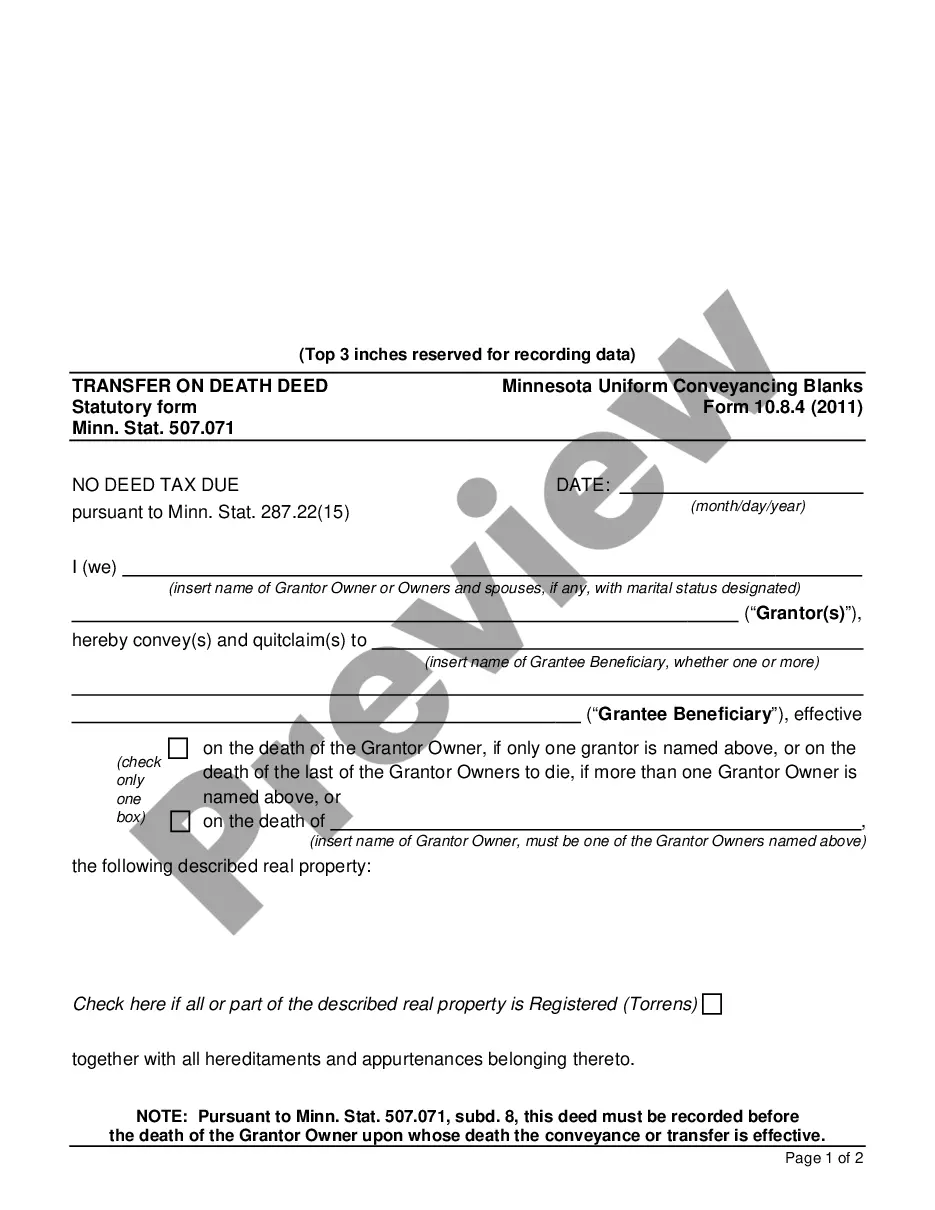

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071

Description

How to fill out Minnesota Transfer On Death Deed By Married Grantor Owner Who Is Sole Spouse In Title Minn. Stat. 507.071?

Obtain any version from 85,000 legitimate records, including Minnesota Transfer on Death Deed by Married Grantor Owner who is the sole spouse in title Minn. Stat. 507.071 online with US Legal Forms. Each template is composed and revised by state-licensed lawyers.

If you possess a subscription, Log In. After reaching the form’s page, click the Download button and navigate to My documents to gain access to it.

If you haven't subscribed yet, adhere to the guidelines outlined below.

With US Legal Forms, you will consistently have immediate access to the suitable downloadable sample. The platform provides access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Transfer on Death Deed by Married Grantor Owner who is the sole spouse in title Minn. Stat. 507.071 swiftly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Transfer on Death Deed by Married Grantor Owner who is the sole spouse in title Minn. Stat. 507.071 that you need to utilize.

- Examine the description and preview the template.

- Once you are assured that the sample meets your requirements, simply click Buy Now.

- Select a subscription plan that fits your financial capacity.

- Establish a personal account.

- Make a payment using one of two convenient methods: by card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable template is prepared, print it or save it to your device.

Form popularity

FAQ

While the Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 offers benefits, it also has some disadvantages. For instance, this deed does not shield the property from creditors, and it may complicate the estate if not properly executed. Additionally, if the grantor becomes incapacitated, the transfer might not occur as intended. Understanding these nuances is crucial, and US Legal Forms can assist you in navigating these complexities.

You should file the Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 at the county recorder's office in the county where your property is situated. It is essential to ensure the deed is filed correctly to make it legally valid. Each county may have specific requirements, so it’s wise to check with your local office. US Legal Forms offers resources to help you determine the right filing process for your area.

To file a Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071, you must first complete the deed form, ensuring all required information is included. After that, you need to sign the deed in front of a notary public. Finally, file the completed deed with the county recorder's office in the county where the property is located. Using US Legal Forms can streamline this process with easy-to-use templates and guidance.

To record a Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title under Minn. Stat. 507.071, you must file the completed deed with the county recorder where the property is located. This step ensures the deed is officially recognized and enforceable. It is advisable to do this as soon as possible after completing the deed to avoid any complications later. Platforms like USLegalForms can provide you with the necessary resources and templates to facilitate the recording process.

Filling out a Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title under Minn. Stat. 507.071 involves providing essential information, such as the grantor's name, the beneficiary's name, and a legal description of the property. It is crucial to follow the required format to ensure validity. If you prefer a straightforward approach, using USLegalForms can guide you through each step, making the process easier and more efficient. Completing the deed correctly is essential for a smooth transfer of property.

You do not necessarily need a lawyer to file a Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title under Minn. Stat. 507.071. However, consulting with a legal professional can provide clarity and ensure that all requirements are met. Using a platform like USLegalForms can simplify the process, offering templates and guidance for accurate completion. Ultimately, having expert advice can help you avoid potential pitfalls and ensure that your deed is valid.

The Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title under Minn. Stat. 507.071 allows property to transfer directly to a designated beneficiary upon the grantor's death. This deed helps avoid probate, making the process easier for your loved ones. Essentially, it enables married couples to retain control of their property during their lifetime while ensuring a smooth transition after death. By utilizing this deed, you can simplify inheritance for your spouse and ensure their financial security.

Yes, Minnesota allows a transfer on death deed, specifically under Minn. Stat. 507.071. This legal tool enables a married grantor owner, who is the sole spouse on the title, to transfer property directly to their beneficiaries upon death without the need for probate. By using the Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071, you can simplify the process of property transfer and ensure your wishes are honored. For more information and assistance, consider exploring the services offered by uslegalforms, which can guide you through the necessary steps.

The transfer-on-death deed by married grantor owners owning property as joint tenants allows for a seamless transfer of property ownership upon death. In this case, the Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 lets the surviving spouse automatically receive full ownership without going through probate. This method simplifies the transition and ensures that the property remains within the family. Using a reliable service like uslegalforms can help you navigate the specifics of this process.

While a Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 offers benefits like avoiding probate, it also has potential downsides. For instance, it may not provide the same level of control as a living trust, as the transfer occurs automatically upon death. Additionally, if you have debts or need to sell the property during your lifetime, complications could arise. Understanding these disadvantages is essential for making an informed decision.