Michigan Debt Management Fee Processing Card, also known as DMPC, is a prepaid debit card issued by the Michigan Department of Treasury. It is designed to help state residents manage their debt by allowing them to make payments towards their outstanding debts. DMPC can be used to make payments to state agencies, government-related services, and certain private companies. The card also provides access to cash withdrawals and balance inquiries at ATMs. There are two types of Michigan Debt Management Fee Processing Cards — the Standard Card and the Plus Card. The Standard Card is free to obtain and can be used for payment of debts up to $2,500. The Plus Card is a premium card with an additional fee, and it allows payments up to $10,000. Both cards come with a monthly maintenance fee, and additional fees may apply depending on the type of payment.

Michigan Debt Management Fee Processing Card

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

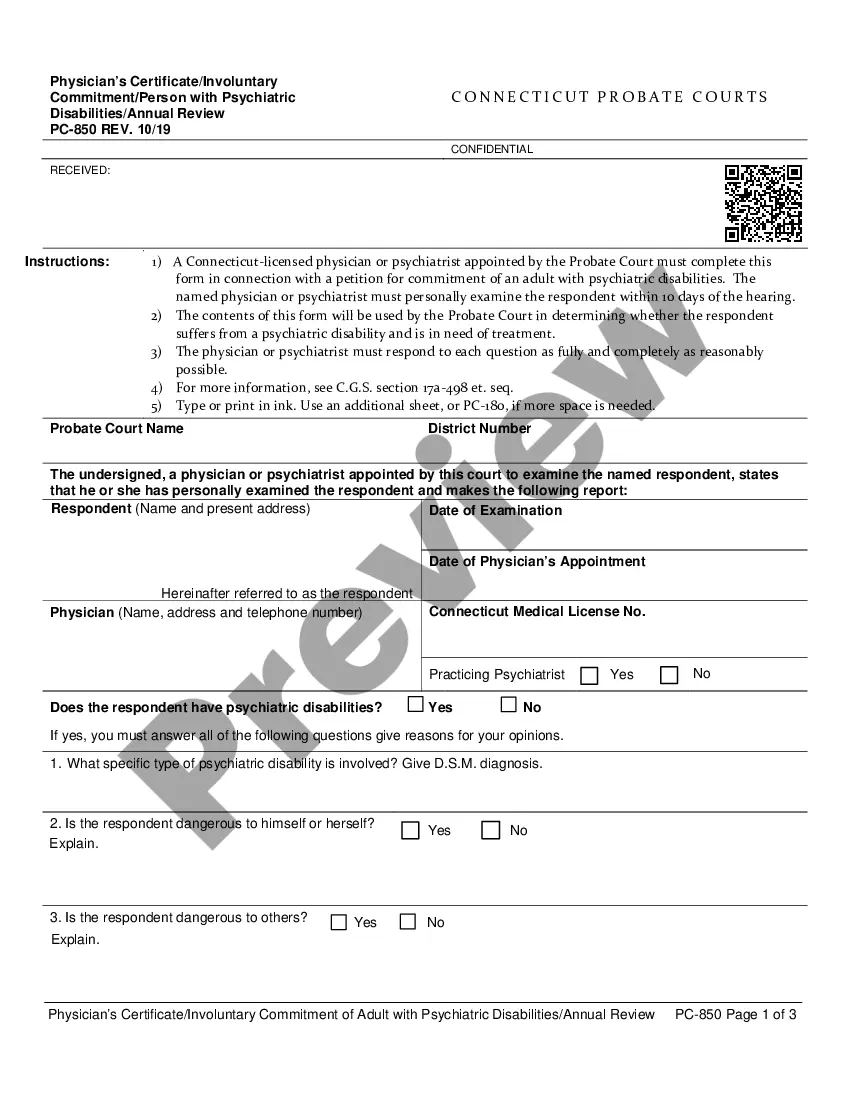

How to fill out Michigan Debt Management Fee Processing Card?

US Legal Forms is the simplest and most economical method to find appropriate official templates.

It’s the largest online repository of business and personal legal documents drafted and validated by legal experts.

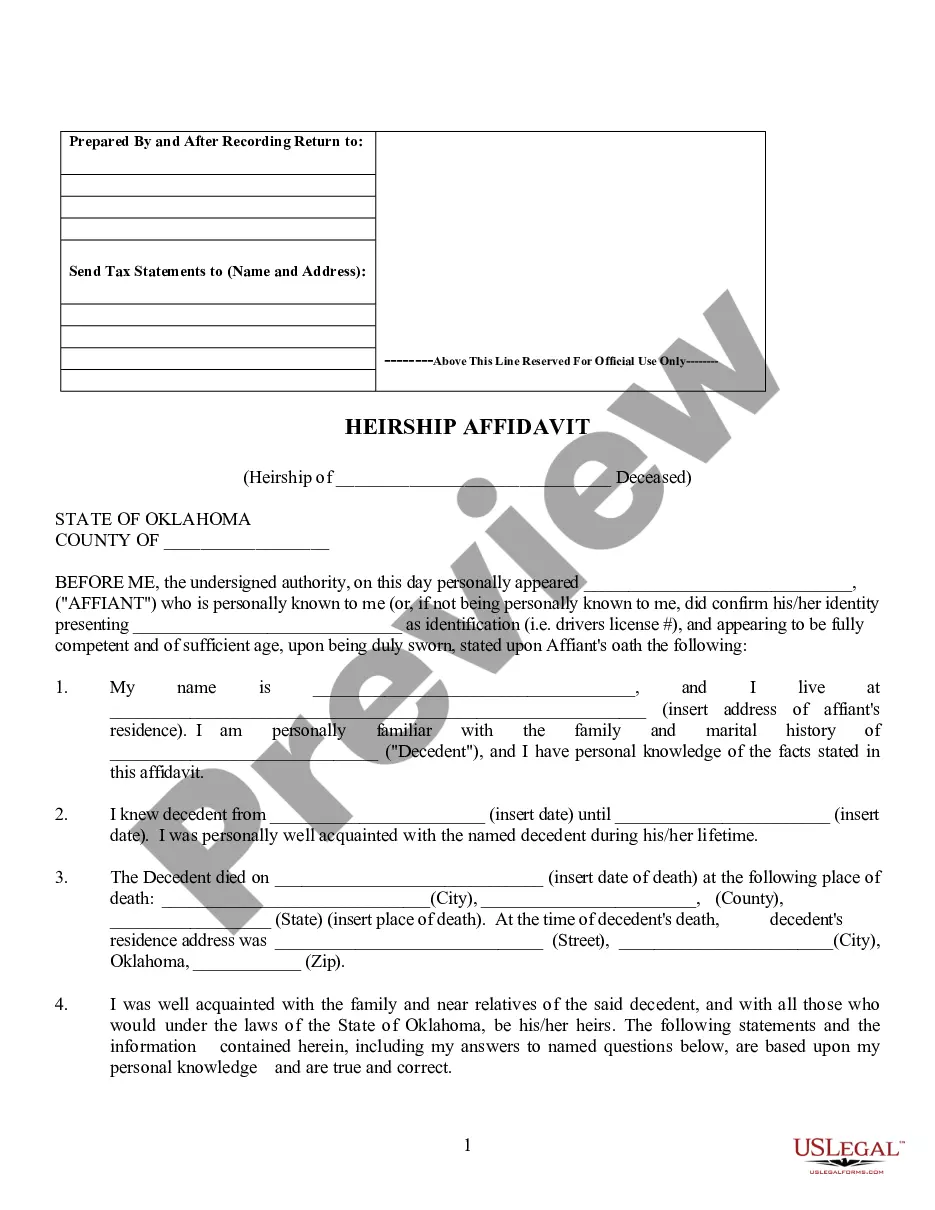

Here, you can discover printable and fillable templates that adhere to national and local regulations - just like your Michigan Debt Management Fee Processing Card.

Review the form description or preview the document to confirm you’ve selected the one that meets your needs, or find an alternative using the search tab above.

Click Buy now when you’re confident of its alignment with all the requirements, and select the subscription plan that suits you best.

- Obtaining your template requires just a few easy steps.

- Users who already possess an account with an active subscription only have to Log In to the site and download the document to their device.

- Subsequently, they can locate it in their profile in the My documents section.

- And here’s how to acquire a professionally drafted Michigan Debt Management Fee Processing Card if you are using US Legal Forms for the first time.

Form popularity

FAQ

Yes, Michigan has a statute of limitations on credit card debt, which lasts for six years. This limitation means that if a creditor does not file a lawsuit within this timeframe, they can no longer enforce payment through legal means. If you find yourself struggling with credit card debt, utilizing a Michigan Debt Management Fee Processing Card can streamline your repayment process and help you regain control of your financial situation.

In Michigan, creditors can typically pursue collections for credit card debt for six years. This period begins when you default on your payments. If you have concerns about your Michigan Debt Management Fee Processing Card, it is crucial to understand that while creditors can collect on this debt, seeking guidance from professional debt management services can help you navigate your options.

Indeed, debt relief options are very much real in Michigan. Various organizations offer assistance to individuals seeking to alleviate their financial burdens through structured repayment plans and negotiations. The Michigan Debt Management Fee Processing Card can enhance your experience by simplifying transactions. To navigate these options confidently, look into services provided by US Legal Forms for reliable guidance and resources.

Yes, Michigan debt relief exists and offers various options to help individuals manage their debts effectively. Programs are available to assist consumers in negotiating their debt terms and reducing payments. Utilizing tools like the Michigan Debt Management Fee Processing Card can streamline this process. For comprehensive solutions, consider platforms like US Legal Forms, which provide resources for effective debt management.

Accounting for credit card processing fees involves recording them as expenses in your financial statements. You should deduct these fees from your revenue to reflect net income accurately. With solutions like uslegalforms, you can streamline this accounting process, making it easy to manage transactions linked to Michigan Debt Management Fee Processing Card fees. This ensures that your financial records remain transparent and accurate for auditing or reporting purposes.

To accurately record credit card processing fees, begin by tracking each transaction that incurs a fee related to Michigan Debt Management Fee Processing Card payments. Ensure that you categorize these fees under operational expenses, as they directly affect your profit margins. Utilize accounting software or platforms like uslegalforms to simplify the tracking process and maintain clear financial records. This way, you can manage your budget effectively while ensuring compliance.

The Debt Management Act in Michigan provides guidelines for companies that offer debt management services. This act ensures that consumers receive fair treatment when working with debt management companies. Moreover, it regulates fees and practices related to Michigan Debt Management Fee Processing Card transactions. Understanding this act helps you to navigate the complexities of debt management while protecting your rights.