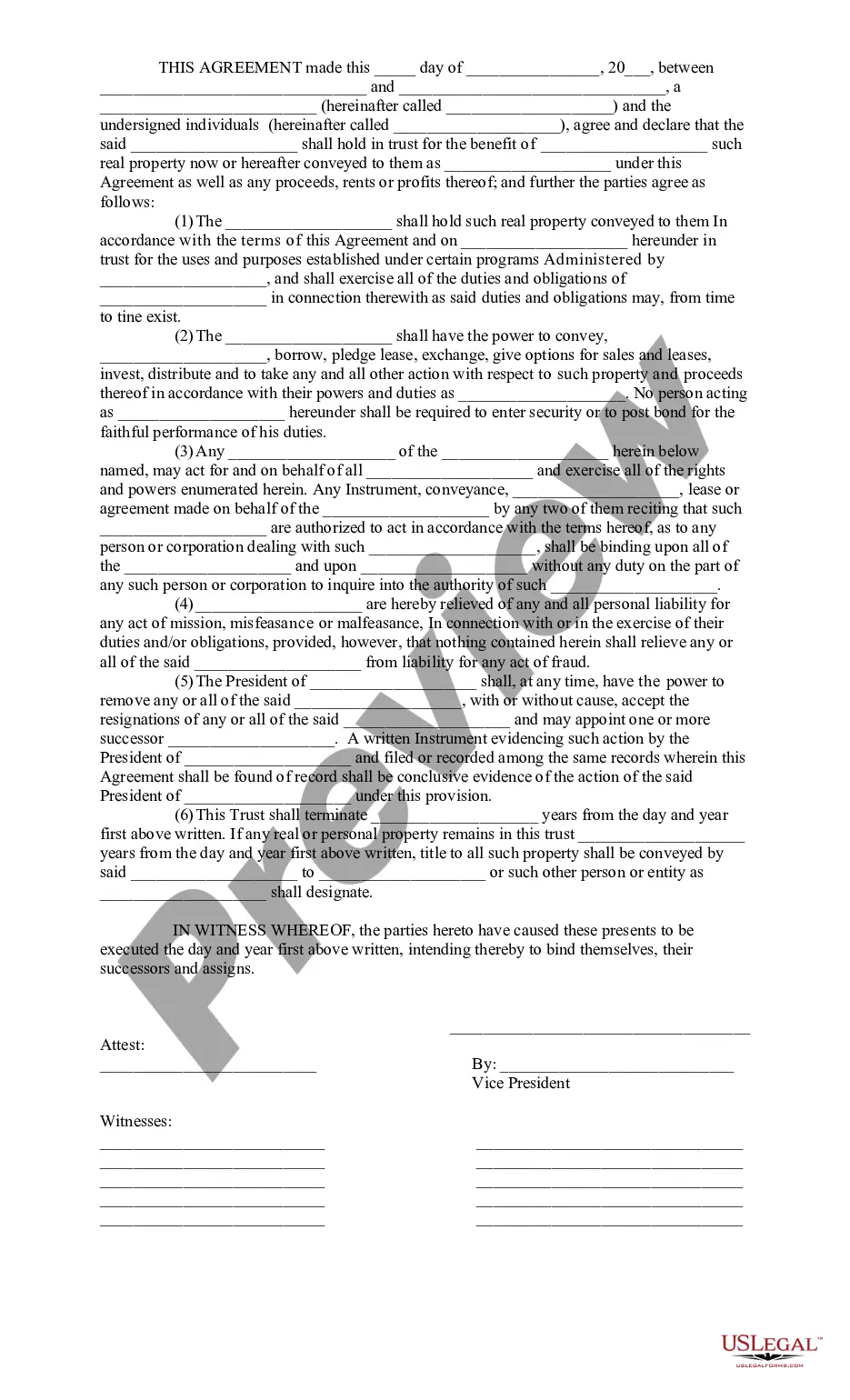

Georgia Trust Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

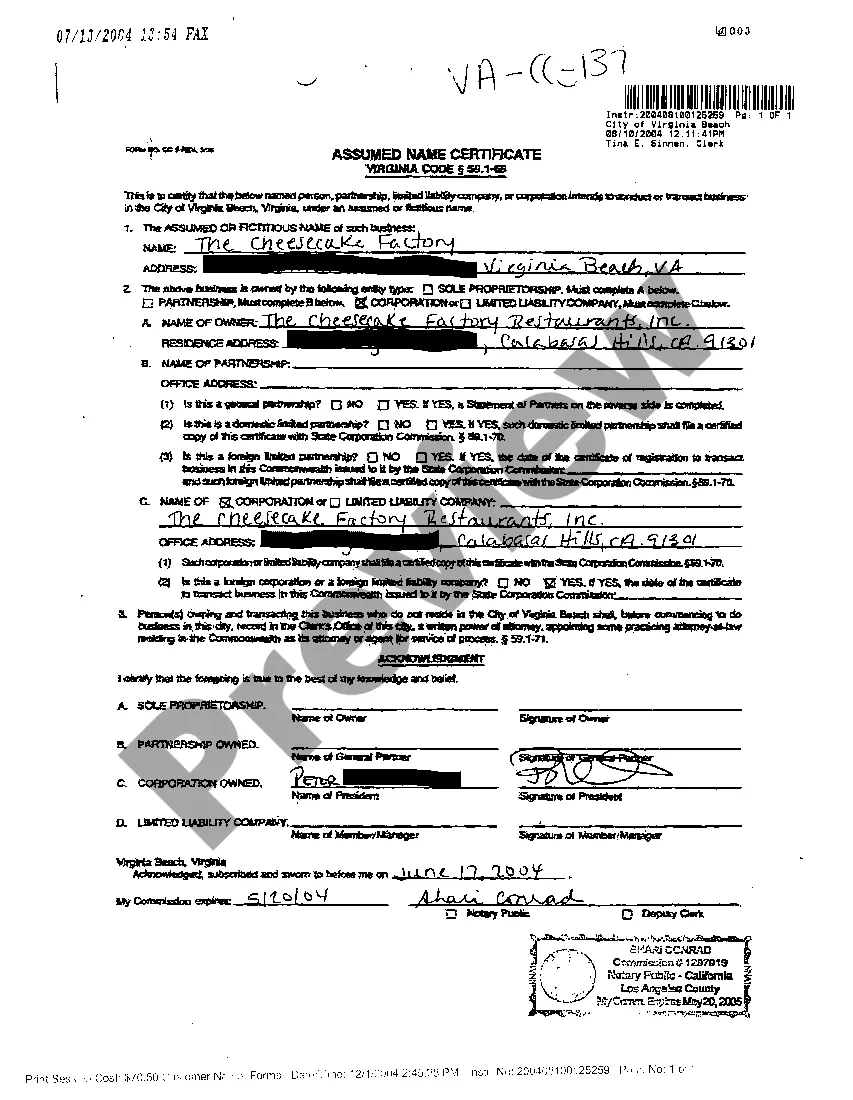

Looking for another form?

How to fill out Georgia Trust Agreement?

Access the largest collection of authorized documents.

US Legal Forms is indeed a resource for locating any state-specific document in moments, including samples of the Georgia Trust Agreement.

No need to squander hours of your time searching for a court-accepted document. Our certified experts guarantee you receive up-to-date samples consistently.

After selecting a pricing option, register your account. Make payment via credit card or PayPal. Download the document to your device by clicking Download. That's it! You must submit the Georgia Trust Agreement document and verify it. To ensure accuracy, consult your local legal advisor for assistance. Register and effortlessly explore over 85,000 useful samples.

- To utilize the document library, select a subscription and create an account.

- If you have already established one, simply Log In and click Download.

- The Georgia Trust Agreement file will be promptly saved in the My documents section (a section for all documents you download from US Legal Forms).

- To establish a new profile, adhere to the brief instructions provided below.

- If you need to use a state-specific document, make sure to specify the correct state.

- If possible, review the description to understand all of the details of the document.

- Utilize the Preview feature if it is available to examine the content of the document.

- If everything is accurate, click Buy Now.

Form popularity

FAQ

To set up a trust without a lawyer, start by researching the necessary laws governing trusts in Georgia. You may use kits or templates available from sites like US Legal Forms to create your Georgia Trust Agreement. Be sure to understand the roles of trustees and beneficiaries, as these are vital for the trust's success. With careful planning and the right resources, you can establish a trust that meets your needs.

You can write your own trust in Georgia, but it is crucial to ensure that it meets all legal requirements. A well-structured Georgia Trust Agreement must clearly outline the terms and the beneficiaries involved. Consider using templates from US Legal Forms to help guide you in drafting a legally sound document. This approach can protect your interests and clarify your intentions.

Yes, it is possible to set up a trust without an attorney in Georgia. However, navigating the intricacies of creating a valid Georgia Trust Agreement can be challenging without legal expertise. You need to understand the requirements and ensure compliance with state laws. Utilizing resources like US Legal Forms can help simplify the process and provide the necessary templates.

One major mistake parents often make when establishing a trust fund is not clearly defining their intentions for the Georgia Trust Agreement. Parents should specify how the funds should be used and for whom. Failing to communicate these details can lead to confusion and conflicts among heirs. A well-drafted Georgia Trust Agreement can minimize risks and ensure that your wishes are honored.

A common example of a trust clause in a Georgia Trust Agreement is the distribution clause, which specifies how and when assets will be distributed to the beneficiaries. This clause can contain conditions that must be met or timelines for distribution. By clearly outlining these terms, you can ensure that your wishes are honored after your passing. Using uslegalforms can help you draft a comprehensive and compliant trust agreement that includes essential clauses.

While a Georgia Trust Agreement can provide many benefits, there are also some drawbacks to consider. Trusts can involve higher initial costs for setup and maintenance compared to a will. Additionally, if not properly funded, a trust may not function as intended. It's important to weigh these factors against the advantages and consult a legal expert to make the best decision for your situation.

Writing a trust agreement involves several key steps to ensure it meets your needs. Start by defining the purpose of the trust and identifying the grantor, trustee, and beneficiaries. Next, outline the terms of the Georgia Trust Agreement, including how the assets will be managed and distributed. You can also use platforms like uslegalforms to access templates and resources to help guide you through creating your trust.

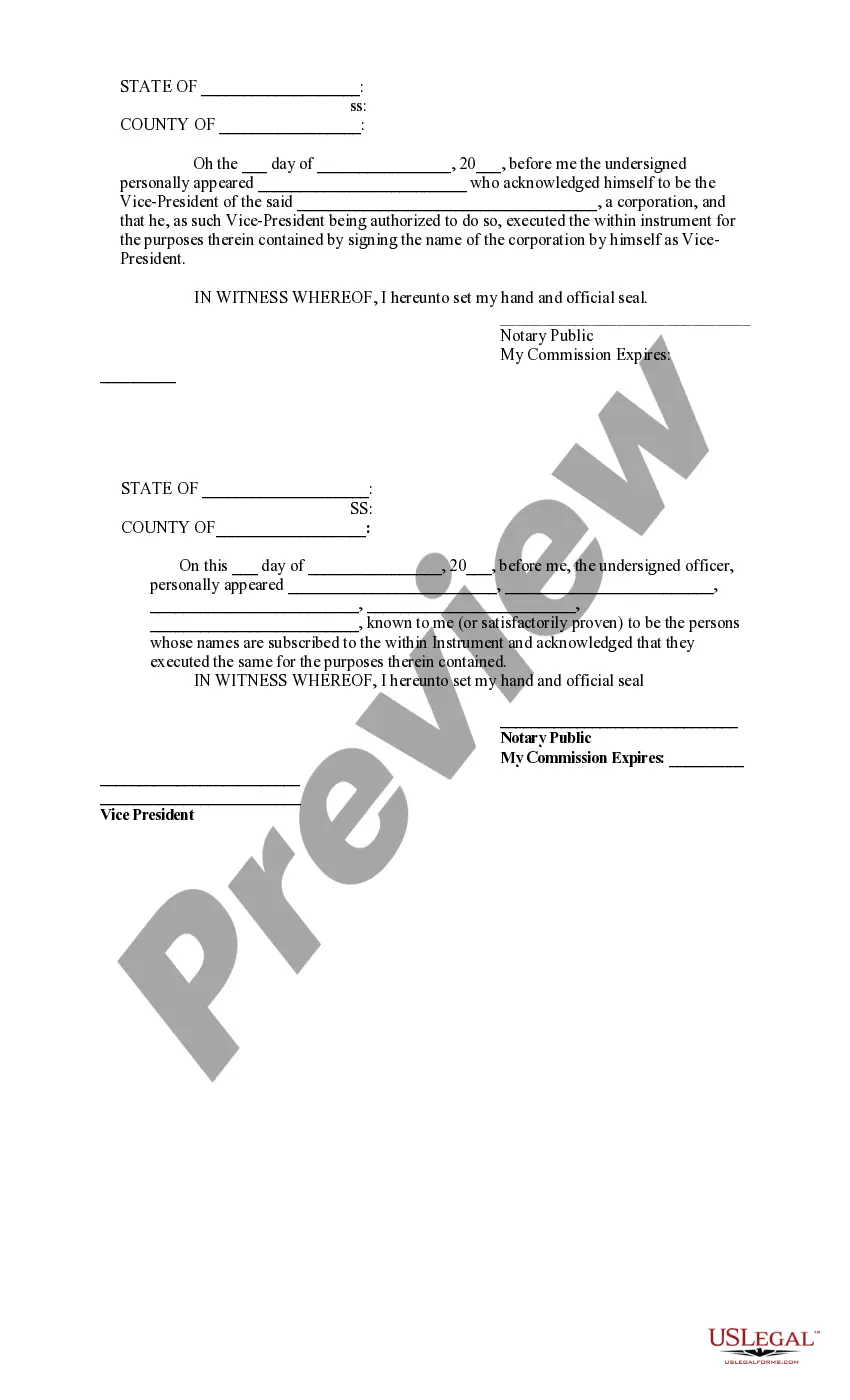

In Georgia, notarization is not strictly required for a trust agreement to be valid. However, having it notarized can provide additional legal protection and simplify the process of proving its authenticity. A Georgia Trust Agreement that includes notarization may also be beneficial when dealing with financial institutions or other entities. It is always wise to consult an attorney to ensure your trust document meets all necessary legal requirements.

The preparation of a trust agreement is typically handled by an estate planning lawyer. They will draft the Georgia Trust Agreement to ensure it adheres to the legal framework in Georgia. By doing so, they guarantee that your wishes regarding asset distribution are accurately documented. Engaging a seasoned lawyer can simplify this complex process.

A trust agreement is usually created by a qualified attorney who specializes in estate planning. They hold the knowledge necessary to draft a Georgia Trust Agreement that meets legal requirements. Beyond just drafting, they also help clarify your goals and tailor the agreement accordingly. This professional guidance is essential for establishing a secure trust.