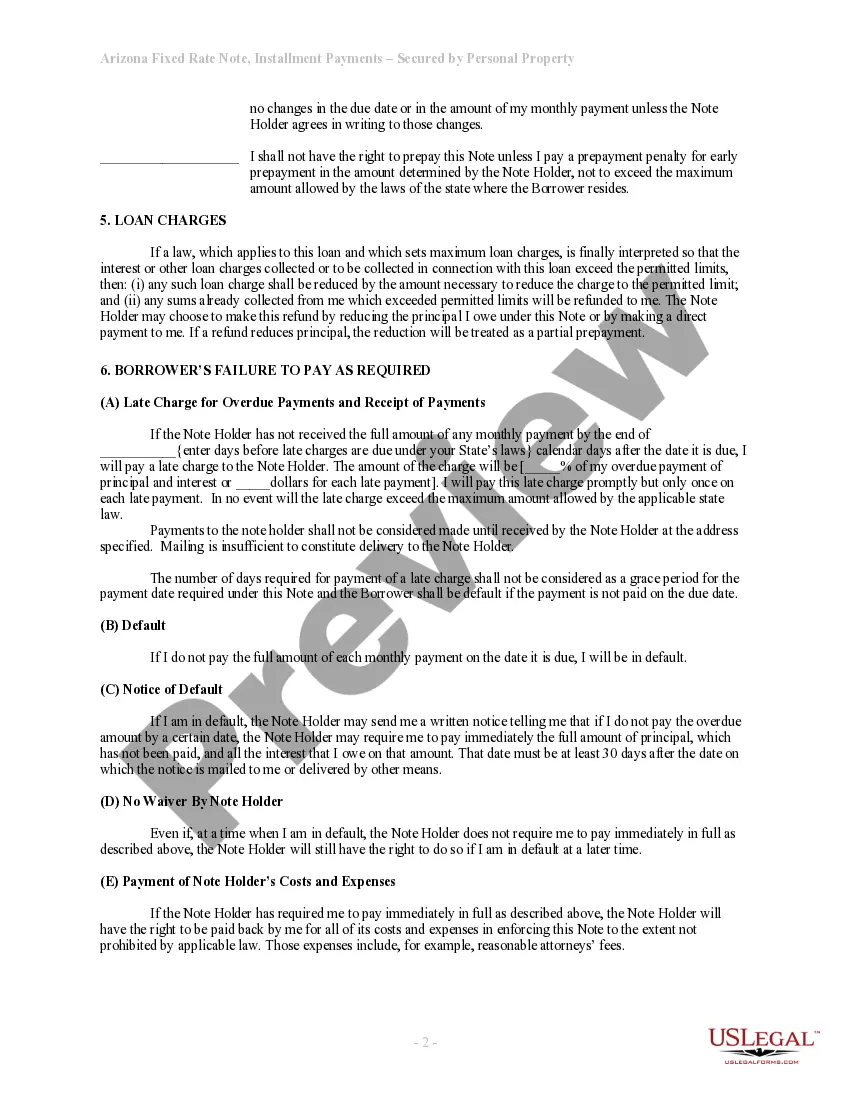

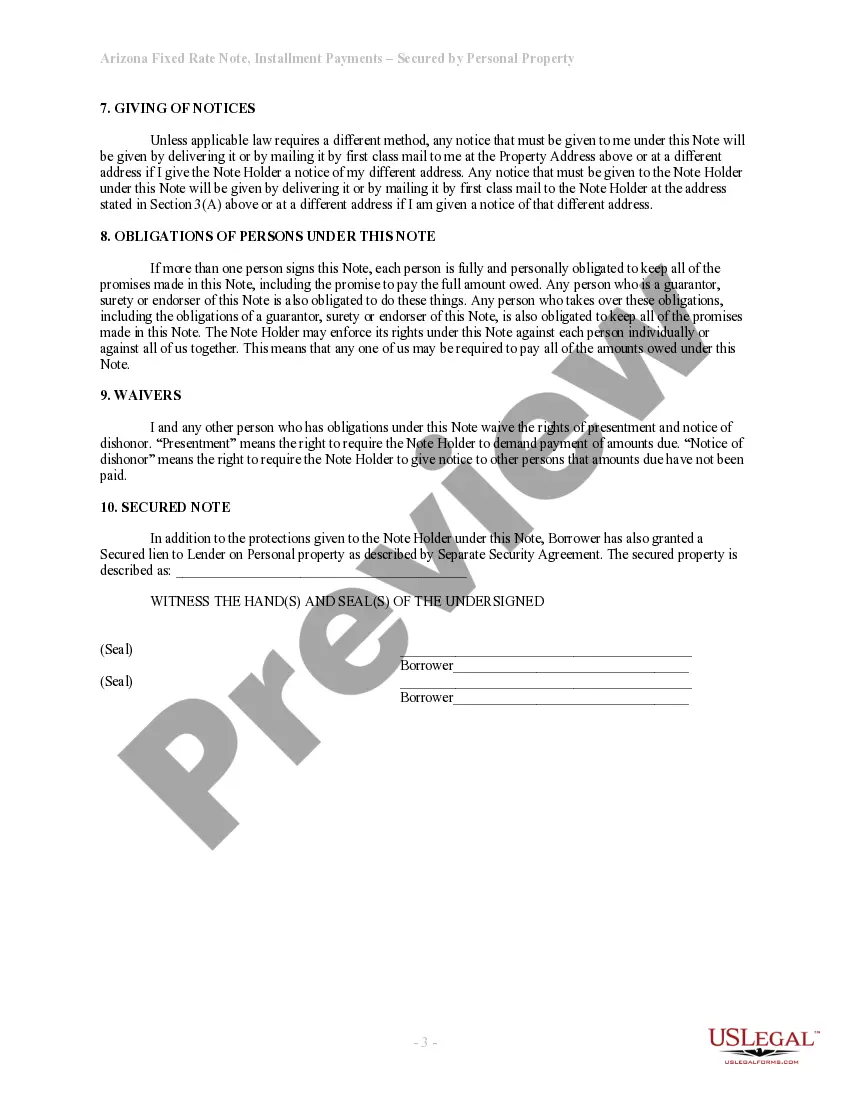

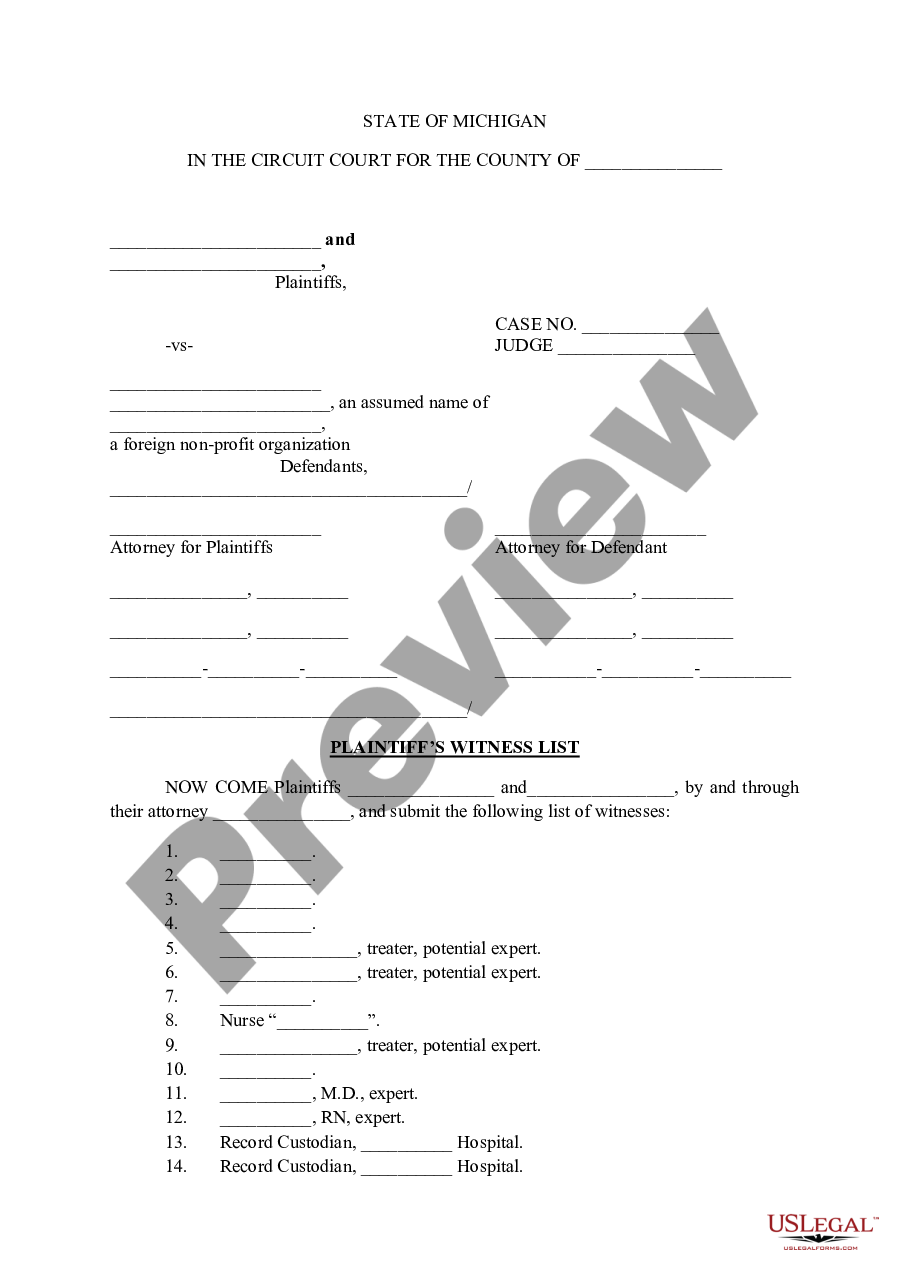

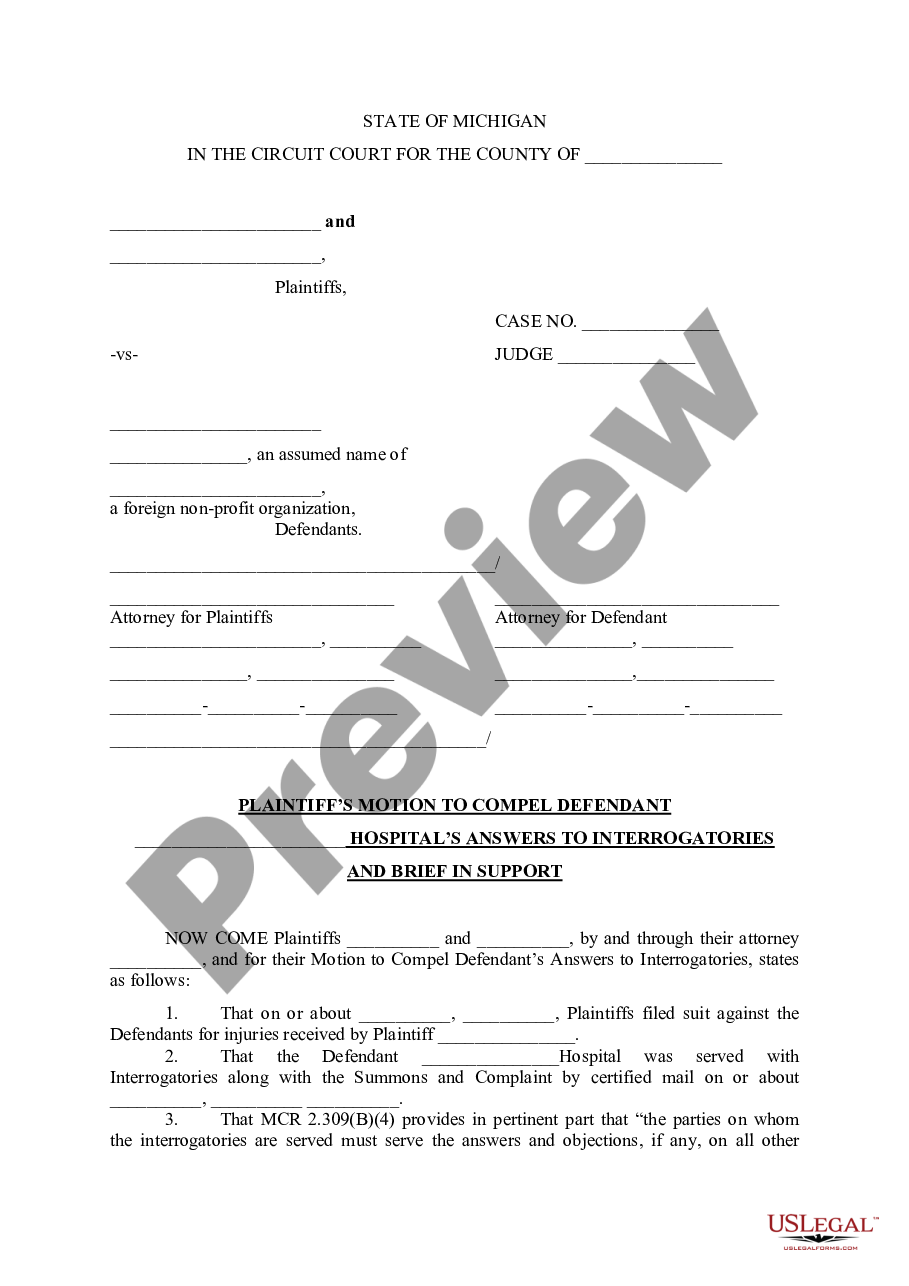

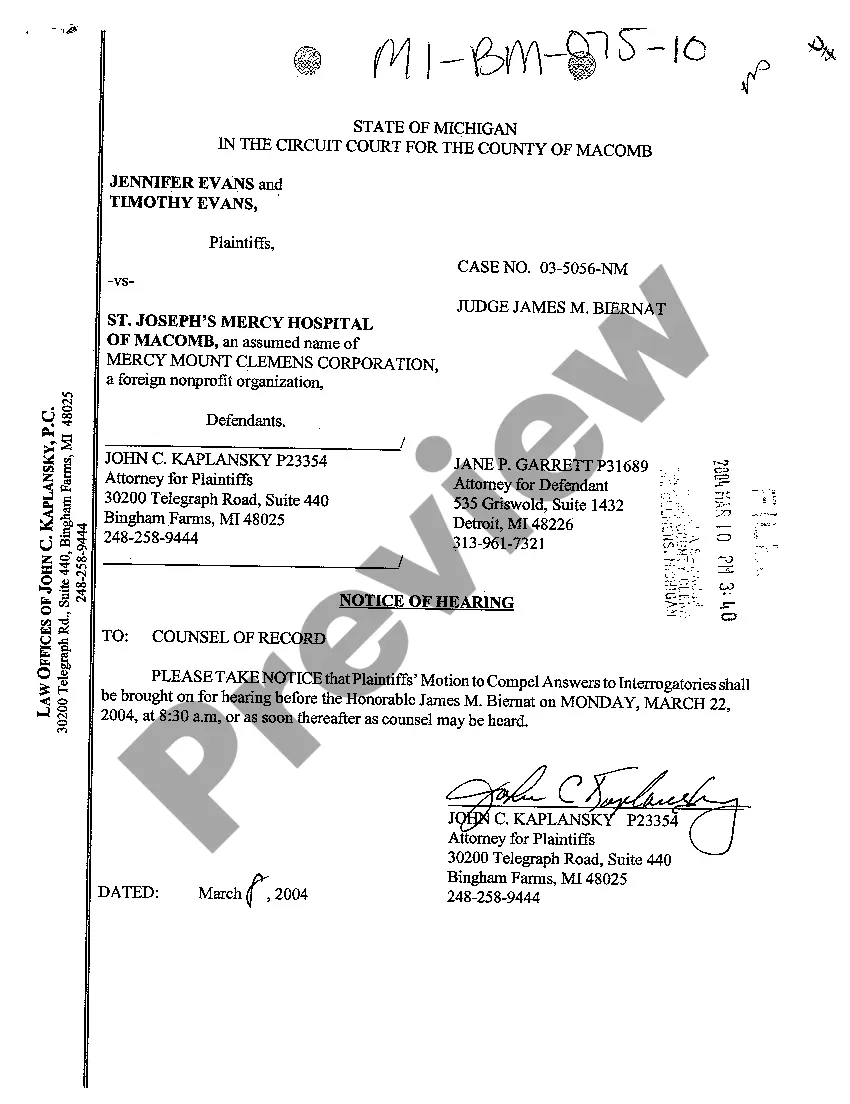

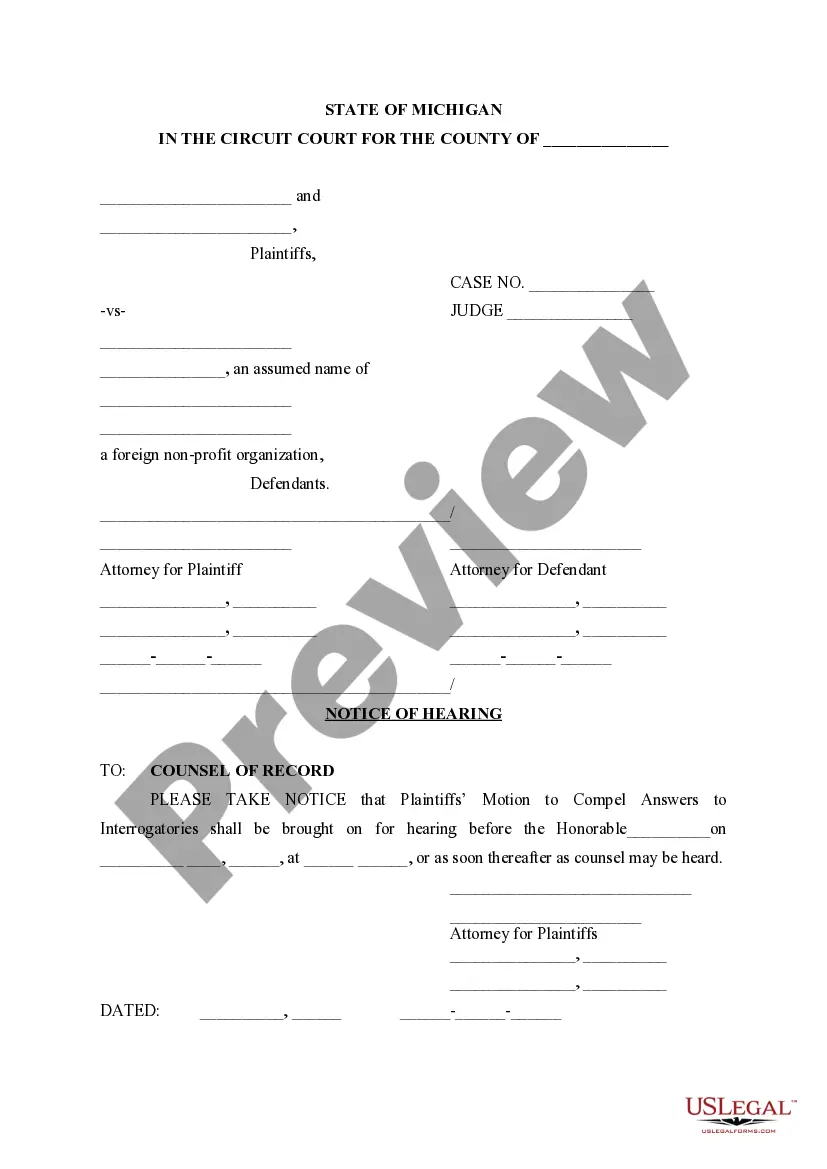

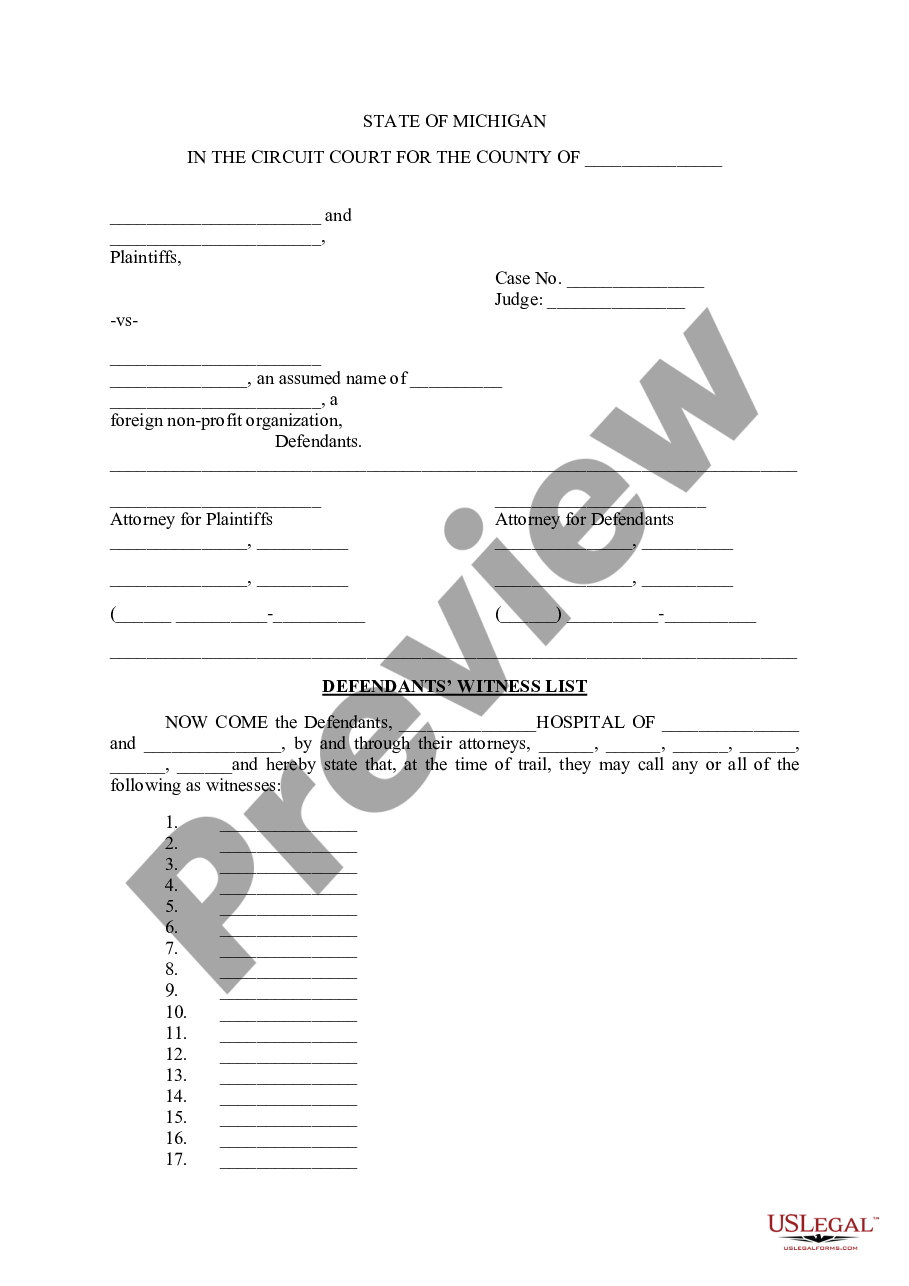

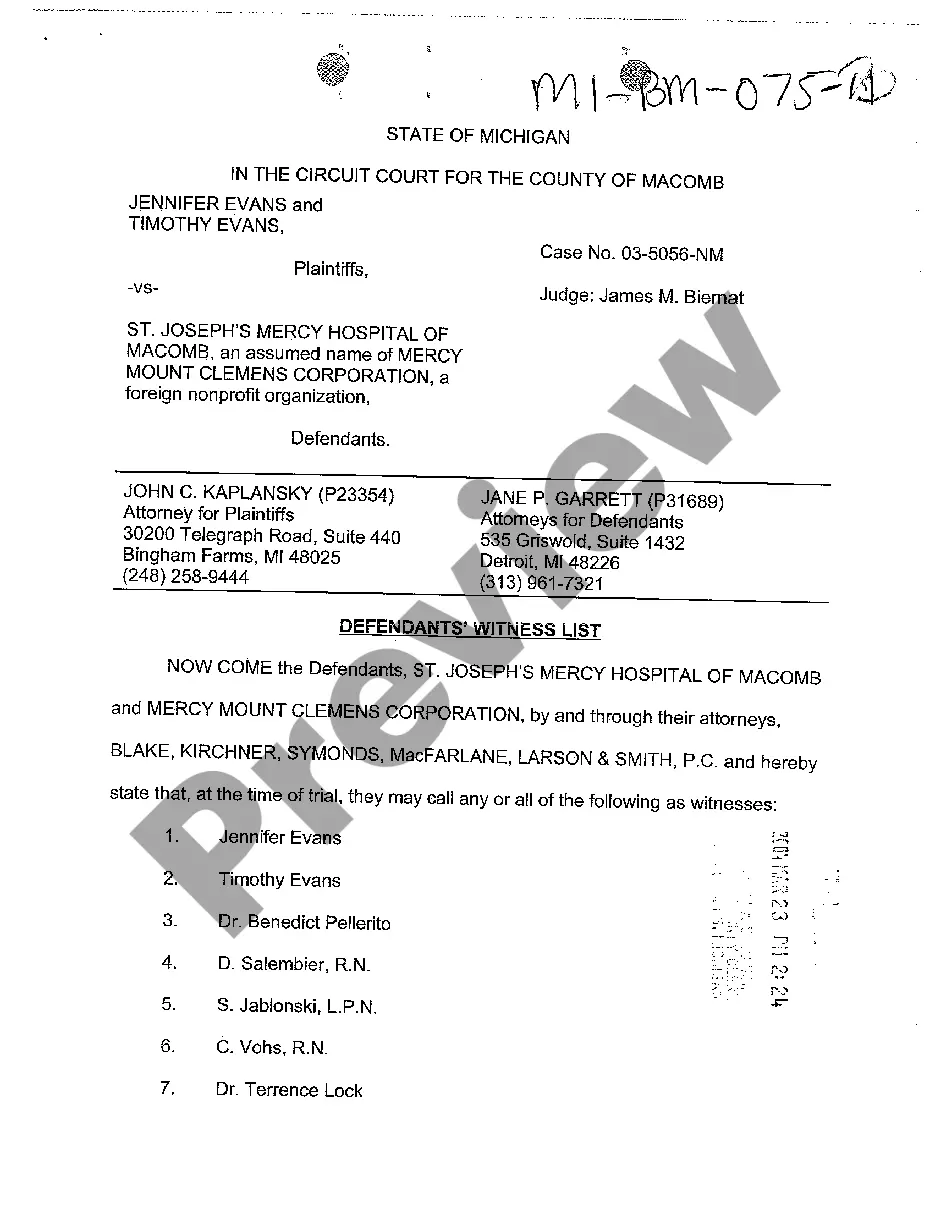

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Arizona Installments Fixed Rate Promissory Note Secured by Personal Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Installments Fixed Rate Promissory Note Secured By Personal Property?

If you're looking for accurate Arizona Installments Fixed Rate Promissory Note Secured by Personal Property templates, US Legal Forms is your solution; find documents created and reviewed by state-licensed attorneys.

Using US Legal Forms not only keeps you safe from issues related to legal paperwork; you also save time, effort, and money! Downloading, printing, and completing a professional form is far more cost-effective than hiring a lawyer to do it for you.

And there you have it. In just a few simple steps, you obtain an editable Arizona Installments Fixed Rate Promissory Note Secured by Personal Property. Once you establish an account, all future purchases will be processed even more conveniently. With a US Legal Forms subscription, simply Log In to your account and click the Download button located on the form's page. Then, whenever you need to access this template again, you can always find it in the My documents section. Don't squander your time searching through countless forms on different platforms. Purchase accurate documents from one reliable source!

- Begin by completing your registration by entering your email and creating a password.

- Follow the instructions below to set up your account and obtain the Arizona Installments Fixed Rate Promissory Note Secured by Personal Property template to address your needs.

- Utilize the Preview feature or check the document details (if available) to ensure that the template is the one you need.

- Verify its validity in your jurisdiction.

- Click on Buy Now to place your order.

- Choose a desired payment plan.

- Set up an account and pay using your credit card or PayPal.

- Select an appropriate format and save the document.

Form popularity

FAQ

In Arizona, a promissory note remains valid for a specific duration depending on the terms outlined within it. Generally, if not specified, the statute of limitations for enforcing a promissory note is six years. However, if you secure an Arizona Installments Fixed Rate Promissory Note Secured by Personal Property, you should review the terms to ensure you understand your obligations and rights. Understanding these details helps you avoid potential disputes in the future.

While a promissory note does not always need to be witnessed or notarized, doing so adds an extra layer of security. For an Arizona Installments Fixed Rate Promissory Note Secured by Personal Property, having a witness or notary can verify the authenticity of the document. This can be particularly beneficial in legal disputes or when enforcing the note.

Enforcing a secured promissory note typically involves initiating legal action to recover owed amounts. Should the borrower default, the lender can claim the secured assets, such as personal property specified in the note. If you're navigating an Arizona Installments Fixed Rate Promissory Note Secured by Personal Property, our platform provides the resources and templates to guide you through the enforcement process effectively.

Yes, a promissory note can be secured by real property, forming what is typically known as a mortgage. This arrangement provides the lender with collateral in case the borrower defaults. If you are interested in an Arizona Installments Fixed Rate Promissory Note Secured by Personal Property, you can also explore how such notes work with real estate in Arizona.

In Arizona, a promissory note does not need to be notarized to be legally binding; however, notarization can add an extra layer of security. For an Arizona Installments Fixed Rate Promissory Note Secured by Personal Property, notarization might help prevent disputes or prove authenticity if challenges arise. Thus, while not mandatory, it is often recommended.

Enforcing a promissory note in the UK requires taking legal action, such as filing a claim in court. While the process may differ from the US, similarities exist in the documentation required, such as having a clearly outlined repayment plan. For those interested in the Arizona Installments Fixed Rate Promissory Note Secured by Personal Property, understanding local laws is key for appropriate enforcement.

An on-demand promissory note serves as a flexible lending option, allowing the lender to call for repayment whenever needed. For instance, suppose you create an Arizona Installments Fixed Rate Promissory Note Secured by Personal Property with a clause stating that the lender can demand repayment at any time. This offers an excellent way for both parties to manage their financial commitments dynamically.

Filling out a promissory note is a straightforward process. Start by entering the names of the borrower and lender, along with the amount borrowed and the interest rate. Next, specify the repayment schedule and any collateral, particularly if it relates to an Arizona Installments Fixed Rate Promissory Note Secured by Personal Property. Ensure you read everything carefully and sign the document to make it legally binding.

The format of a promissory note typically includes essential elements such as the borrower's name, the lender's name, the principal amount, the interest rate, and the repayment terms. It is crucial to clearly outline the obligations you commit to when you create an Arizona Installments Fixed Rate Promissory Note Secured by Personal Property. This structured format helps ensure both parties understand their responsibilities and rights under the agreement.