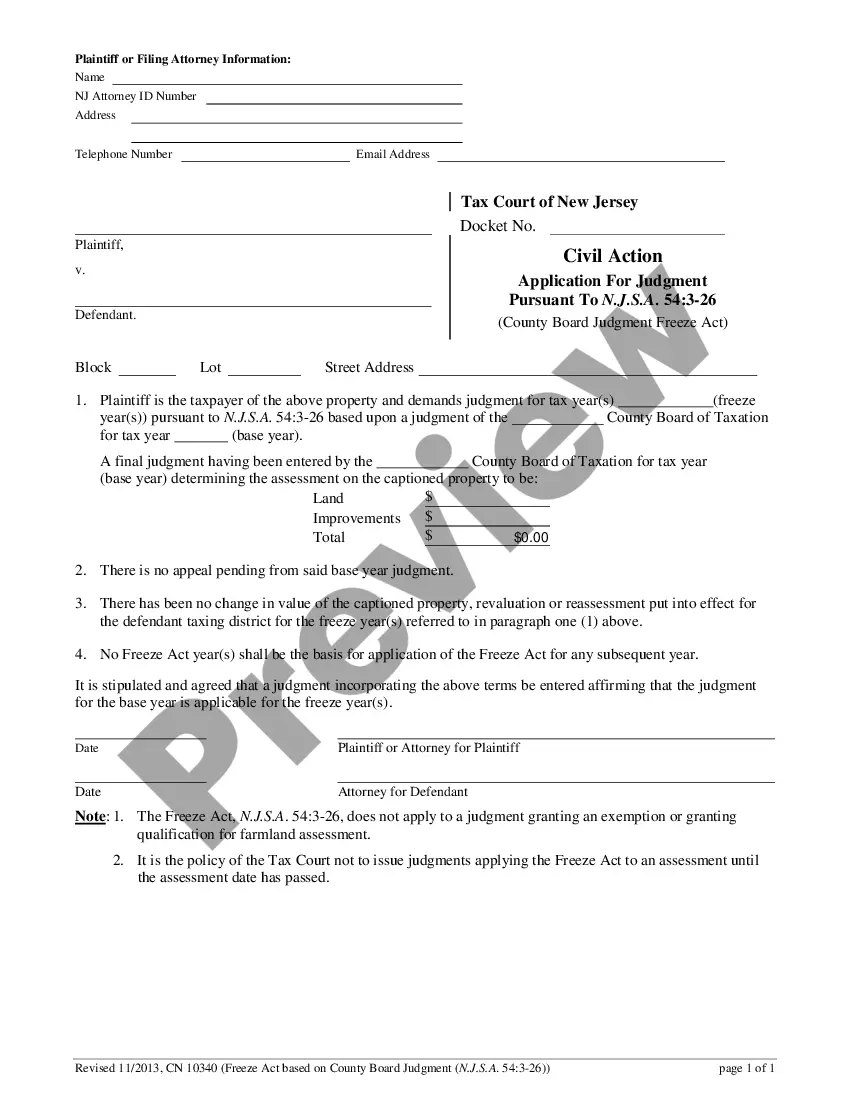

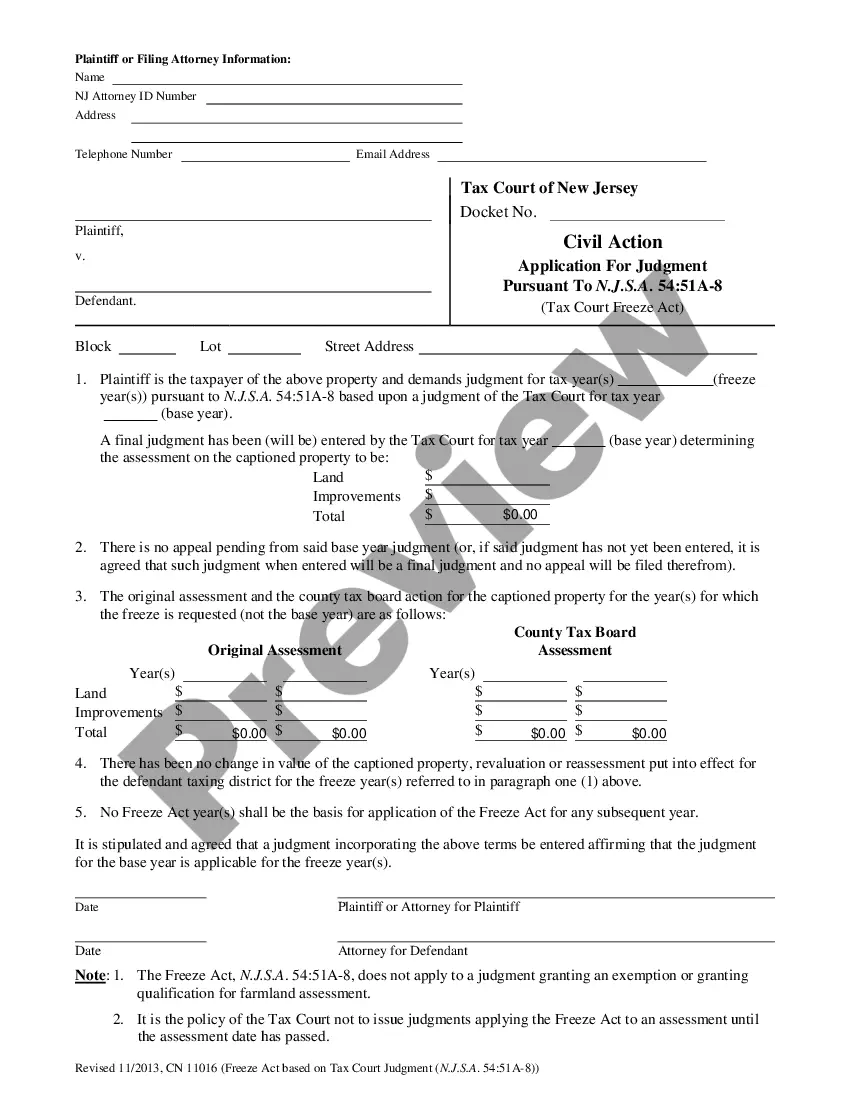

The New Jersey Application for Judgment Pursuant to N.J.S.A. 54:3-26 (County Board Judgment Freeze Act) is a form used to freeze the amount of a judgment by the County Board of Taxation. It is used to prevent the amount of a judgment from increasing due to inflation or other factors. The form must be completed and filed with the County Tax Board in the county where the judgment was entered. There are two types of New Jersey Application for Judgment Pursuant to N.J.S.A. 54:3-26 (County Board Judgment Freeze Act): the initial freeze application, and the supplemental freeze application. The initial freeze application is used to freeze the amount of a judgment at the time it was entered, while the supplemental freeze application is used to freeze the amount of a judgment at a later date. Both forms must be filed with the County Tax Board in the county where the judgment was entered.

New Jersey Application for Judgment Pursuant to N.J.S.A. 54:3-26 (County Board Judgment Freeze Act)

Description

How to fill out New Jersey Application For Judgment Pursuant To N.J.S.A. 54:3-26 (County Board Judgment Freeze Act)?

US Legal Forms is the most straightforward and profitable way to locate appropriate formal templates. It’s the most extensive online library of business and personal legal documentation drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with national and local laws - just like your New Jersey Application for Judgment Pursuant to N.J.S.A. 54:3-26 (County Board Judgment Freeze Act).

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted New Jersey Application for Judgment Pursuant to N.J.S.A. 54:3-26 (County Board Judgment Freeze Act) if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one corresponding to your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your New Jersey Application for Judgment Pursuant to N.J.S.A. 54:3-26 (County Board Judgment Freeze Act) and save it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Take full advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding official paperwork. Give it a try!

Form popularity

FAQ

The Tax Court shall have initial review jurisdiction of all final decisions including any act, action, proceeding, ruling, decision, order or judgment including the promulgation of any rule or regulation of a County Board of Taxation, the Director of the Division of Taxation, any other state agency or official (

The U.S. Tax Court is a specialized court that hears only federal tax cases at the trial level. Before 1943, the U.S. Tax Court was called the Board of Tax Appeals (BTA). Taxpayers appearing before the Tax Court are not required to pay the disputed tax amount before the case is heard (i.e., "deficiency procedure").

While the Tax Court is headquartered in Washington, D.C., its 19 judges hear cases in about 80 cities throughout the U.S. (See also Article I and Article III tribunals). Appeals from the Tax Court are taken to whichever of the United States courts of appeals has geographical jurisdiction over the claimant.

Congress created the Tax Court as an independent judicial authority for taxpayers disputing certain IRS determinations. The Tax Court's authority to resolve these disputes is called its jurisdiction. Generally, a taxpayer may file a petition in the Tax Court in response to certain IRS determinations.

NJ Taxation The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence (main home). To qualify, you must meet all the eligibility requirements for each year from the base year through the application year.

The Tax Court resolves disputes involving local property taxes, state income taxes, homestead rebates, and sales and business taxes.