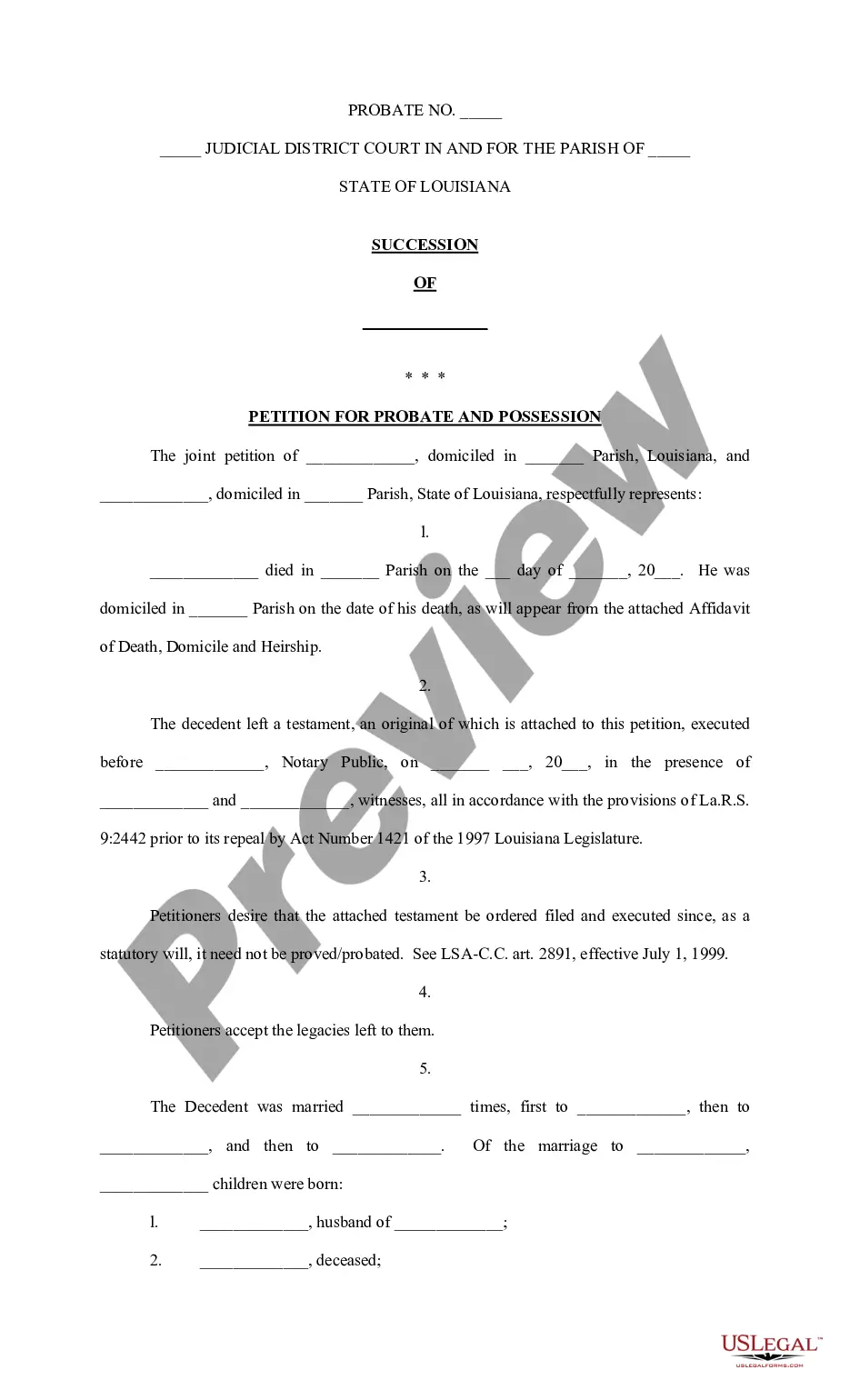

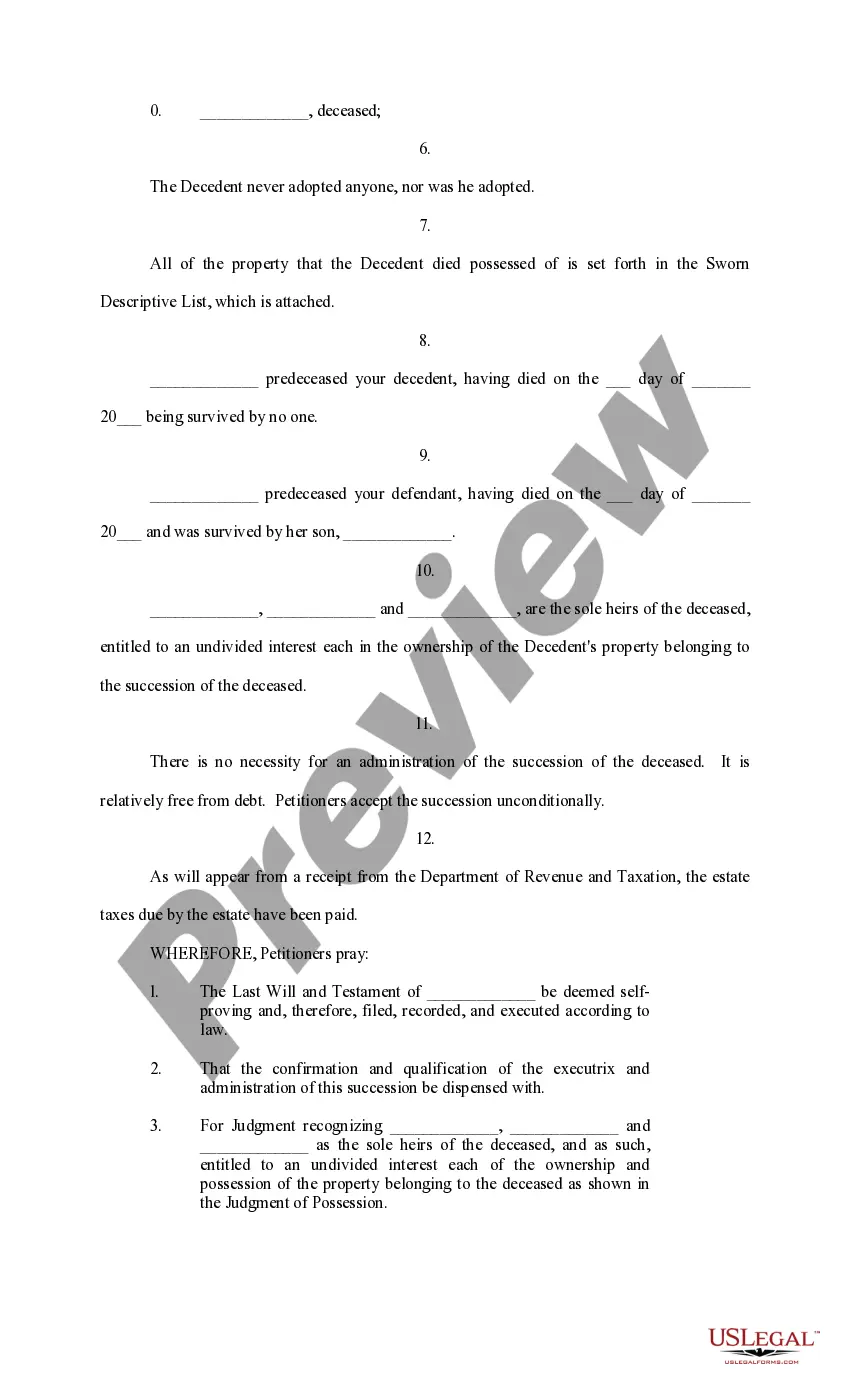

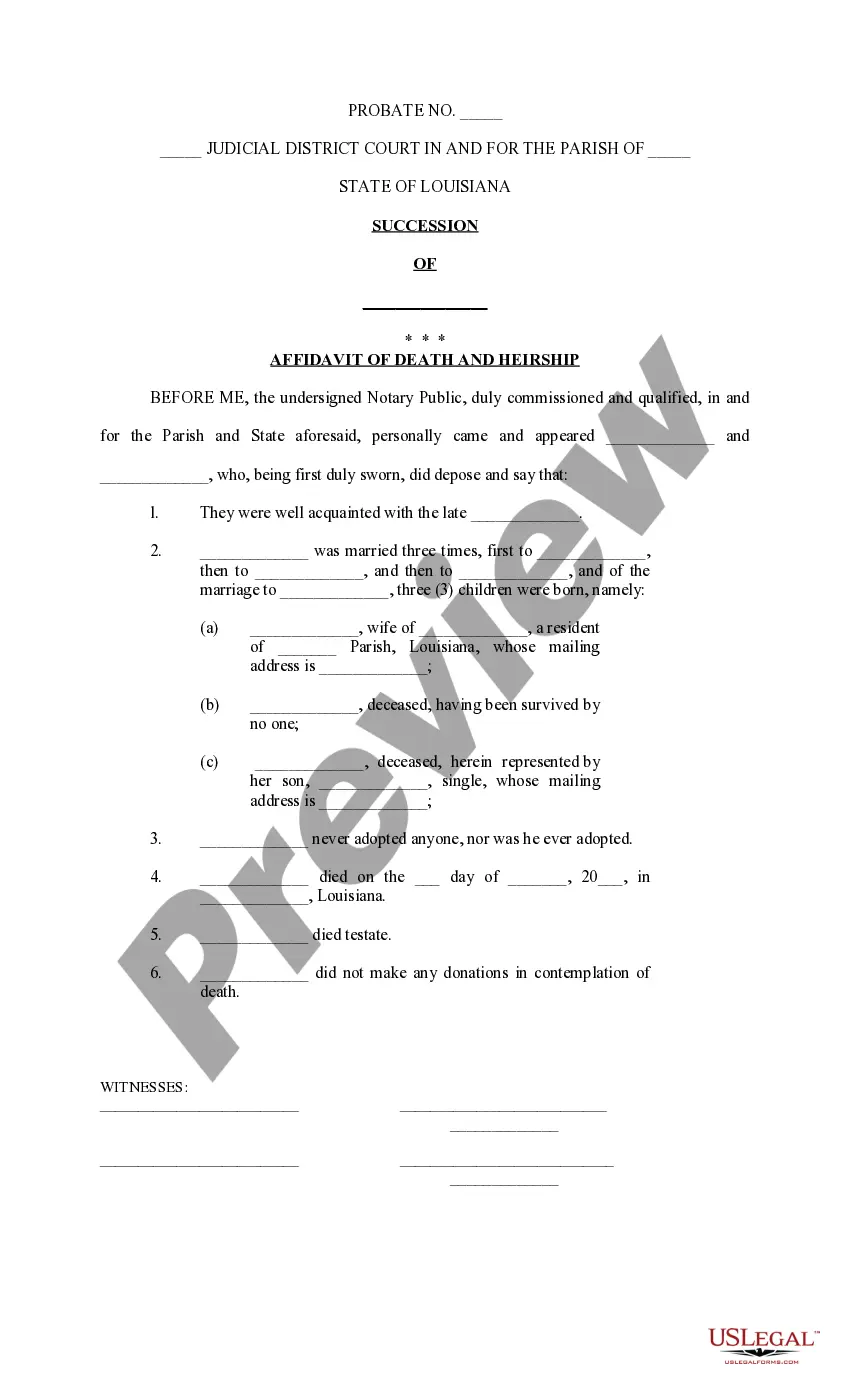

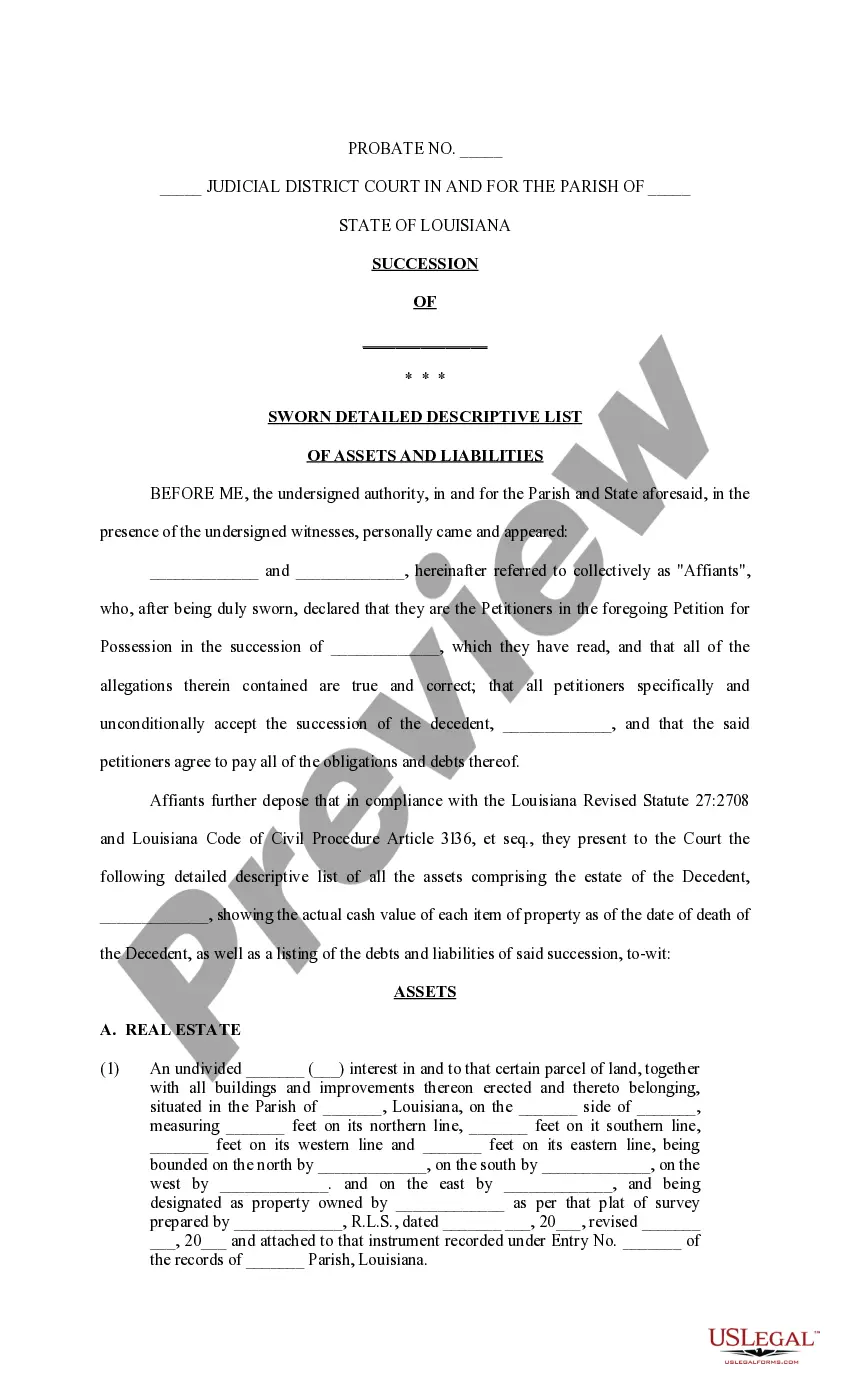

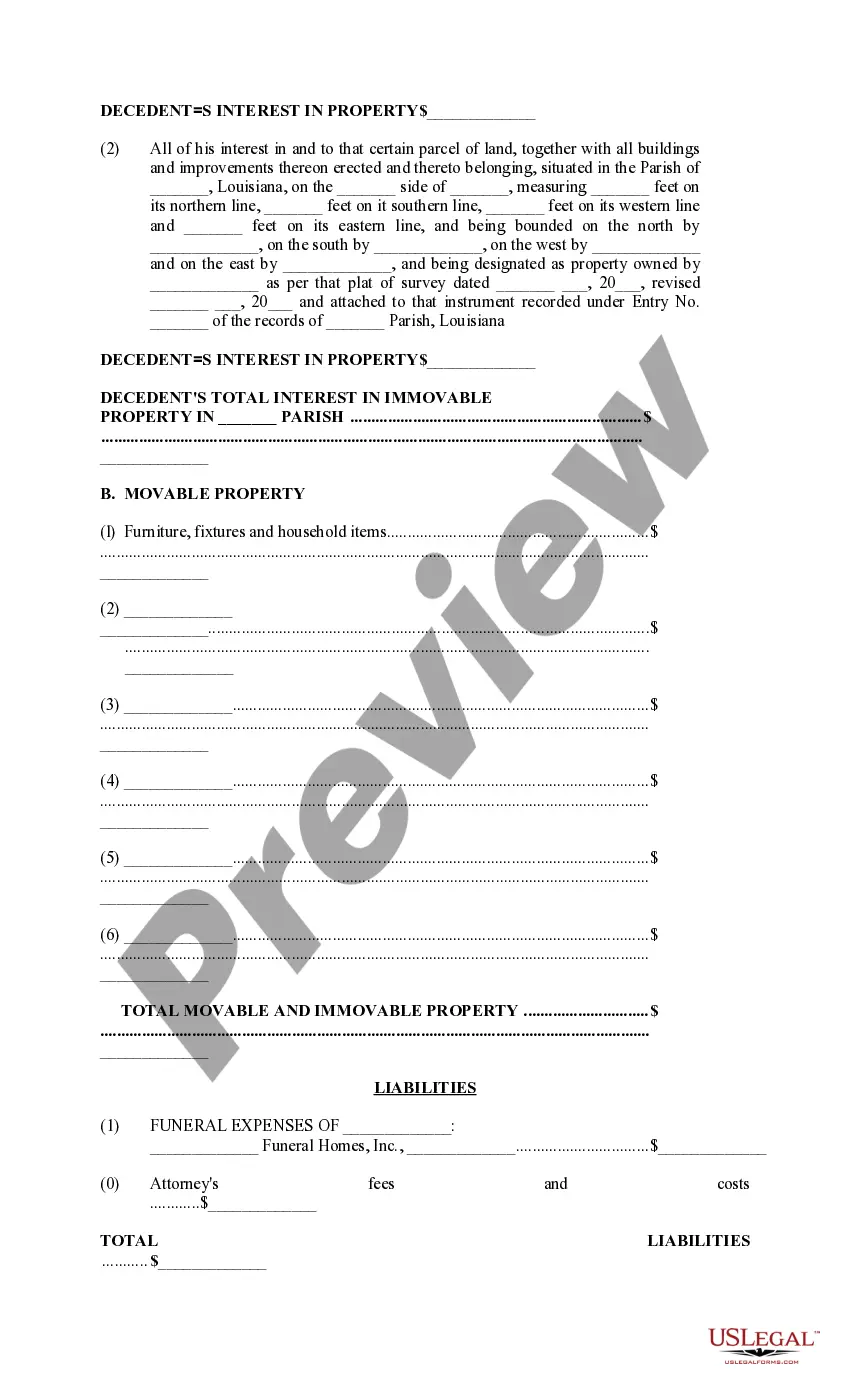

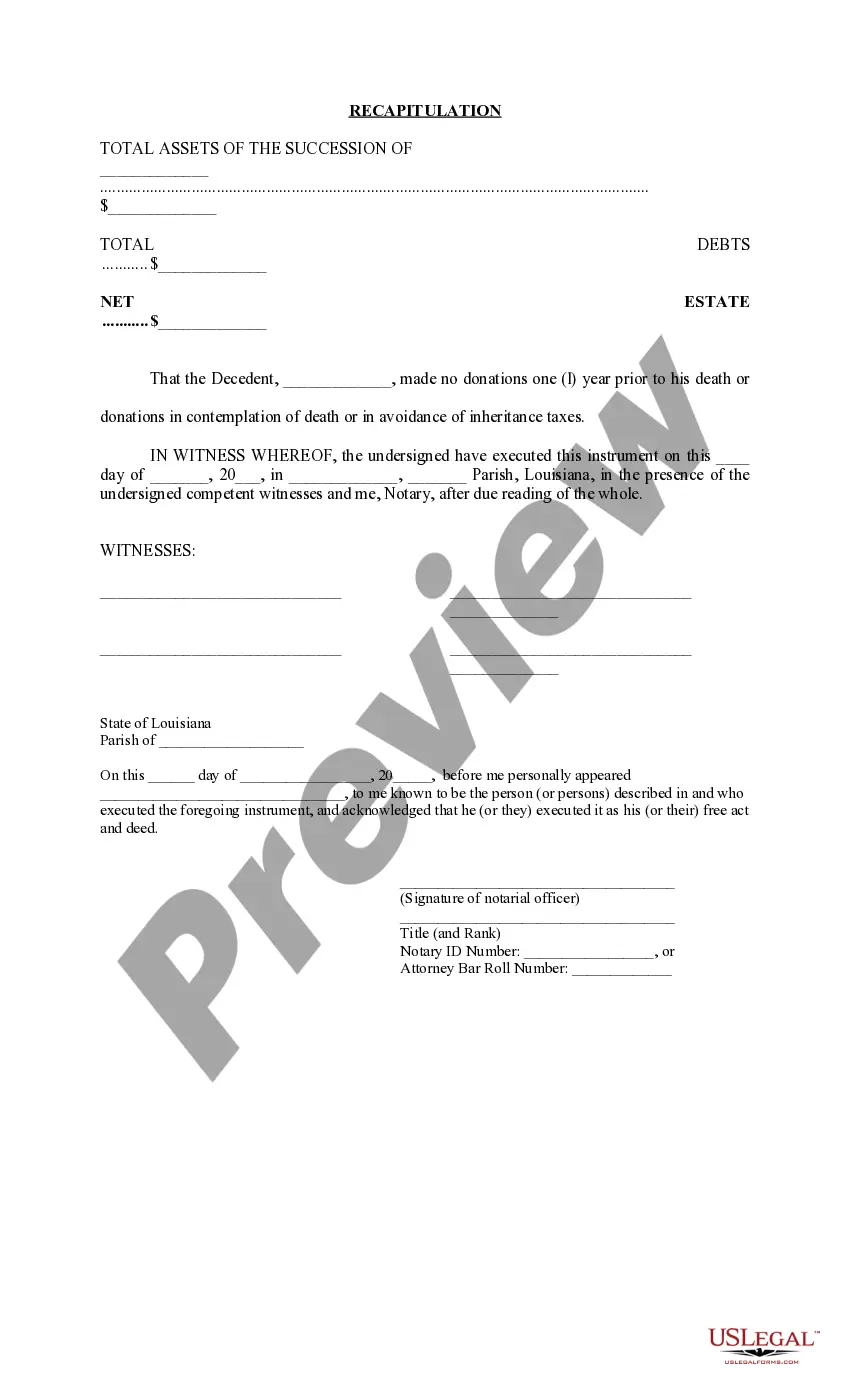

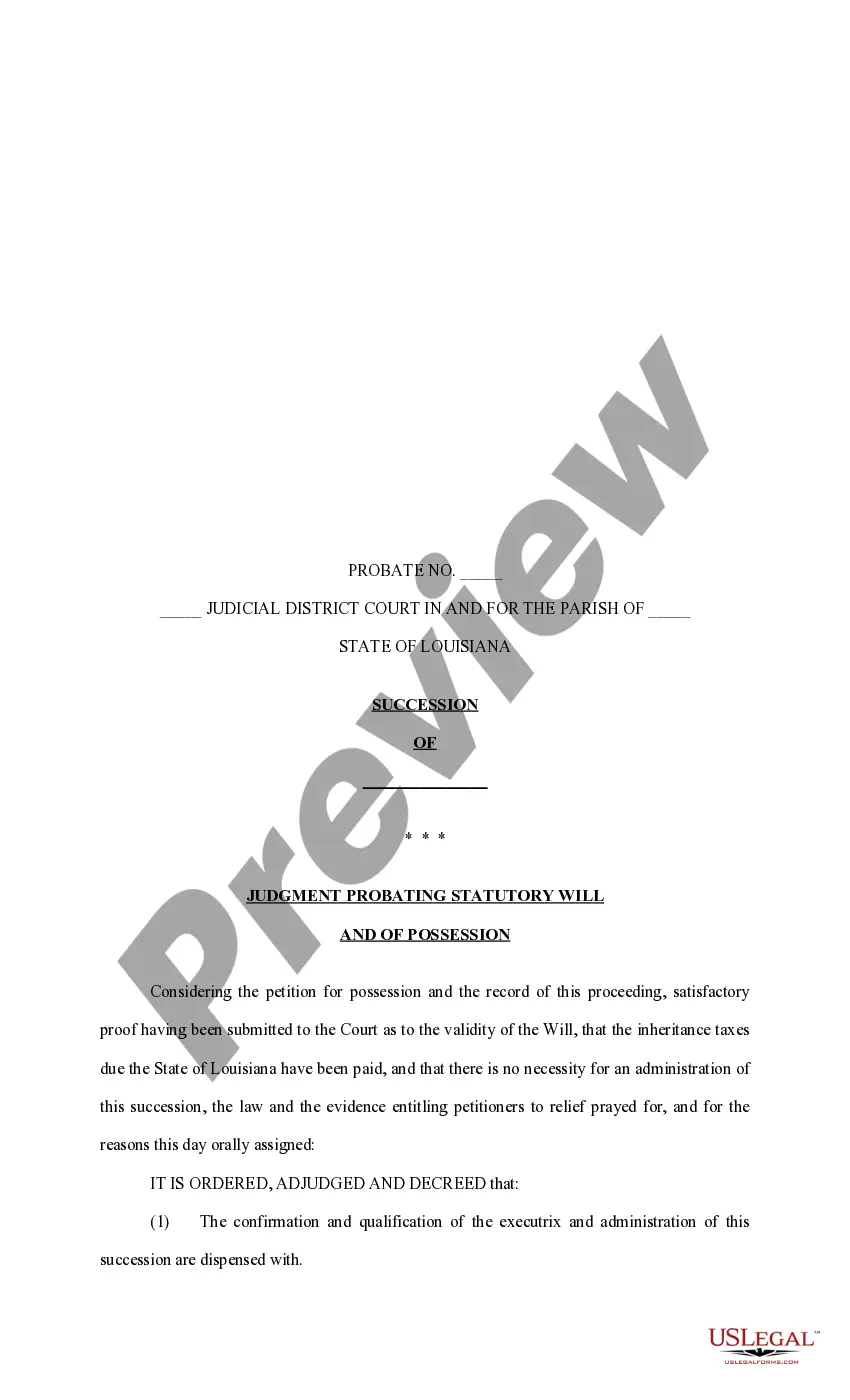

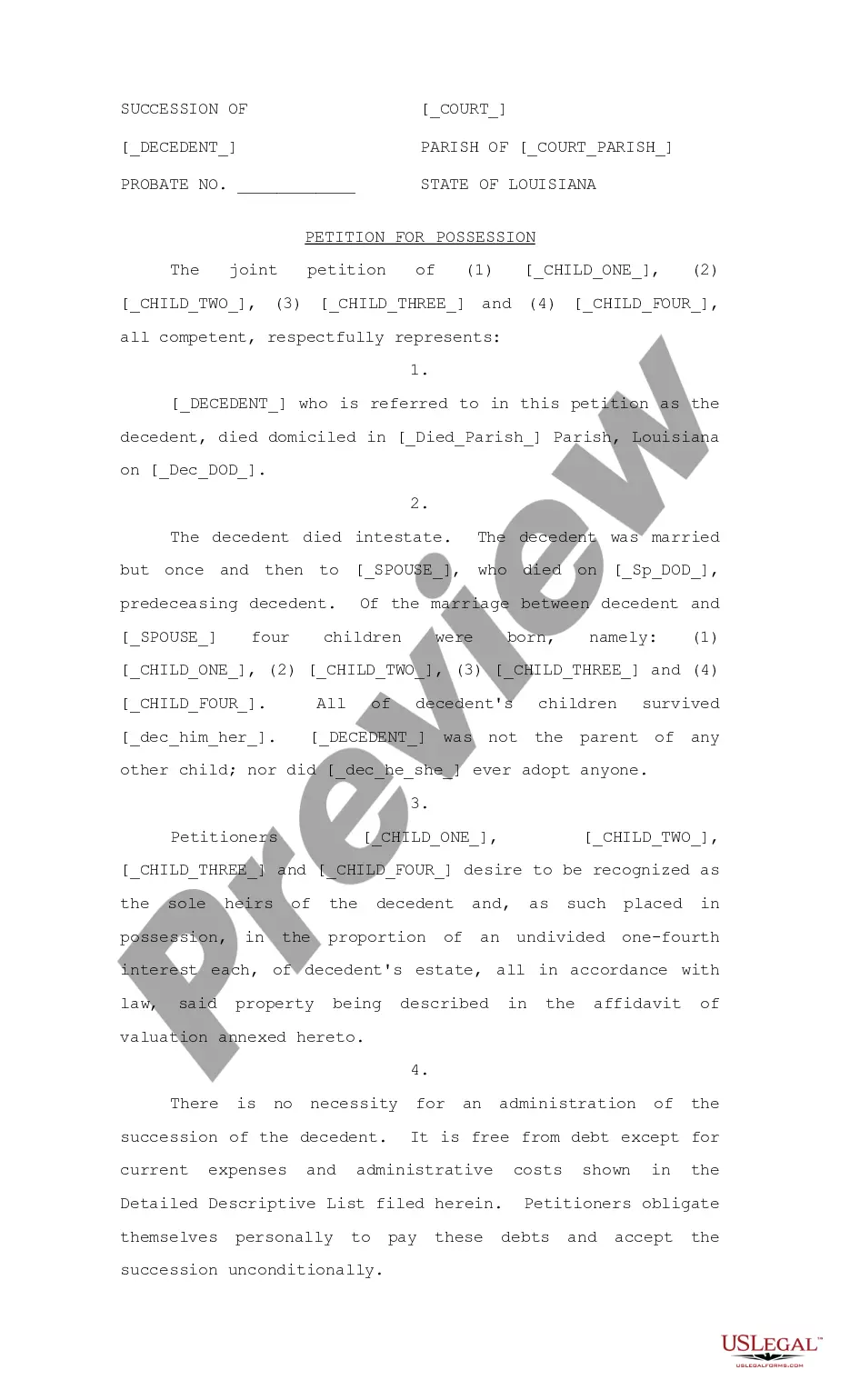

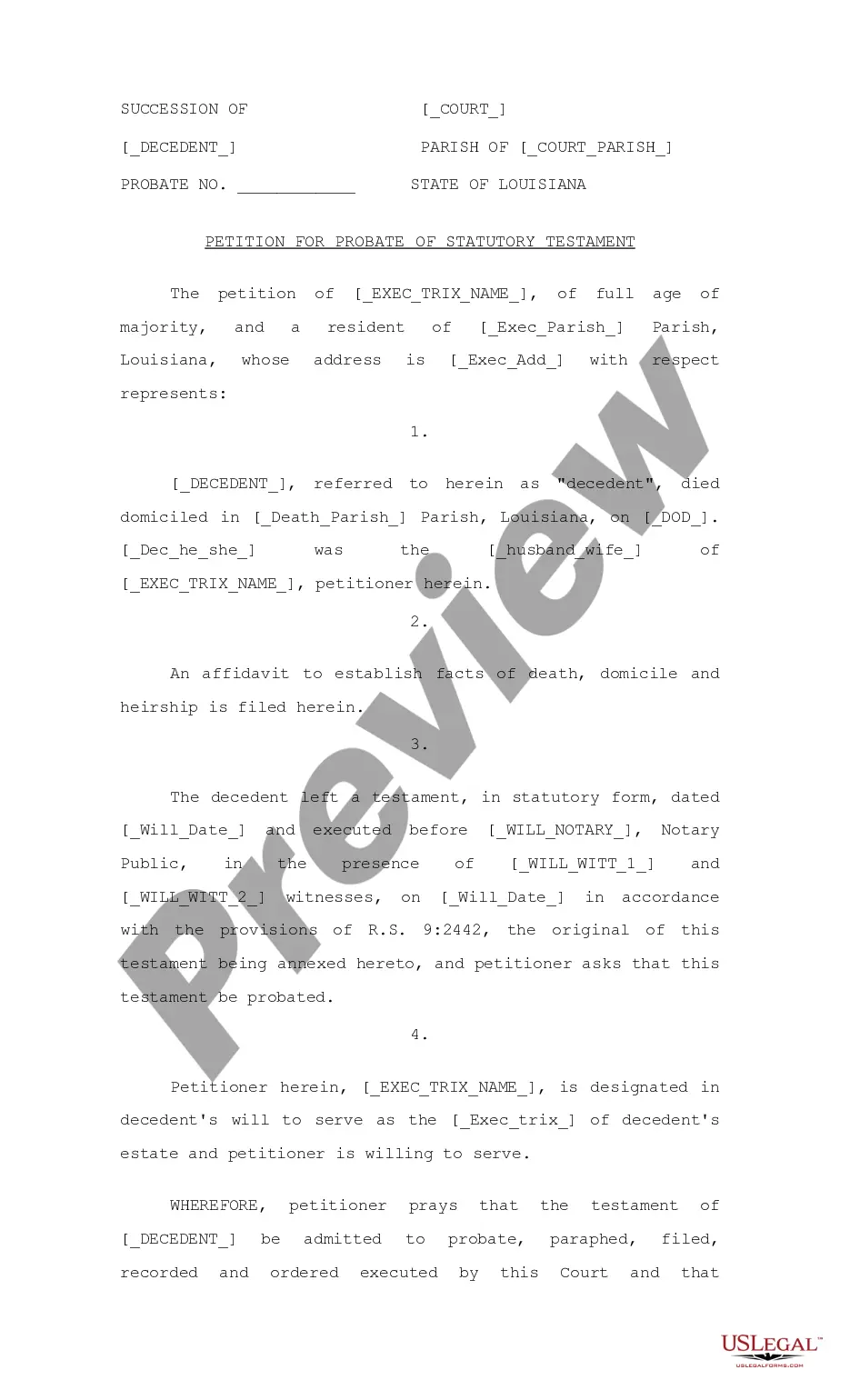

Louisiana Petition for Probate and Possession, Heirship or Descent Affidavit, Sworn Descriptive List, Judgment and Order

Description

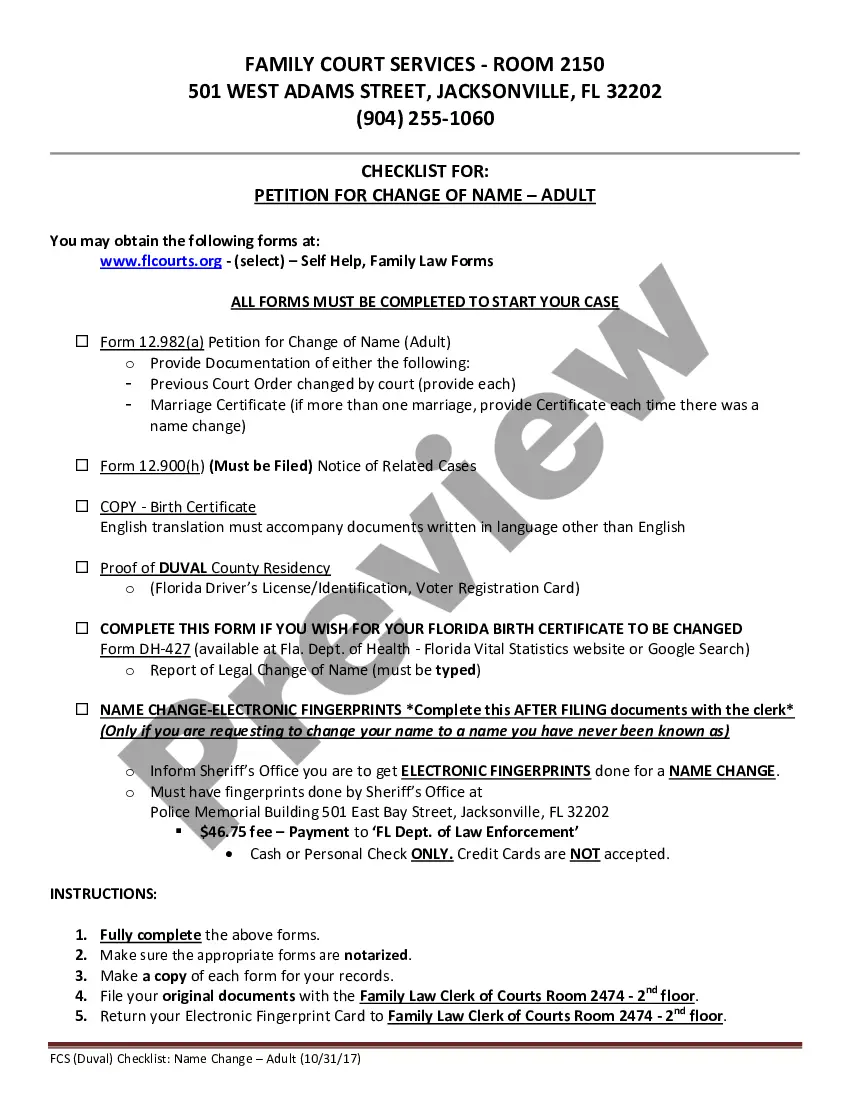

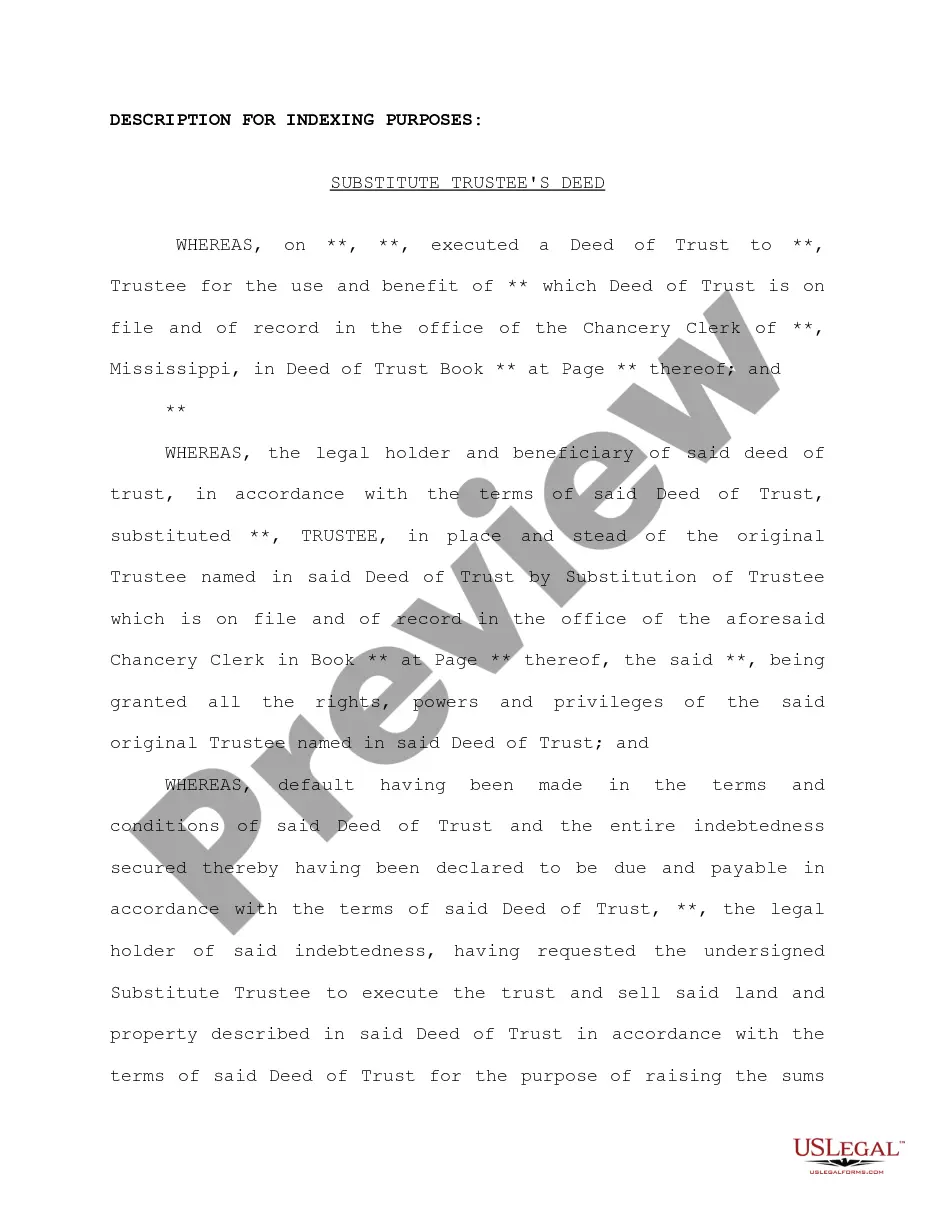

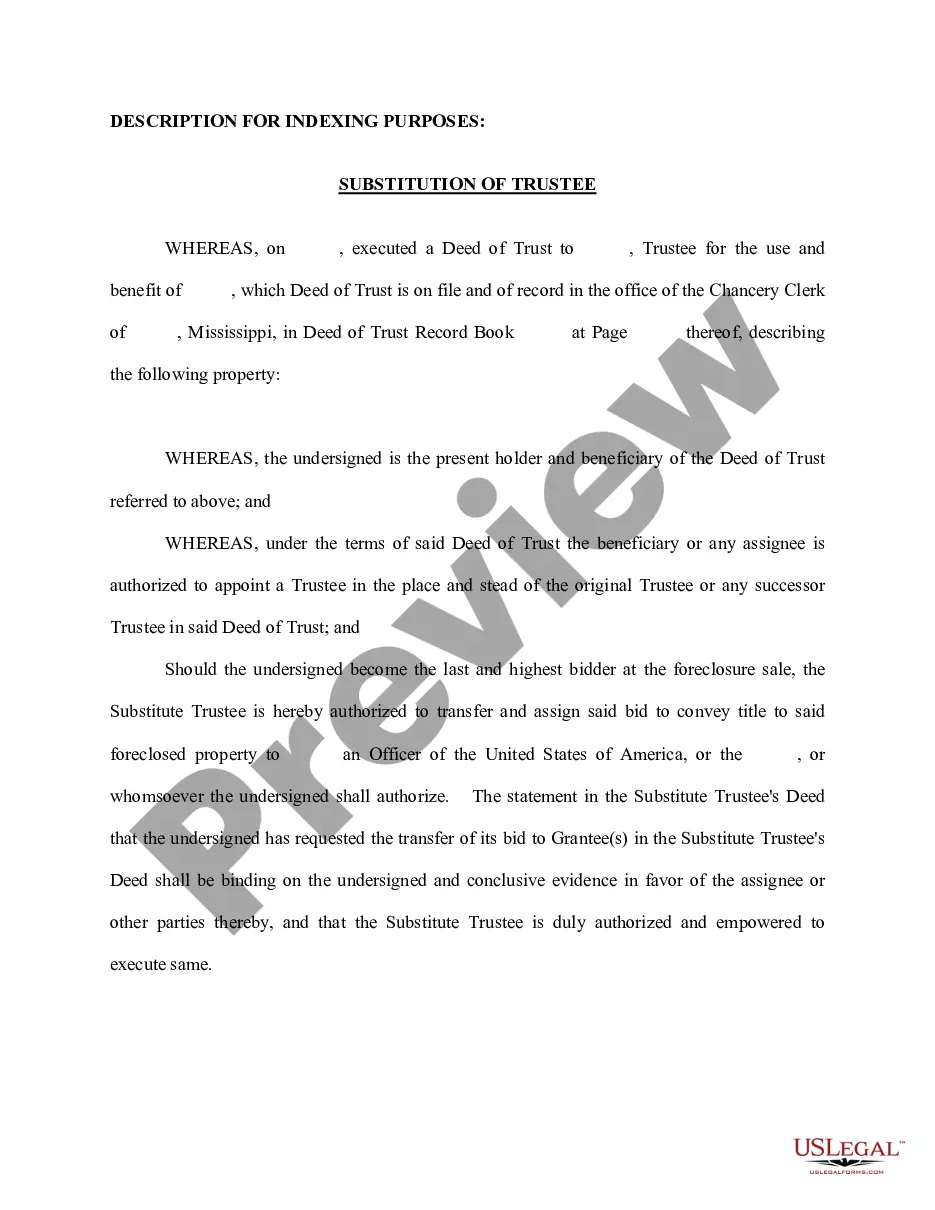

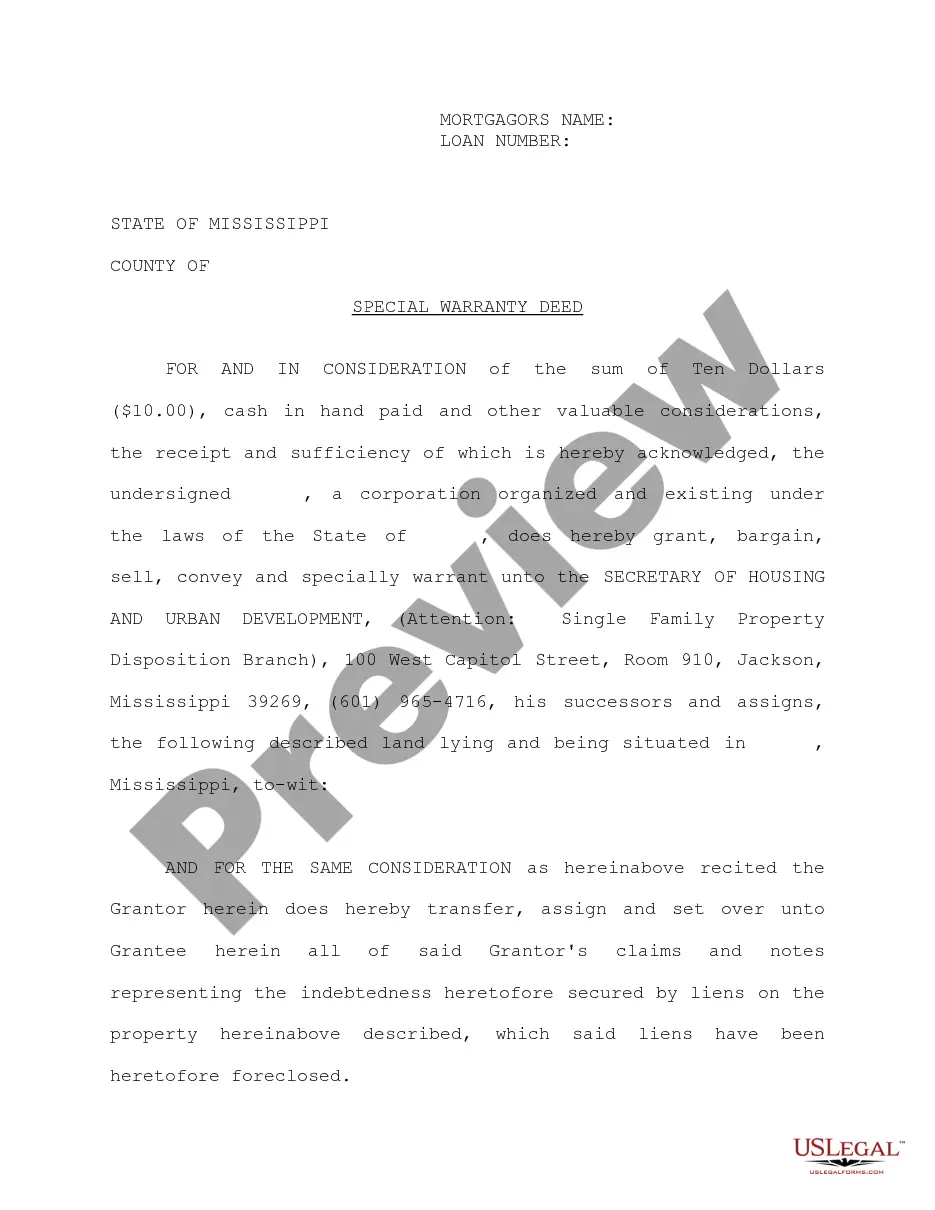

How to fill out Louisiana Petition For Probate And Possession, Heirship Or Descent Affidavit, Sworn Descriptive List, Judgment And Order?

Locating Louisiana Petition for Probate and Possession, Heirship or Descent Affidavit, Sworn Descriptive List, Judgment and Order template and completing them can prove to be quite the task.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the appropriate template specifically for your state in merely a few clicks.

Our lawyers prepare each document, so you only need to complete them. It's really that straightforward.

Click Buy Now if you have found what you are seeking. Choose your plan on the pricing page and create an account. Indicate whether you wish to pay via card or PayPal. Save the form in your desired format. Now you can print the Louisiana Petition for Probate and Possession, Heirship or Descent Affidavit, Sworn Descriptive List, Judgment and Order template or fill it out using any online editor. No need to worry about making mistakes as your form can be utilized and submitted, and printed as many times as you like. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Sign in to your account and return to the form's page to download the template.

- Your downloaded forms are saved in My documents and are therefore always accessible for future use.

- If you haven't signed up yet, you need to register.

- Check out our detailed instructions on how to obtain your Louisiana Petition for Probate and Possession, Heirship or Descent Affidavit, Sworn Descriptive List, Judgment and Order template in just a few minutes.

- To obtain a suitable sample, confirm its applicability for your state.

- Examine the sample using the Preview feature (if it's available).

- If there’s a description, peruse it to understand the essential details.

Form popularity

FAQ

To obtain a judgment of possession in Louisiana, start by filing a Louisiana Petition for Probate and Possession with the proper court. You will need to provide documentation of the deceased's estate and the heirs involved. Once your petition is filed, the court will process your request, and a hearing may be scheduled to review your case. After the court issues the judgment, you will have legal recognition of your right to the inherited property.

Once the succession has gone through Louisiana estate administration (if required), the Louisiana succession attorney will prepare a Petition for Possession and other documents needed to close the succession. The attorney then presents these documents to the court and obtains a Judgment of Possession.

The statute of limitations for filing a claim against an estate is a strict one year from the date of the debtor's death (pursuant to California Code of Civil Procedure Section 366.2). This limitation period applies regardless of whether the judgment creditor knew the judgment debtor had died!

Technically, there is no time limit on opening a succession in Louisiana. It can be done months or even years after a person's death. However, it's recommended that the probate process be started soon as possible.

If all heirs agree and the property is easy to find; you could be looking at a rate of $1,250-$3,500 plus court costs. Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

For simple successions, court costs can range from $300.00 to $600.00 depending on the parish where the succession will be filed. When an administration is needed for an estate, court costs will be higher depending on the filings necessary to complete the administration and can range from $1,500.00 up to $3,000.00.

By the time the executor takes inventory and creditors have an opportunity to submit claims, it will be at least six months. Expect succession to take from six months to a year before the final assets may be distributed to the heirs. In complicated situations, that timeline may be extended to several years.

Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

Is there a time limit for a claim against a deceased estate? Yes, there is. You have only 6 months from the date of the grant of probate to make a claim. In some very limited circumstances, an extension of this time frame may be granted.

A succession (probate) is required when there is no other method to transfer a deceased person's assets to their heirs.If someone who owns real estate in Louisiana dies while domiciled in another state, a succession will have to be opened to transfer the Louisiana property to the heirs.