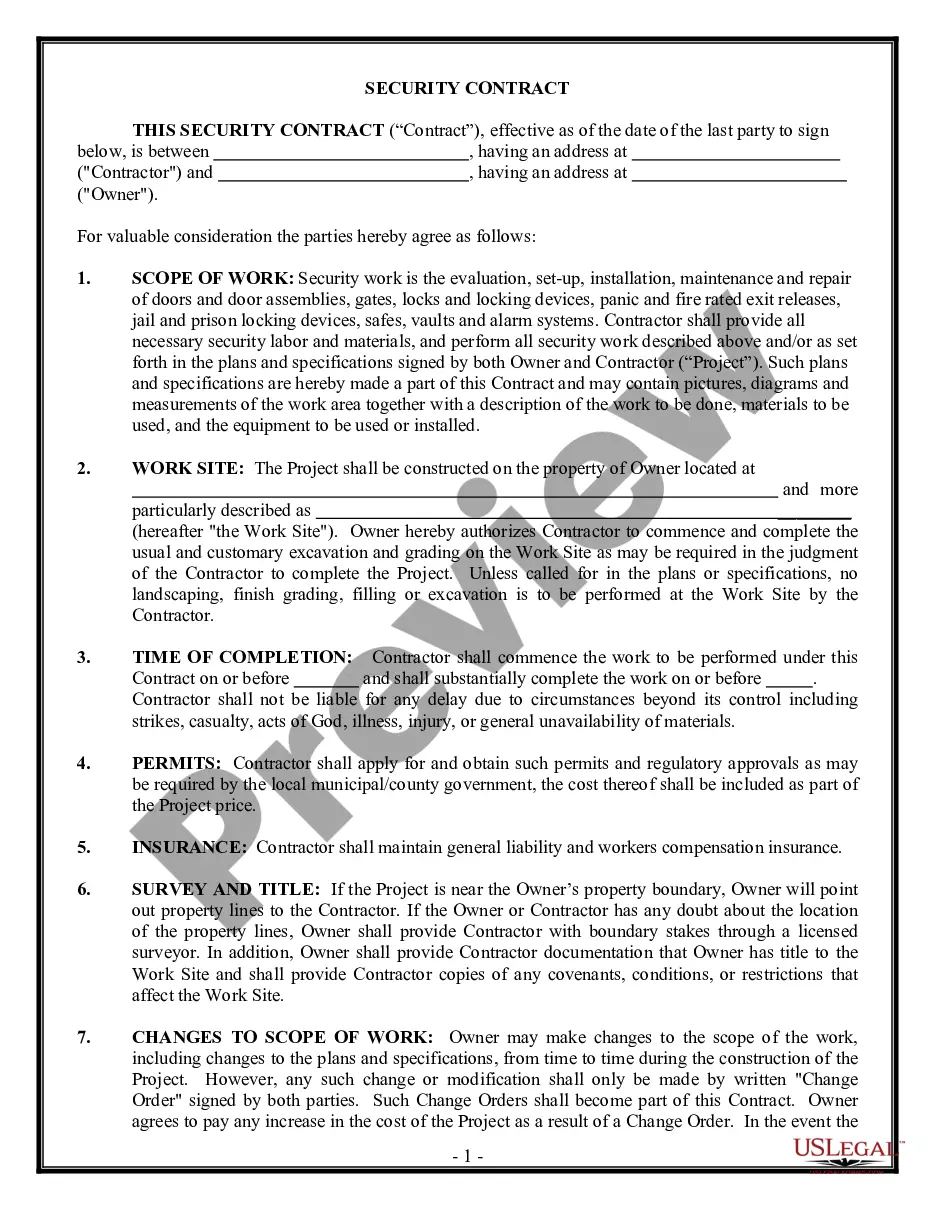

North Carolina Security Contract for Contractor

Understanding this form

The Security Contract for Contractor is a legal document that establishes a formal agreement between a security contractor and a property owner. Its primary purpose is to outline the terms and conditions under which security services will be provided, including payment arrangements, project scope, permits, and insurance requirements. This specific form is drafted to comply with the laws of North Carolina, making it distinct in addressing the local legal framework applicable to such services.

What’s included in this form

- Permits: Specifies the contractor's responsibility to obtain necessary permits for the project.

- Insurance: Outlines required general liability and workers' compensation insurance coverage.

- Changes to Scope of Work: Allows the owner to make modifications through written change orders.

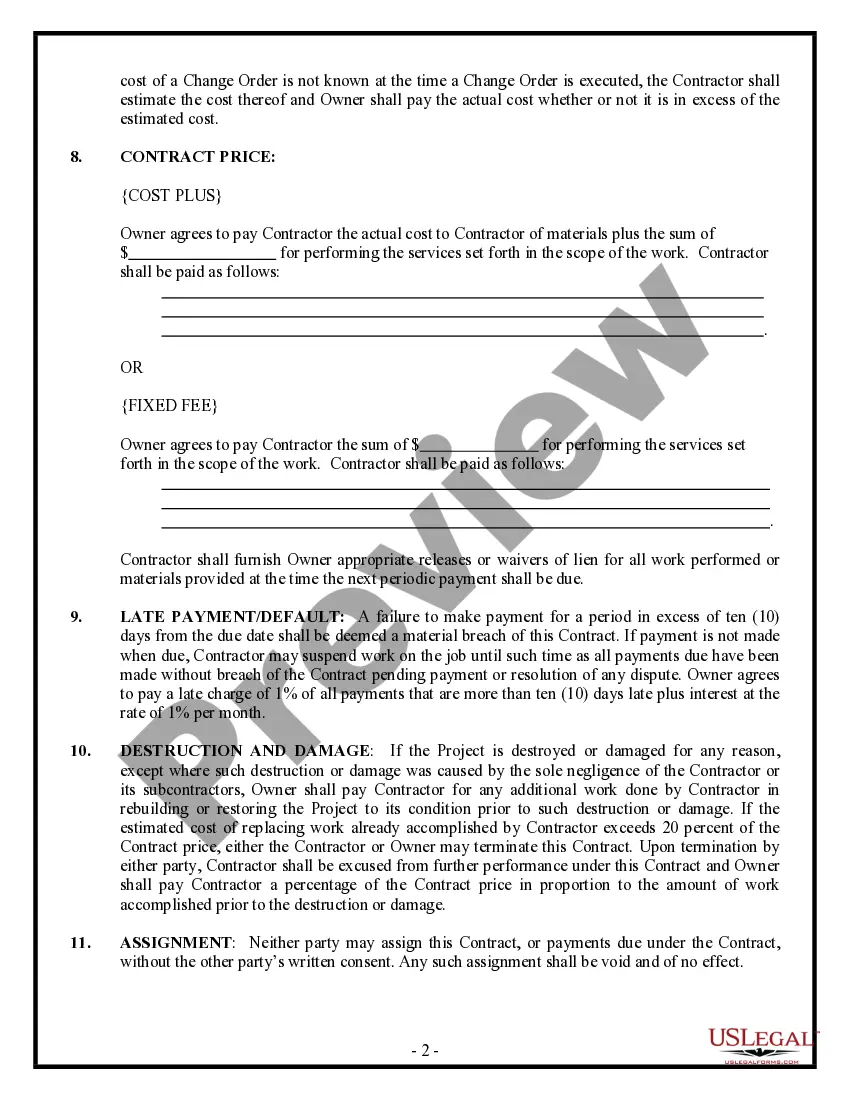

- Contract Price: Clarifies pricing agreements and adjustments due to changes in project scope.

- Destruction and Damage: Details the procedure and compensation for project destruction or damage.

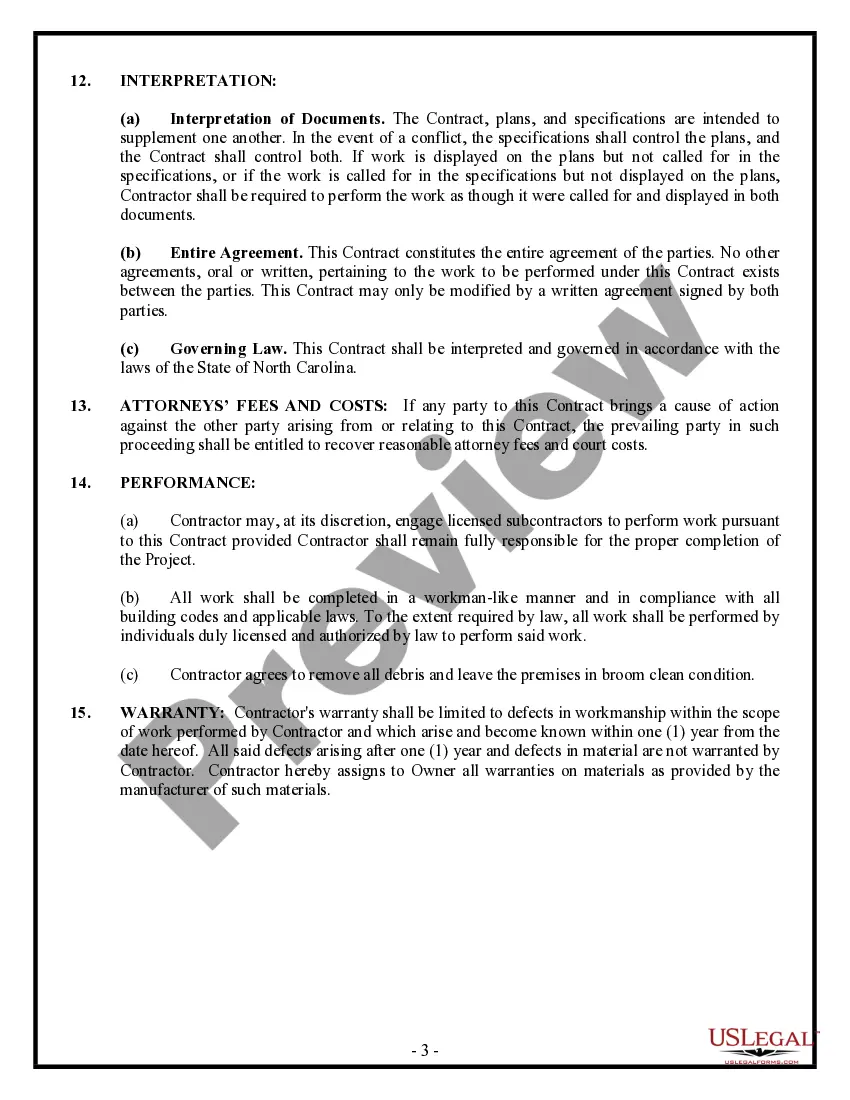

- Performance: Sets standards for work quality and contractor responsibilities.

Situations where this form applies

This form should be used when a property owner hires a security contractor for services involving site security, surveillance, or related activities. It is particularly useful in situations where a clear, formal agreement is required to manage expectations, project details, and legal compliance. Whether operating under a fixed fee or cost-plus contract, using this form helps protect the rights and responsibilities of both parties involved.

Who needs this form

- Property owners seeking to hire security contractors for various projects.

- Security contractors looking to formalize agreements with clients.

- Individuals or businesses involved in contractual services related to property or event security.

Instructions for completing this form

- Identify the parties involved, including the property owner and contractor.

- Specify the project details, including the scope of the security services required.

- Detail the payment structure, whether cost-plus or fixed fee, and the contract price.

- Include provisions for permits, insurance, and any required change orders.

- Sign and date the completed contract, ensuring all parties agree to the terms.

Notarization requirements for this form

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to specify the scope of work adequately.

- Not including or neglecting to sign change orders for modifications.

- Omitting important insurance requirements.

- Not addressing potential destruction or damage clauses clearly.

Why use this form online

- Convenience of accessing and downloading the form at any time.

- Editable templates that allow customization to fit specific needs.

- Drafted by licensed attorneys, ensuring legal compliance and reliability.

Looking for another form?

Form popularity

FAQ

The short answer is yes. North Carolina law allows a person or company who improves real estate to file a lien against the owner of the property if the owner will not or cannot pay for the work.If you do not owe the contractor, and prove it in court, the lien is dissolved.

North Carolina has a three-year statute of limitations period on actions for breach of contract and negligence. This means that claims based on a contract with the builder must be brought within this period, or they are barred.

The employment rates for self-employment grow at an average rate, and due to the rarity of a security guard being self-employed (about one percent of security guards are unemployed), smaller businesses that may not want to go through an agency will be more receptive to hiring a self-employed guard.

You shouldn't pay more than 10 percent of the estimated contract price upfront, according to the Contractors State License Board.

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

Pay basis: If you pay a worker on an hourly, weekly, or monthly basis, the IRS will consider it a sign the worker is your employee. An independent is generally paid by the job, project, assignment, etc., or receives a commission or similar fee.

A security guard may not act as an independent contractor to provide security services. A security guard must be employed as an employee of either a PPO, or the person, or business for whom the guard is providing security services.A bodyguard is a security guard.

The maximum allowed is $10,000. Also, contractors that have provided materials and labor to property may have lien rights against the real property.