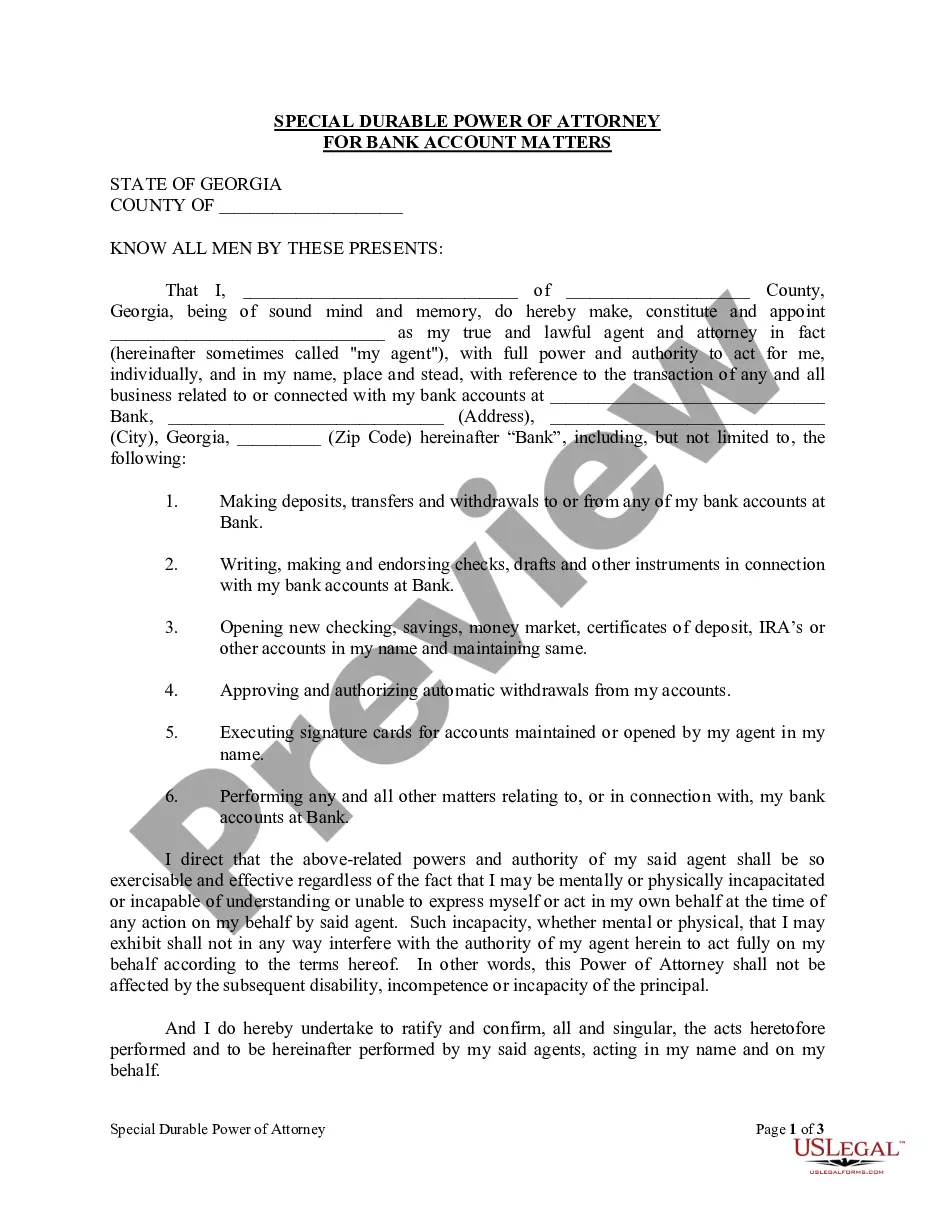

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Georgia Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Georgia Special Durable Power Of Attorney For Bank Account Matters?

Obtain access to the most comprehensive collection of sanctioned forms. US Legal Forms is truly a platform where you can locate any state-specific template within a few clicks, such as Georgia Special Durable Power of Attorney for Bank Account Matters samples.

No need to waste hours searching for a court-acceptable form. Our certified experts ensure that you receive the latest documents each time.

To utilize the forms library, choose a subscription option and create an account. If you have already registered, just Log In and select Download. The Georgia Special Durable Power of Attorney for Bank Account Matters sample will instantly be stored in the My documents section (a section for every form you access on US Legal Forms).

That's it! You should complete the Georgia Special Durable Power of Attorney for Bank Account Matters form and verify it. To ensure that everything is precise, consult your local legal advisor for assistance. Sign up and effortlessly discover around 85,000 valuable templates.

- If you are about to use a state-specific document, make sure to specify the correct state.

- Whenever possible, review the description to understand all the details of the document.

- Use the Preview option if it’s available to examine the document's content.

- If everything looks correct, click Buy Now.

- After selecting a pricing plan, create an account.

- Make payment via card or PayPal.

- Download the document to your device by clicking on the Download button.

Form popularity

FAQ

To obtain a financial power of attorney in Georgia, you can start by drafting the Georgia Special Durable Power of Attorney for Bank Account Matters. This document must be signed in the presence of a notary public and should detail the powers you wish to grant to your agent. You can create this document easily through platforms like uslegalforms, which guide you through the process and ensure all necessary legal requirements are met. Once completed, provide copies to your agent and any relevant financial institutions.

Yes, a power of attorney can cover bank accounts, allowing your chosen agent to manage financial matters on your behalf. With a Georgia Special Durable Power of Attorney for Bank Account Matters, you can grant specific rights to your agent, such as accessing bank accounts, paying bills, and making deposits. This document ensures your financial needs are met when you cannot manage them yourself. It's essential to clearly outline these powers to avoid any confusion.

To add power of attorney to your bank account, you typically need to provide your bank with a copy of the Georgia Special Durable Power of Attorney for Bank Account Matters. Each bank may have its specific procedures, so it is wise to contact them directly to understand their requirements. By following these steps, you ensure that the power of attorney can effectively manage the account on your behalf.

In Georgia, a power of attorney does not have to be filed with the court unless it is a durable power of attorney for health care. However, financial institutions may require a copy of the Georgia Special Durable Power of Attorney for Bank Account Matters to ensure proper authority is granted. It's always best to check with the specific bank for their requirements to facilitate processing.

A power of attorney is not allowed to act beyond the powers granted in the document. This means they cannot make decisions that violate the law, change beneficiary designations, or act in ways that contradict the principal’s wishes. Understanding these restrictions within the context of a Georgia Special Durable Power of Attorney for Bank Account Matters is crucial for ensuring that all actions taken are legally compliant and aligned with the principal's intentions.

Being a power of attorney can be demanding. You hold significant responsibilities, such as managing the finances and making key decisions for another person. This role can lead to stress, especially if the principal has complex bank account matters. Additionally, you may face legal liability if you do not act in the best interests of the principal, particularly concerning the Georgia Special Durable Power of Attorney for Bank Account Matters.

Banks are meticulous about powers of attorney because they want to protect against fraud. They need to verify that the document meets all legal requirements and that the agent has the authority to act on behalf of the account holder. This is particularly crucial for complicated matters like a Georgia Special Durable Power of Attorney for Bank Account Matters, where unauthorized transactions could lead to significant financial losses.

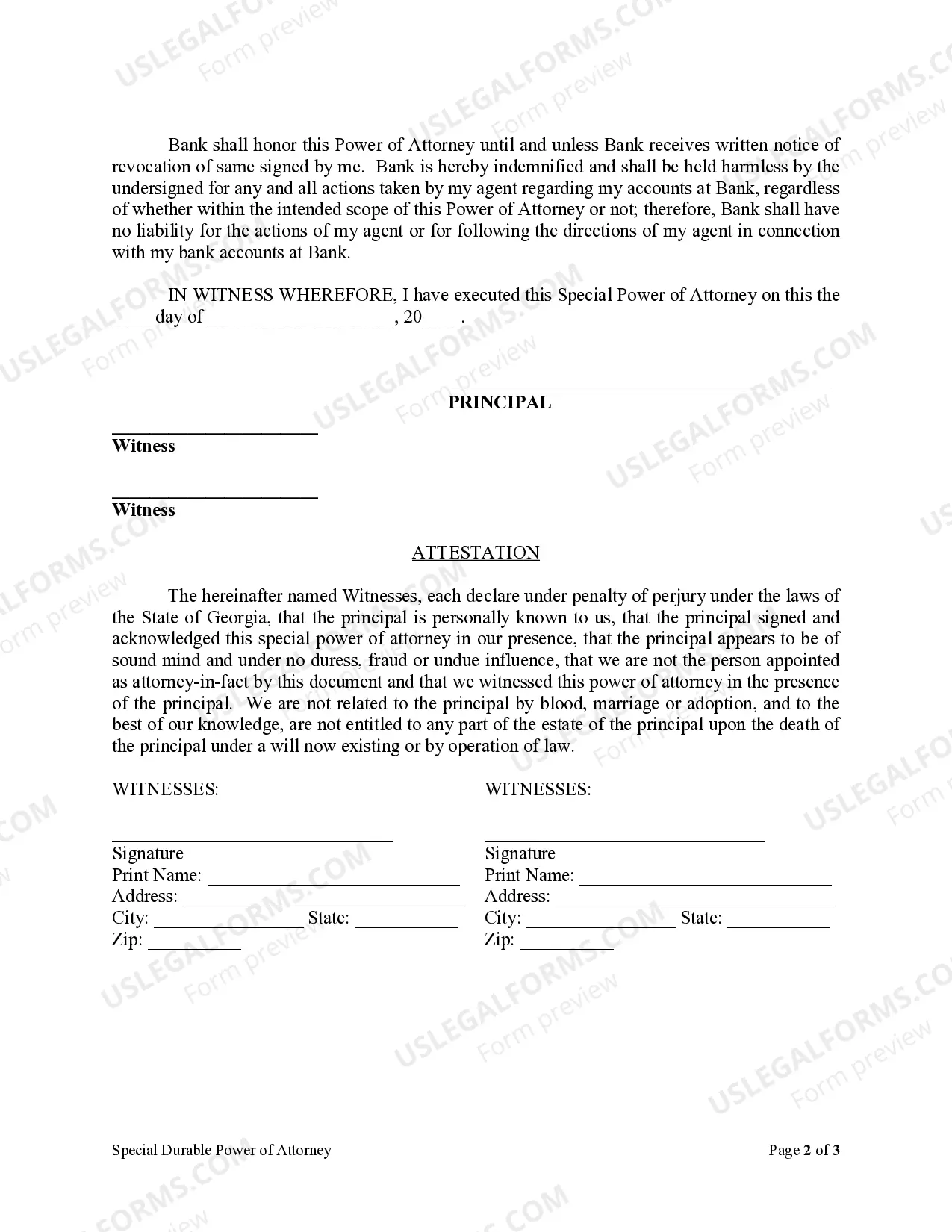

In Georgia, the requirements for a durable power of attorney include having the document written and signed by the principal. It must also be notarized, and witnesses may be required depending on the specifics of the power granted. To ensure everything is in order, consider using a platform like uslegalforms, which provides templates and guidance tailored to the Georgia Special Durable Power of Attorney for Bank Account Matters.

One potential disadvantage of a durable power of attorney is the possibility of misuse. When you grant power to an agent, there's a risk they may act against your best interests. Moreover, if you're unable to revoke it due to incapacity, you could lose control over your financial decisions, especially concerning Georgia Special Durable Power of Attorney for Bank Account Matters.

To create a Georgia Special Durable Power of Attorney for Bank Account Matters, you need to gather specific information. This includes the name and address of the principal, the agent, and any additional relevant details about the bank account involved. Additionally, you must ensure that the document is notarized to confirm its validity and authenticity.