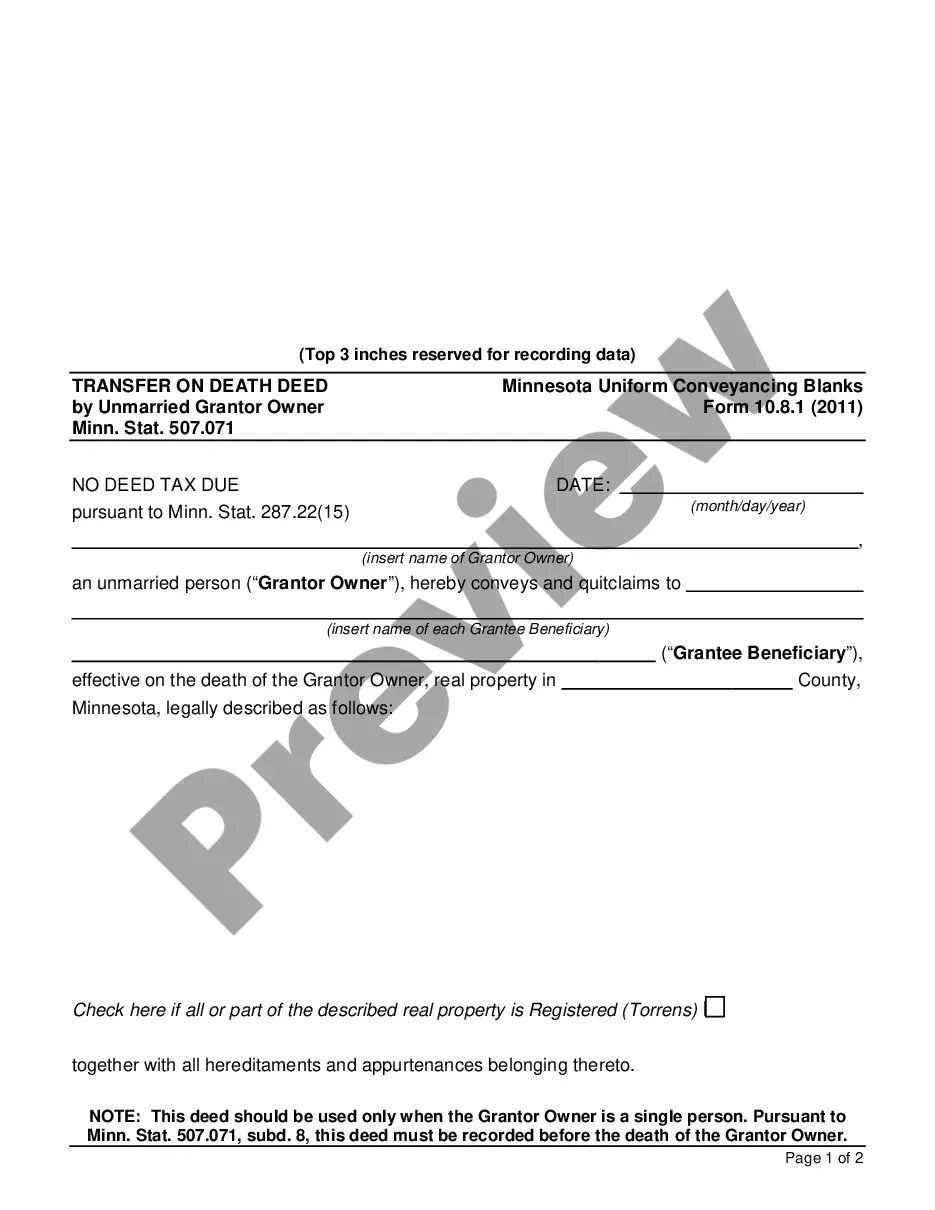

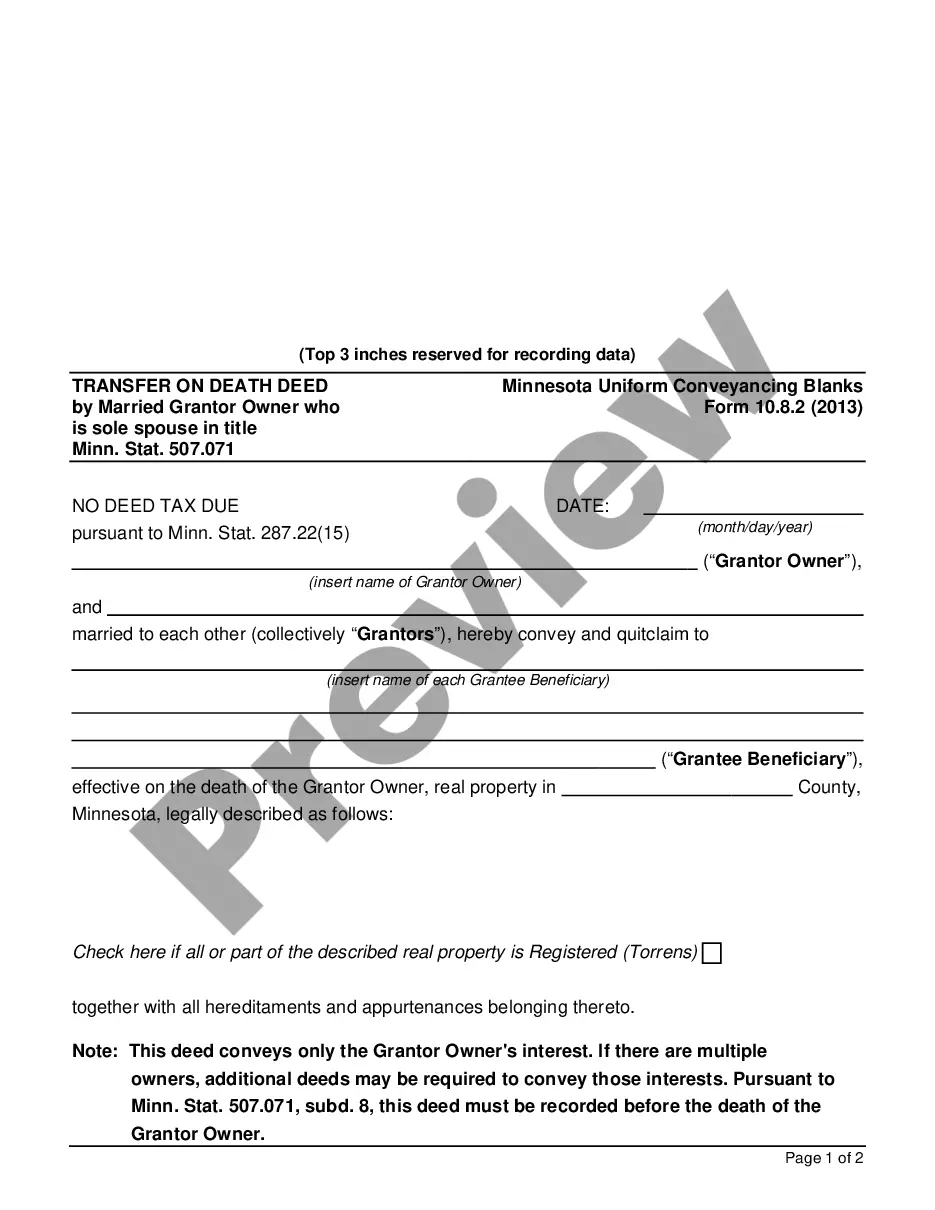

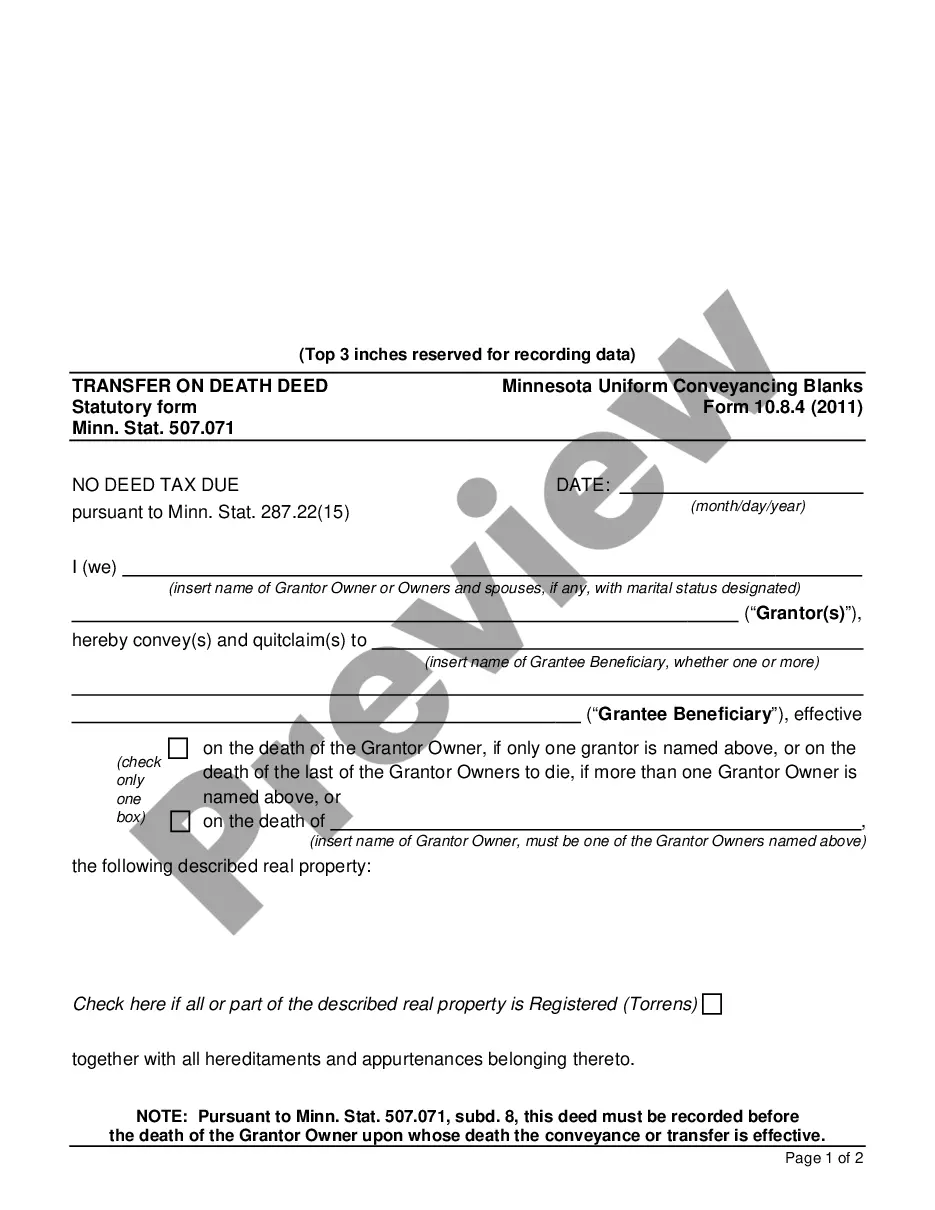

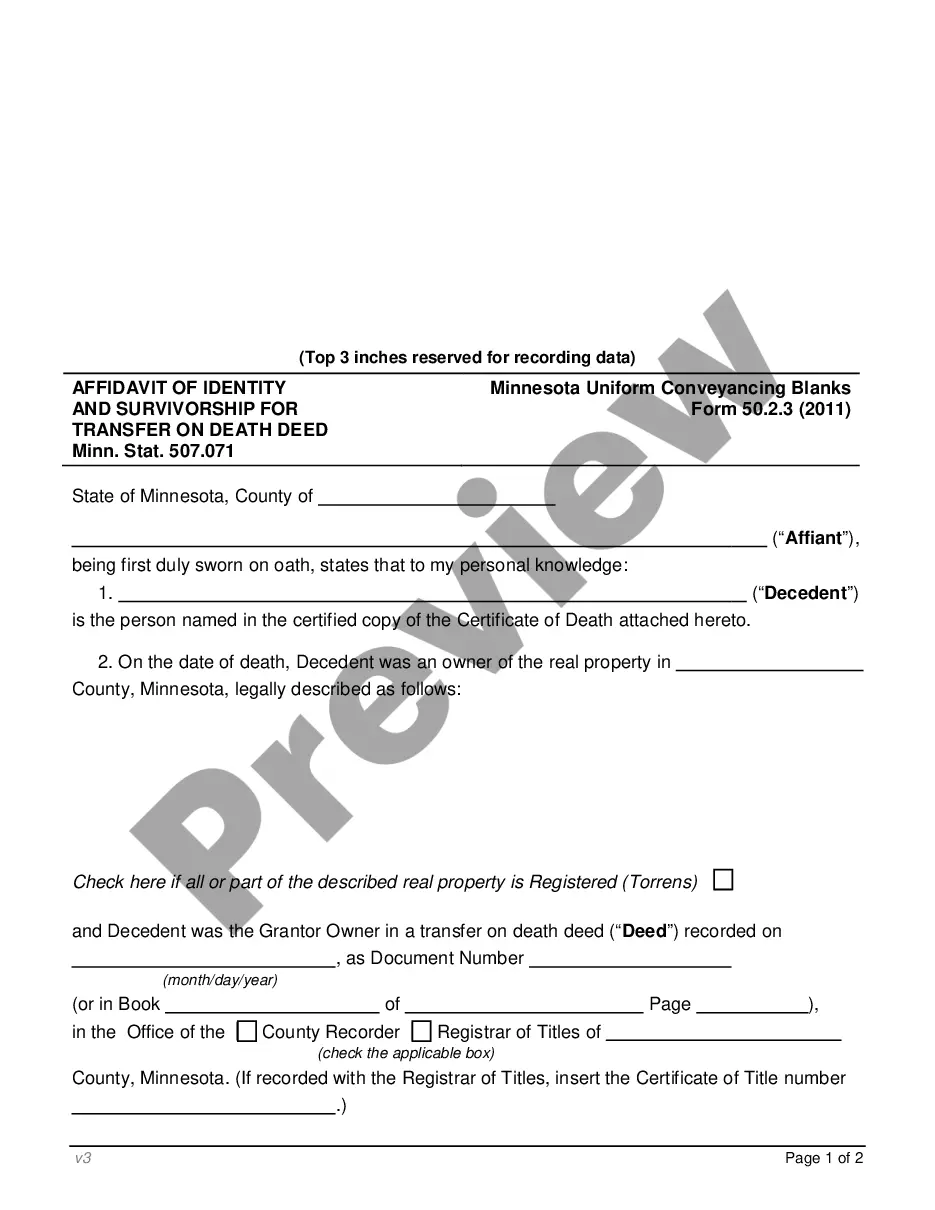

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071

Description

Key Concepts & Definitions

Transfer on Death Deed (TOD Deed): A legal document that allows property owners to name a beneficiary who will receive the property upon the owner's death without the need for probate. Married Grantor Owners: Refers to a married couple who jointly own property and are considering a TOD deed to manage the transfer of their estate.

Step-by-Step Guide to Utilizing a TOD Deed by Married Grantor Owners

- Determine Eligibility: Confirm that your state recognizes TOD deeds. Not all states allow these, and regulations may vary.

- Consult a Legal Professional: Discuss your estate planning with an attorney to ensure a TOD deed is appropriate for your situation.

- Select a Beneficiary: Decide who will receive the property after the death of the owners. This can be a person, multiple people, or a legal entity.

- Complete the Deed: Fill out the TOD deed form, which typically requires detailed information about the property and the beneficiary.

- Sign and Notarize: Both owners must sign the deed in front of a notary.

- Record the Deed: File the completed deed with the local county's recorder's office to make it legally binding.

- Retain Copies: Keep a copy of the recorded deed for personal records and give one to the beneficiary for safekeeping.

Risk Analysis for TOD Deeds by Married Grantor Owners

- Revocation Difficulty: Revoking a TOD deed can be complex, especially without mutual agreement if only one spouse wishes to change the beneficiary or terms.

- Disagreements: Potential for disputes among beneficiaries or between surviving owners and beneficiaries regarding the property.

- Legal Challenges: Improperly drafted or recorded TOD deeds may be subject to legal challenges, potentially leading to prolonged court proceedings.

Pros & Cons of Using Transfer on Death Deeds

- Pros:

- Avoids probate, potentially saving time and money.

- Can be reversed or changed as long as the grantor is alive and competent.

- Simple and less expensive compared to other estate planning tools like trusts.

- Cons:

- Not available in all states, limiting applicability.

- May lead to unintended tax implications, especially with respect to estate taxes and inheritance taxes.

- Requires all owners to agree on changes, which might not always be feasible.

Common Mistakes & How to Avoid Them

- Failing to Record the Deed: Always ensure the TOD deed is officially recorded at the county recorder's office. Non-recorded deeds are generally considered void.

- Overlooking Tax Implications: Consult with a tax advisor to understand potential tax consequences of transferring real estate via a TOD deed.

- Ignores Long-Term Care Planning: Consider how a TOD deed fits into broader financial planning, especially concerning long-term care and related expenses.

FAQ

- Can a TOD deed be used for any type of property? Primarily, TOD deeds are used for real estate properties but it is best to consult a legal advisor as some states might allow other types of assets.

- What happens if one of the married grantor owners dies? The surviving owner continues to own the property and can modify the TOD deed as needed, subject to state laws and any agreements made between the spouses.

How to fill out Minnesota Transfer On Death Deed By Married Grantor Owners Owning Property As Joint Tenants Minn. Stat. 507.071?

Obtain any version from 85,000 legal papers like Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 online with US Legal Forms. Each template is crafted and refreshed by state-certified legal experts.

If you already possess a subscription, Log In. Once you are on the form’s page, hit the Download button and navigate to My documents to retrieve it.

If you have not yet subscribed, follow the instructions below: Check the state-specific prerequisites for the Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 you need to utilize. Review description and preview the example. Once you are assured the template is what you require, simply click Buy Now. Choose a subscription plan that fits your budget. Create a personal account. Make payment in one of two suitable methods: by credit card or through PayPal. Choose a format to download the file in; two options are available (PDF or Word). Download the document to the My documents tab. When your reusable template is prepared, print it out or save it to your device.

- With US Legal Forms, you’ll consistently have quick access to the suitable downloadable sample.

- The platform provides you access to forms and categorizes them into groups to ease your search.

- Utilize US Legal Forms to acquire your Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 quickly and effortlessly.

Form popularity

FAQ

While hiring a lawyer is not required to file a Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071, it is often beneficial. A legal professional can guide you through the process, ensuring that all necessary details are accurate and compliant with state regulations. However, using platforms like US Legal Forms can simplify the process, offering you the necessary forms and instructions without the need for legal representation.

To execute a Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071, you must complete the required form and provide specific details about the property and the beneficiaries. It’s essential to have the deed signed by both grantors in front of a notary public. After signing, file the deed with your local county recorder to ensure it is legally recognized and enforceable.

The Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 allows married couples to transfer property upon death without going through probate. This deed enables both owners to retain control of the property during their lifetime while designating beneficiaries to receive the property automatically after one spouse passes away. By utilizing this deed, you simplify the process of transferring property, ensuring a smoother transition for your loved ones.

To file a Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071, you first need to complete the deed accurately with all required information. Next, you must sign the deed in front of a notary public to validate it. After notarization, submit the signed deed to your county recorder's office. This step is essential for the deed to take effect and ensure the intended transfer of property upon the grantors' passing.

While a Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 offers benefits, it has some disadvantages. One potential drawback is that the property may still be subject to creditors' claims after the grantors' death. Additionally, if the grantors decide to sell the property, the deed must be revoked, which can complicate the process. It is crucial to consider these factors before proceeding.

To fill out a Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071, start by clearly identifying the property and the married grantor owners. Include the names of the beneficiaries who will receive the property upon the grantors' death. Be sure to sign the deed in front of a notary public. Lastly, file the completed deed with the county recorder to ensure it is legally recognized.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.

Fill in information about you and the TOD beneficiary. write a description of the property. check over the completed deed. sign the deed and have it notarized. record the deed at the recorder's office in the county where the property is located.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.