Georgia Quitclaim Deed

What this document covers

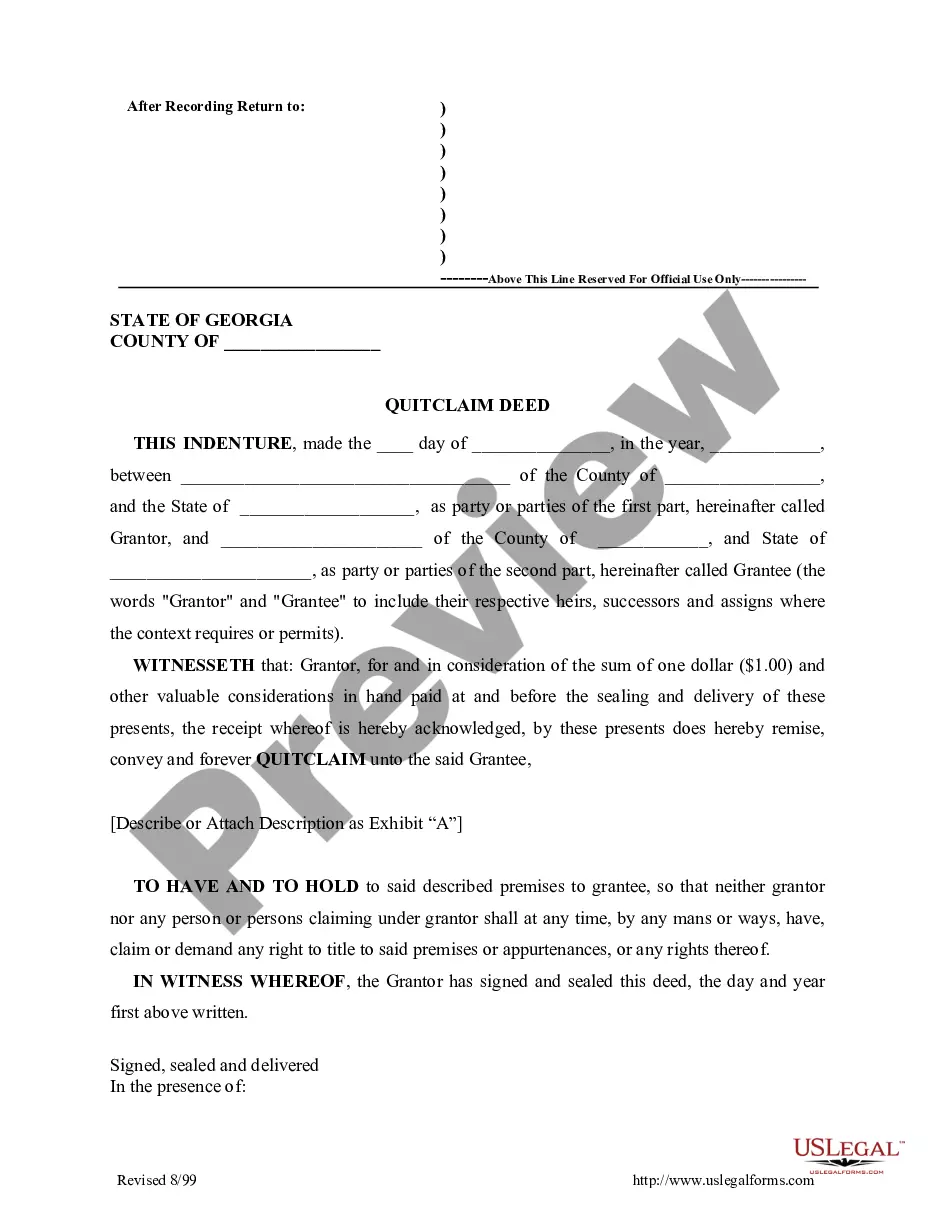

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the title. Unlike other deeds, a Quitclaim Deed offers no guarantees, making it essential in situations where the parties trust one another. This form is particularly useful for informal transactions between family members or friends, or to clear up issues with property titles.

Key parts of this document

- Identification of the Grantor and Grantee: The parties involved in the transfer.

- Property Description: A detailed description of the property being transferred.

- Consideration: A statement acknowledging the payment, typically one dollar or other valuable consideration.

- Warranties: A clear statement that the Grantor is relinquishing any claim to the property.

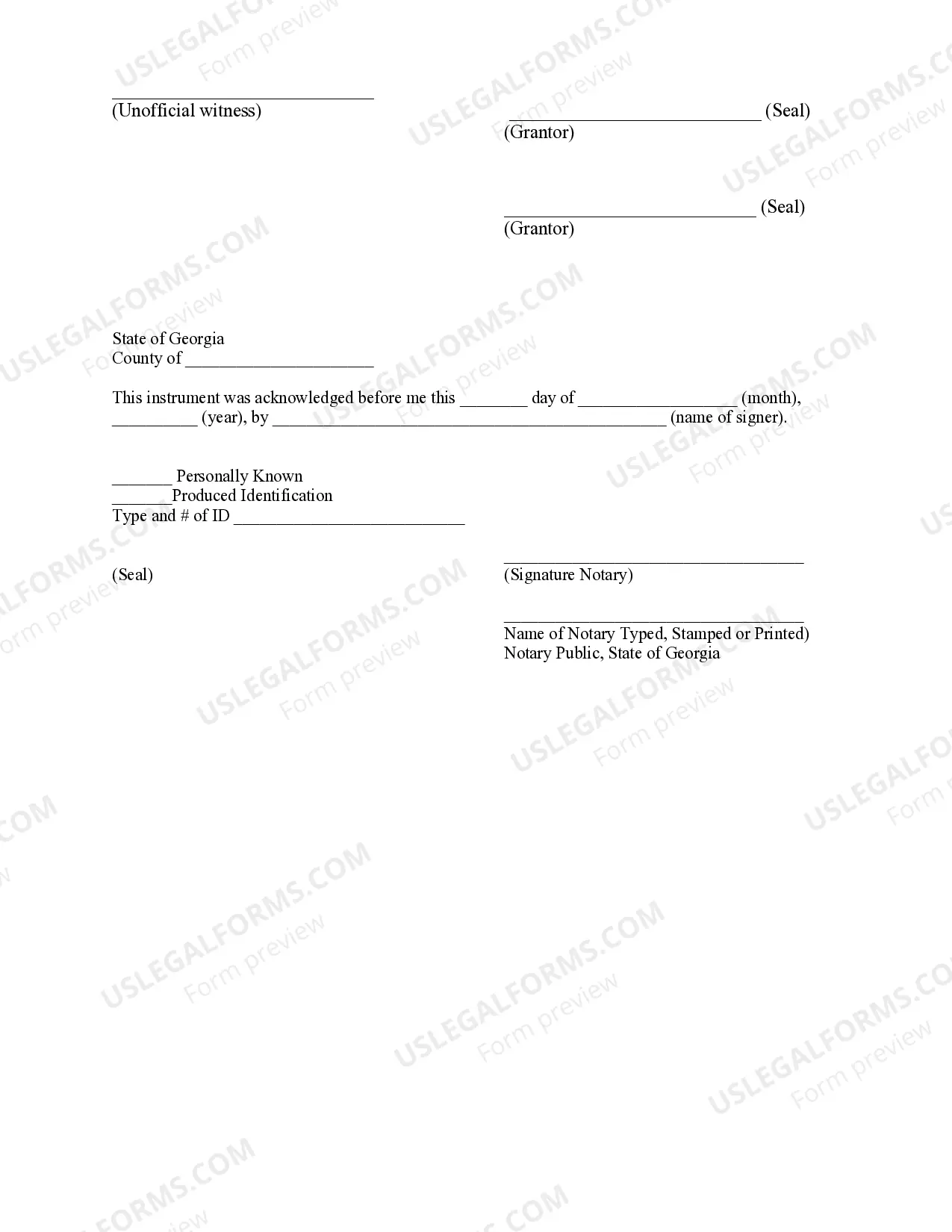

- Signatures: Requires the signatures of the Grantor and possibly a witness or notary public.

Common use cases

This form is commonly used when a property owner wants to transfer rights or interests in the property to another person efficiently and without complications. Typical scenarios include transferring property to family members, resolving title defects, or handling property in divorce settlements. It is also applicable for transferring property without the involvement of a real estate transaction, where the parties have a mutual understanding.

Who should use this form

This form is suitable for:

- Property owners wishing to transfer their interest in real estate to someone else.

- Individuals involved in informal property transactions, such as family gifts.

- Anyone needing to release a claim on a property without warranties.

- Parties looking to resolve title issues quickly and easily.

How to complete this form

- Identify the parties: Fill in the names and addresses of the Grantor and Grantee.

- Specify the property: Clearly describe the property being transferred to avoid future disputes.

- Enter consideration: Include the amount being exchanged for the property, typically one dollar.

- Complete the signature section: Both Grantor and any required witnesses must sign the document.

- Notarize if necessary: If local rules require notarization, ensure a notary public is present at the signing.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide a complete property description, which can lead to disputes.

- Not including signatures or failing to have the form notarized if required.

- Misunderstanding the implications of a Quitclaim Deed, believing it provides warranties.

Why use this form online

- Convenience of immediate access and download, saving time and effort.

- Editability allows you to customize the form to suit your specific property transfer needs.

- Reliability, with documents tailored by licensed attorneys to ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Yes, a quitclaim deed must be notarized in Georgia to be legally valid. Notarization verifies the identities of the parties and confirms that they willingly signed the document. This crucial step helps protect all parties involved and ensures the deed is enforceable under state law.

A Georgia Quitclaim Deed can become invalid if it lacks essential components, such as the required signatures or a proper notarization. Also, if the property description is vague or incorrect, the deed risks being challenged in court. To avoid issues, it is best to double-check all details before submission.

You can fill out a quitclaim deed by obtaining the form online or from local county offices. Begin by clearly writing the names of the grantor and grantee, then fill in the property’s legal description. Once you've completed the form, sign it in front of a notary public for validation, ensuring that all information is accurate and complete.

To complete a Georgia Quitclaim Deed, you need the names of the parties involved, a clear property description, and the signature of the grantor. Additionally, the deed must be notarized to be considered valid under state law. Having these elements in place ensures a smoother transfer of property ownership.

Yes, any qualified notary public can notarize a Georgia Quitclaim Deed as long as they meet state requirements. It is crucial to have the notary witness both the grantor's and grantee's signatures to validate the deed. A valid notarization adds a layer of authenticity, ensuring the transaction is recognized legally.

Filling out a Georgia Quitclaim Deed requires you to start with the correct form. Begin by entering the names of the grantor and grantee, as well as their contact information. Make sure to describe the property accurately, including the legal description. Finally, sign the document in the presence of a notary to ensure its validity.

Generally, a Georgia Quitclaim Deed is not directly reported to the IRS. However, if the property being transferred involves a sale or significant financial gain, you may still have tax obligations to consider. It's advisable to consult a tax professional to understand any implications that may arise from transferring property, especially in tax-related matters.

The disadvantages of a Georgia Quitclaim Deed include the lack of legal protection for the grantee and potential challenges if the grantor has unresolved debts tied to the property. Moreover, using a quitclaim deed can lead to complicated ownership situations if not all parties are clear about the terms. For more complex transactions, you may consider alternatives or consulting with a professional.

One of the main negatives of a Georgia Quitclaim Deed is that it does not provide any warranty of title. This means that if any issues arise regarding ownership, the grantee may have limited recourse. Additionally, since this type of deed does not require title insurance, the risk associated with undisclosed liens or claims can be significant.

While it is not legally required to hire a lawyer for a Georgia Quitclaim Deed, having legal assistance can be beneficial. A lawyer can help ensure that the deed is properly filled out, filed, and executed. This can save you from potential future complications or disputes over property rights.