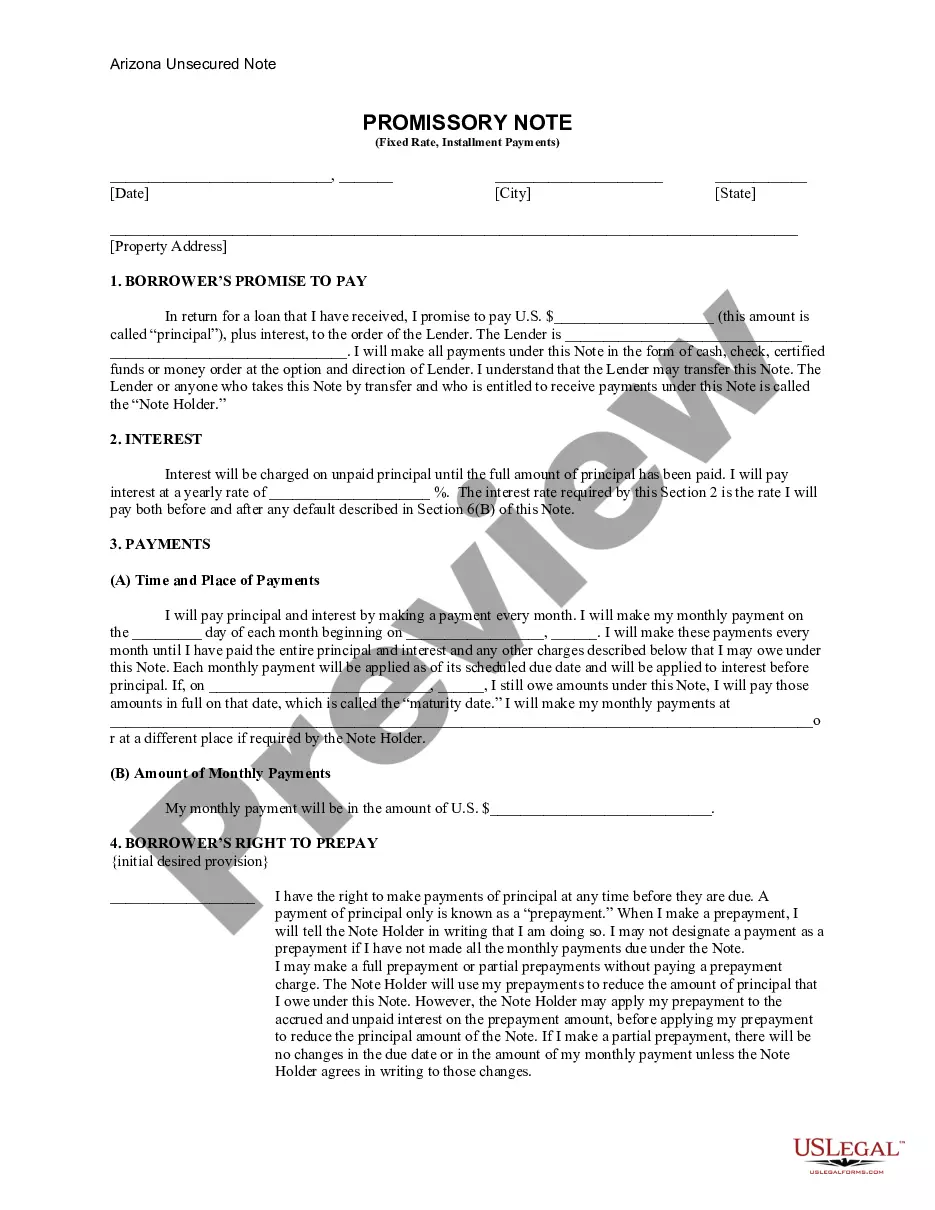

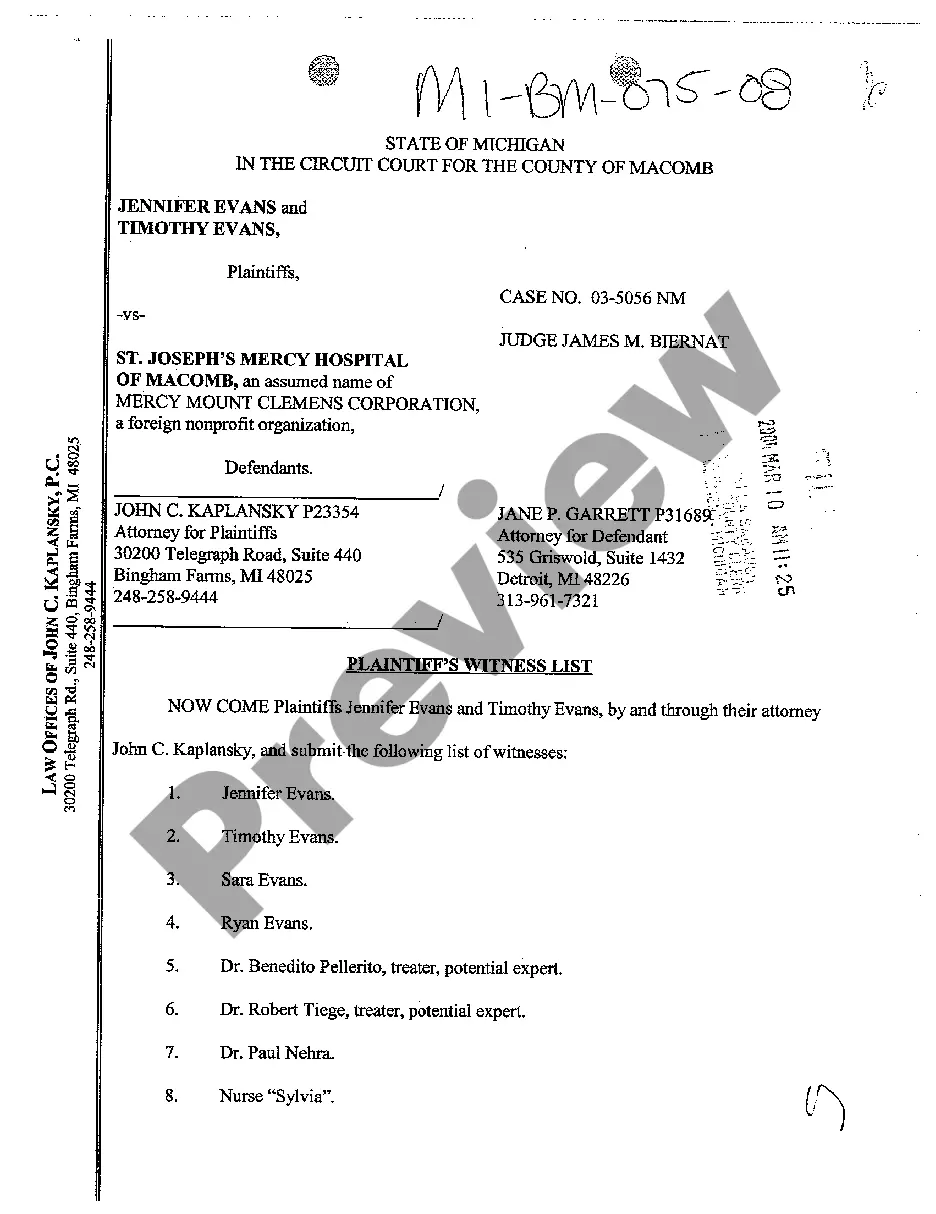

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

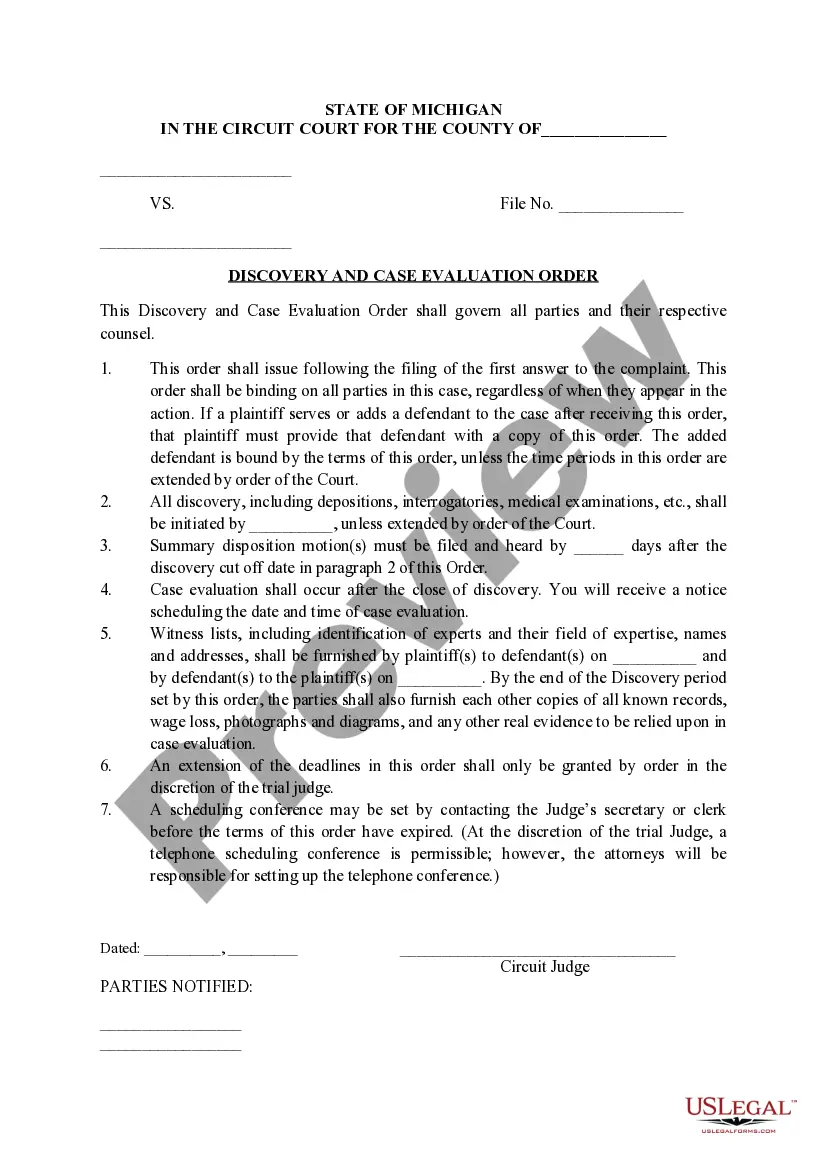

How to fill out Arizona Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you're looking for precise Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate samples, US Legal Forms is precisely what you require; access files crafted and verified by state-certified attorneys.

Utilizing US Legal Forms not only alleviates concerns about legal documentation; additionally, it saves you time, effort, and money! Obtaining, printing, and completing a professional form is significantly cheaper than hiring a lawyer to do it for you.

And that’s all. In just a few simple clicks, you receive an editable Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Once you establish your account, all subsequent orders will be processed even more easily. When you have a US Legal Forms subscription, simply Log In to your account and hit the Download button you see on the form’s page. Then, when you wish to utilize this template again, you'll always be able to find it in the My documents section. Don’t waste your time searching through numerous forms on various web platforms. Order accurate versions from a single reliable source!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the instructions below to establish your account and acquire the Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate template to address your issues.

- Utilize the Preview feature or review the file description (if accessible) to ensure that the template is the one you desire.

- Verify its validity in your residing state.

- Click Buy Now to place your order.

- Choose a preferred payment plan.

- Set up your account and pay with your credit card or PayPal.

- Select a preferred format and download the document.

Form popularity

FAQ

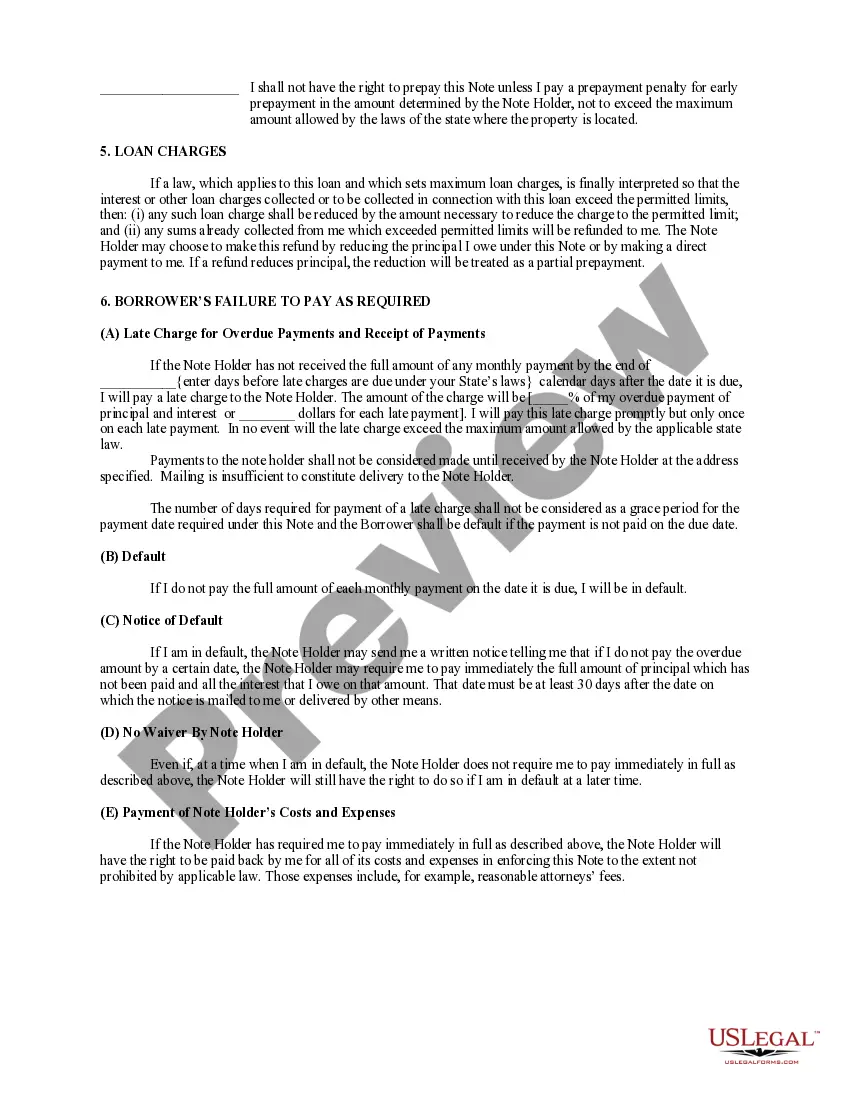

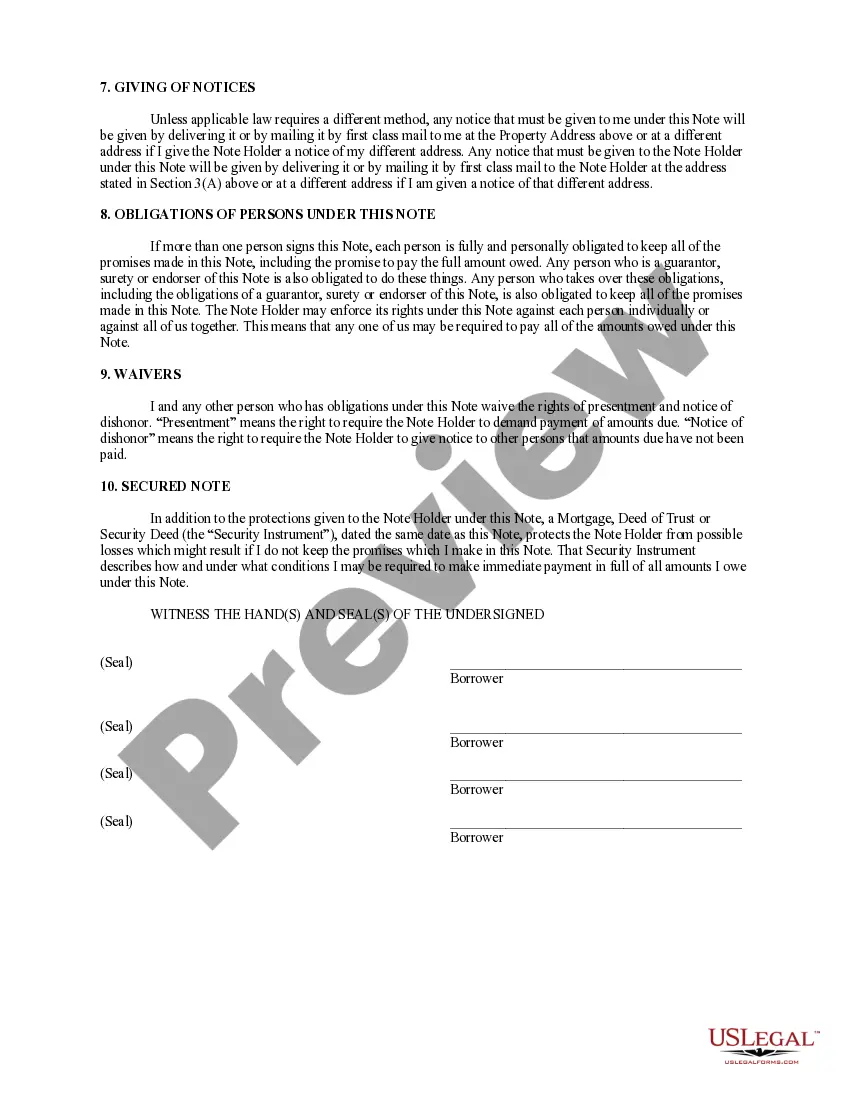

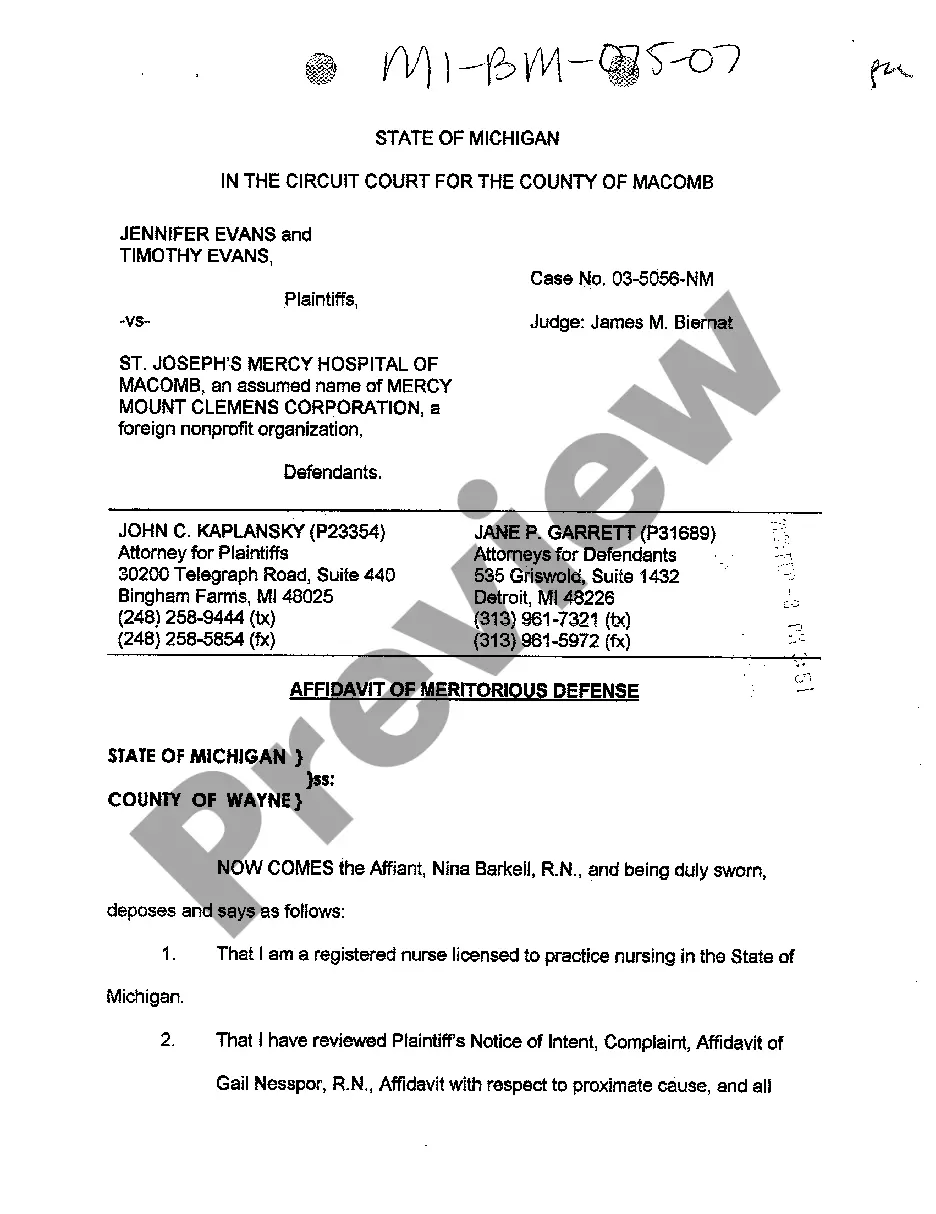

There are several types of promissory notes, including demand notes, installment notes, and secured notes. Demand notes require full payment upon request, while installment notes allow payments over time. An Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a specific type of installment note that provides both stability in payments and security for the lender.

To fill out a promissory note, start with the names and addresses of both the borrower and lender. Next, specify the amount being borrowed, the terms of repayment, and the interest rate. Finally, sign and date the note, and if applicable, include details related to an Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate for accuracy and legal protection.

An installment promissory note allows borrowers to repay the principal and interest in a series of scheduled payments over time. This type of note breaks down the total amount owed into manageable installments, making it easier for borrowers to budget. An Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate typically provides these structured payments, which can help borrowers manage their financial obligations effectively.

In Arizona, a promissory note does not legally require notarization; however, having it notarized can help establish its validity and provide additional security for both parties. Notarization creates a record of the transaction and can be beneficial in legal situations. For an Arizona Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this extra step can be crucial for ensuring that all terms are enforceable.

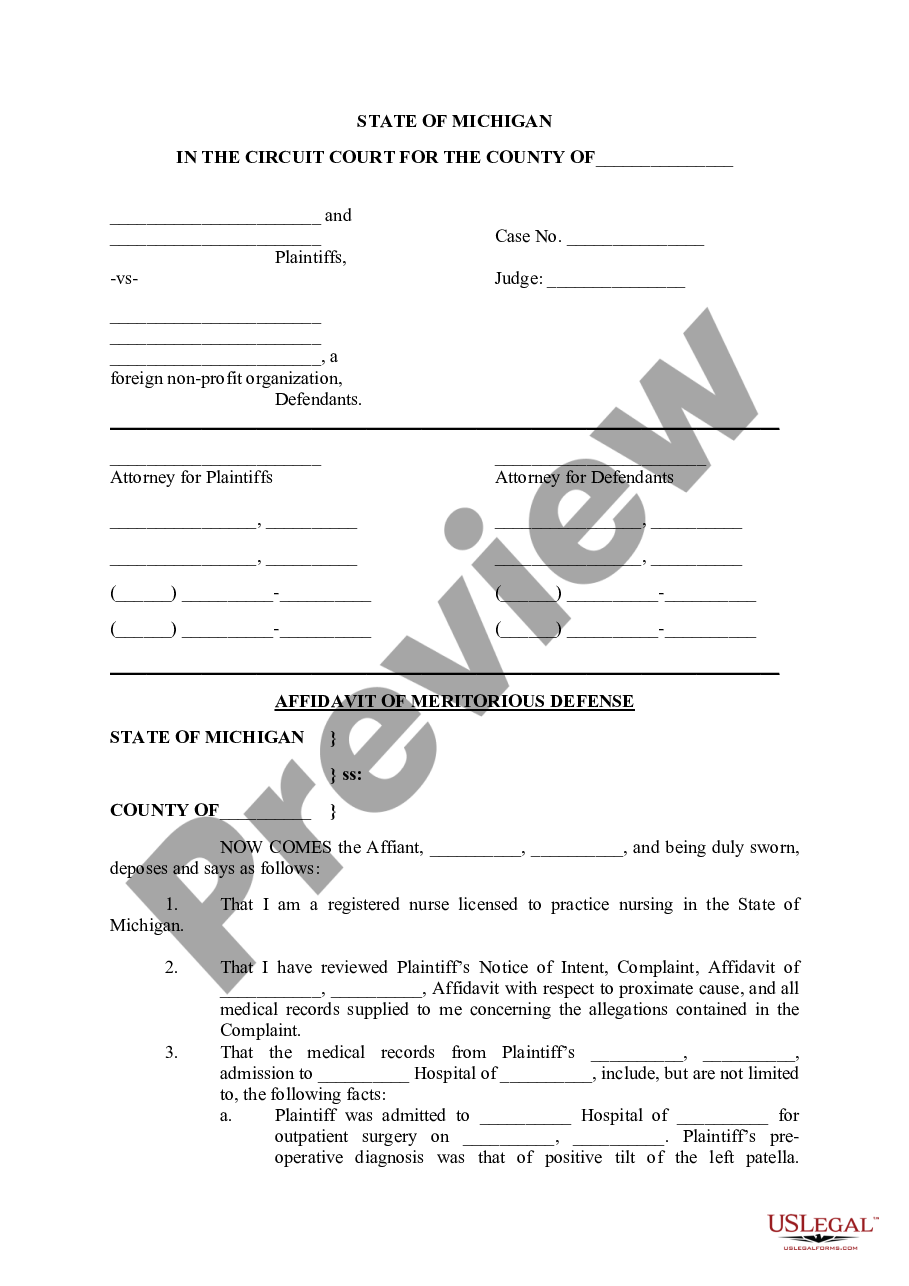

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note is a simple document that is not as complex as a loan agreement, and may be shorter and less detailed.Unlike a promissory note, a loan agreement imposes obligations on both parties, which is why both the borrower and lender must sign the agreement.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.