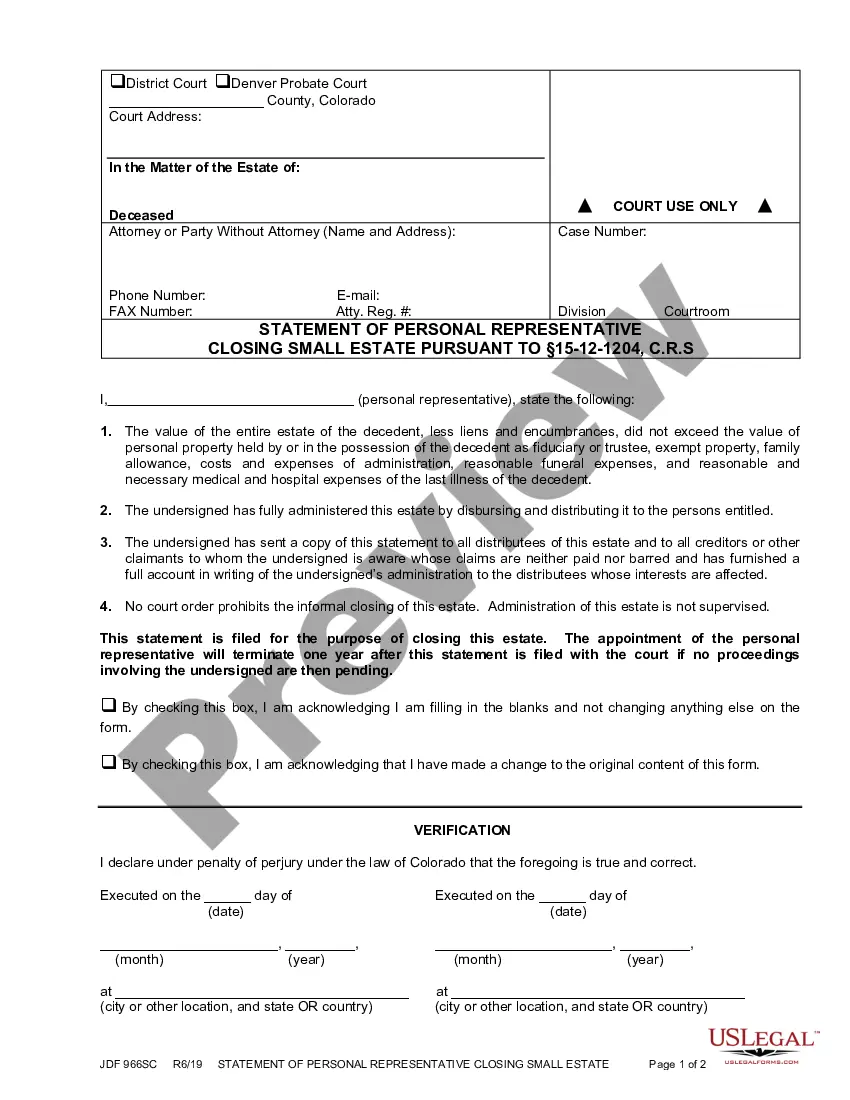

Statement of Personal Representative Closing Small Estate: This is an official form from the Colorado Probate Court, which complies with all applicable laws and statutes. USLF amends and updates the Colorado Probate Court forms as is required by Color

Colorado Statement of Personal Representative Closing Small Estate is a form used by the personal representative of an estate in Colorado to close a small estate with a value of $50,000 or less. The form is used to document the final disposition of the assets of the estate and to request the release of the personal representative from any further duties or responsibilities. The form must be signed and notarized by the personal representative, and then filed with the court. There are two types of Colorado Statement of Personal Representative Closing Small Estate: Form DR 0001 for estates with assets of $50,000 or less, and Form DR 0002 for estates with assets of more than $50,000 but less than $75,000.