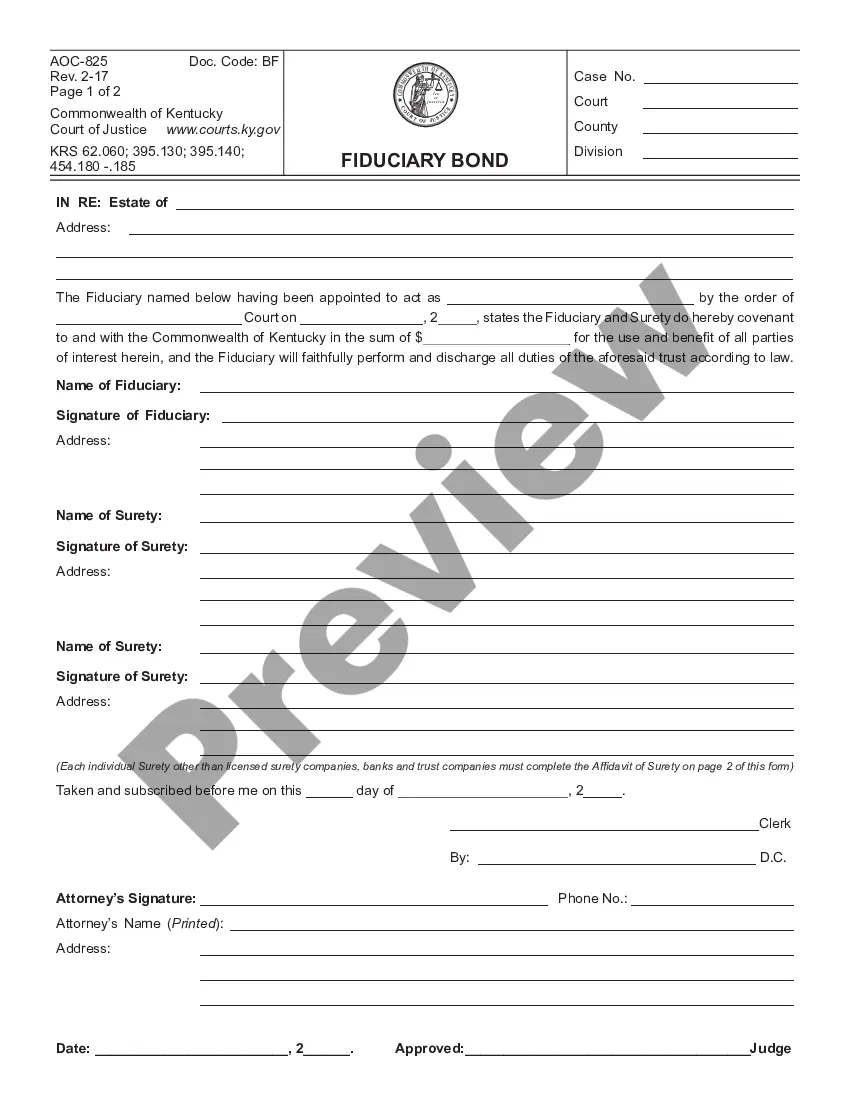

This Supersedeas Bond is an official form used by the Commonwealth of Kentucky in a civil action, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Kentucky Supersedeas Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kentucky Supersedeas Bond?

Searching for Kentucky Supersedeas Bond templates and completing them can pose a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable sample specifically for your state within a couple of clicks.

Our legal experts create every document, allowing you to simply complete them. It is genuinely that straightforward.

Click Buy Now if you have found what you are looking for. Select your plan on the pricing page and create your account. Choose your payment method with a credit card or via PayPal. Download the sample in your desired format. You can print the Kentucky Supersedeas Bond form or complete it using any online editor. You need not worry about making errors since your form can be utilized and sent, and printed as many times as you wish. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the sample.

- All your downloaded samples are stored in My documents and are accessible anytime for future use.

- If you haven’t subscribed already, you must register.

- Review our extensive guidelines on how to obtain the Kentucky Supersedeas Bond sample in minutes.

- To acquire a qualified form, verify its legitimacy for your state.

- Examine the example using the Preview option (if it’s available).

- If there’s a description, peruse it to grasp the key elements.

Form popularity

FAQ

A surety bond protects the obligee (the party to whom the bond is paid to in the event of a default) against losses, up to the limit of the bond, that result from the principal's (the party with the guaranteed obligation) failure to perform its obligation.

A replevin bond permits the plaintiff to take possession the property withheld by the defended prior to a hearing. Replevin bonds make sure that if the defendant wins the case, the plaintiff will forfeit the property to them.The court will habitually set the bond amount.

A supersedeas bond in Texas covers the cost of a money judgment and court fees, in order to stay a judgment during an appeal process. Without using a surety bond, a defendant is required to immediately settle the judgment with the plaintiff.

A Florida supersedeas bond is a legal mechanism available to plaintiffs and defendants that have sustained a monetary judgment and wish to stay collection pending hearing of further pleadings. Rule 9.310(b) addresses the amount in which the appeal bond must be executed.

The purpose of a Supersedeas Bond is to hold the defendant liable for court costs should their appeal be unsuccessful. If the higher court upholds the lower court's decision, the Appeal Bond guarantees the defendant will pay the judgment, interest, court costs, and attorney fees.

You will generally pay 1-15% of the total bond amount. Your rate is often based off your personal credit score. For example, if you need a $10,000 surety bond and you get quoted at a 1% rate, you will pay $100 for your surety bond. Higher risk bonds, like construction bonds, may cost 10% or more of the bond's value.

A: The cost of your surety bond will vary depending on the type of bond and the amount of bond coverage you need. Surety bond premiums usually range from 1-15% of the total bond amount. For example, if you get quoted a 2% rate on a $50,000 bond, you will pay $1,000 for your surety bond.

State laws determine the amount of the bond, which is generally based on the estimated amount of the estate or assets being managed. The cost of an Appeal/Supersedeas Bond is usually 1.5 to 5 percent of the bond amount.