Wisconsin Last Will and Testament with All Property to Trust called a Pour Over Will

Overview of this form

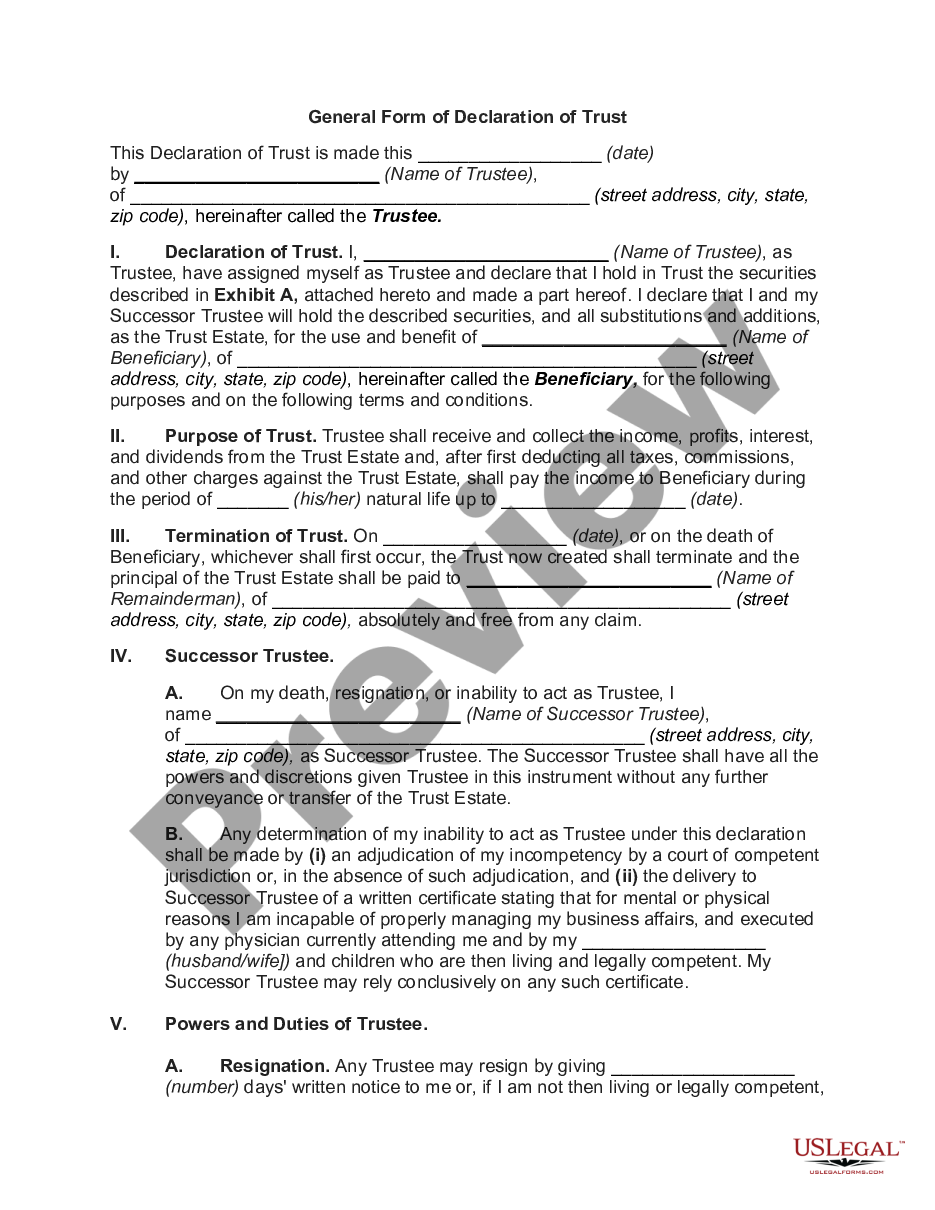

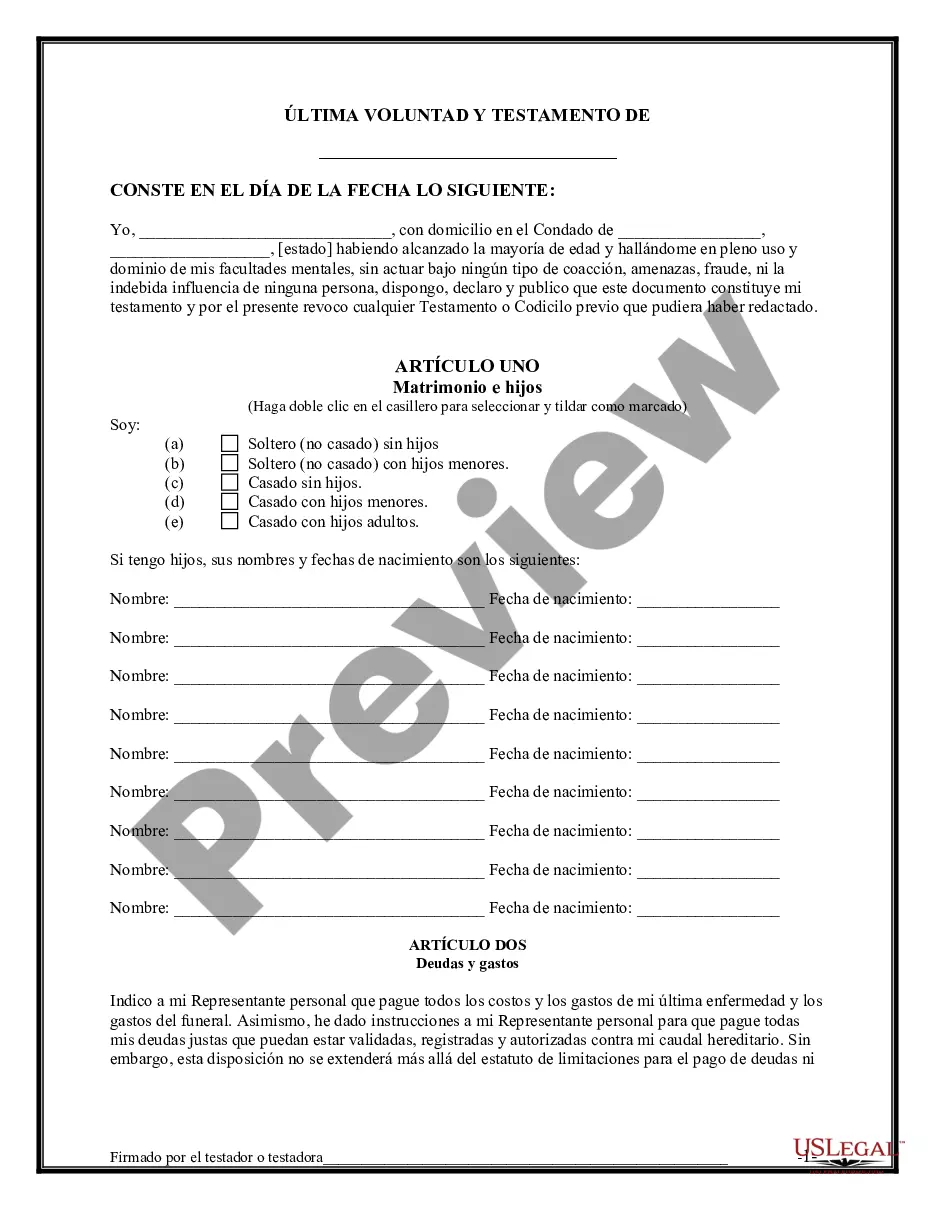

The Last Will and Testament with All Property to Trust, commonly referred to as a Pour Over Will, is a legal document that designates all assets not previously conveyed to a living trust to be transferred to that trust upon the testator's death. This form is essential for individuals establishing or who have already established a living trust, ensuring a smooth transfer of any remaining assets and facilitating effective estate planning.

Key components of this form

- Article One - Conveyance to Trust: Specifies that any property not already in the trust will be transferred to it.

- Article Two - Debts and Expenses: Outlines the payment of debts, funeral expenses, and administrative costs.

- Article Three - Guardian of Minor Children: Designates a guardian for any minor children, if applicable.

- Article Four - Appointment of Personal Representative: Names an individual to oversee the execution of the will.

- Article Five - Waiver of Bond: Waives the requirement for the personal representative to post a bond.

Situations where this form applies

This form should be used by individuals who have established or are in the process of establishing a living trust. It is particularly important when there are assets that may not have been transferred to the trust before death, ensuring that all property is ultimately managed according to the testator's wishes.

Who this form is for

This form is suitable for:

- Individuals creating a living trust.

- Persons looking to ensure all assets are transferred to their trust upon death.

- Parents with minor children who wish to appoint a guardian.

- Anyone wanting to specify the distribution of their estate.

How to complete this form

- Identify the parties involved, including the testator and the personal representative.

- Specify the living trust details and any property that will be conveyed.

- Fill in the names of the appointed guardians for any minor children, if applicable.

- Complete the sections regarding debts and expenses as outlined in the form.

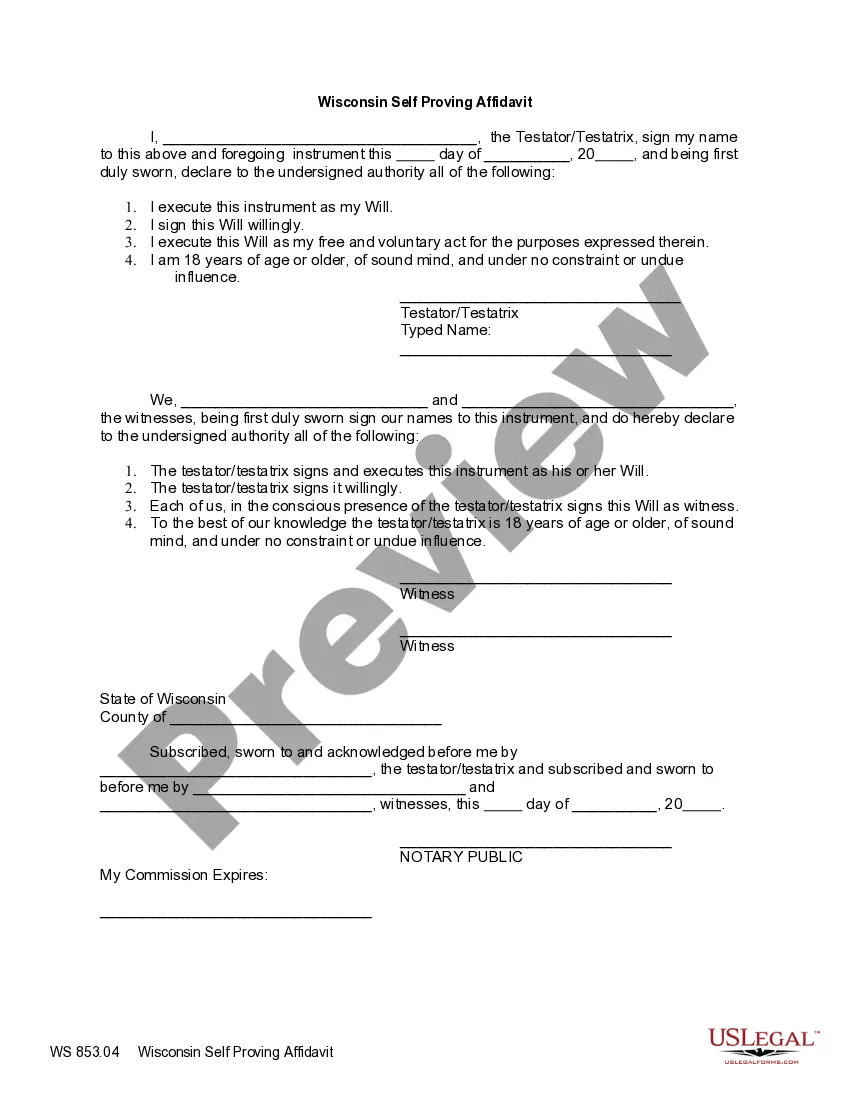

- Sign the document in the presence of the required witnesses.

Notarization requirements for this form

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

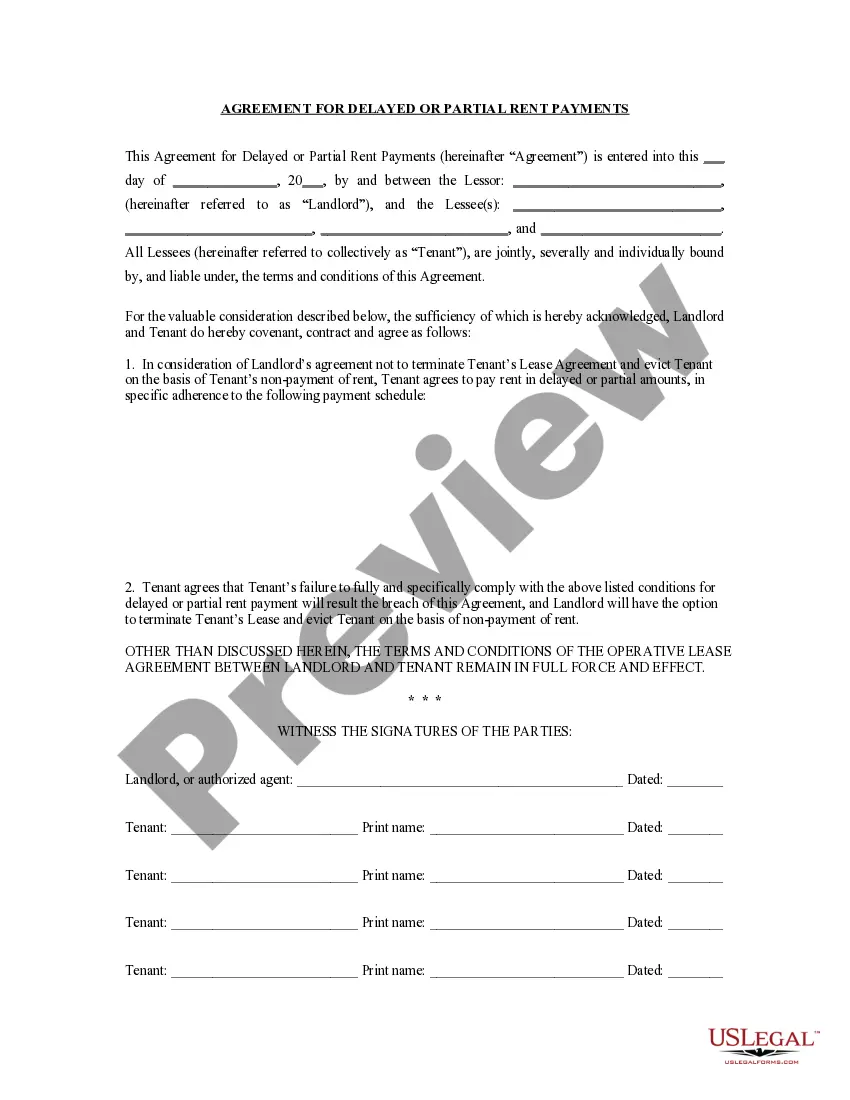

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to transfer all assets to the trust before death.

- Not appointing a guardian for minor children, which can lead to complications.

- Omitting necessary signatures or witness verifications.

- Not reviewing the will periodically, leading to outdated provisions.

Why complete this form online

- Convenient access and the ability to complete it digitally.

- Editable fields allow for easy updating of information.

- Ensures compliance with legal formatting and requirements.

- Availability of instructions that guide you through the process.

Looking for another form?

Form popularity

FAQ

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A pourover trust is a way to plan for incapacity that allows a donor to set up a trust and act as the trustee, or manager, pourover trust terminates at the death of the donor or trustee, and all assets go back to the estate and must go through probate.

A will and a trust are separate legal documents that usually have a common goal of coordinating a comprehensive estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, in the event that there are issues between the two.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

Spillover Trusts definition: Spillover trusts are established to hold any remaining assets after all other instructions from the will are carried out.

A pour-over will is a just-in-case will that states that your living trust is the beneficiary for any property in your name that's not in the trust at the time of your death, thereby moving any forgotten or remaining assets into the trust.One of the main reasons to create a living trust is to avoid probate.