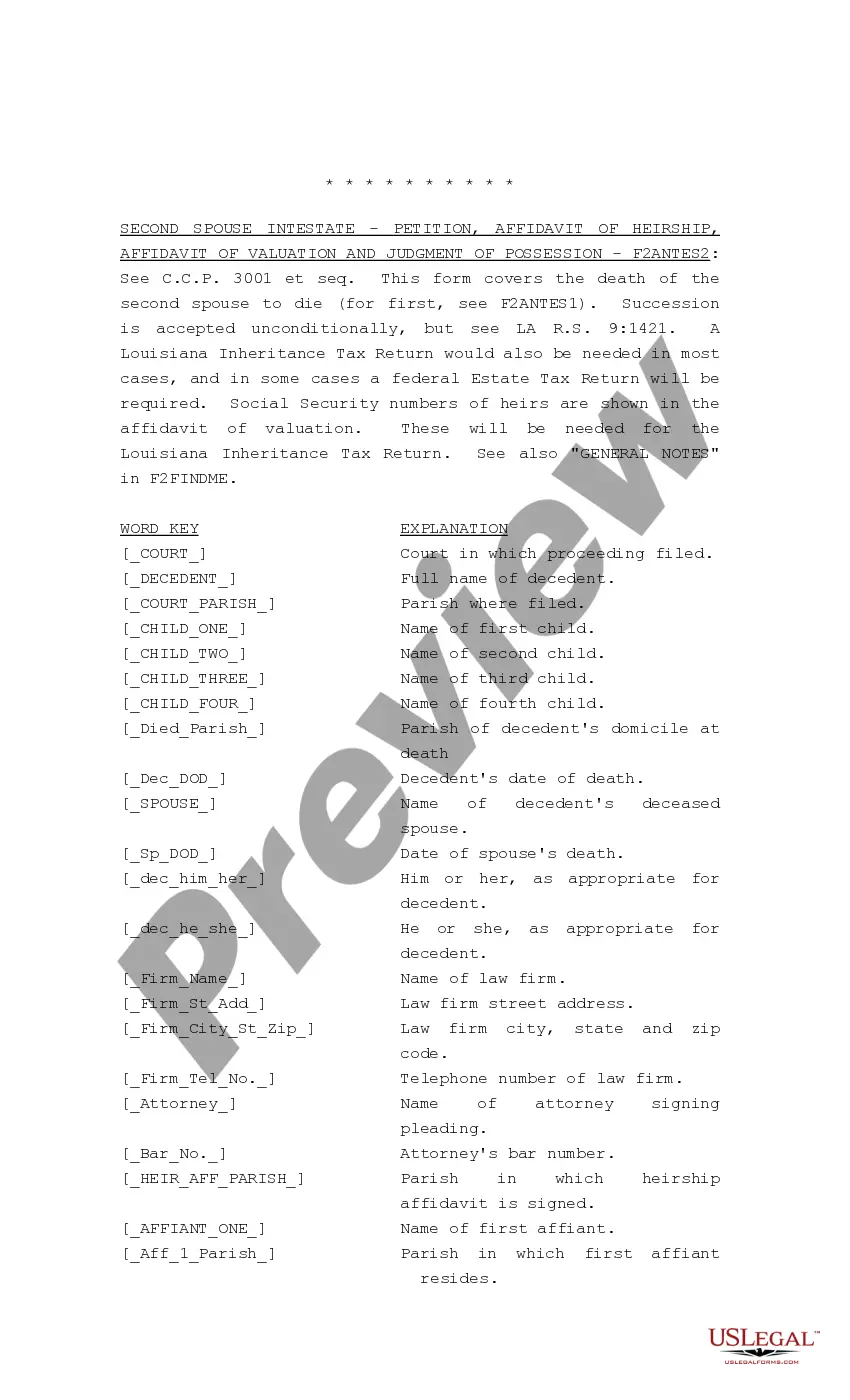

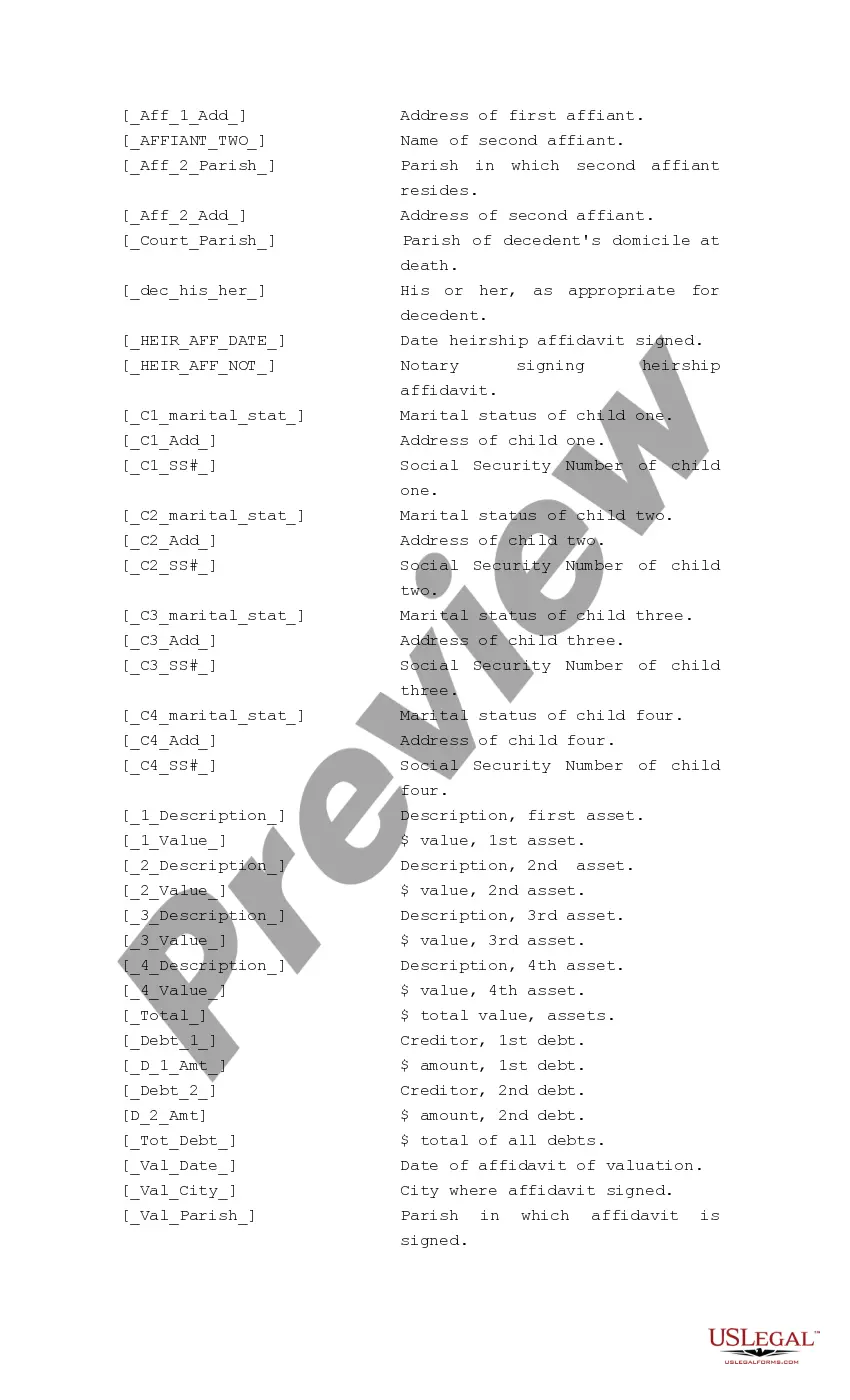

Louisiana Petition for Possession and Affidavit of Valuation and Detailed Descriptive List, Judgment of Possession

Description

How to fill out Louisiana Petition For Possession And Affidavit Of Valuation And Detailed Descriptive List, Judgment Of Possession?

You are invited to the finest legal document repository, US Legal Forms. Here you can acquire any template such as Louisiana Petition for Possession and Affidavit of Valuation and Detailed Descriptive List, Judgment of Possession documents and store them (as many of them as you desire). Create official papers in a few hours, instead of days or weeks, without spending a fortune on a lawyer or attorney.

Obtain your state-specific form in just a few clicks and feel assured knowing it was crafted by our proficient legal experts.

If you’re already a registered user, simply Log In to your account and click Download next to the Louisiana Petition for Possession and Affidavit of Valuation and Detailed Descriptive List, Judgment of Possession you prefer. As US Legal Forms is an online solution, you’ll typically access your saved forms, regardless of the device you’re using. View them within the My documents section.

Print the document and complete it with your/your business’s details. Once you have finished the Louisiana Petition for Possession and Affidavit of Valuation and Detailed Descriptive List, Judgment of Possession, submit it to your legal adviser for review. It’s an additional step but a crucial one for ensuring you’re fully protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- If you have not yet registered, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific template, verify its legality in your residing state.

- Review the description (if available) to determine if it’s the correct template.

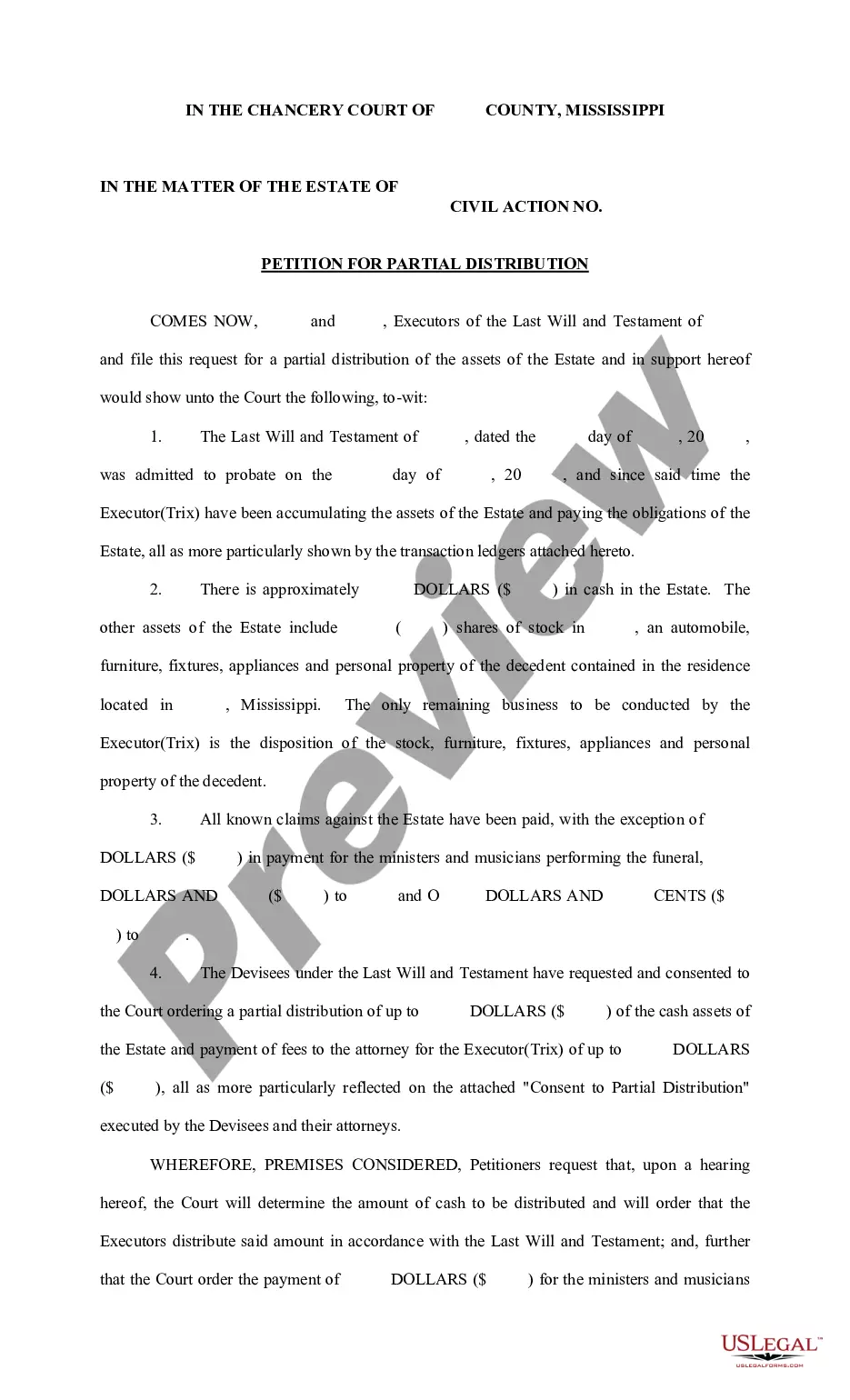

- Explore additional content with the Preview feature.

- If the template meets all your requirements, click Buy Now.

- To create your account, choose a subscription plan.

- Utilize a credit card or PayPal account to sign up.

- Download the template in the format you require (Word or PDF).

Form popularity

FAQ

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

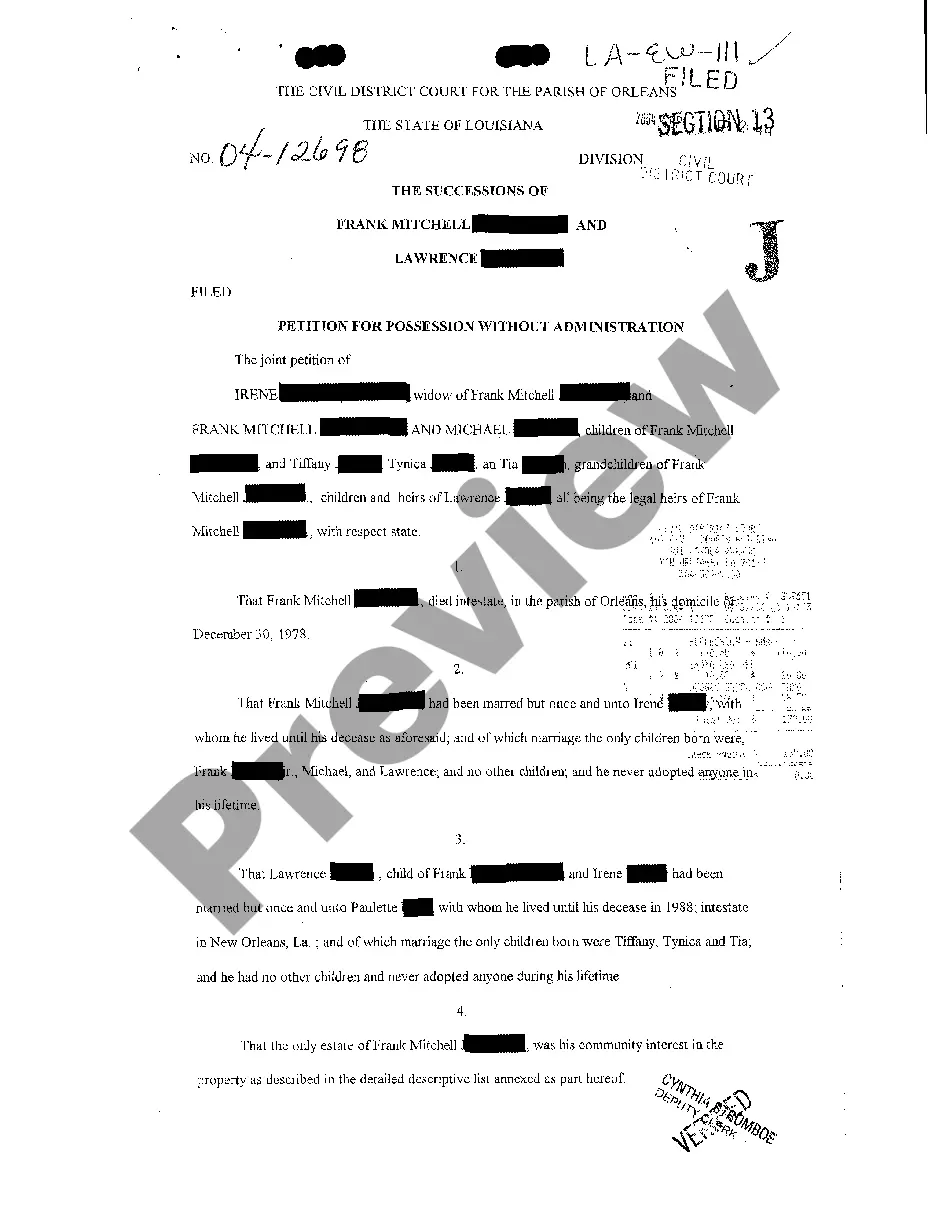

This is the process which transfers ownership of the property from the deceased person to those who inherit. A succession is the process of settling a deceased person's estate and distributing the property to those who inherit after the debts are paid. This process is called probate in other states.

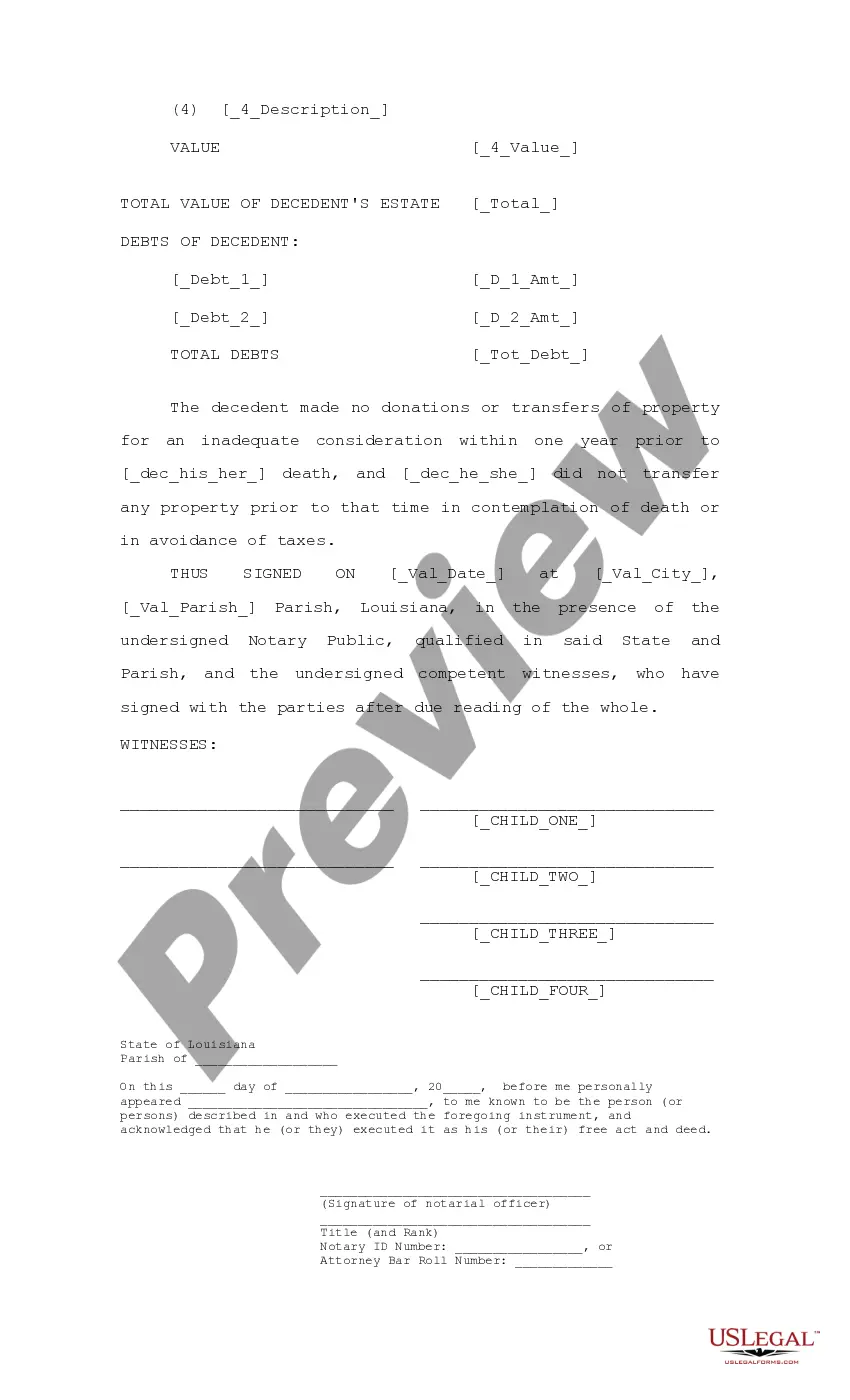

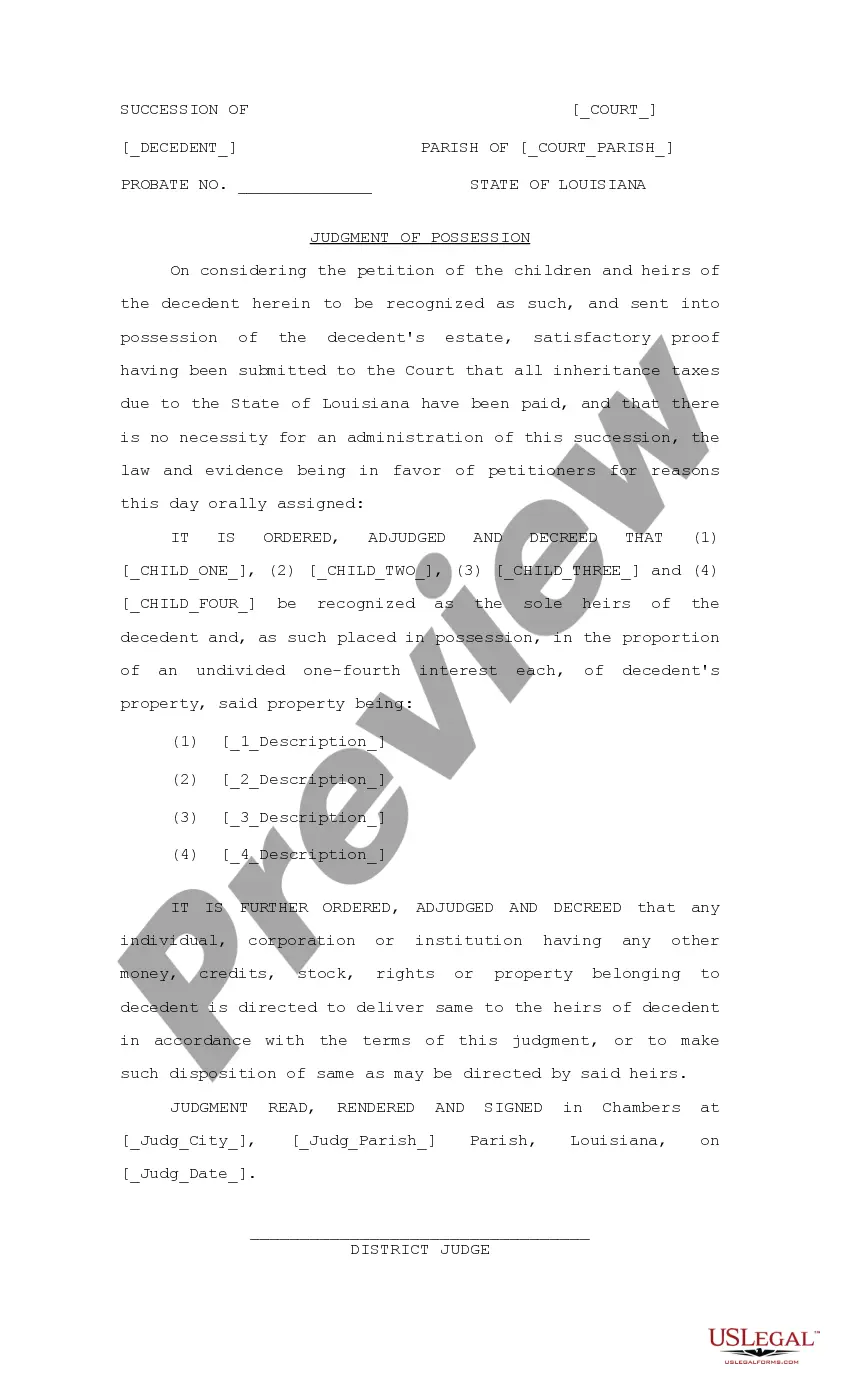

The parties enclose a list of the decedent's assets, an affidavit of death and heirship, and a copy of the death certificate. The court will issue a Judgment of Possession placing all heirs and legatees into possession of the decedent's assets retroactive to the date of the decedent's death.

Succession costs for smaller estates with cooperative heirs will typically range from $1,500.00 to $3,000.00. Succession costs for larger estates that require administration will typically range from $5,000.00 up to $15,000.00 depending on what needs to be done.

Legal Heir certificate is also provided for transfer of property- movable and immovable assets. 3) A Succession Certificate is required when someone inherits any immovable property or movable property under the various Property Laws in the country. Most of these issues come under the Hindu Succession Act.

While it is possible to probate a will by yourself, engaging an experienced lawyer can prevent future problems with real estate holdings, inheritance, disputes, and a myriad of other potential issues.

Many executors are able to wrap up an estate themselves, without hiring a probate lawyer.But if you're handling an estate that's straightforward and not too large, you may find that you can get by just fine without professional help.

Yes! For the vast majority of probate cases, an attorney is not required. In fact, anyone can interact with the court system and you do not need a lawyer to do so.

The executor is entitled to compensation for his or her services. In Louisiana, the minimum fee is set by statute. It is equal to 2 1/2 percent of the gross estate of the decedent. The fee may be subject to review depending on the complexity as well as the time and effort expended by the executor.