Florida Warranty Deed from Limited Partnership or LLC is the Grantor, or Grantee

Description

How to fill out Florida Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

Amid numerous complimentary and premium templates available online, you cannot guarantee their trustworthiness.

For instance, who designed them or whether they possess the expertise necessary to fulfill your requirements.

Stay composed and utilize US Legal Forms!

Proceed with the Buy Now option to initiate the purchasing process or search for an alternative template using the Search bar located in the header.

- Find Florida Warranty Deed from Limited Partnership or LLC as the Grantor or Grantee templates crafted by experienced attorneys and avoid the expensive and lengthy endeavor of searching for a lawyer and then compensating them to create a document that you can acquire yourself.

- If you already possess a membership, Log In to access your account and locate the Download button next to the file you seek.

- You will also be able to retrieve all of your previously saved documents from the My documents section.

- If you’re using our service for the first time, adhere to the instructions below to obtain your Florida Warranty Deed from Limited Partnership or LLC as the Grantor or Grantee effortlessly.

- Ensure that the document you see is valid in your residing state.

- Examine the document by reviewing the details using the Preview function.

Form popularity

FAQ

The grantor on a quit claim deed is the individual or entity that relinquishes their interest in the property without making any guarantees about the title. This means that they transfer whatever rights they have, but do not assure the grantee of clear ownership. If you're considering using a quit claim deed, it's essential to understand these nuances, especially in context with the Florida Warranty Deed from Limited Partnership or LLC.

While the grantor is often the owner of the property, they are not necessarily the same in every situation. The grantor is the individual or entity transferring ownership through a warranty deed, whereas the owner may refer to anyone who holds legal title to the property at any given time. Clarifying this difference can help individuals understand their rights during a transaction involving a Florida Warranty Deed from Limited Partnership or LLC.

In most cases, the seller is the grantor on a warranty deed. This means the seller is the one transferring ownership of the property to the buyer, who acts as the grantee. Recognizing this distinction helps streamline the transaction process and ensures that all parties understand their roles within a Florida Warranty Deed from Limited Partnership or LLC.

On a warranty deed, the grantor is the party offering the property, often an individual or an entity such as a limited partnership or LLC. The grantee is the recipient of that property, effectively becoming the new owner once the transfer is complete. Understanding these roles is particularly essential for anyone dealing with a Florida Warranty Deed from Limited Partnership or LLC.

The grantor is the party that transfers property ownership, while the grantee is the individual or entity that receives that ownership. In Florida, this distinction is critical when dealing with documents like the Florida Warranty Deed from Limited Partnership or LLC. Knowing who the grantor and grantee are can impact future legal and financial responsibilities.

The grantee on a warranty deed is the individual or entity that is receiving the ownership of the property. In the context of a Florida Warranty Deed from Limited Partnership or LLC, this is often either a person or an entity like an LLC that stands to benefit from the property. Their correct identification is essential for the deed to be valid.

The owner of the property is identified as the grantee once the warranty deed is executed. The grantor relinquishes ownership rights to the grantee through the warranty deed process. Therefore, when the Florida Warranty Deed from Limited Partnership or LLC is in play, the entity named as the grantee becomes the new legal owner.

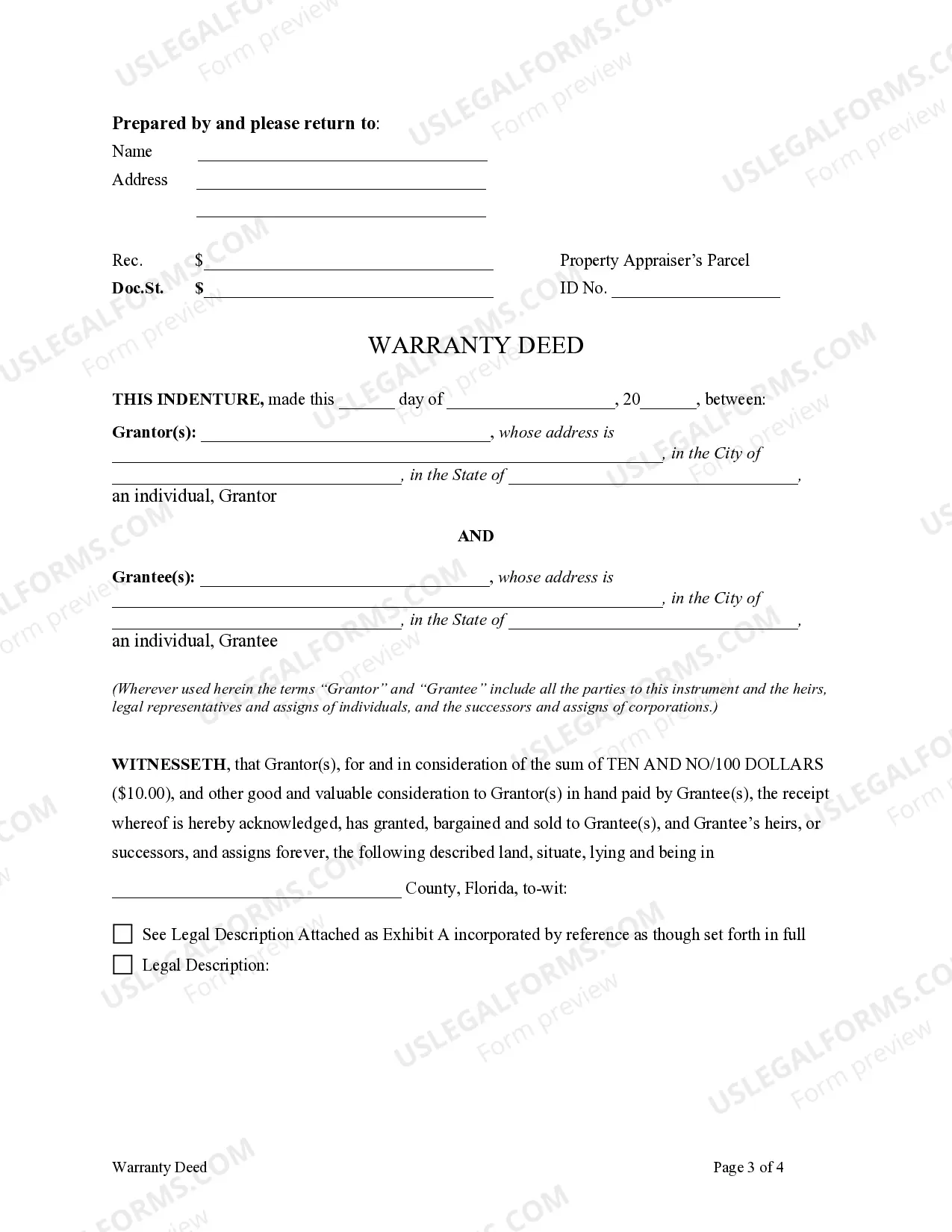

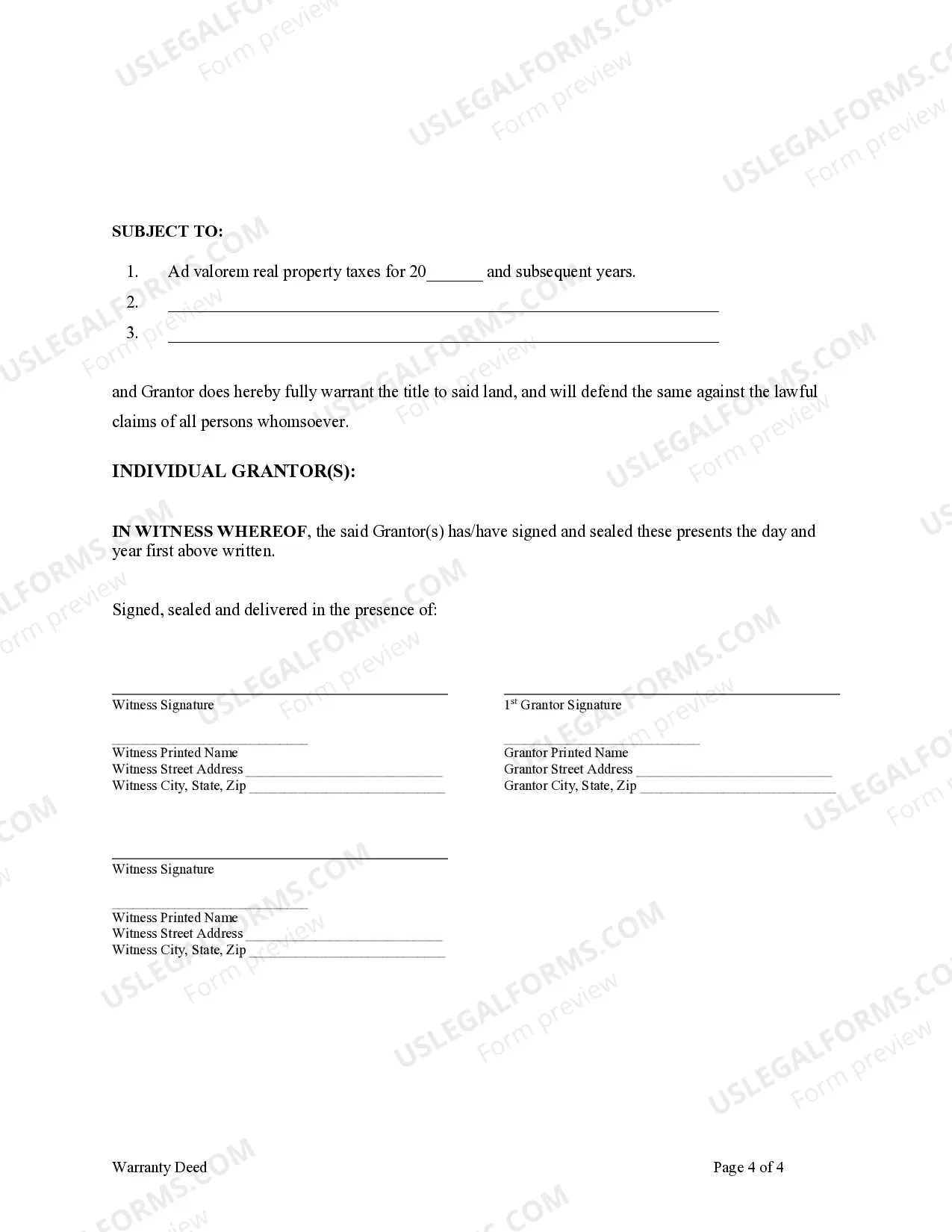

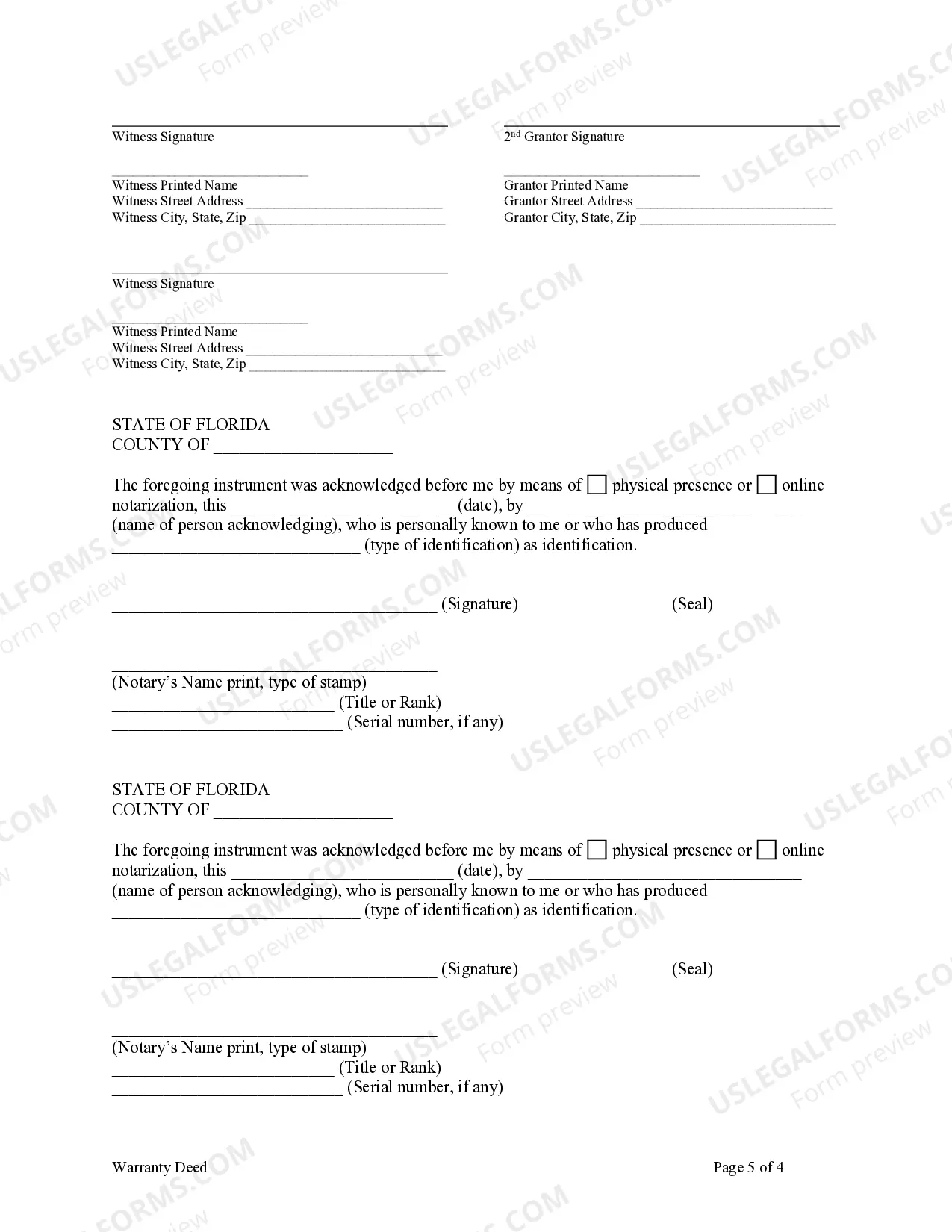

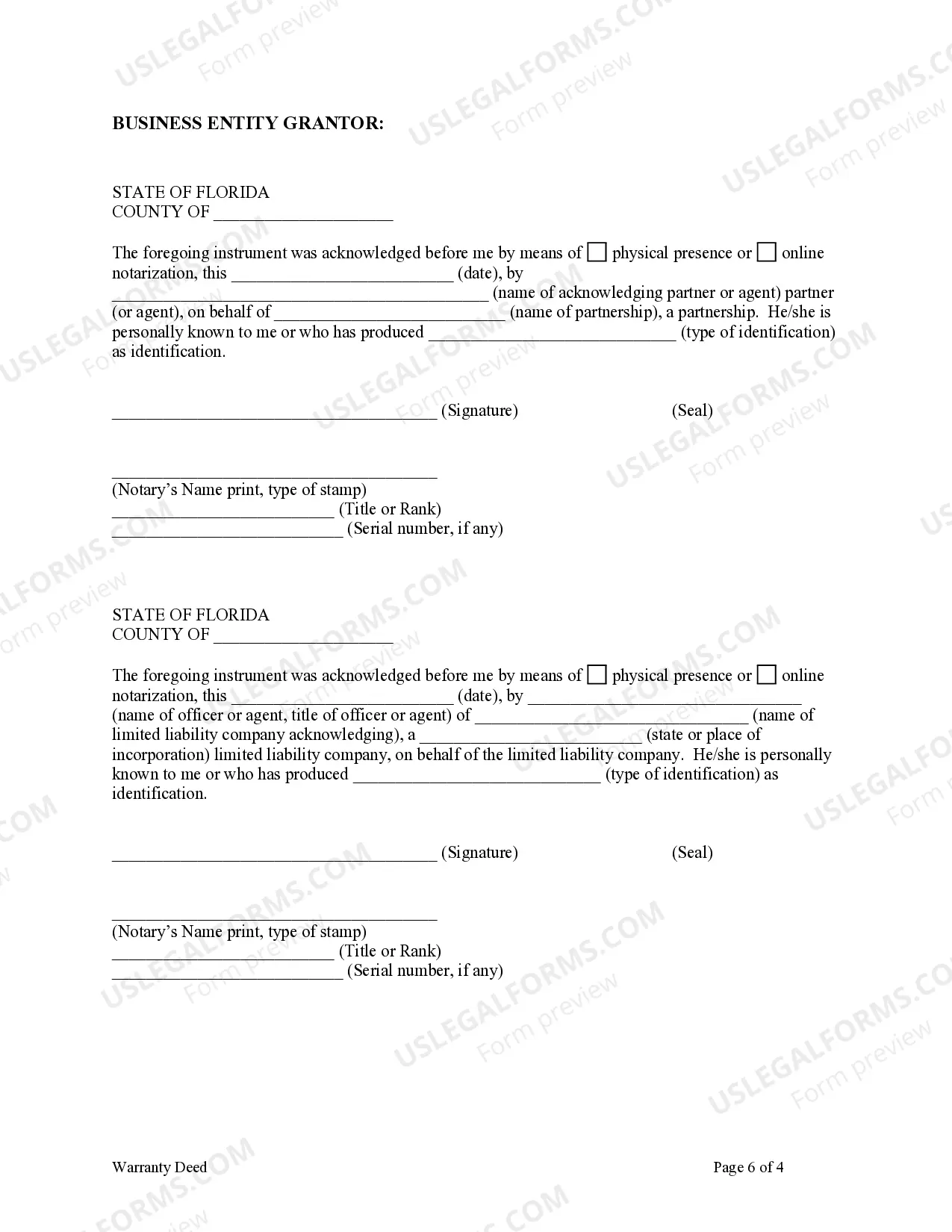

To fill out a Florida warranty deed, gather the names of the grantor and grantee, and obtain a detailed description of the property. Ensure that the document is signed by the grantor, and consider having it notarized for added security. This process is crucial when the Florida Warranty Deed from Limited Partnership or LLC is the Grantor or Grantee, as it formalizes the property transfer.

In a property transfer, the grantor is the individual or entity, such as a limited partnership or LLC, that is transferring the ownership. Conversely, the grantee is the individual or entity receiving the ownership. For instance, if a limited partnership sells a property to an individual, the partnership acts as the grantor, while the buyer is the grantee.

Filling out a warranty deed form requires specific details about the property, grantor, and grantee. Start by accurately entering the names and addresses of both the grantor and grantee, along with a legal description of the property. The Florida Warranty Deed from Limited Partnership or LLC must be signed by the grantor to ensure the transfer is valid.