This Fiduciary Bond is an official form used by the Commonwealth of Kentucky, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Kentucky Fiduciary Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kentucky Fiduciary Bond?

Locating Kentucky Fiduciary Bond templates and filling them out can be challenging.

To conserve time, resources, and effort, utilize US Legal Forms to discover the suitable template specifically for your state within a few clicks.

Our lawyers create each document, so you merely need to complete them.

Choose your desired payment method, whether through a credit card or PayPal, and save the sample in your preferred file format. Now, you can print the Kentucky Fiduciary Bond form or complete it using any online editor. Don’t worry about making mistakes as your sample can be used, submitted, and printed as many times as you need. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's web page to download the sample.

- All your saved samples are kept in My documents and are always accessible for future use.

- If you haven’t signed up yet, you'll need to register.

- Review our detailed guidelines on how to obtain the Kentucky Fiduciary Bond sample in just a few minutes.

- To acquire a qualified sample, verify its relevance for your state.

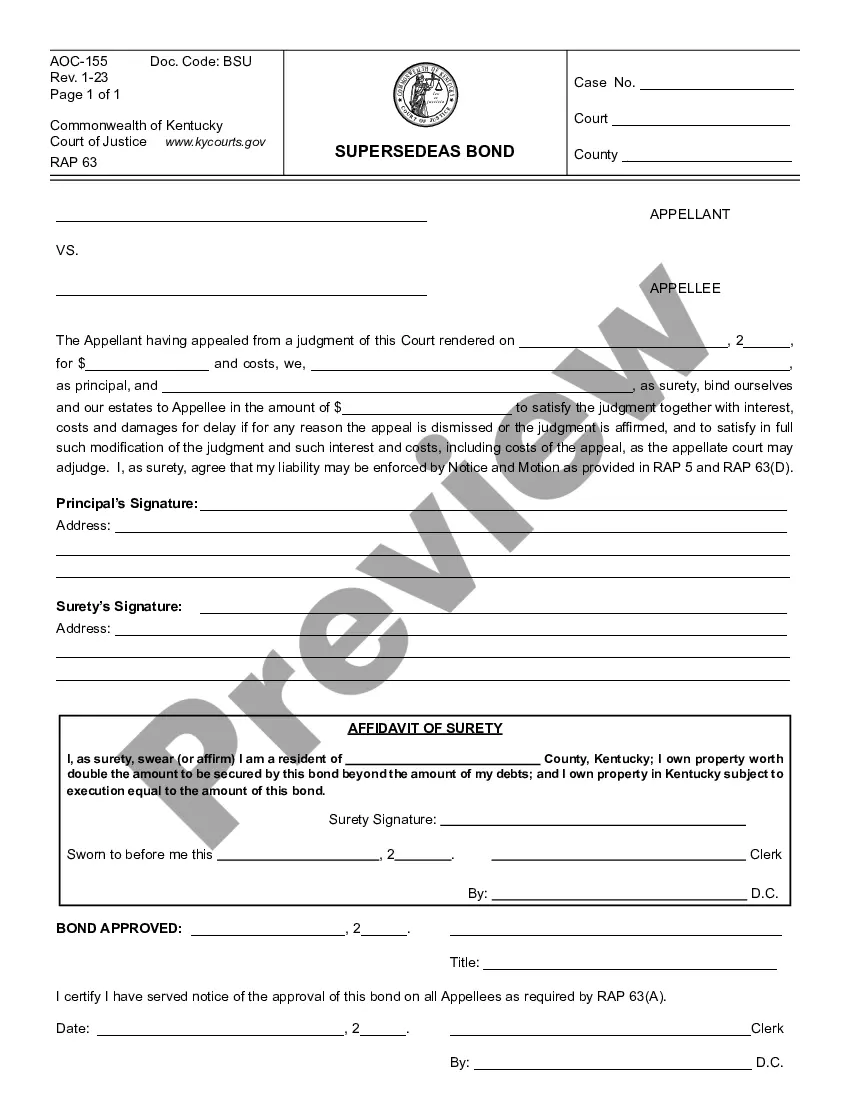

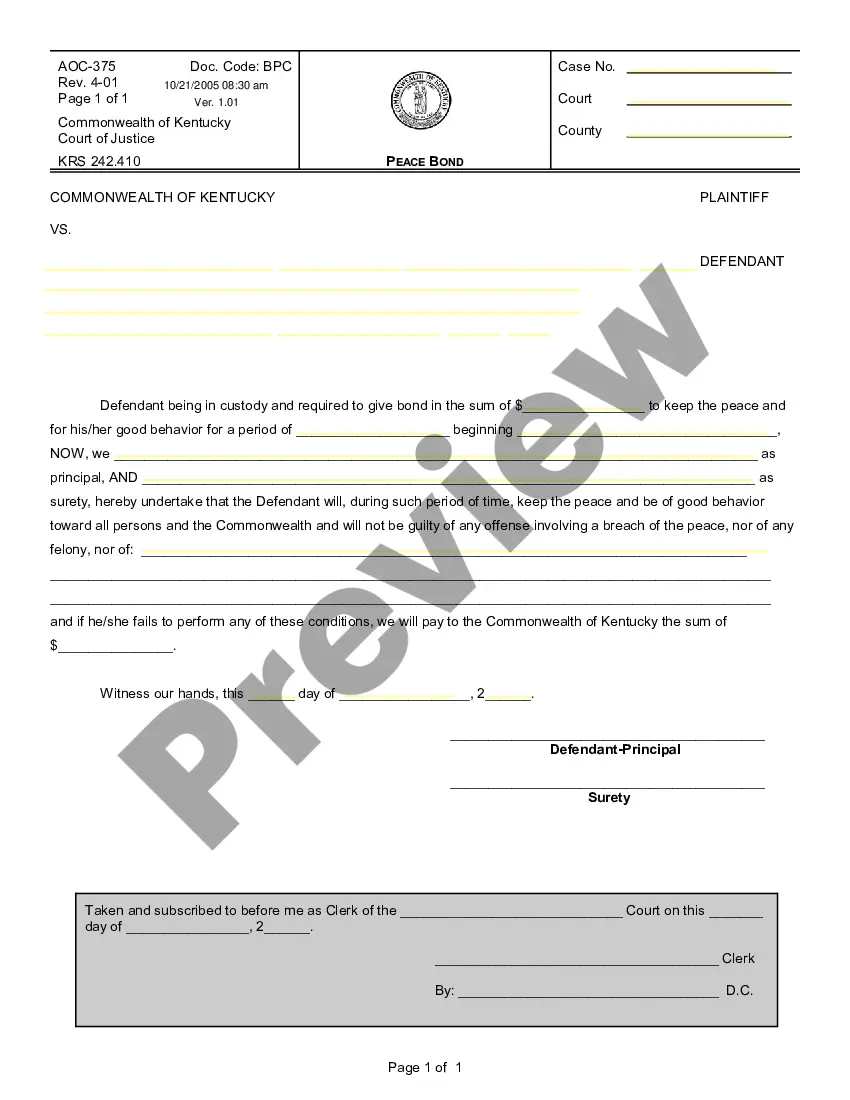

- View the example using the Preview function (if available).

- If there’s a description, read it to understand the specifics.

- Click the Buy Now button if you found what you’re looking for.

Form popularity

FAQ

Kentucky law provides for many different manners in which to avoid probate. For example, probate is altogether unnecessary for small estates.In this way, the owner who dies first passes his or her interest in the property to the survivor, and the interest in property does not have to go through the probate process.

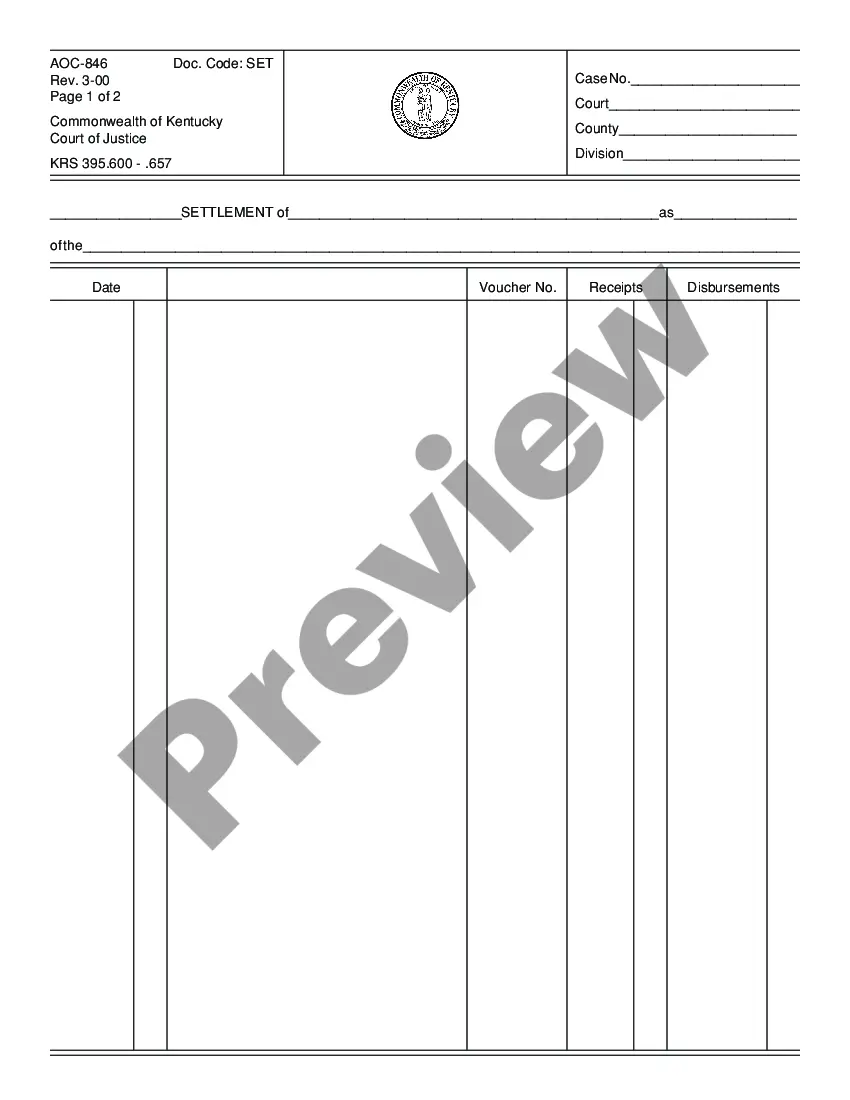

Of the Estate's Affairs The final settlement with the probate clerk may be filed any time after six months following the date of appointment as executor and must be filed at least two years following appointment.

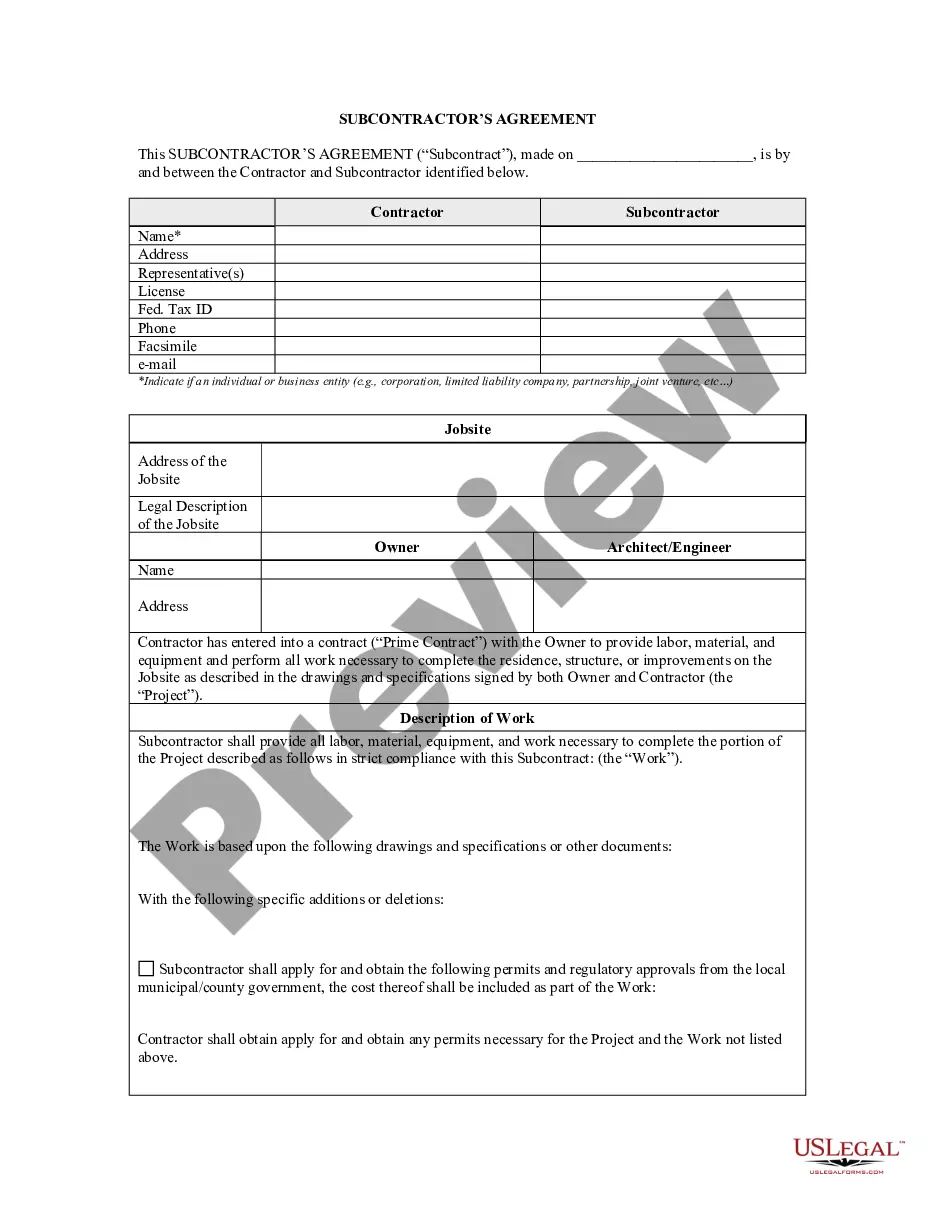

A fiduciary bond is a legal instrument that essentially serves as insurance to protect beneficiaries, heirs and creditors when a fiduciary fails to perform honestly or competently. A court may require a fiduciary bond for any person or party that has fiduciary duty or responsibility to another.

Submit an application and executed indemnity agreement supplied by the surety broker/agent; Provide a copy of the court paperwork pertinent to the case; and. Pay the premium for the bond once approved.

A fiduciary bond is a legal instrument that essentially serves as insurance to protect beneficiaries, heirs and creditors when a fiduciary fails to perform honestly or competently. A court may require a fiduciary bond for any person or party that has fiduciary duty or responsibility to another.

Settling the Estate The settlement may not be filed until at least six months from the date the personal representative was appointed. KRS §395.190. If settling the estate takes more than two years, a periodic settlement may be required.

In Kentucky, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).