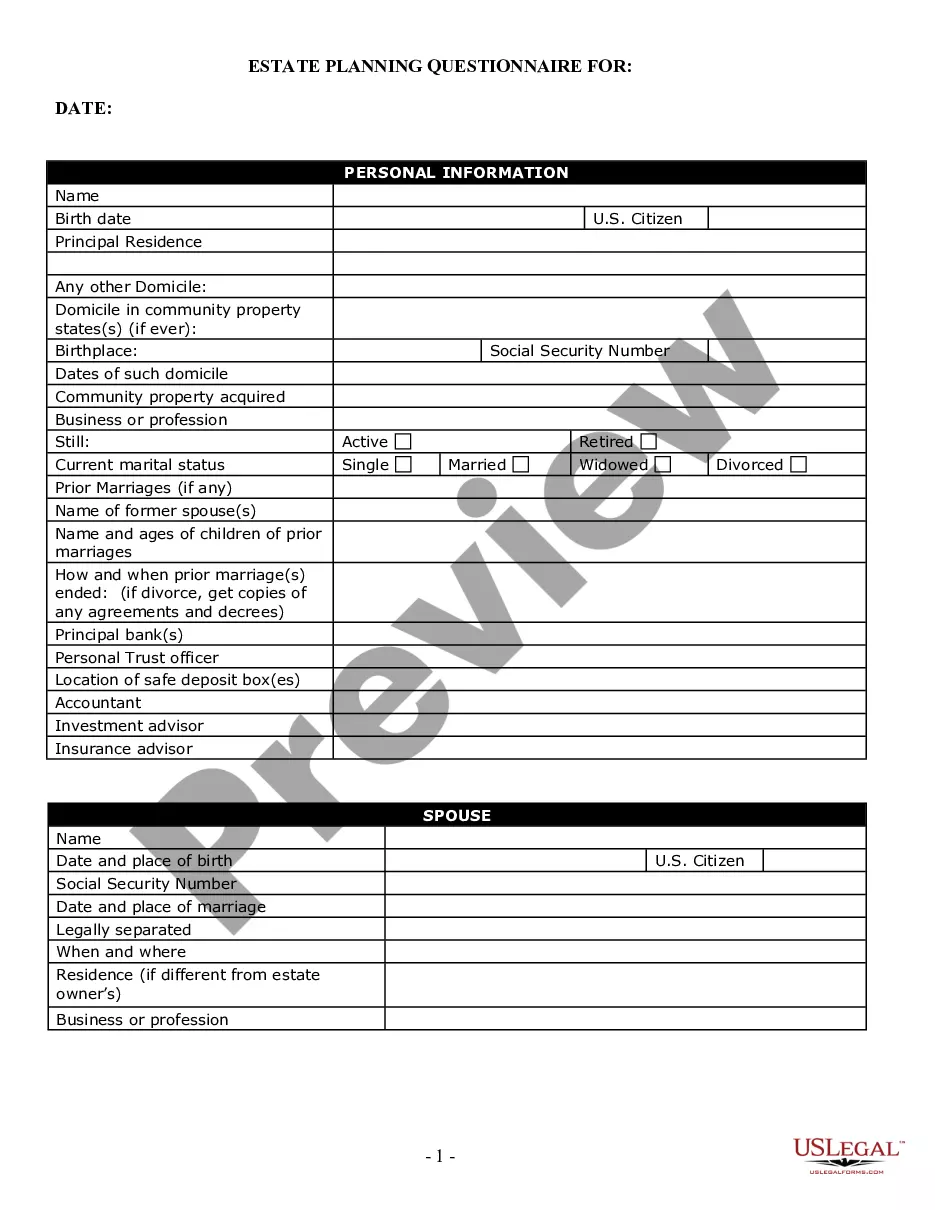

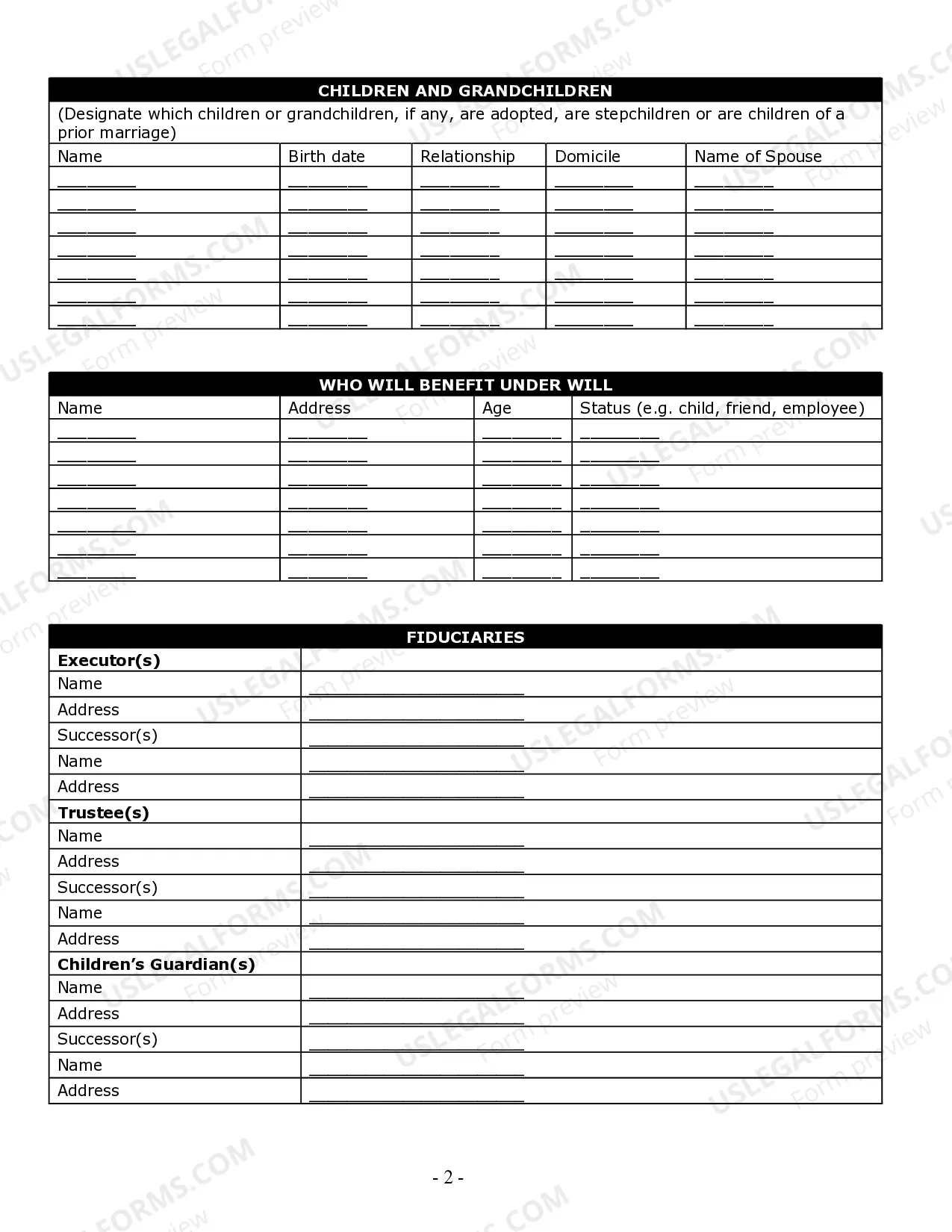

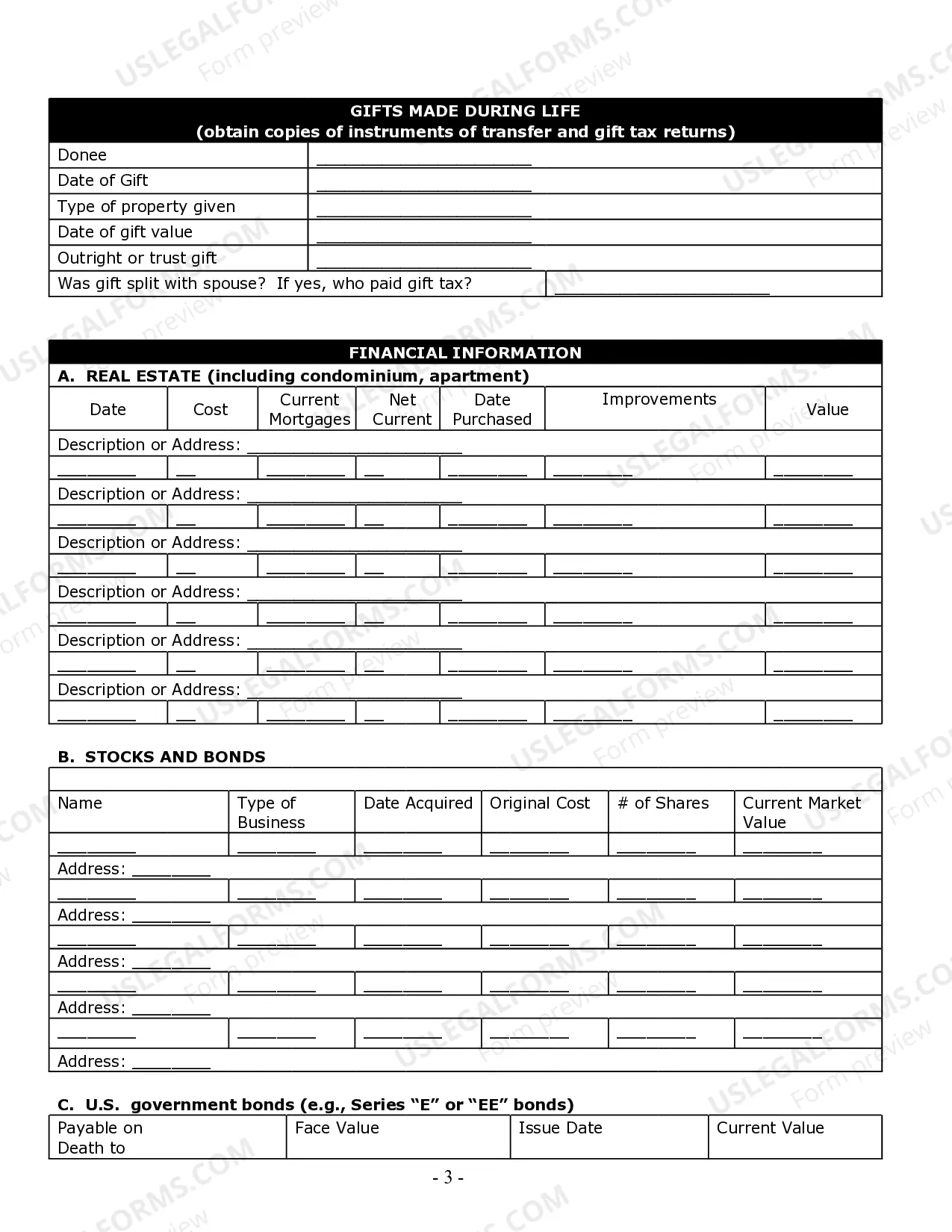

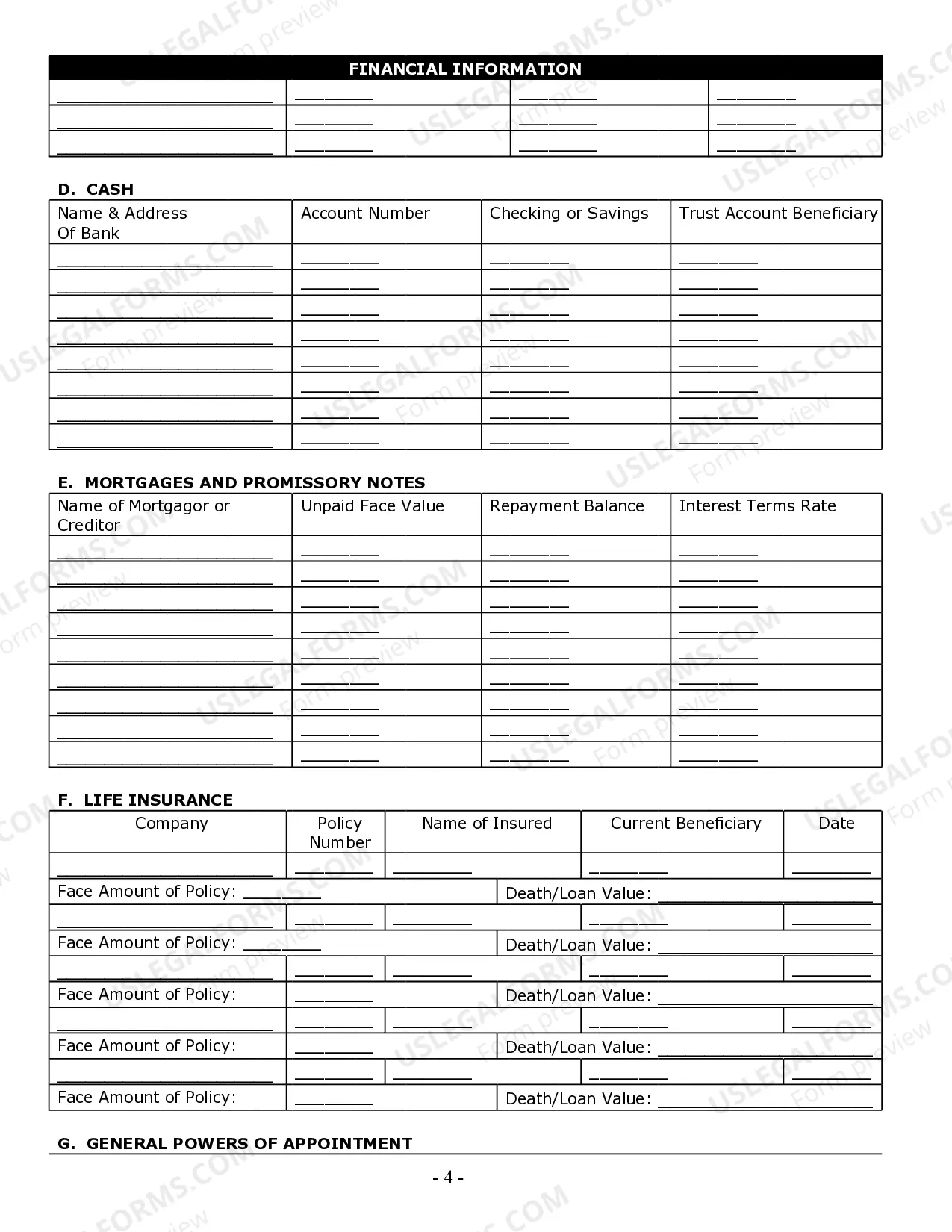

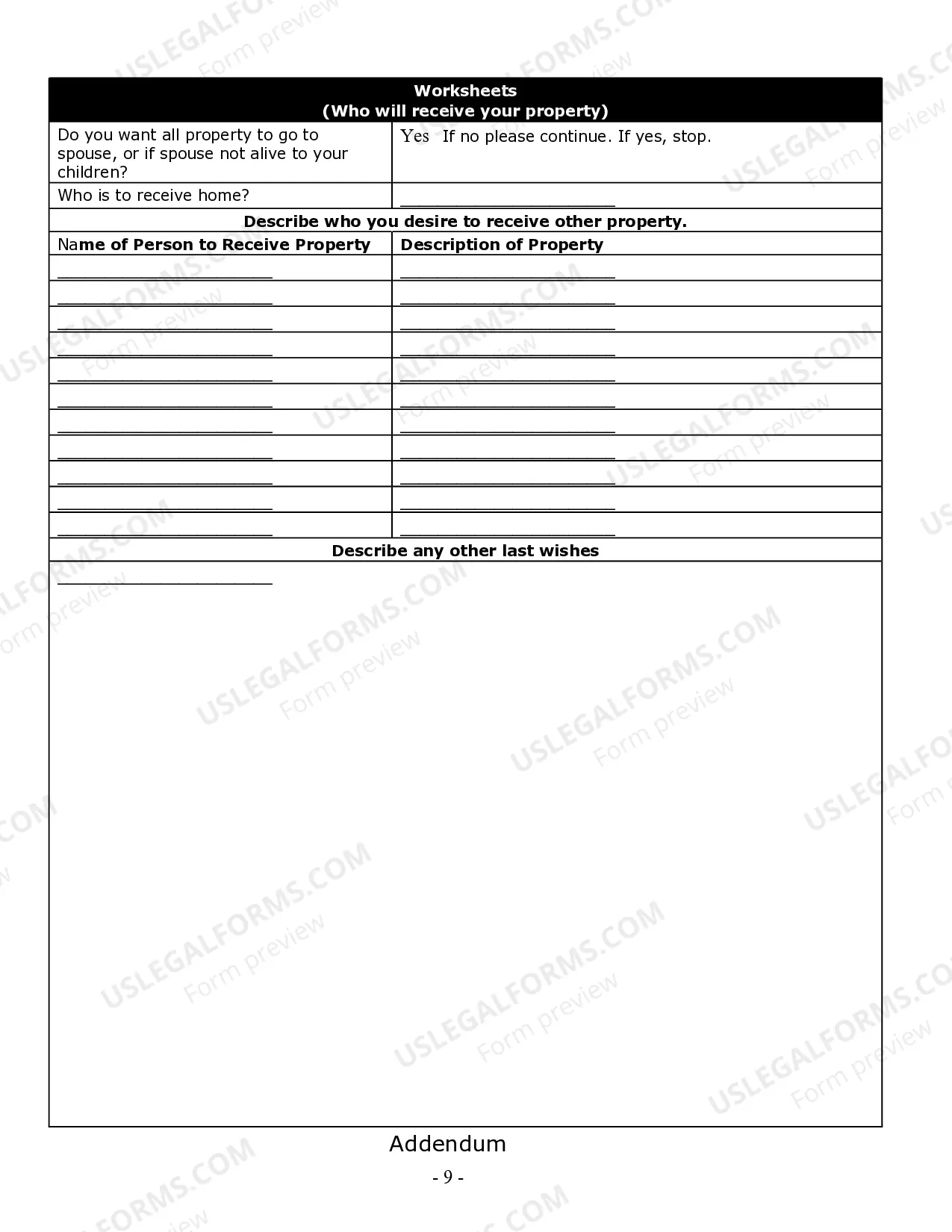

Florida Estate Planning Questionnaire and Worksheets

Description

How to fill out Florida Estate Planning Questionnaire And Worksheets?

Obtain the most extensive collection of legal documents.

US Legal Forms offers a way to locate any specific form for your state in just a few clicks, including Florida Estate Planning Questionnaire and Worksheets formats.

No need to invest hours searching for a court-acceptable template.

That's it! You should complete the Florida Estate Planning Questionnaire and Worksheets form and finalize it. To ensure everything is accurate, consult your local legal advisor for assistance. Register and simply explore around 85,000 helpful templates.

- Our certified professionals guarantee that you receive current documents at all times.

- To access the document library, select a subscription plan and create your account.

- If you've completed this step, simply Log In and click the Download button.

- The Florida Estate Planning Questionnaire and Worksheets format will be instantly saved in the My documents section (a section for each document you download from US Legal Forms).

- To create a new account, follow the brief guidelines provided below.

- Ensure you select the correct state when using state-specific documents.

- If possible, read through the description to understand all the details of the form.

- Utilize the Preview option if available to review the content of the document.

- If everything is satisfactory, click on the Buy Now button.

- After selecting a pricing option, set up your account.

- Make your payment via credit card or PayPal.

- Download the sample to your device by selecting the Download button.

Form popularity

FAQ

The 5 and 5 rule for irrevocable trusts permits a beneficiary to withdraw the greater of $5,000 or 5% of the trust's value without affecting the tax-exempt status. This rule can be beneficial for financial planning, offering beneficiaries a balance between access to funds and adherence to tax law. The Florida Estate Planning Questionnaire and Worksheets can guide you in incorporating this rule effectively into your estate plans.

The 5 by 5 rule specifies that beneficiaries can withdraw up to $5,000 or 5% of the total trust value each year without incurring penalties. This allows for a degree of financial freedom while maintaining the integrity of the trust. Using the Florida Estate Planning Questionnaire and Worksheets can help you establish a clear strategy that aligns with this rule.

The 5 or 5 rule allows a donor to withdraw a sum of up to $5,000 or 5% of the trust principal each year without penalizing the trust. This flexibility can help beneficiaries manage their funds more effectively while still adhering to gift tax regulations. Incorporating insights from the Florida Estate Planning Questionnaire and Worksheets can clarify how this rule applies to your specific situation.

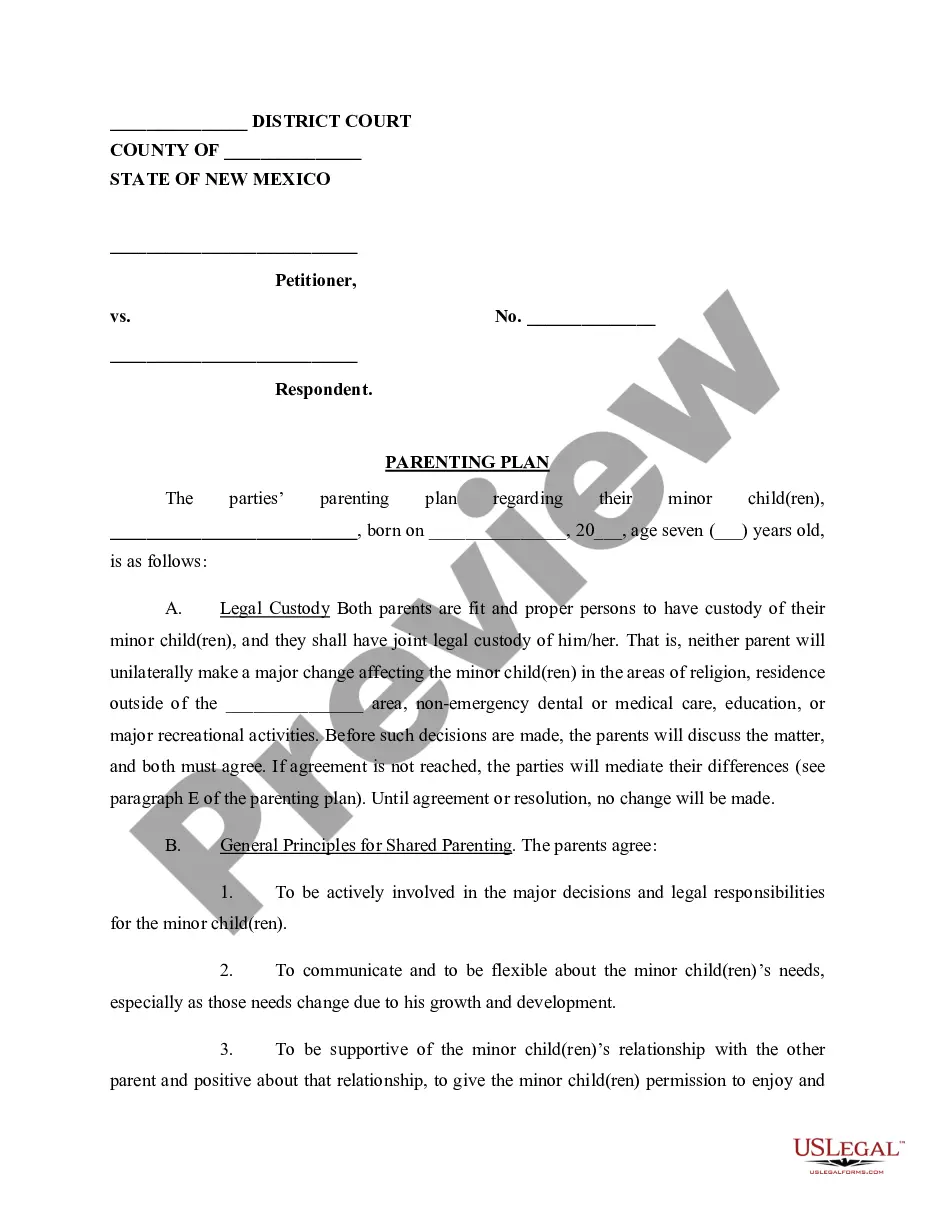

One major mistake parents often make is not clearly defining the terms of the trust. This can lead to confusion and disputes among beneficiaries down the line. It's crucial to utilize resources like the Florida Estate Planning Questionnaire and Worksheets to ensure all details are laid out effectively, minimizing potential conflicts.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

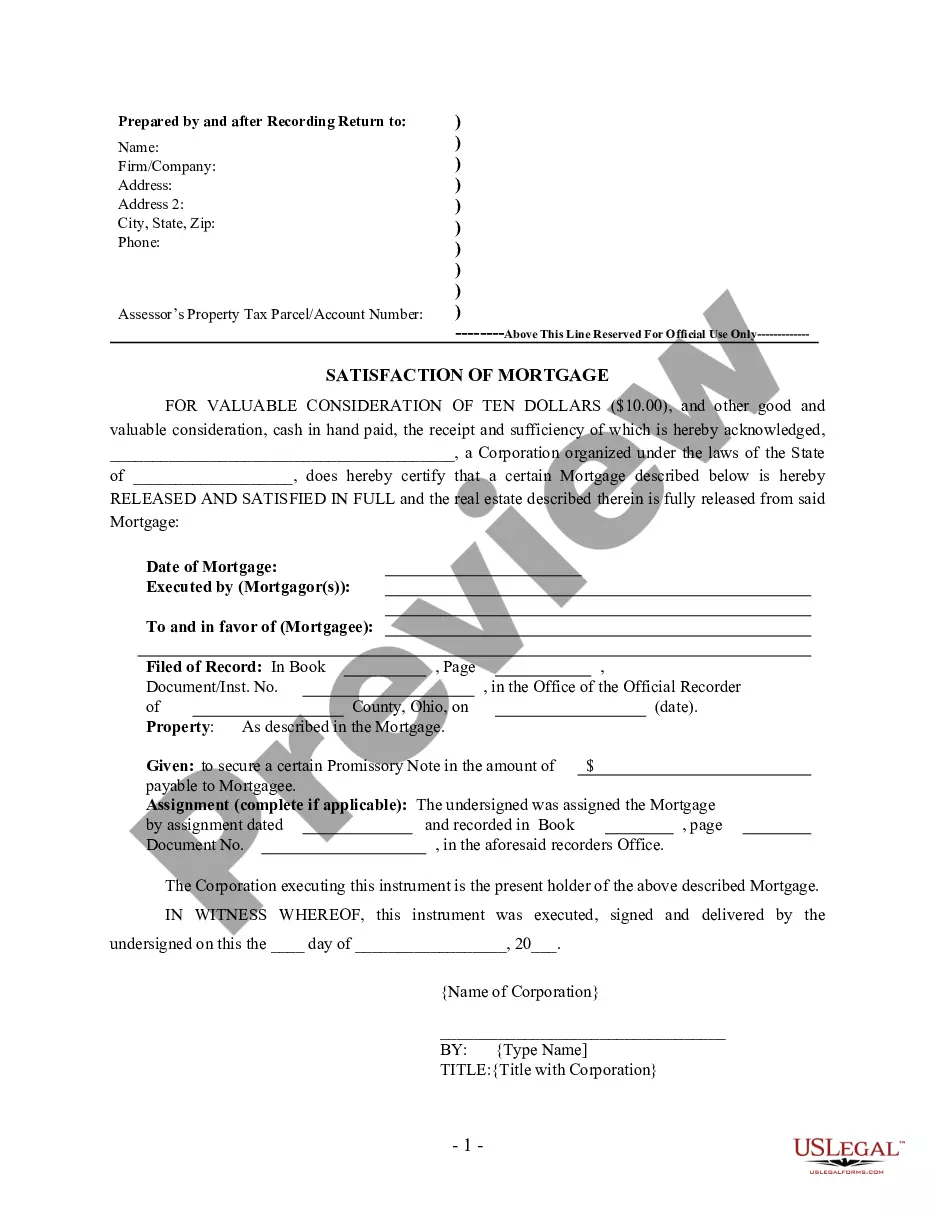

What Property Can Go in a Living Trust? Who Should Be My Trustee? Does a Living Trust Avoid Estate and Probate Taxes? What Are the Benefits of a Living Trust? What Are the Drawbacks of a Living Trust? Do I Still Need a Power of Attorney?

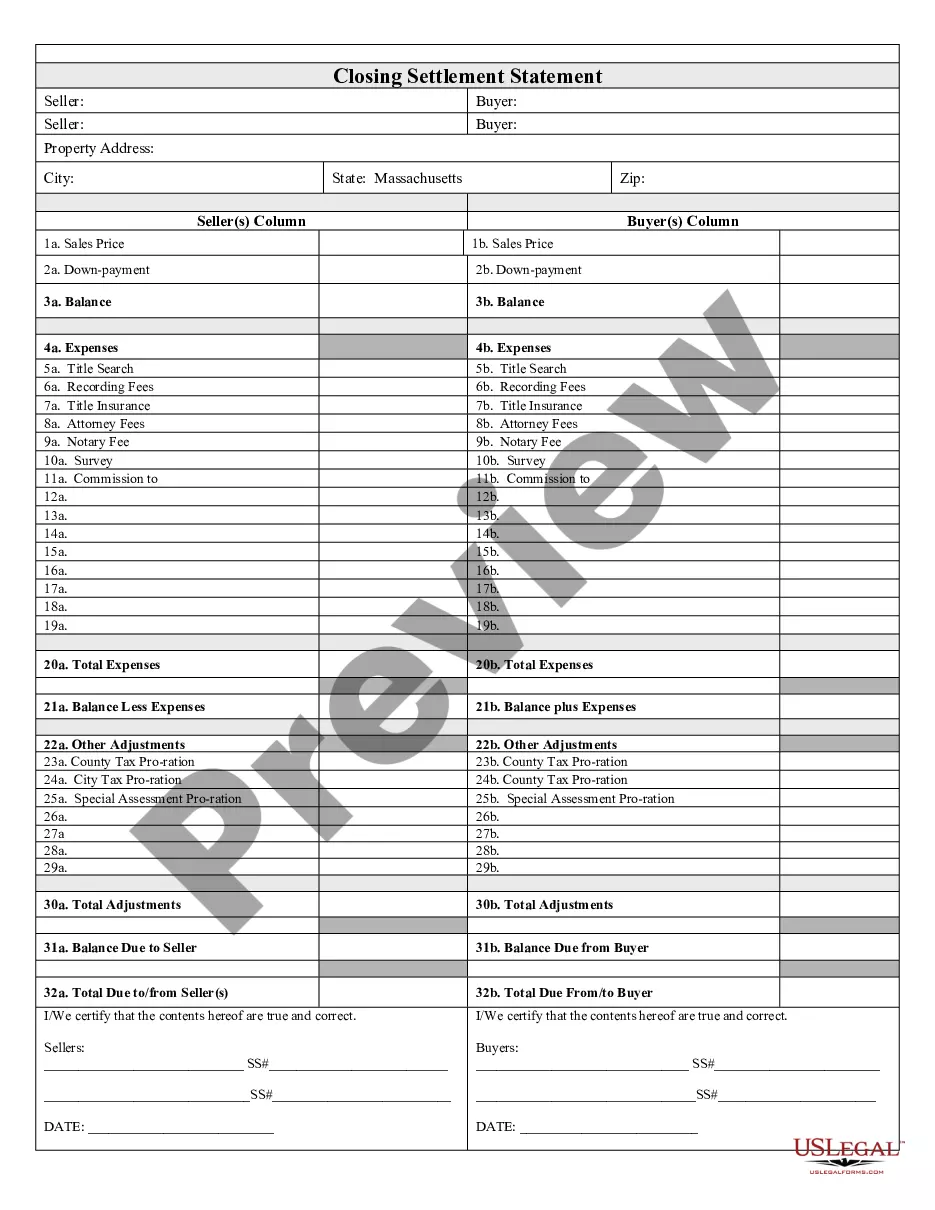

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

A will may be a relatively simple document that sets forth your wishes regarding the distribution of property; it may also include instructions regarding the care of minor children. An estate plan goes much further than a will.

There are four main elements of an estate plan; these include a will, a living will and healthcare power of attorney, a financial power of attorney, and a trust.

Lay out Your Assets & Think About Final Wishes. Consider Your Digital Assets. Gather Documents Needed for Will Preparation. Choose Your Executor & Beneficiaries. Nominate Guardians. Sign Your Will. Store Your Will. Update or Amend Your Will.