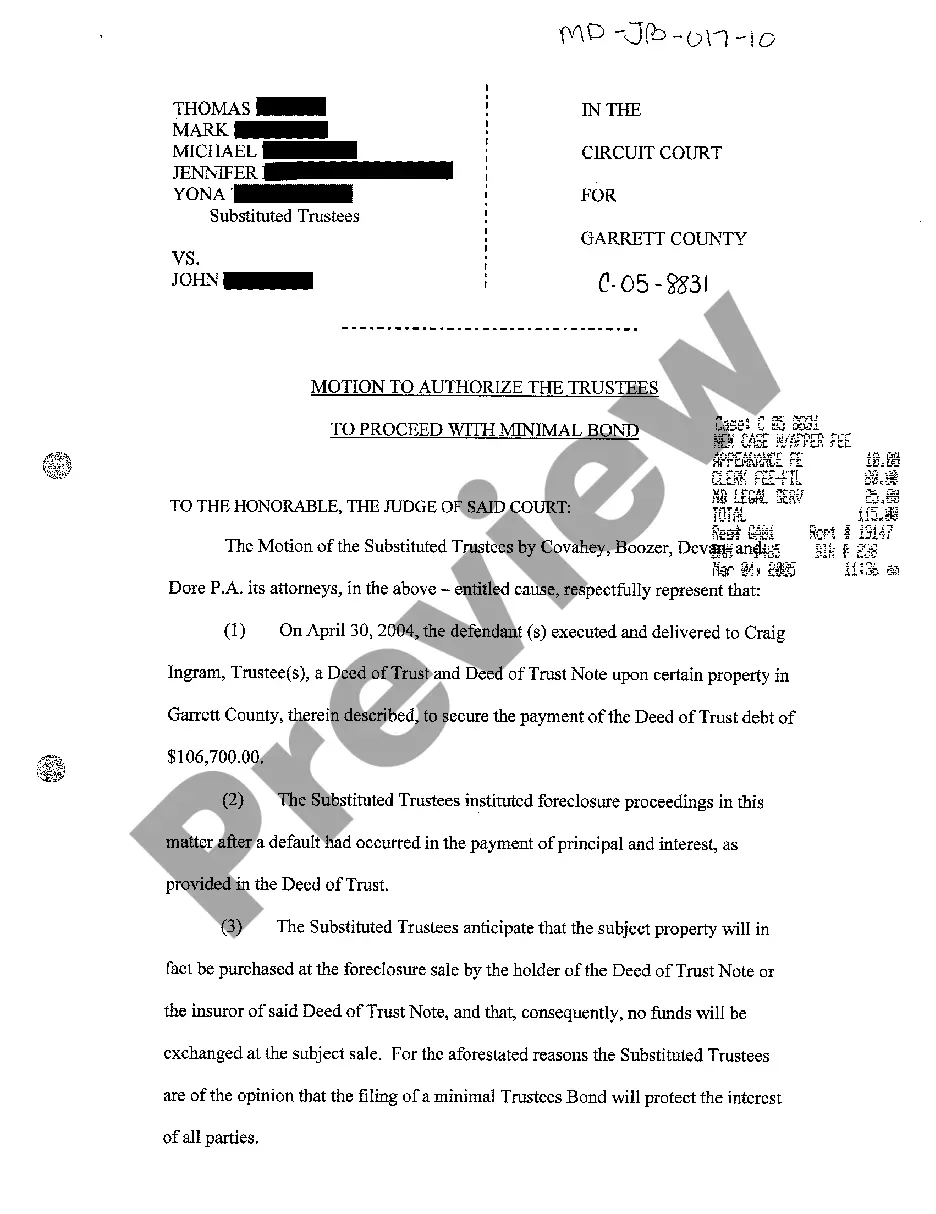

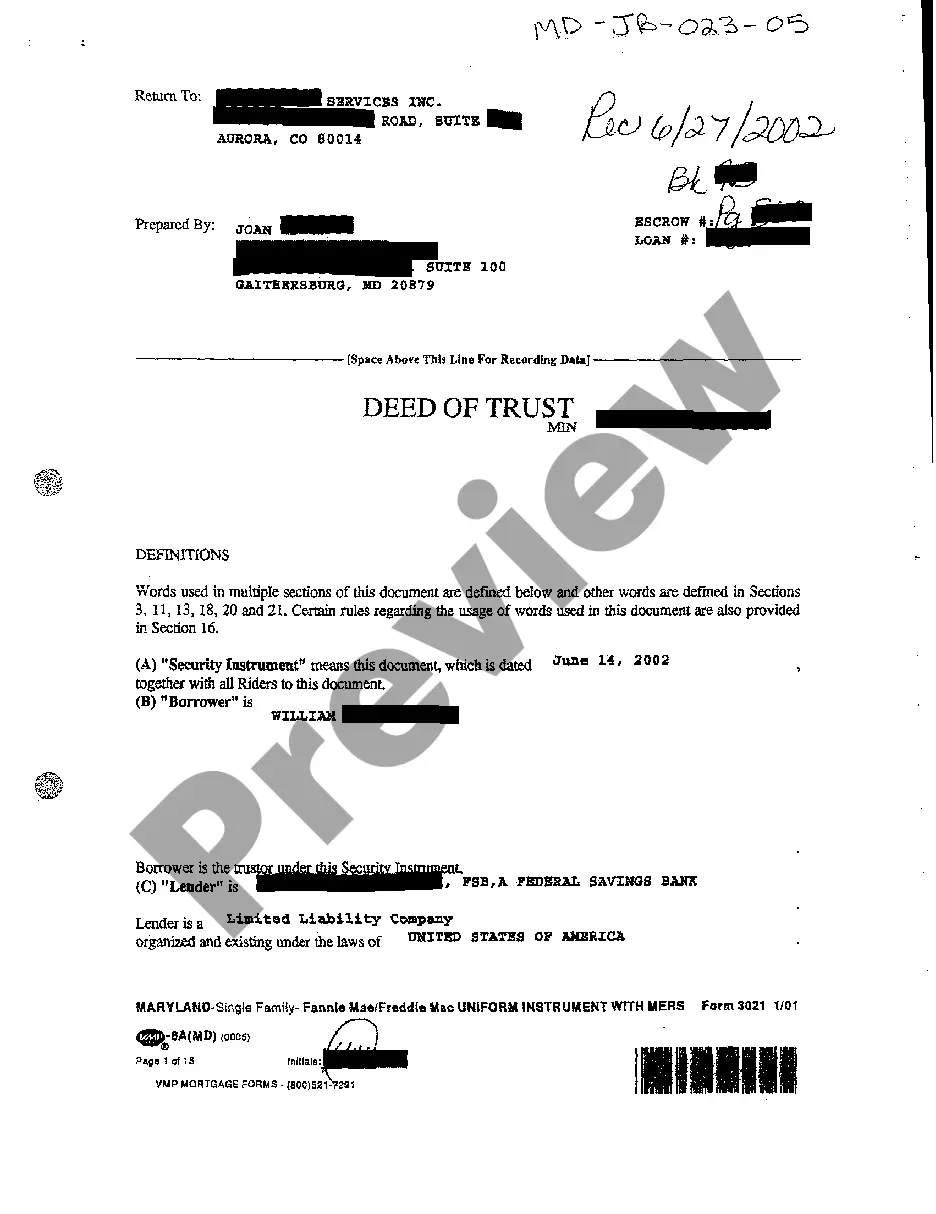

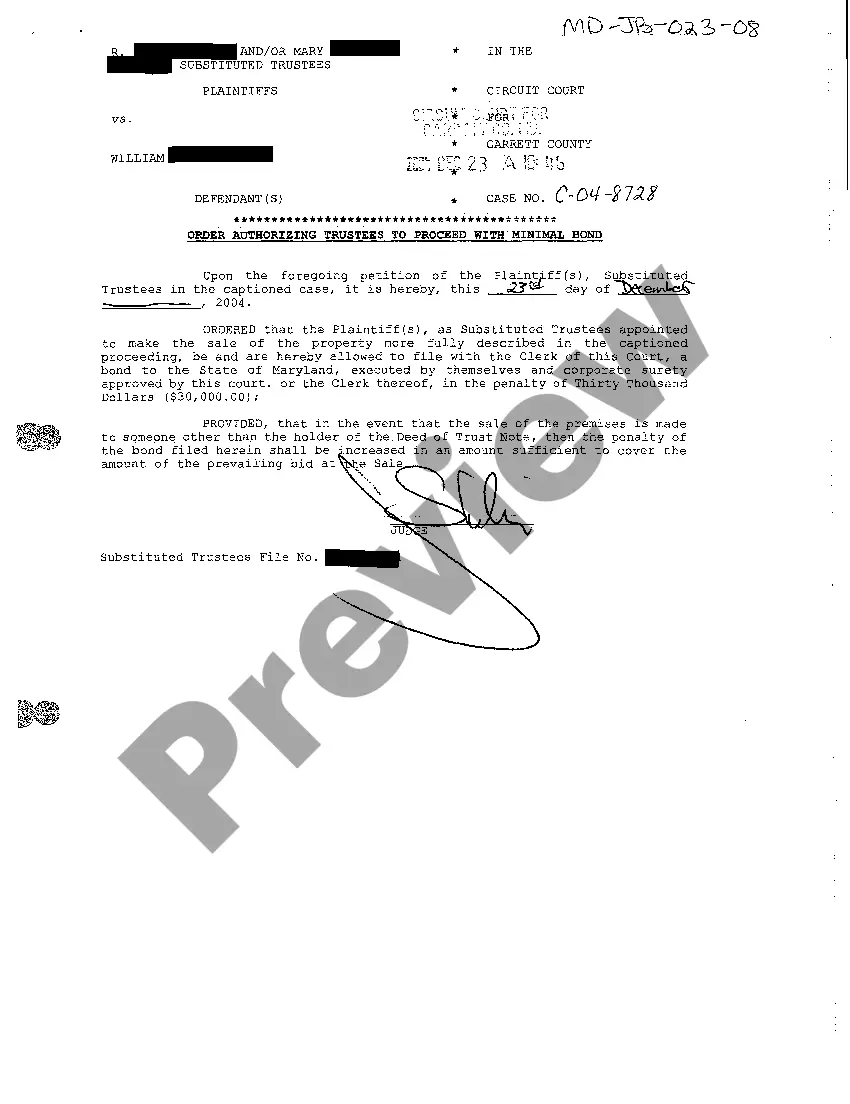

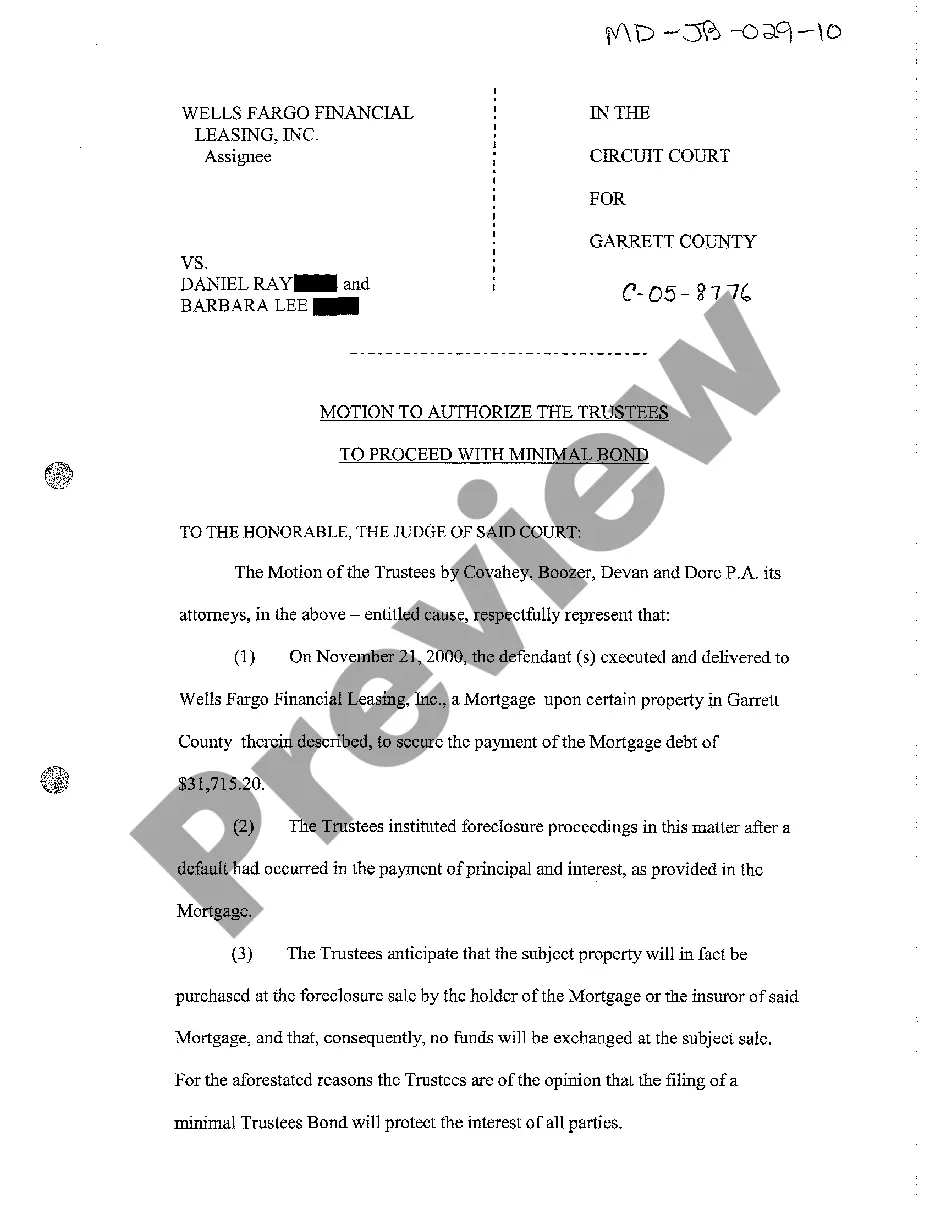

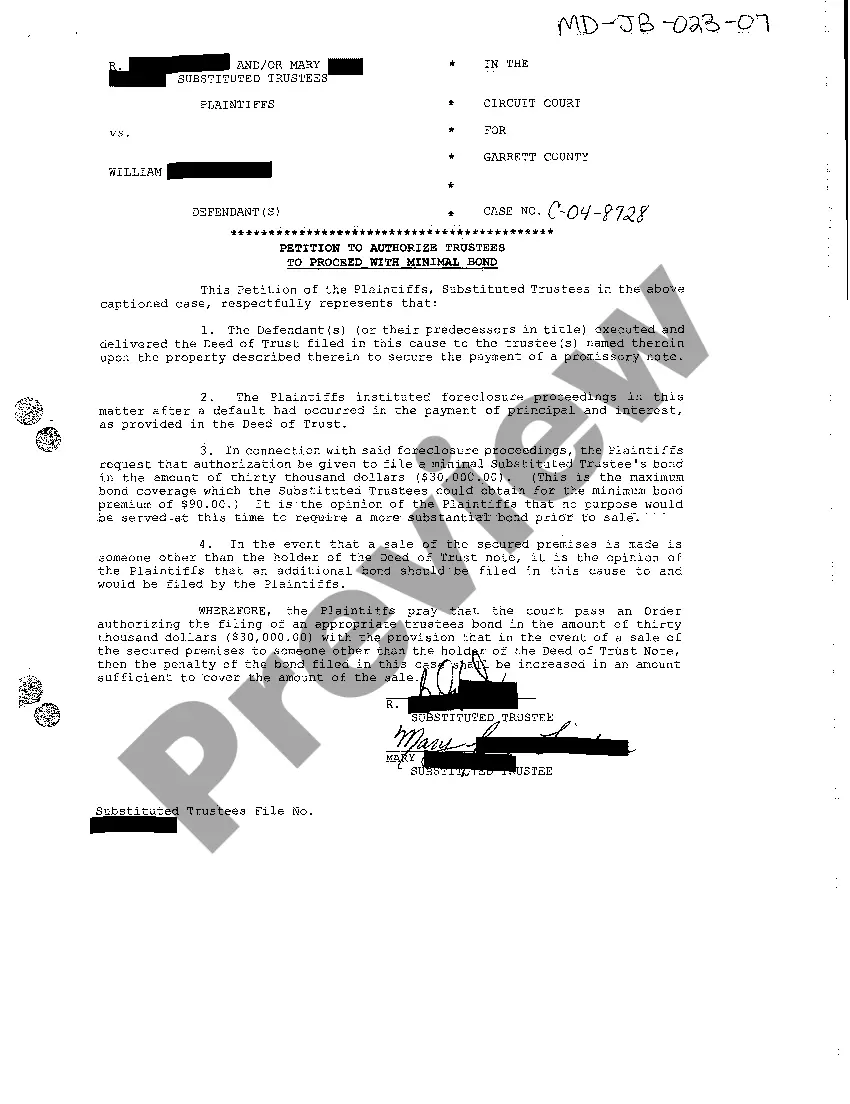

Maryland Petition to Authorize Trustees to Proceed with Minimal Bond

Description

How to fill out Maryland Petition To Authorize Trustees To Proceed With Minimal Bond?

You are invited to the largest legal documents repository, US Legal Forms. Here, you can locate any example such as Maryland Petition to Authorize Trustees to Proceed with Minimal Bond forms and store them (as many as you desire/require). Prepare official documents within hours, not days or even weeks, without having to spend a fortune on a lawyer or attorney. Obtain your state-specific template in a few clicks and feel confident knowing that it was created by our certified legal experts.

If you’re already a registered user, just Log Into your account and then click Download next to the Maryland Petition to Authorize Trustees to Proceed with Minimal Bond you require. Since US Legal Forms is an online solution, you’ll consistently have access to your saved documents, regardless of the device you’re on. Find them within the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions below to get started.

Once you have completed the Maryland Petition to Authorize Trustees to Proceed with Minimal Bond, send it to your attorney for verification. It’s an additional step but a crucial one for ensuring you’re completely covered. Join US Legal Forms today and gain access to a multitude of reusable templates.

- If this is a state-specific template, verify its validity in your state.

- Review the description (if available) to determine if it’s the right example.

- Explore more content using the Preview feature.

- If the template meets all your standards, simply click Buy Now.

- To establish your account, choose a pricing plan.

- Utilize a credit card or PayPal account to sign up.

- Download the template in your preferred format (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

Rule 6 414 in Maryland governs the procedures regarding trusts. It outlines the conditions under which a trustee may proceed with the management of trust assets while requiring a minimal bond. This is significant for those looking to streamline the process, as it simplifies the legal requirements involved. By utilizing the Maryland Petition to Authorize Trustees to Proceed with Minimal Bond, you can benefit from a more efficient approach to trust administration.

Under state law, fees are usually calculated either as a percentage of the total value of trust assets or a percentage of the transactions you make (the money that goes in and out of the trust).

Trustees are entitled to reasonable compensation whether or not the trust explicitly provides for such. Typically, professional trustees, such as banks, trust companies, and some law firms, charge between 1.0% and 1.5% of trust assets per year, depending in part on the size of the trust.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

Small Estate: property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Most professional Trust Companies (Administrators) will typically charge between 1% to 2% for a Trust estate that is settled within one (1) year, or 1% to 2% annually, based on the net value of Trust Assets under Management.

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.

2.2 Trustees are likewise entitled to commissions for their services in administering a trust. These commissions are two-fold: an income based commission and a commission based on corpus. The income portion is graduated from 6.5% on the first $10,000; 6% on the next $10,000; 4% on the next $10,000 and 3% thereafter.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.