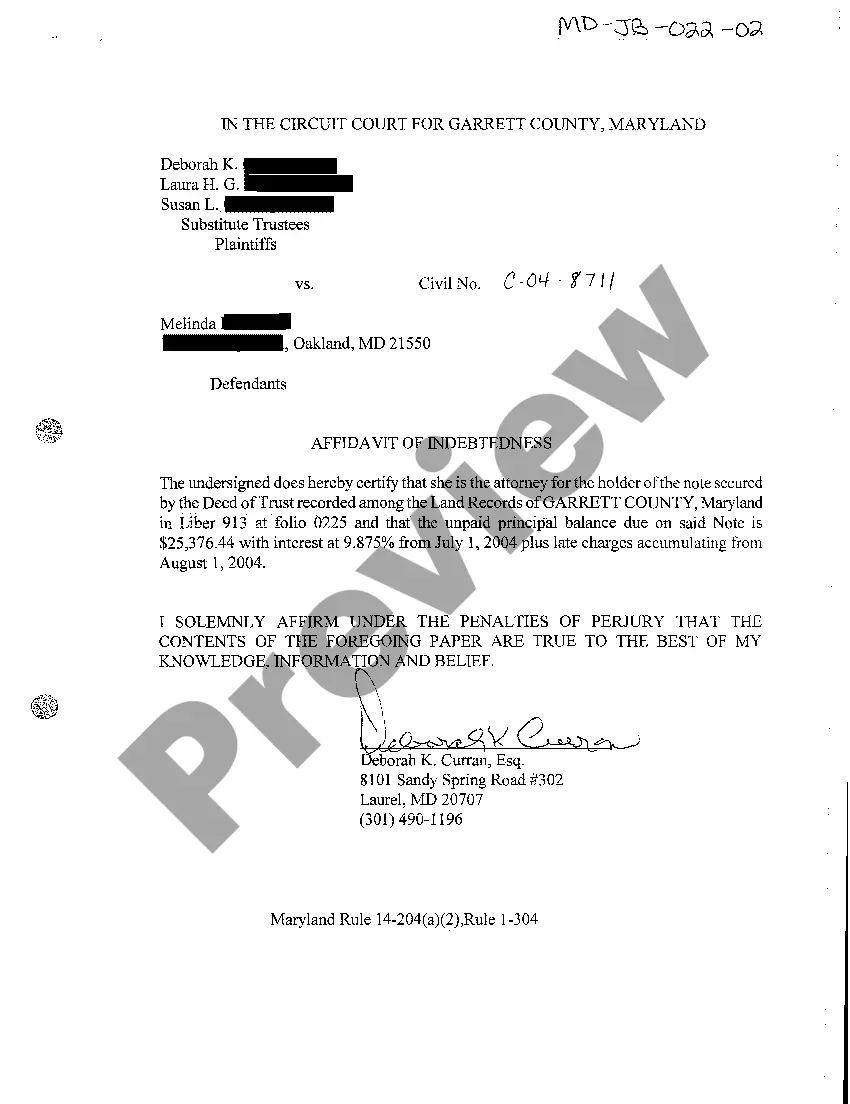

Maryland Affidavit of Indebtedness

Description

How to fill out Maryland Affidavit Of Indebtedness?

You are invited to the largest repository of legal documents, US Legal Forms. Here you will discover any template including Maryland Affidavit of Indebtedness templates and download them (as many as you desire). Prepare official documents in merely a few hours, rather than days or even weeks, without having to spend a fortune on a lawyer. Obtain your state-specific sample in a few clicks and rest assured knowing that it was crafted by our qualified attorneys.

If you’re already a registered customer, simply Log Into your account and click Download next to the Maryland Affidavit of Indebtedness you need. Since US Legal Forms is web-based, you’ll always have access to your saved forms, regardless of what device you’re utilizing. View them in the My documents section.

If you do not possess an account yet, what are you waiting for? Review our guidelines below to get started.

Once you’ve filled out the Maryland Affidavit of Indebtedness, present it to your attorney for validation. It’s an additional step but an important one for ensuring you’re completely secure. Join US Legal Forms now and gain access to a vast array of reusable templates.

- If this is a state-specific sample, verify its validity in your residing state.

- Examine the description (if available) to find out if it’s the appropriate example.

- Explore more details with the Preview feature.

- If the document aligns with your requirements, click Buy Now.

- To create your account, select a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the document in your required format (Word or PDF).

- Print the document and complete it with your/your business’s details.

Form popularity

FAQ

In Maryland, a judgment is only valid for 12 years. If you have not been able to collect your judgment within that time, you will have to renew the judgment to continue your collection efforts.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).You may even be able to win the case.

It does not restrict the creditor from reporting the debt to the credit reporting agencies or contacting you to collect the debt. Once a judgment is entered against you, the creditor has 12 years to collect it.

Affidavits and statutory declarations must be signed before an individual with the power to witness an oath, such as a solicitor or notary public.

Arrange a Repayment Plan. One option you have for stopping a judgement against you is to speak to the creditor before they file any court documents. Dispute the Debt. File for Bankruptcy.

In general, the statute of limitations in Maryland for debt collection is three or four years after you stopped making payments, although it can be as long as 12 years in limited cases.

California allows the judgment to last ten years and it can be renewed for an additional ten years if the creditor files the required forms in a timely fashion.

Failure to Respond: If a defendant fails to answer the complaint or file a motion to dismiss within the time limit set forth in the summons, the defendant is in default. The plaintiff can ask the court clerk to make a note of that fact in the file, a procedure called entry of default.

Is there a statute of limitations on my judgment? While there are time limits for collecting debts, once a court judgment is obtained, that limit does not apply. In California a judgment is valid for 10 years; however, if renewed prior to 10 years, it is extended for another decade.