This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071

Description

How to fill out Minnesota Transfer On Death Deed By Unmarried Grantor Owner Minn. Stat. 507.071?

Obtain any version from 85,000 legal records including Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 online with US Legal Forms. Every document is designed and refreshed by state-recognized lawyers.

If you possess a subscription, sign in. Once you’re on the document’s page, click on the Download button and head to My documents to retrieve it.

If you have not subscribed yet, follow the instructions below: Check the state-specific prerequisites for the Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 you wish to utilize. Browse the description and preview the template. When you’re assured the sample is what you require, simply click Buy Now. Select a subscription plan that fits your budget. Establish a personal account. Pay using one of two suitable methods: by credit card or through PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the file to the My documents section. Once your reusable template is prepared, print it or save it to your device.

- With US Legal Forms, you will consistently have immediate access to the appropriate downloadable sample.

- The platform provides you with access to documents and categorizes them to facilitate your search.

- Utilize US Legal Forms to acquire your Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 swiftly and effortlessly.

Form popularity

FAQ

You do not necessarily need a lawyer to file a Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071, as the process can be completed by following the instructions carefully. However, consulting with a lawyer can provide peace of mind and ensure that all legal requirements are met. Platforms like US Legal Forms can also simplify the process by offering templates and resources.

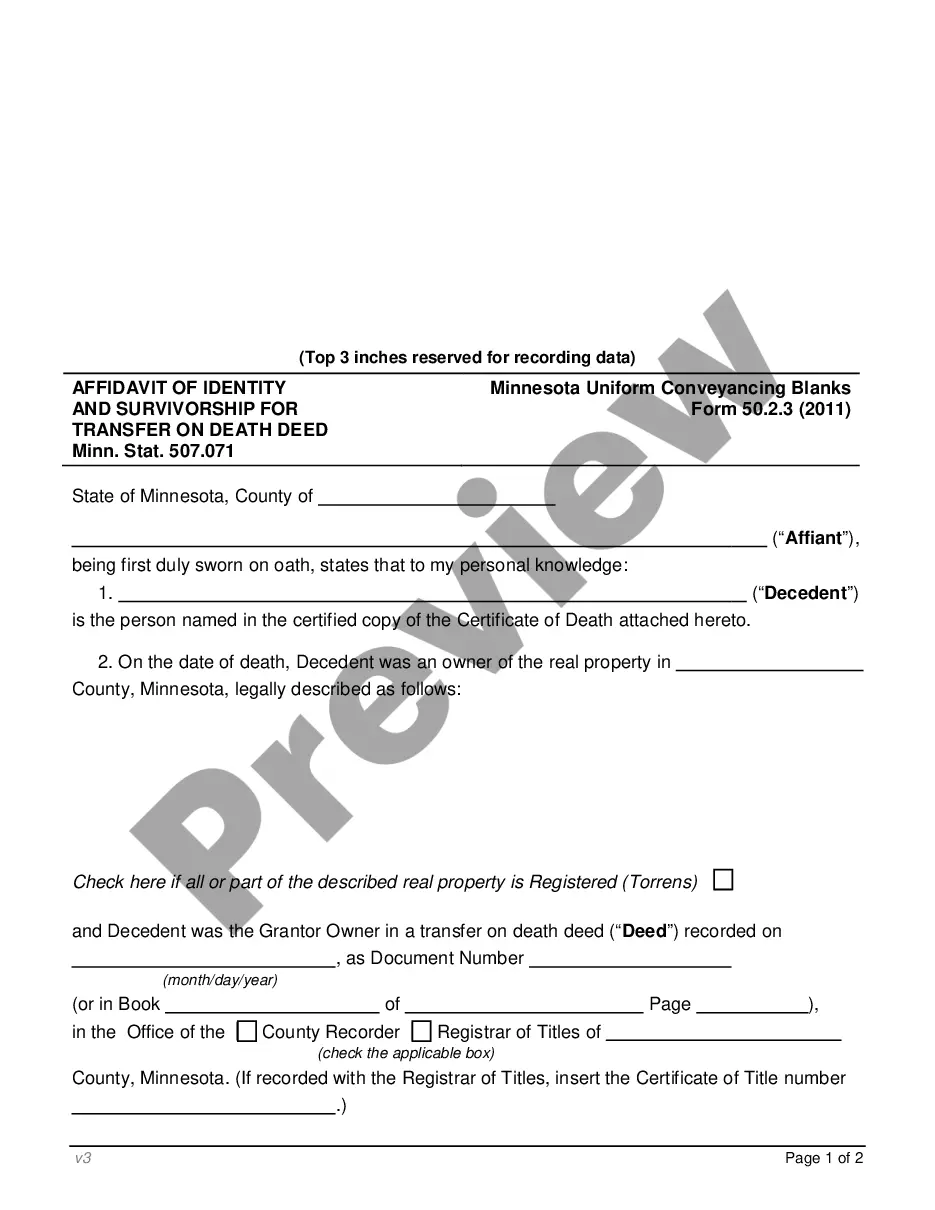

You need to file a Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 with the county recorder's office in the county where the property is located. It is important to ensure that the deed is filed correctly and in a timely manner to avoid any delays in the transfer of property upon your passing.

While a Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 offers benefits, it also has some disadvantages. One key concern is that the property may still be subject to creditor claims after your death. Additionally, if you decide to sell the property while you are alive, you must revoke the deed, which could complicate the process.

You can file a Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 at your local county recorder's office. Each county has specific requirements, so it is wise to check their website or contact them before you file. Make sure to bring the signed and notarized deed to ensure a smooth filing process.

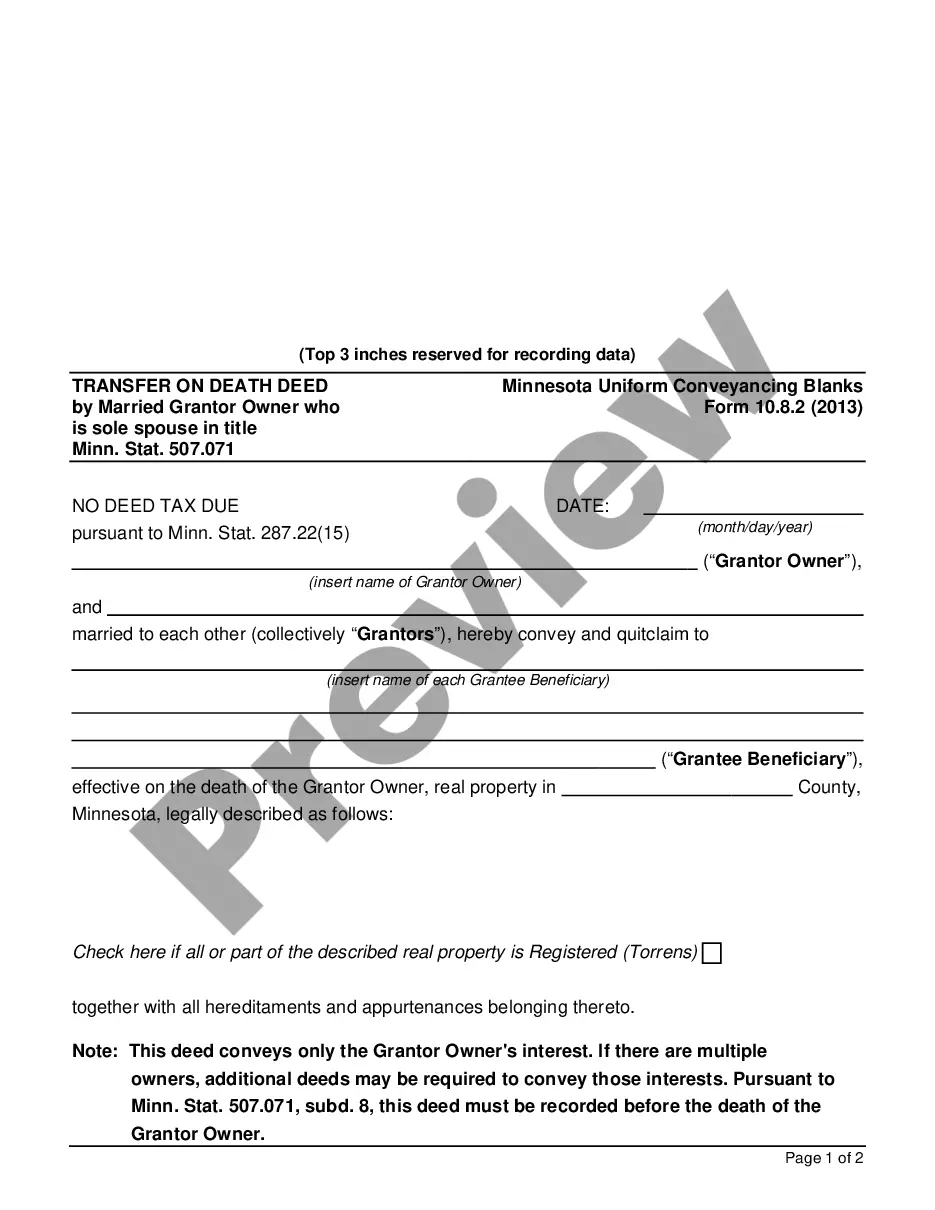

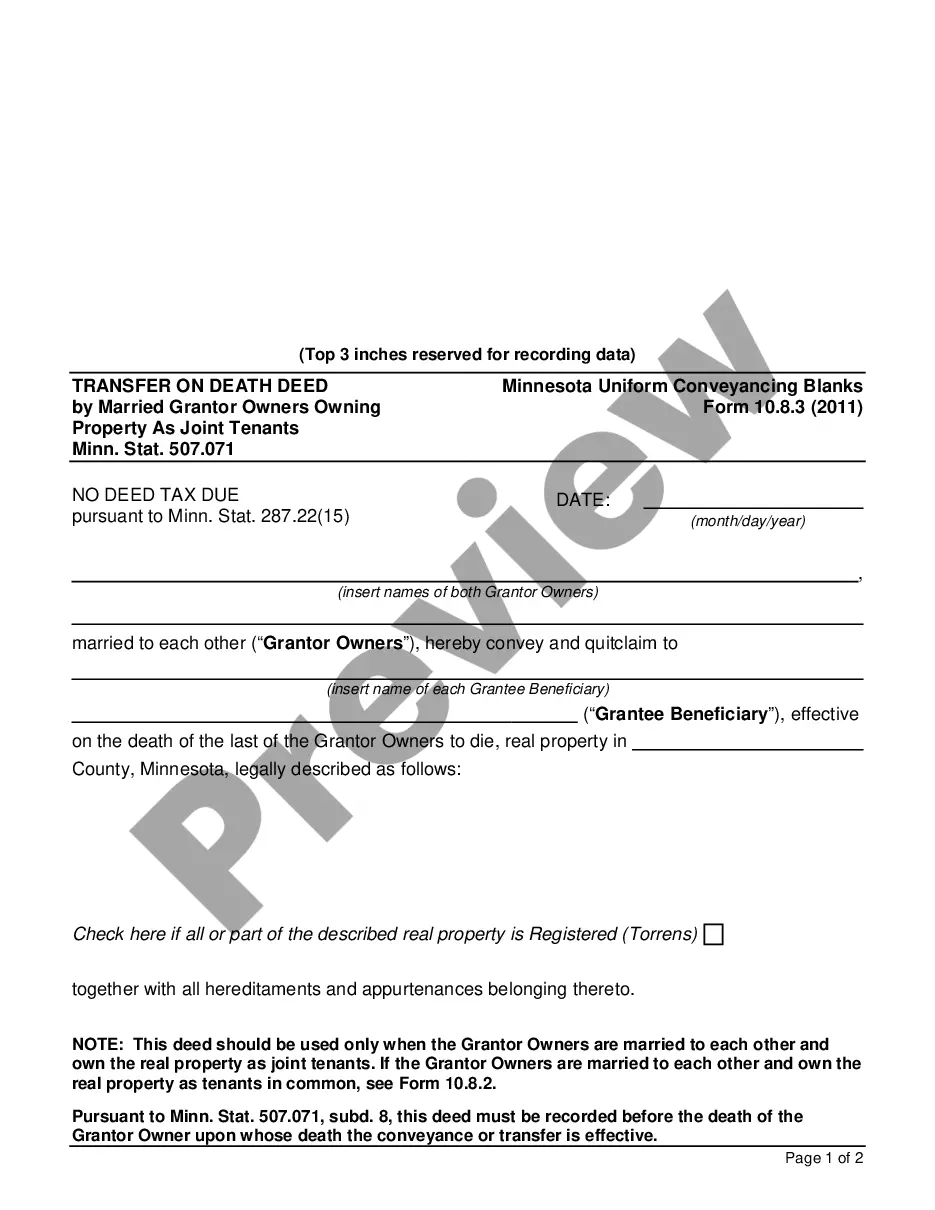

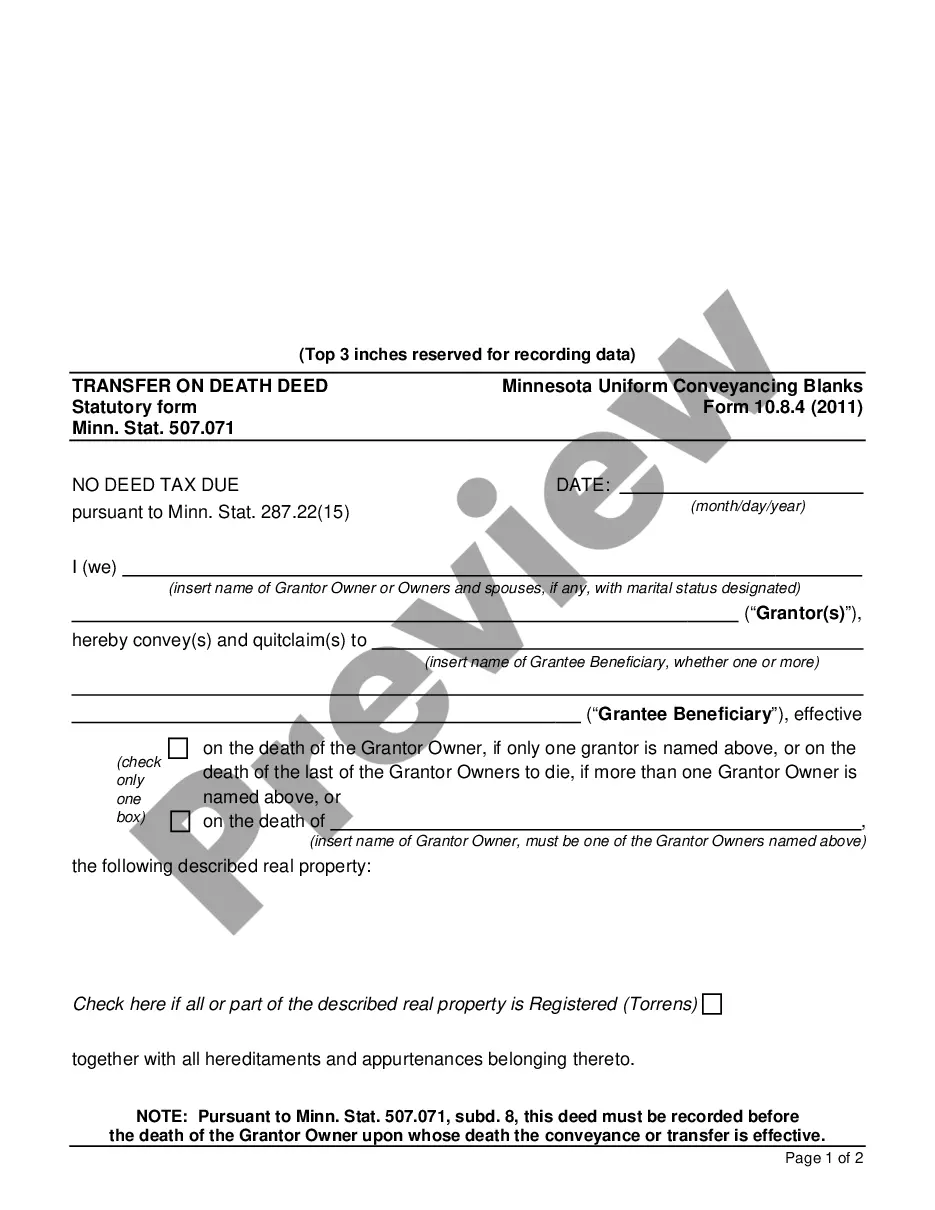

To fill out a Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 form, start by providing your name and details as the grantor. Next, include the name of the beneficiary who will receive the property after your death. It is essential to describe the property accurately and to sign the deed in front of a notary. For assistance, consider using platforms like US Legal Forms, which offer templates and guidance.

Filling out a Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 involves several clear steps. First, you need to provide your name as the grantor and the legal description of the property you wish to transfer. Next, you should designate the beneficiary who will receive the property upon your passing. Finally, ensure that you sign the deed in front of a notary public and file it with your county's recorder office to make it legally binding.

The Minnesota Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071 allows property owners to transfer real estate to beneficiaries upon their death, without needing to go through probate. This statute simplifies the transfer process and ensures that your property can be passed on according to your wishes. By using this deed, you can retain ownership during your lifetime, making it a flexible option for estate planning. For those seeking guidance, USLegalForms provides useful resources to help you navigate the Minnesota Transfer on Death Deed process.