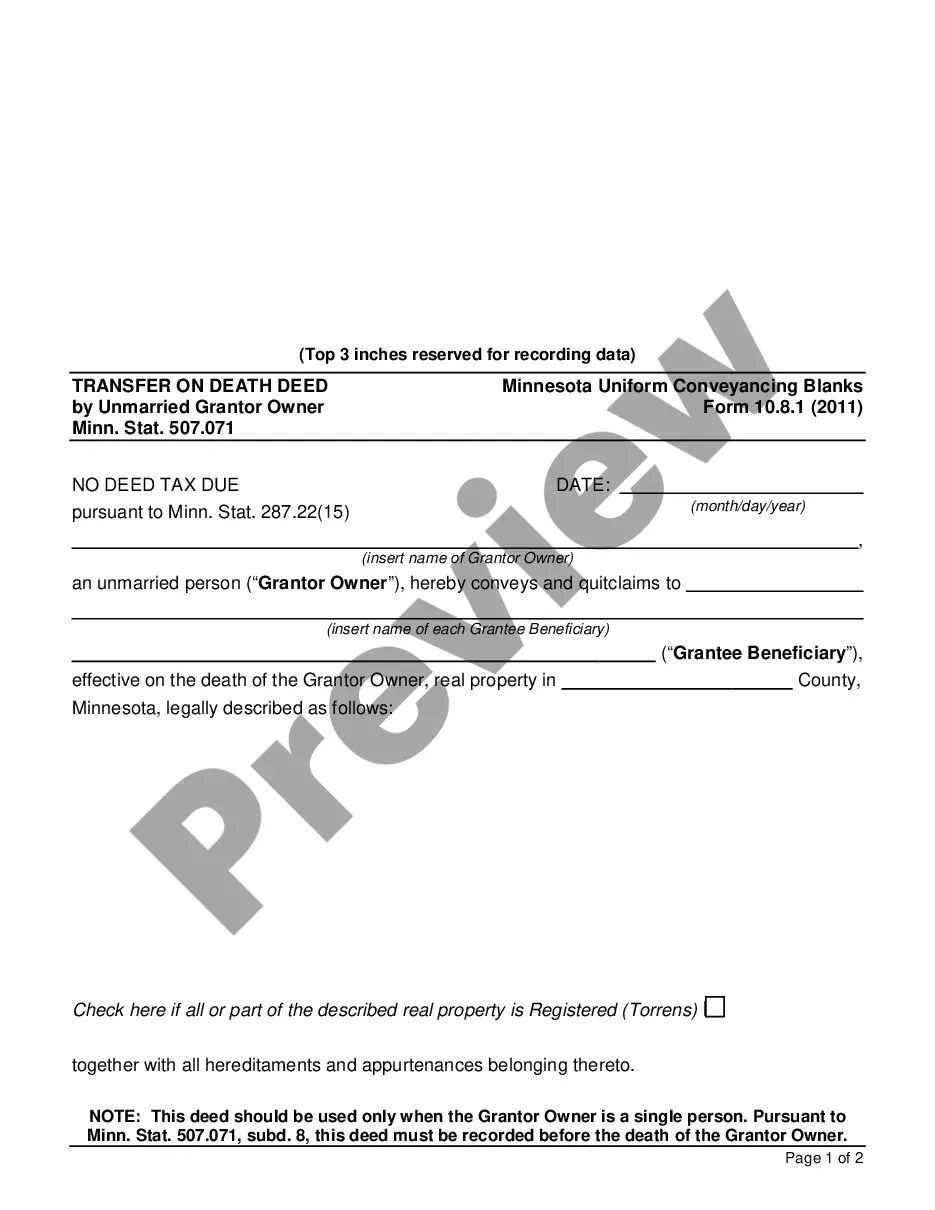

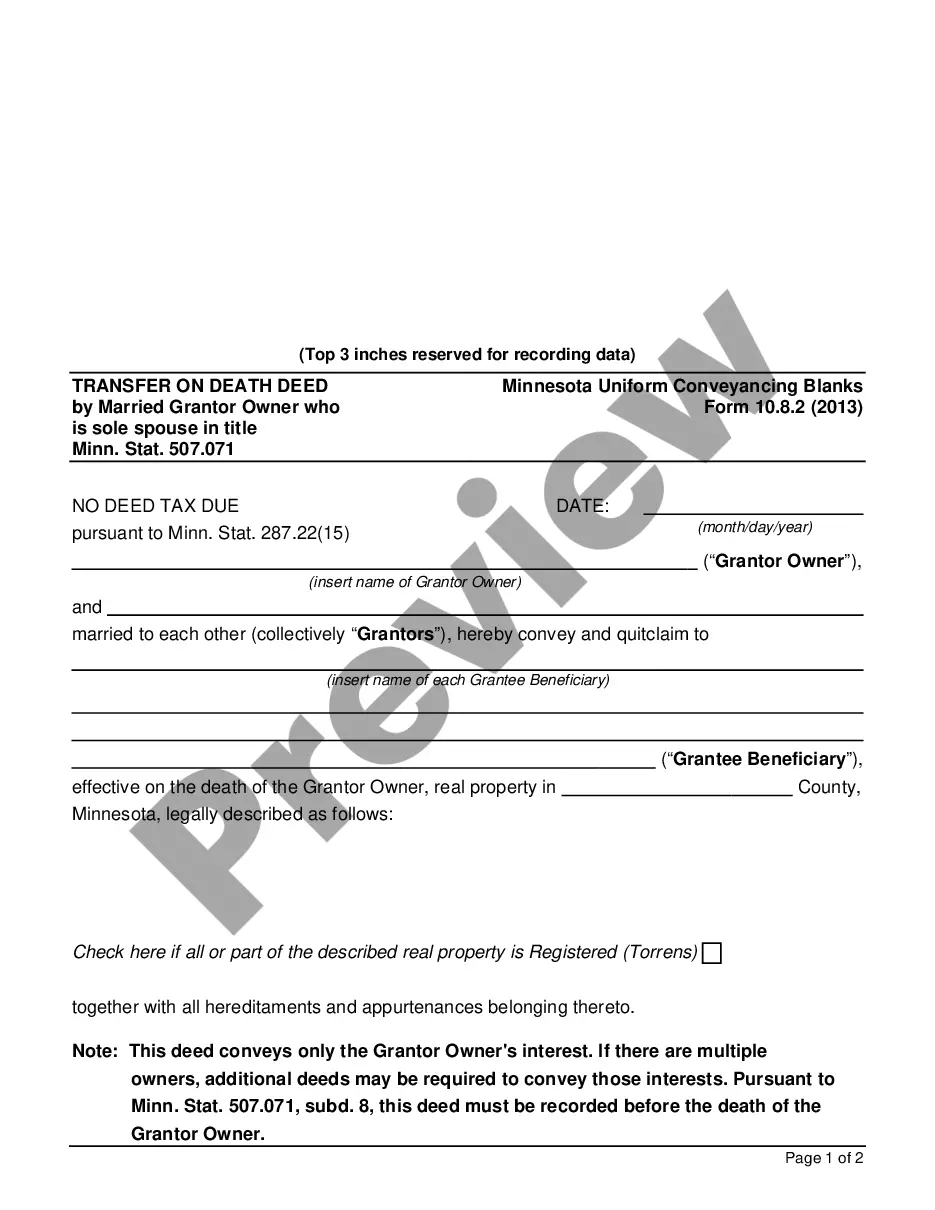

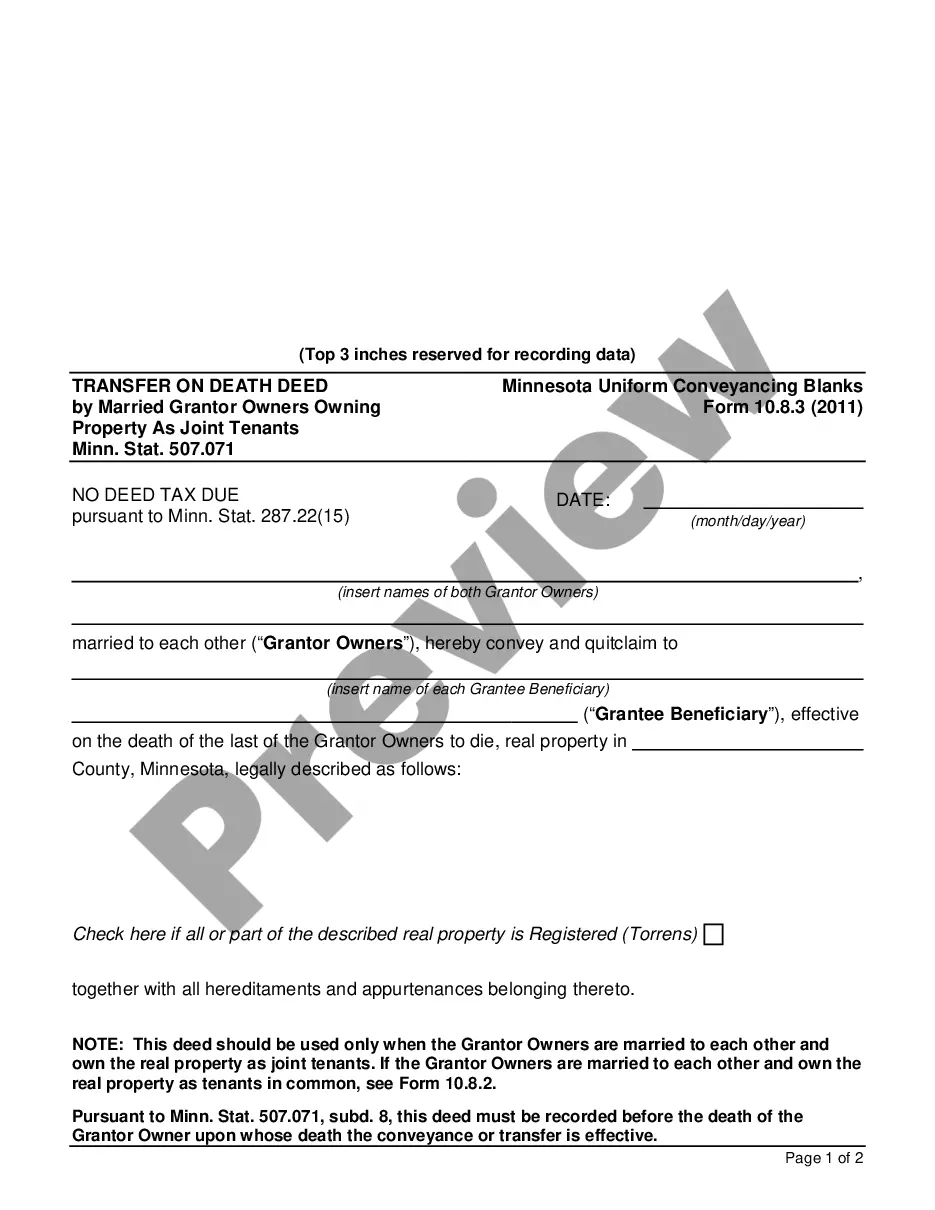

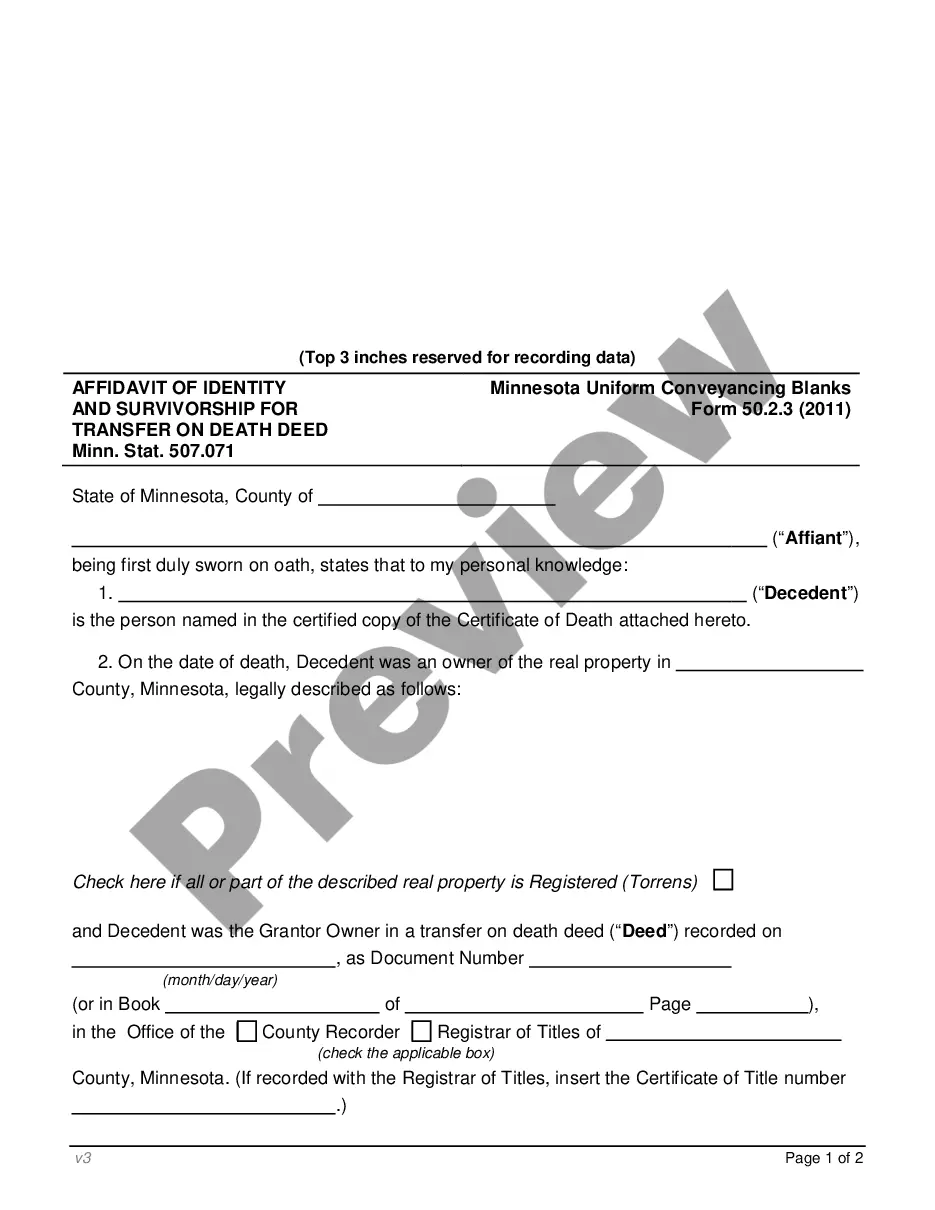

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Transfer On Death Deed - Statutory Form Minn. Stat. 507.071?

Obtain any template from 85,000 legal documents including Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071 online with US Legal Forms. Each template is crafted and refreshed by state-authorized attorneys.

If you already possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and navigate to My documents to access it.

If you have yet to subscribe, follow the instructions outlined below.

With US Legal Forms, you'll consistently have swift access to the appropriate downloadable sample. The platform provides access to documents and organizes them into categories to simplify your search. Utilize US Legal Forms to acquire your Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071 quickly and efficiently.

- Verify the state-specific criteria for the Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071 you wish to utilize.

- Review the description and preview the template.

- Once you are certain the sample meets your needs, click on Buy Now.

- Choose a subscription plan that fits your budget.

- Establish a personal account.

- Complete payment through one of two available methods: by credit card or via PayPal.

- Select a format to download the document; two options are available (PDF or Word).

- Download the file to the My documents section.

- When your reusable template is prepared, print it out or save it to your device.

Form popularity

FAQ

You should file your Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071 with the county recorder's office in the county where the property is located. This filing is crucial as it officially records your intentions and protects your beneficiaries' rights. Make sure to check with the specific county's requirements to ensure all necessary documents are submitted for a smooth filing process.

While it is not legally required to hire a lawyer for a Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071, consulting with one can provide valuable guidance. A lawyer can ensure that the deed is completed correctly and meets all legal requirements, helping to prevent potential disputes or issues in the future. However, many individuals feel confident using resources like USLegalForms to navigate the process independently.

To file a Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071, you will need to complete the form with accurate information about the property and the beneficiaries. Once completed, you must sign the deed in front of a notary public. After notarization, file the deed with the county recorder's office in the county where the property is located to make it legally binding.

The Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071 allows property owners to transfer their real estate to designated beneficiaries upon their death. This deed enables property owners to avoid the probate process, making it easier and more efficient for heirs to inherit the property. It is essential to understand that this deed must be properly executed and recorded to be valid.

You do not necessarily need a lawyer to file a Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071. Many individuals successfully complete this process on their own by following the statutory requirements. However, consulting with a lawyer can be beneficial if you have complex questions or need specific legal advice. US Legal Forms offers resources and templates that can help you navigate the filing process with confidence.

To complete a Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071, you must first fill out the appropriate form with the required details, including the names of the beneficiaries and the property description. Afterward, you need to sign the deed in front of a notary public. Finally, ensure that you file the completed deed with the county recorder in the county where the property is located. Using platforms like US Legal Forms can simplify this process by providing the correct forms and guidance.

No, Georgia does not offer a transfer on death deed option similar to the Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071. Instead, Georgia has other estate planning tools, such as wills and trusts, which serve similar purposes. If you're exploring options for transferring property in Georgia, it's wise to consult with a legal professional who can guide you on the best method for your situation.

You can obtain a Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071 from various sources, including local government offices and legal websites. Many people find it convenient to download the form directly from uslegalforms, which provides a clear and easy-to-use template. Ensure that you choose the correct version that meets Minnesota’s legal requirements to avoid any issues during the transfer process.

To complete a Minnesota Transfer on Death Deed - Statutory form Minn. Stat. 507.071, you must first fill out the form accurately with the necessary details, including the names of the grantor and grantee. Next, you need to sign the deed in front of a notary public to ensure its validity. Once notarized, file the deed with the county recorder's office where the property is located. This process allows you to transfer property directly to your beneficiaries upon your passing, avoiding probate.