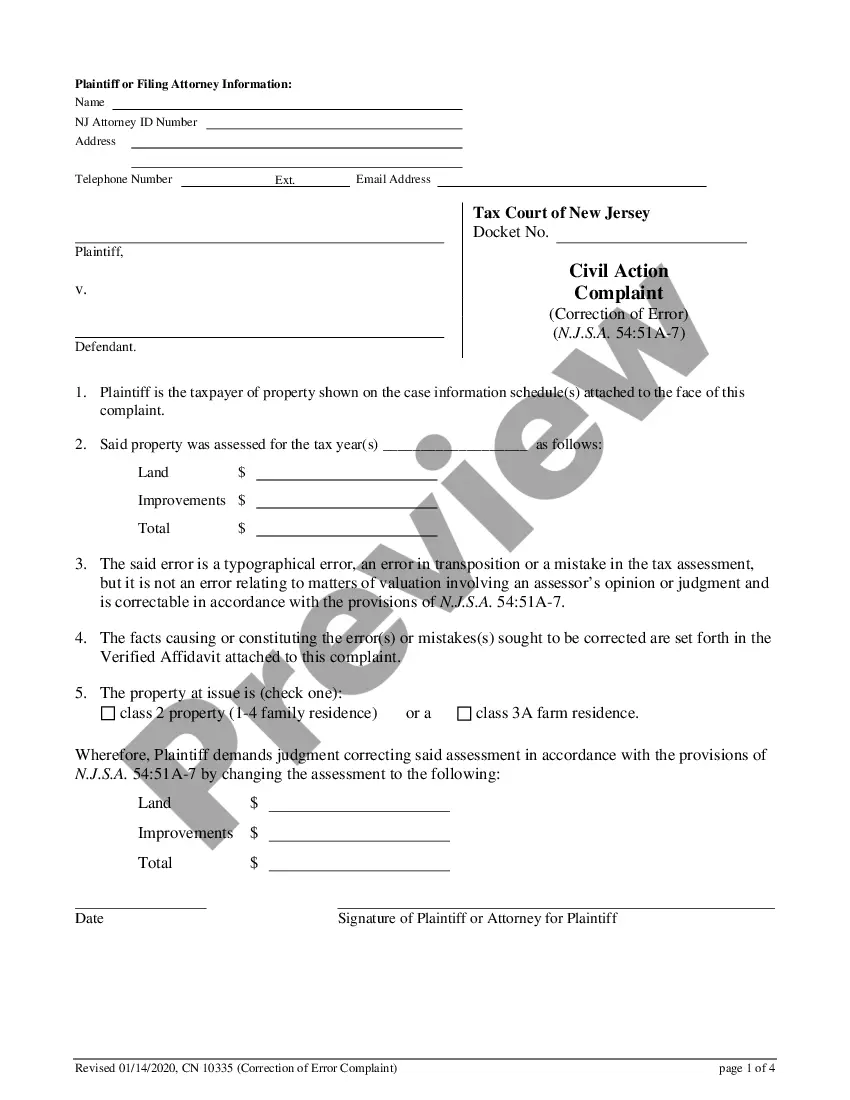

The New Jersey Correction of Error Complaint (N.J.S.A. 54:51A-7) is a legal action that allows taxpayers to challenge the assessment of their taxes by the state of New Jersey. This complaint is filed with the Superior Court of New Jersey, and the taxpayer must provide evidence that the assessment is incorrect. There are two types of New Jersey Correction of Error Complaint (N.J.S.A. 54:51A-7): a regular complaint and a Petition for Reassessment. The regular complaint is used to challenge an existing tax assessment, while the Petition for Reassessment is used to request a new tax assessment. Both types of New Jersey Correction of Error Complaint (N.J.S.A. 54:51A-7) require the taxpayer to provide evidence to support their claim that the assessment is incorrect.

New Jersey Correction of Error Complaint (N.J.S.A. 54:51A-7)

Description

How to fill out New Jersey Correction Of Error Complaint (N.J.S.A. 54:51A-7)?

If you’re searching for a way to properly complete the New Jersey Correction of Error Complaint (N.J.S.A. 54:51A-7) without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every personal and business situation. Every piece of paperwork you find on our online service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to obtain the ready-to-use New Jersey Correction of Error Complaint (N.J.S.A. 54:51A-7):

- Ensure the document you see on the page complies with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your New Jersey Correction of Error Complaint (N.J.S.A. 54:51A-7) and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

To appeal your property's assessment, File Form A-1 and Form A-1 Comp. Sale with the County Board of Taxation. Occasionally, property owners make changes or additions to real property after October 1, when municipalities set the value of property for tax purposes for the following tax year.

While the Tax Court is headquartered in Washington, D.C., its 19 judges hear cases in about 80 cities throughout the U.S. (See also Article I and Article III tribunals). Appeals from the Tax Court are taken to whichever of the United States courts of appeals has geographical jurisdiction over the claimant.

The Tax Court resolves disputes involving local property taxes, state income taxes, homestead rebates, and sales and business taxes.

The U.S. Tax Court is a specialized court that hears only federal tax cases at the trial level. Before 1943, the U.S. Tax Court was called the Board of Tax Appeals (BTA). Taxpayers appearing before the Tax Court are not required to pay the disputed tax amount before the case is heard (i.e., "deficiency procedure").

Congress created the Tax Court as an independent judicial authority for taxpayers disputing certain IRS determinations. The Tax Court's authority to resolve these disputes is called its jurisdiction. Generally, a taxpayer may file a petition in the Tax Court in response to certain IRS determinations.

Calculations of property assessments are annually based upon market trends and will be reflected in the following year's assessment. Due to the New Jersey Division of Taxation guidelines for the program, each property will be inspected once every five years.

The Tax Court shall have initial review jurisdiction of all final decisions including any act, action, proceeding, ruling, decision, order or judgment including the promulgation of any rule or regulation of a County Board of Taxation, the Director of the Division of Taxation, any other state agency or official (

The tax levy is divided by the total assessed value of all taxable property within the municipality-or the tax base - to determine the general tax rate. The general tax rate is then applied to the assessed value of each individual parcel of property to determine the property owner's tax liability.