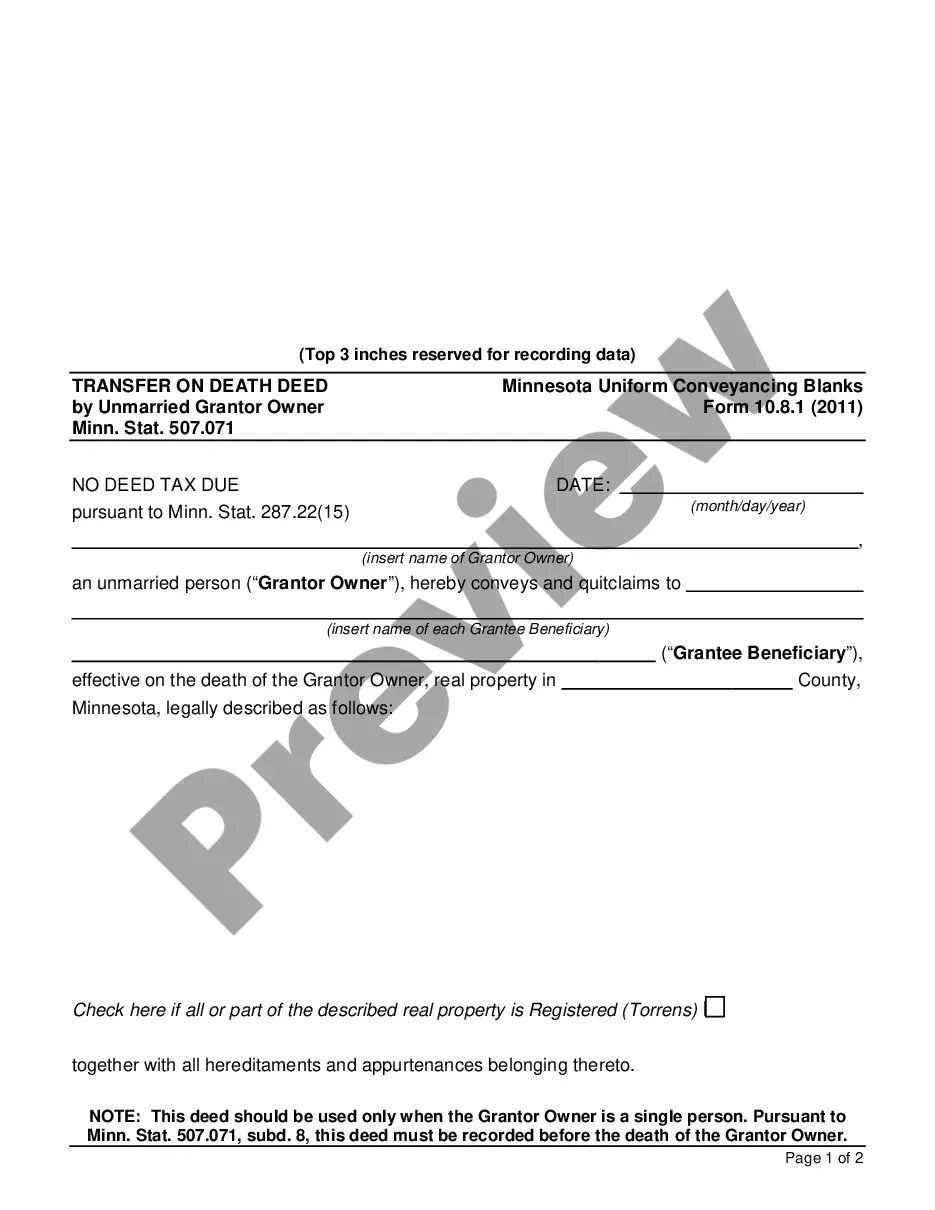

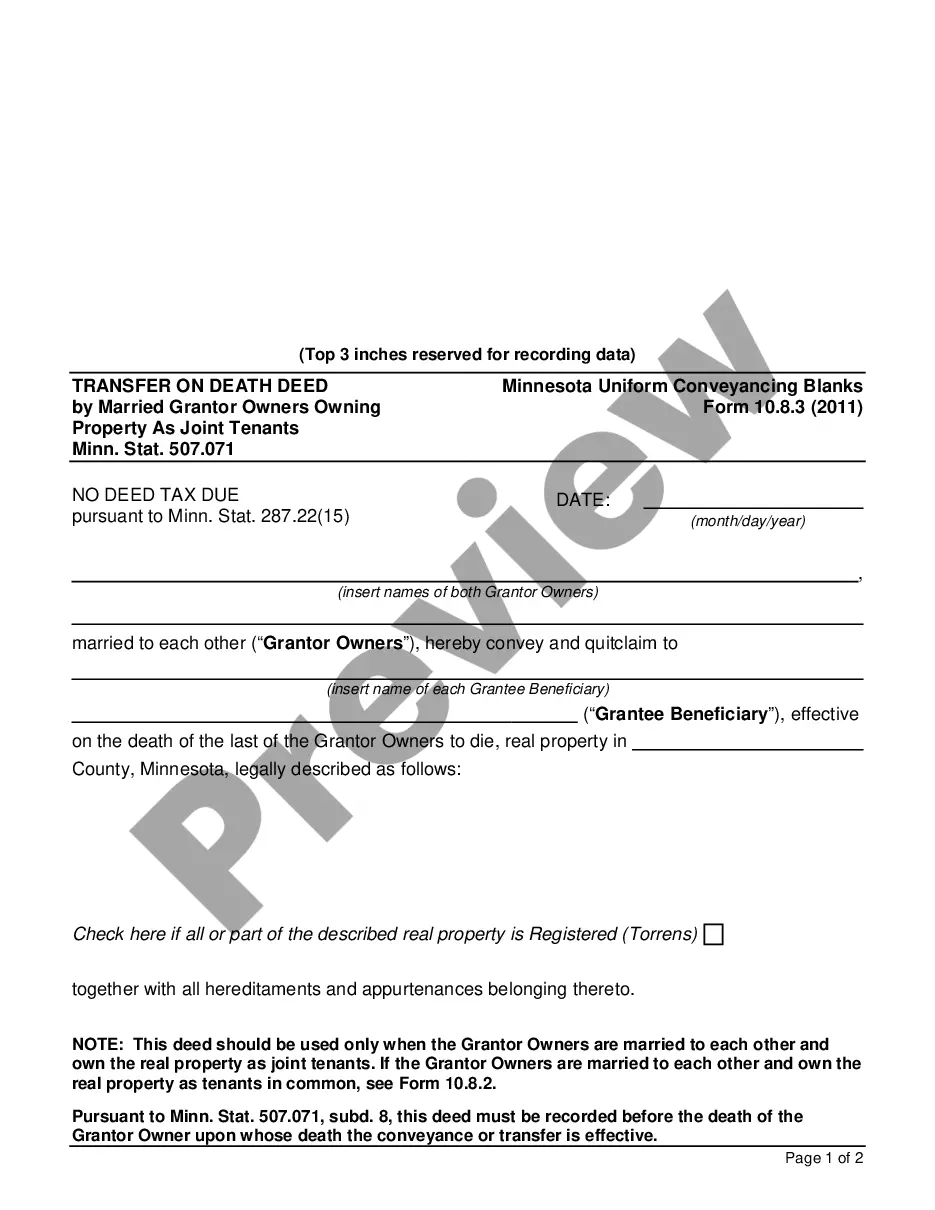

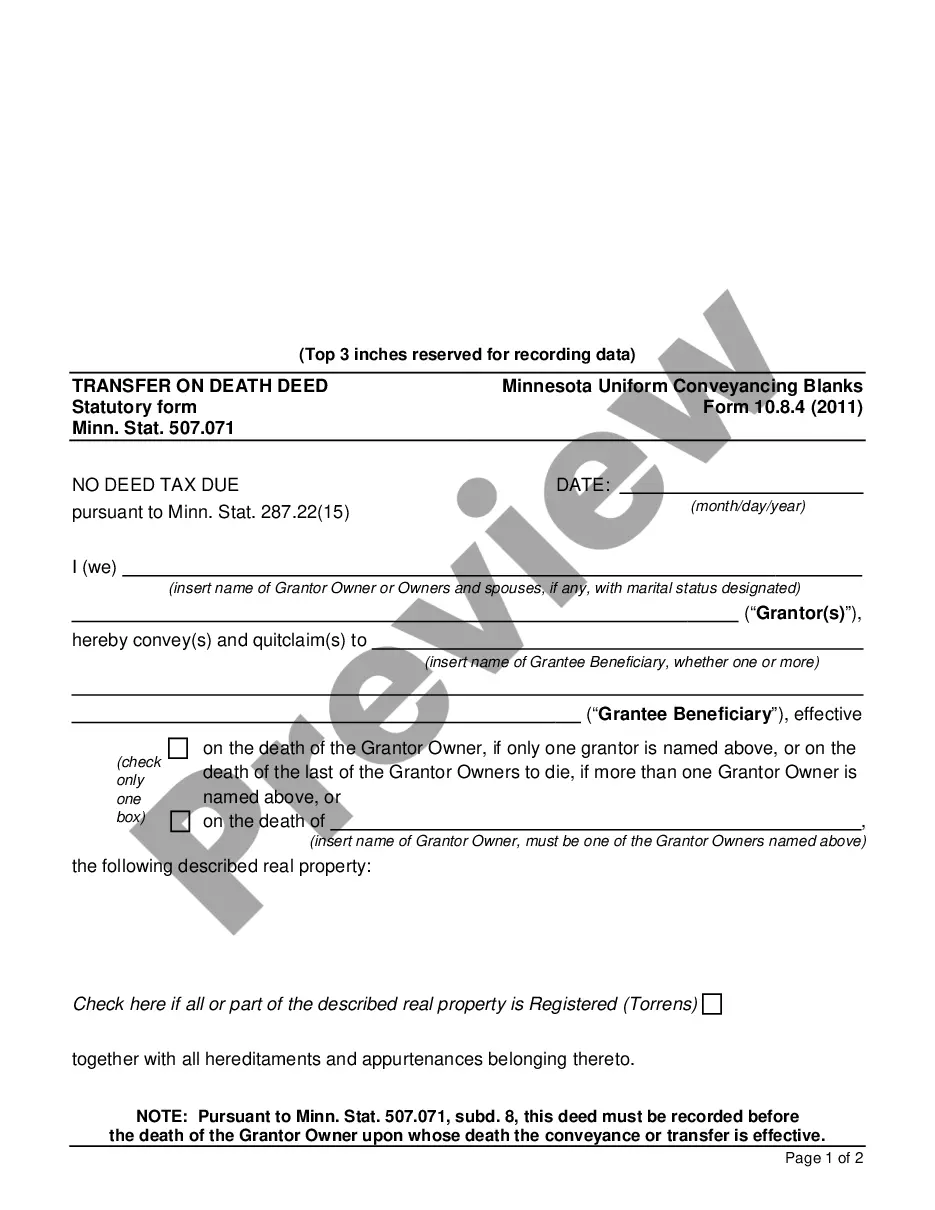

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071

Description

How to fill out Minnesota Affidavit Of Identity And Survivorship For Transfer On Death Deed Minn. Stat. 507.071?

Acquire any version from 85,000 legitimate documents like Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071 online through US Legal Forms. Each template is composed and revised by state-licensed attorneys.

If you already possess a subscription, Log In. When you reach the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you haven't subscribed yet, follow these instructions below.

With US Legal Forms, you’ll consistently have swift access to the relevant downloadable template. The service grants you access to forms and categorizes them to ease your search. Utilize US Legal Forms to acquire your Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071 quickly and effortlessly.

- Verify the state-specific criteria for the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071 you must utilize.

- Examine the description and review the sample.

- Once you confirm the sample meets your needs, click Buy Now.

- Select a subscription plan that aligns with your financial situation.

- Establish a personal account.

- Make a payment in one of two acceptable methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable document is set, print it out or save it to your device.

Form popularity

FAQ

Yes, a transfer on death deed can help avoid probate in Minnesota. By using this deed, property transfers directly to the designated beneficiaries upon your death, bypassing the probate process. This method can save time and costs associated with probate. Utilizing the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed effectively facilitates this process, ensuring your wishes are honored.

Filling out a transfer-on-death affidavit requires you to provide specific information about the property and the beneficiaries. You must complete the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed with accurate details. Each party's name, address, and relationship to the deceased should be clearly stated. If you need assistance, platforms like uslegalforms offer resources to simplify this process.

Filing a transfer-on-death deed in Minnesota involves preparing the deed and submitting it to your local county recorder's office. You must also include the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed with your submission. Ensure all documents are filled out accurately to prevent delays. Once filed, your property will be prepared for transfer upon your passing.

To record a transfer on death deed in Minnesota, you need to take the completed deed and any necessary affidavits to your local county recorder's office. Make sure you have the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed filled out correctly. Once submitted, the county office will record the deed, making it legally binding. This step is crucial for ensuring that your property transfers as intended.

While you can complete a transfer on death deed without an attorney, consulting one may provide valuable guidance. An attorney can help ensure that the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed meets all legal requirements. This can prevent potential issues during the property transfer process. Ultimately, having legal support can give you peace of mind.

You can file a transfer on death deed at your local county recorder's office in Minnesota. It's essential to ensure that the deed complies with Minnesota statutes, specifically Minn. Stat. 507.071. After filling out the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed, make sure to submit it along with the deed to the appropriate office. This process helps in securing your property transfer wishes.

While a transfer on death deed can simplify the transfer of property, it also has potential disadvantages. For instance, it does not protect the property from creditors or tax implications, and the transfer may affect eligibility for government benefits. Additionally, if the beneficiary predeceases the owner, the property may not be transferred as intended. To navigate these complexities, consider using the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071, and consult the resources available on USLegalForms for further assistance.

Yes, Minnesota does recognize transfers on death deeds, allowing property owners to transfer their assets to beneficiaries upon their death without going through probate. This process is governed under Minn. Stat. 507.071, which includes the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed. Utilizing this legal tool simplifies the transfer process and helps ensure your wishes are honored. For those seeking to create a transfer on death deed, USLegalForms offers useful resources to guide you through the necessary steps.

An affidavit of identity and survivorship in Minnesota is a legal document used to establish the identity of a surviving co-owner after one owner has passed away. This affidavit serves to confirm the surviving owner's rights to the property without the need for probate. It is essential for ensuring a smooth transfer of property ownership. For those needing assistance, US Legal Forms provides templates specifically for the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071.

To fill out an affidavit of identity and survivorship in Minnesota, collect all necessary information, including the full names and addresses of the deceased and surviving owners. Specify the property details, and ensure you provide accurate dates and signatures. This affidavit confirms the identity of the survivor and the transfer of property rights. US Legal Forms can help by offering user-friendly templates designed for the Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071.