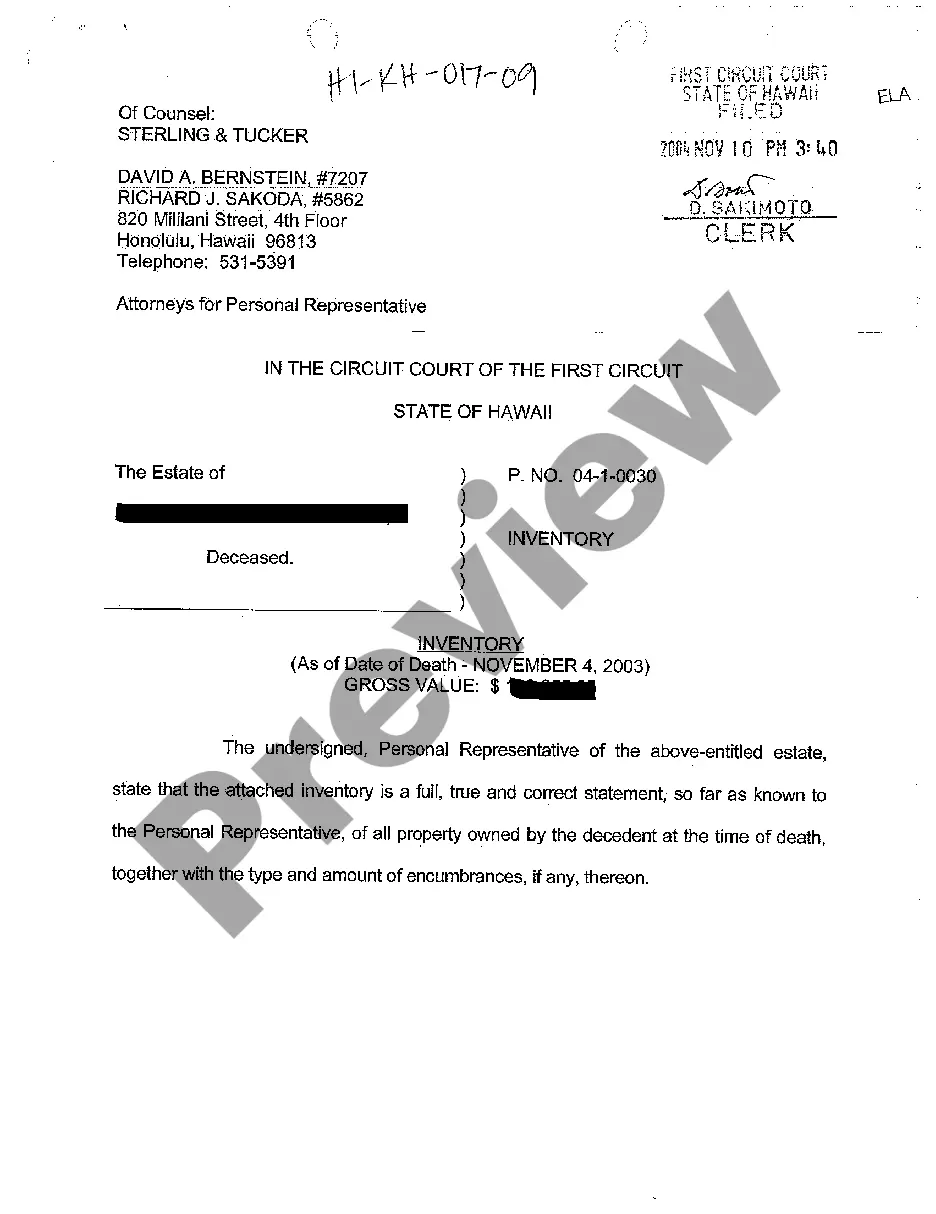

Hawaii Inventory of Property of Deceased

Description

How to fill out Hawaii Inventory Of Property Of Deceased?

Amidst numerous complimentary and premium templates that you can discover online, you cannot guarantee their precision.

For instance, who created them or if they possess the necessary expertise to handle your requirements.

Always remain composed and utilize US Legal Forms! Obtain Hawaii Inventory of Property of Deceased samples produced by qualified attorneys and steer clear of the expensive and lengthy endeavor of searching for a lawyer and subsequently compensating them to draft a document that you can source independently.

Select a pricing plan and establish an account. Remit payment for the subscription using your credit/debit card or Paypal. Download the form in your chosen file format. Once you've registered and completed your payment, you may utilize your Hawaii Inventory of Property of Deceased as many times as necessary or for as long as it remains valid in your jurisdiction. Modify it with your preferred editor, complete it, sign it, and generate a hard copy. Achieve much more for less with US Legal Forms!

- If you hold a subscription, sign in to your account and locate the Download button adjacent to the file you wish to find.

- You will also have access to all your previously saved documents in the My documents section.

- If this is your first time using our platform, adhere to the instructions below to obtain your Hawaii Inventory of Property of Deceased swiftly.

- Ensure that the document you find is applicable in your location.

- Examine the document by reviewing the details using the Preview function.

- Click Buy Now to initiate the purchasing process or search for another sample using the Search field located in the header.

Form popularity

FAQ

Generally, you should aim to transfer property as soon as possible after a person’s death. In Hawaii, while there is no strict deadline, delays can complicate the process and may lead to additional legal issues. Utilizing the Hawaii Inventory of Property of Deceased ensures you have a thorough understanding of the estate, which can help facilitate quicker transfers to heirs.

Rule 50 in Hawaii pertains to the requirements for filing a petition for informal probate proceedings. This rule necessitates a detailed account of the estate's assets, which is where the Hawaii Inventory of Property of Deceased proves essential. Understanding this rule helps streamline the probate process and ensures compliance with state regulations.

Transferring assets from a deceased estate typically involves probate proceedings. The Hawaii Inventory of Property of Deceased is required to document all estate assets before any transfers can occur. Once the probate court approves the distribution, the executor can distribute assets, such as property or bank accounts, to beneficiaries according to established legal protocols.

Assets from an estate are distributed based on the instructions provided in the will or, if there is no will, according to Hawaii's intestacy laws. The Hawaii Inventory of Property of Deceased plays a pivotal role in this process, as it outlines all assets and their values. Executors or personal representatives facilitate the distribution process to ensure beneficiaries receive their rightful shares.

In Hawaii, you generally need to file for probate within three months after the death of the individual. However, it is vital to start this process sooner to ensure that the Hawaii Inventory of Property of Deceased is completed effectively. Prompt action can streamline the distribution of assets, so addressing this matter quickly is advisable.

To get assets out of your estate, you must first gather all relevant information about the property and its beneficiaries. Filing the Hawaii Inventory of Property of Deceased is crucial, as it helps identify and appraise the assets. Once this process is complete, you can initiate transfers to heirs according to your wishes or the instructions in your will.

In Hawaii, an estate must be valued at $100,000 or more to require probate proceedings. If the value falls below this threshold, the estate may not need to go through the formal probate process, which can save time and resources. However, every case is unique, and sometimes the Hawaii Inventory of Property of Deceased may still play a crucial role in clarifying ownership and distribution. Consulting with a professional can help you understand the specifics and navigate the requirements effectively.

Rule 42 in Hawaii probate outlines the procedures for filing the Hawaii Inventory of Property of Deceased. This rule mandates that the inventory must be submitted within a specific timeframe after the appointment of the personal representative. By adhering to this rule, you ensure the probate process runs smoothly and that the estate is managed transparently. Understanding these requirements can simplify the responsibilities of handling a loved one's estate.

Yes, you can look up an estate in probate by accessing court records at the county where the estate was filed. Many courts offer online access or allow you to visit in person for information. This process can help you gather details about the Hawaii Inventory of Property of Deceased and the overall management of the estate.

Probate is triggered in Hawaii when an individual passes away and has assets that need to be legally distributed. Common scenarios include owning real estate solely in the deceased's name or having significant personal property. Knowing what triggers probate can help you anticipate steps to file the Hawaii Inventory of Property of Deceased promptly.