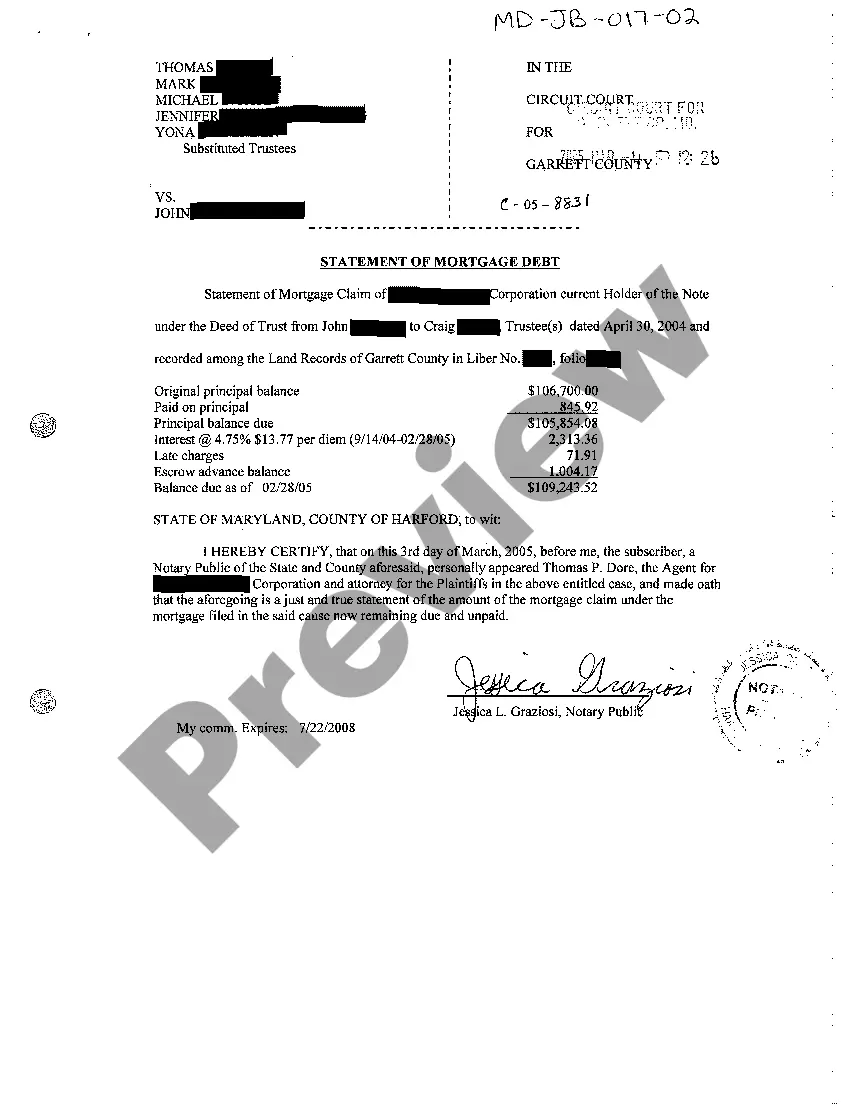

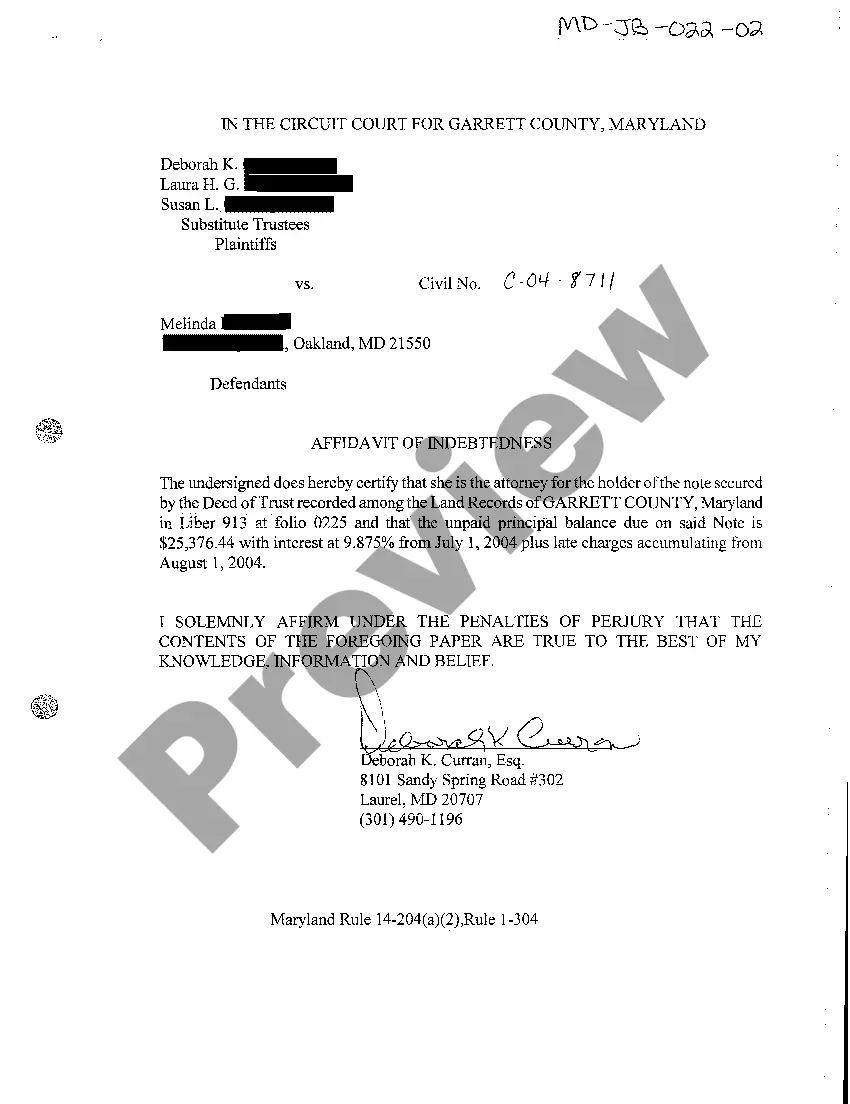

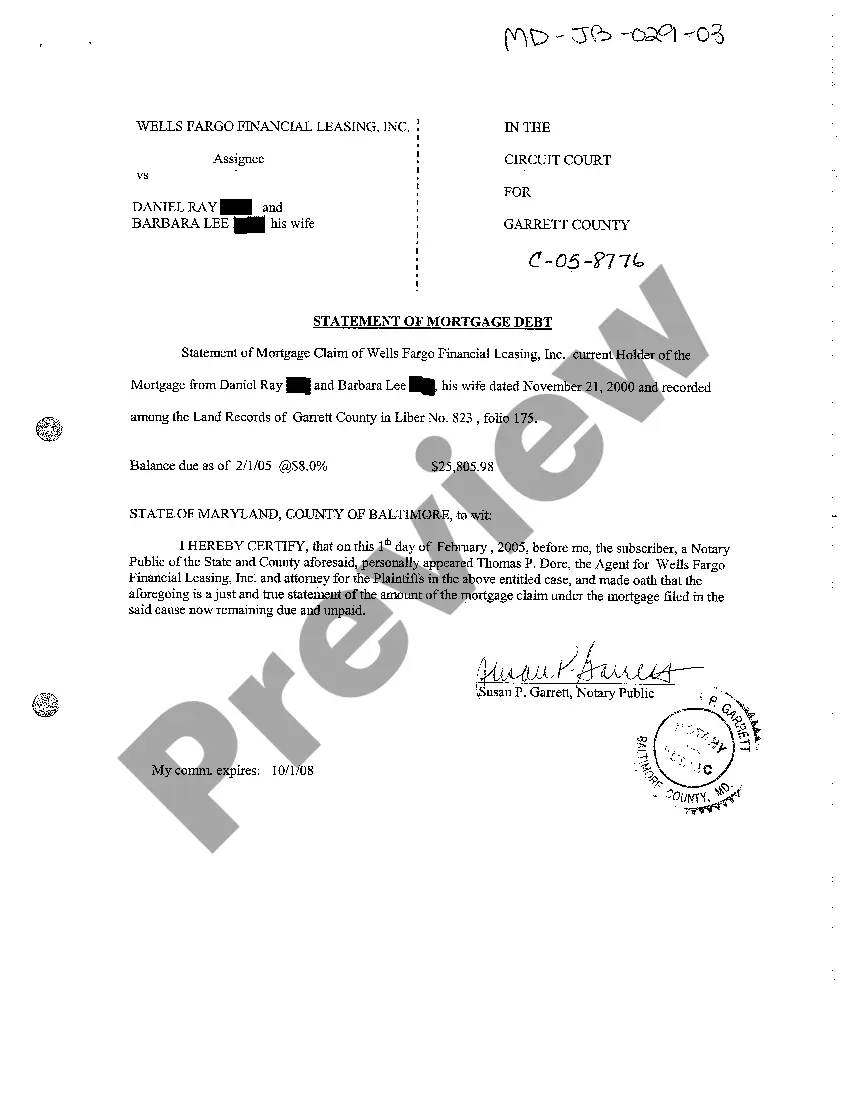

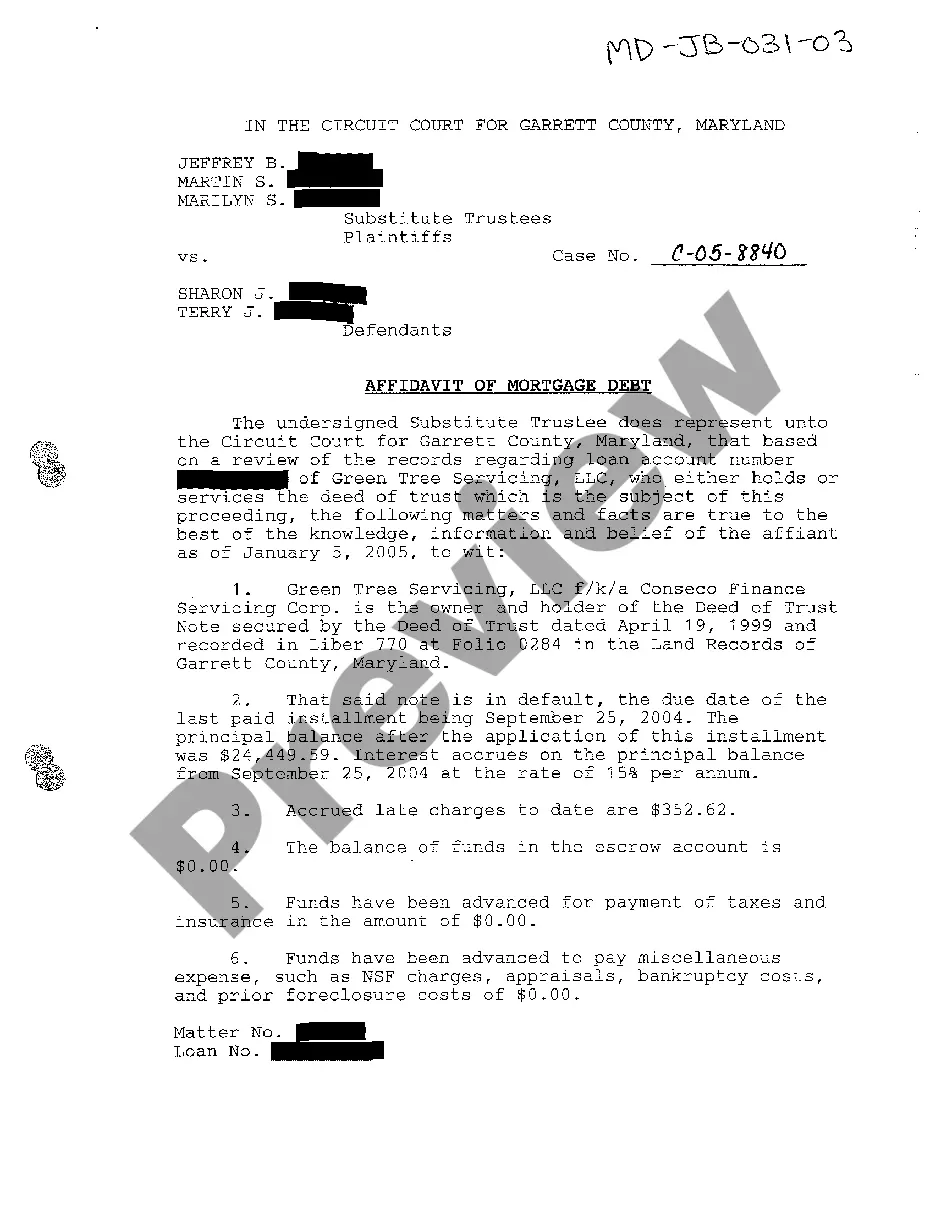

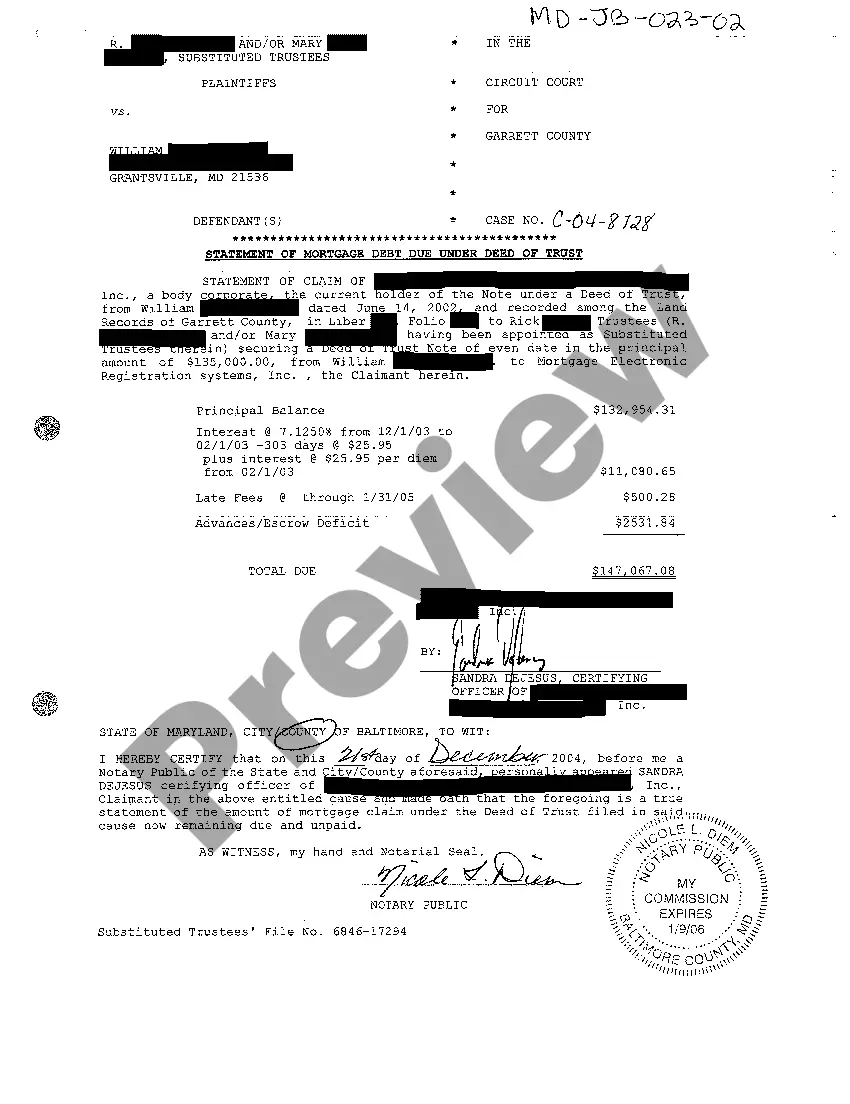

Maryland Statement of Mortgage Debt Due Under Deed of Trust

Description

How to fill out Maryland Statement Of Mortgage Debt Due Under Deed Of Trust?

Greetings to the most vital legal documents repository, US Legal Forms. Here, you can obtain any template such as Maryland Statement of Mortgage Debt Due Under Deed of Trust forms and download them (as many as you desire). Create official paperwork in a few hours, rather than days or even weeks, without having to spend a fortune with a legal advisor.

If you’re already a subscribed client, simply Log In to your account and click Download next to the Maryland Statement of Mortgage Debt Due Under Deed of Trust you require. Because US Legal Forms is an online platform, you’ll always have access to your downloaded documents, irrespective of the device you are using. Find them in the My documents section.

If you don’t have an account yet, what are you waiting for? Follow our instructions below to get started.

After you’ve completed the Maryland Statement of Mortgage Debt Due Under Deed of Trust, send it to your attorney for verification. It’s an additional step, but an essential one to ensure you're fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific document, verify its validity in the state you reside.

- Review the description (if available) to determine if it’s the right template.

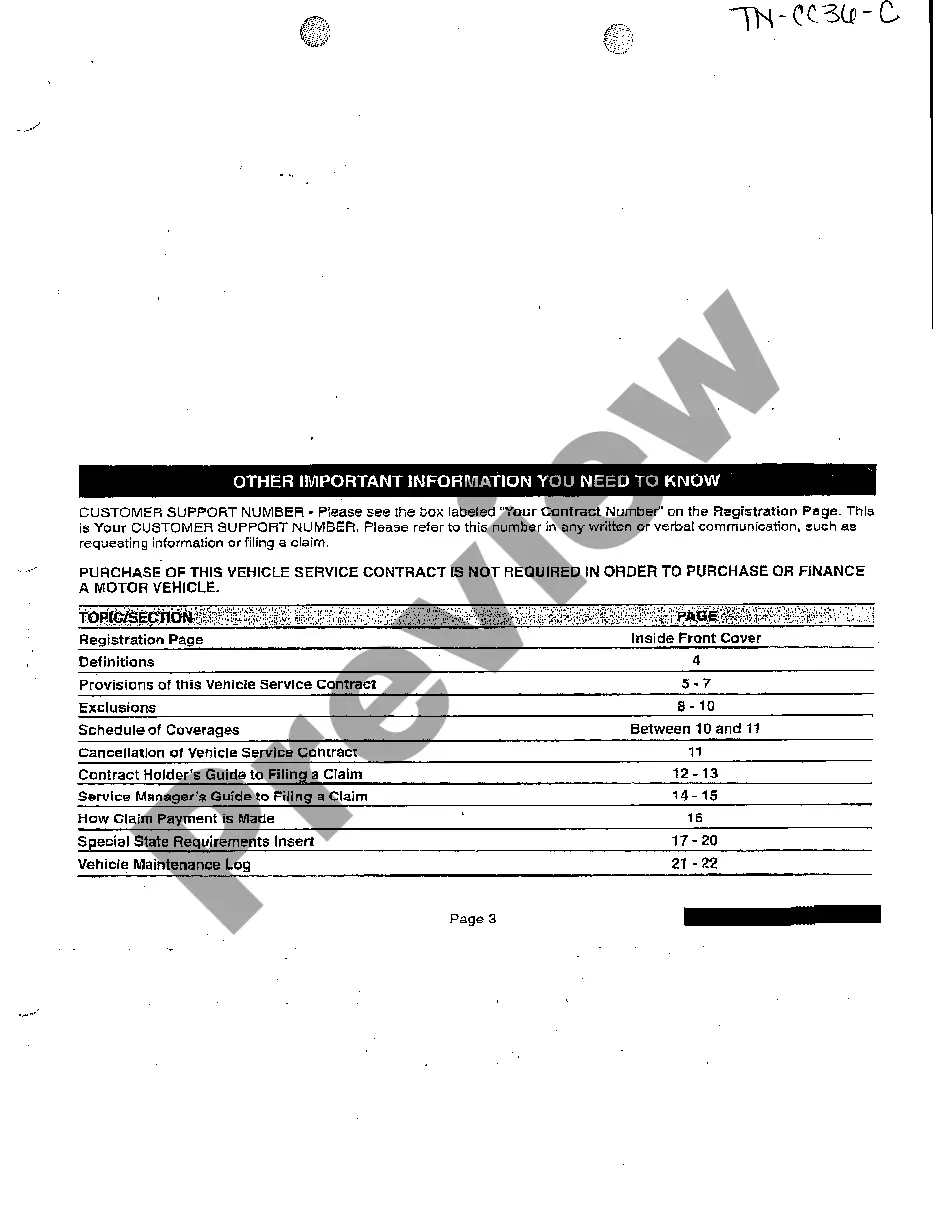

- Explore more information using the Preview feature.

- If the document fulfills all your requirements, click Buy Now.

- To create an account, choose a pricing plan.

- Utilize a credit card or PayPal account to sign up.

- Save the document in your preferred format (Word or PDF).

- Print the document and fill it in with your or your business's information.

Form popularity

FAQ

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

A deed of trust is normally recorded with the recorder or county clerk for the county where the property is located as evidence of and security for the debt. The act of recording provides constructive notice to the world that the property has been encumbered.

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.The trustee, however, holds the legal title to the property.

A deed of trust includes most of the same information as a mortgage, including: The original loan amount. A legal description of the property that's used as security or collateral for the mortgage. The names of parties: trustee, trustor, and beneficiary.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)