Estate Planning Questionnaire

Understanding this form

The Estate Planning Questionnaire is a document designed to help individuals assess their estate planning needs. It facilitates effective communication between clients and attorneys by identifying key issues related to wills, trusts, healthcare documents, and deeds. This form enhances the lawyer's evaluation process and potentially lowers the costs associated with preparing an estate plan by ensuring thorough preparation.

Main sections of this form

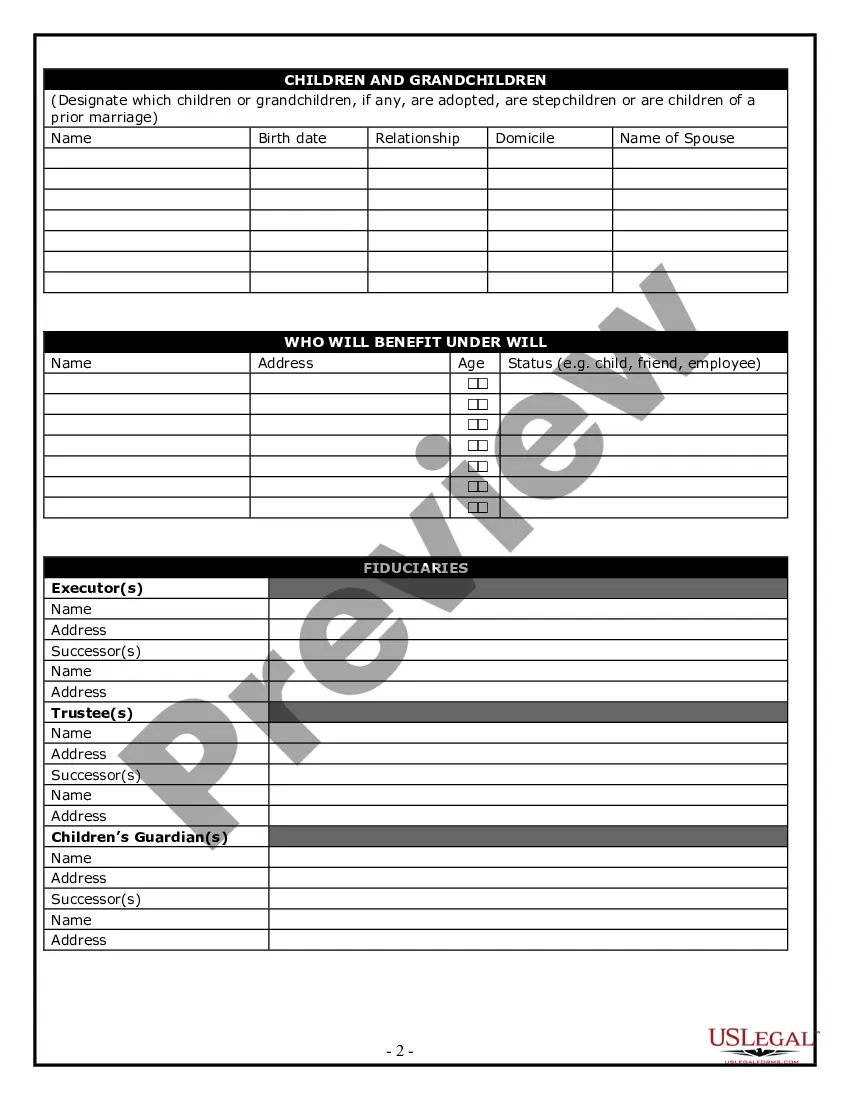

- Personal information section to gather basic client details.

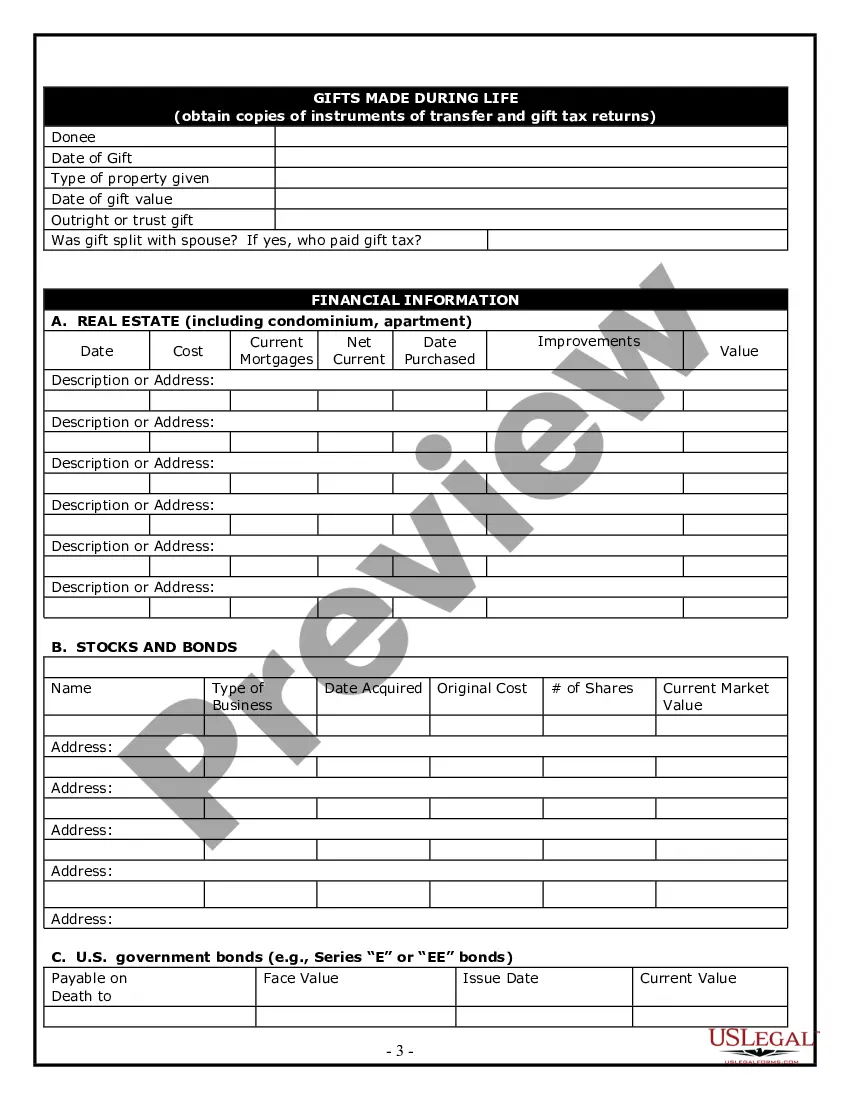

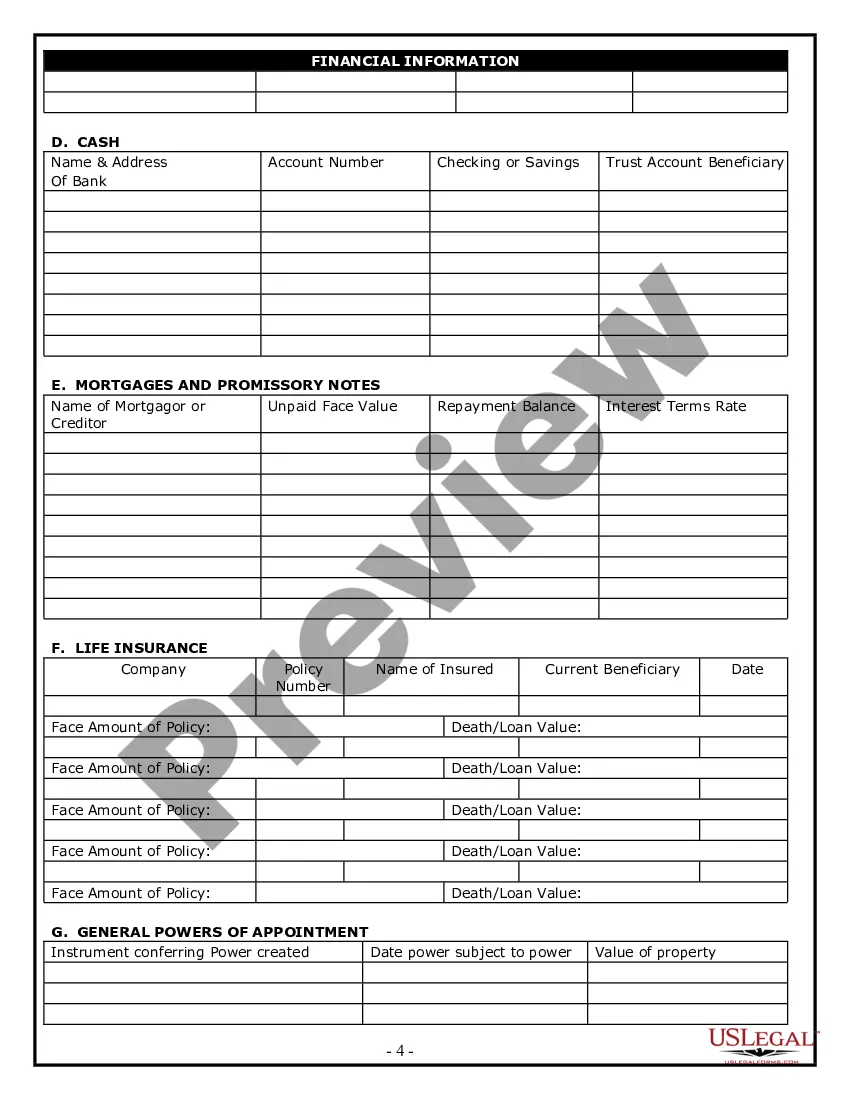

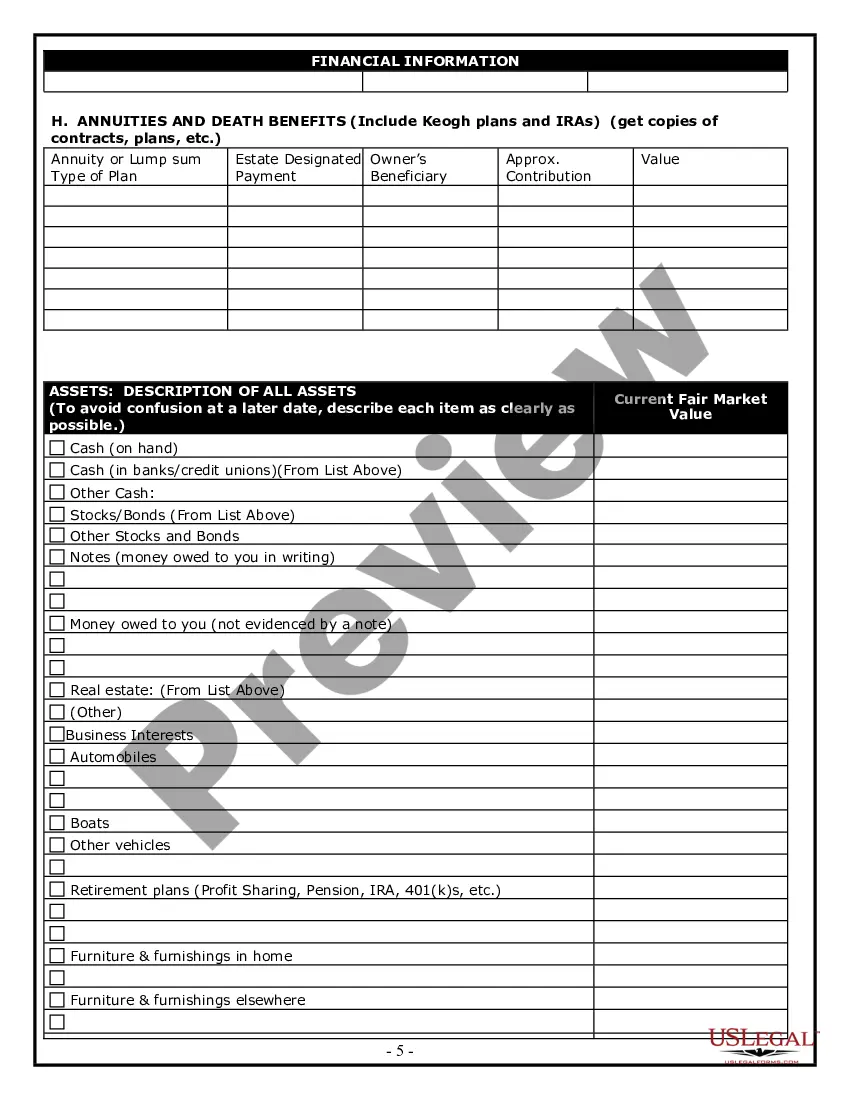

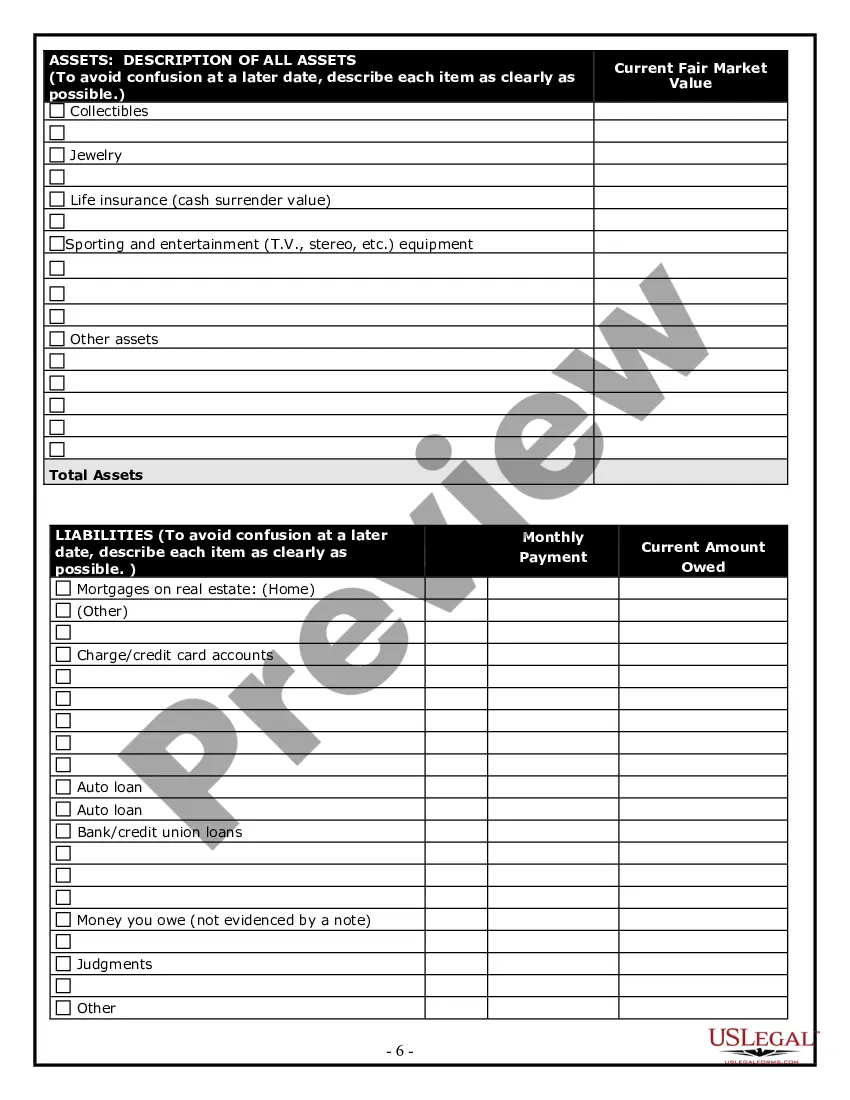

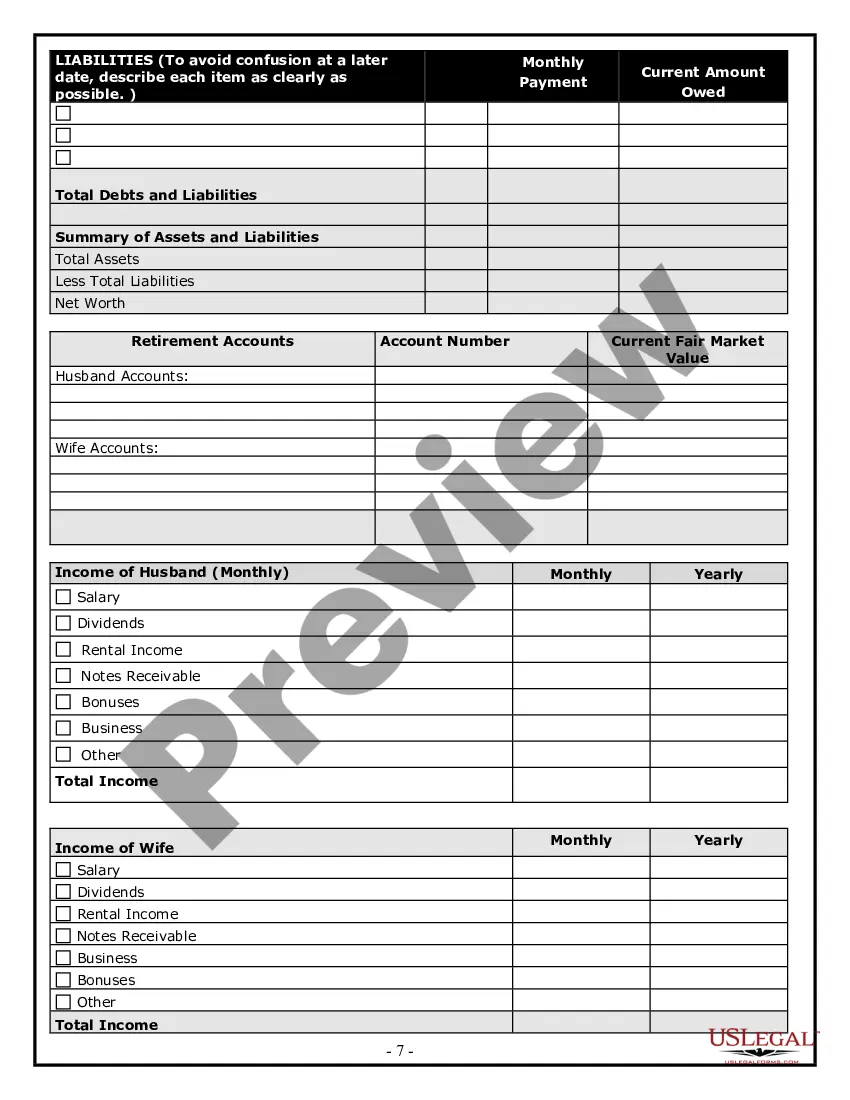

- Questions about current assets and liabilities, aiding in wealth assessment.

- Sections focusing on healthcare preferences and directives.

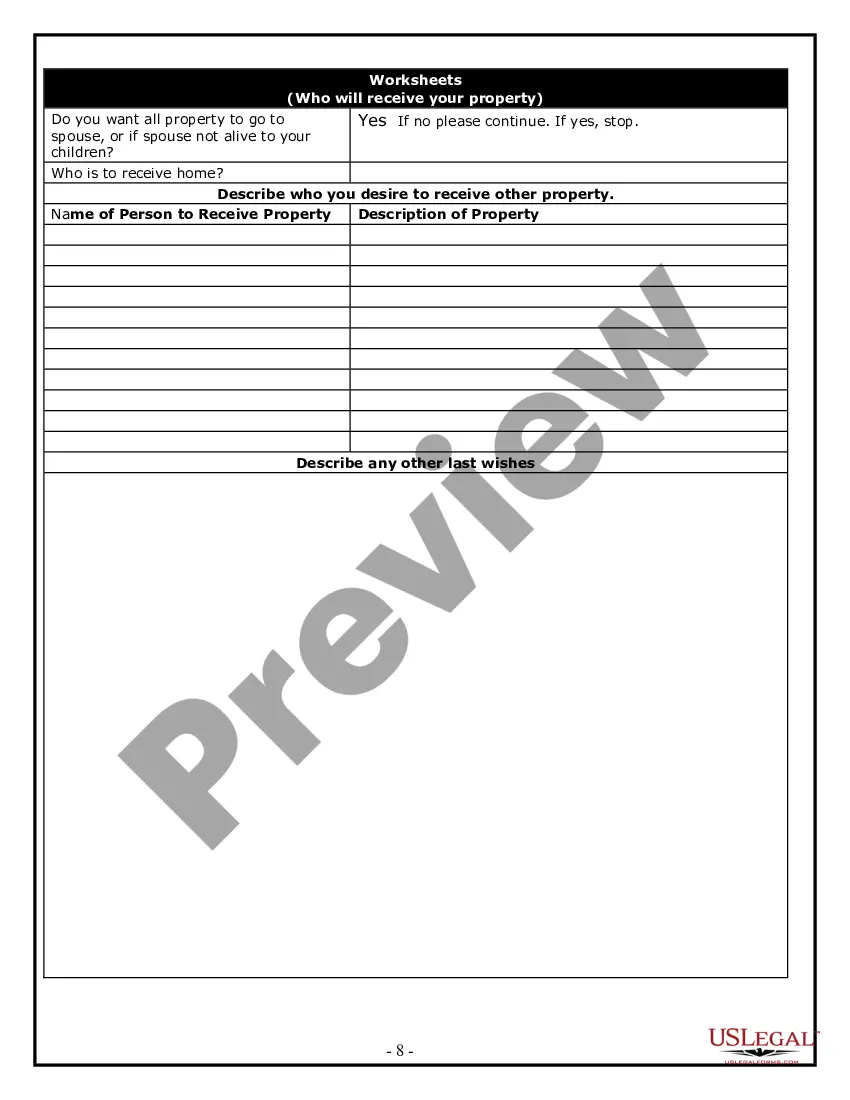

- Inquiries about family structure and beneficiaries to tailor the estate plan.

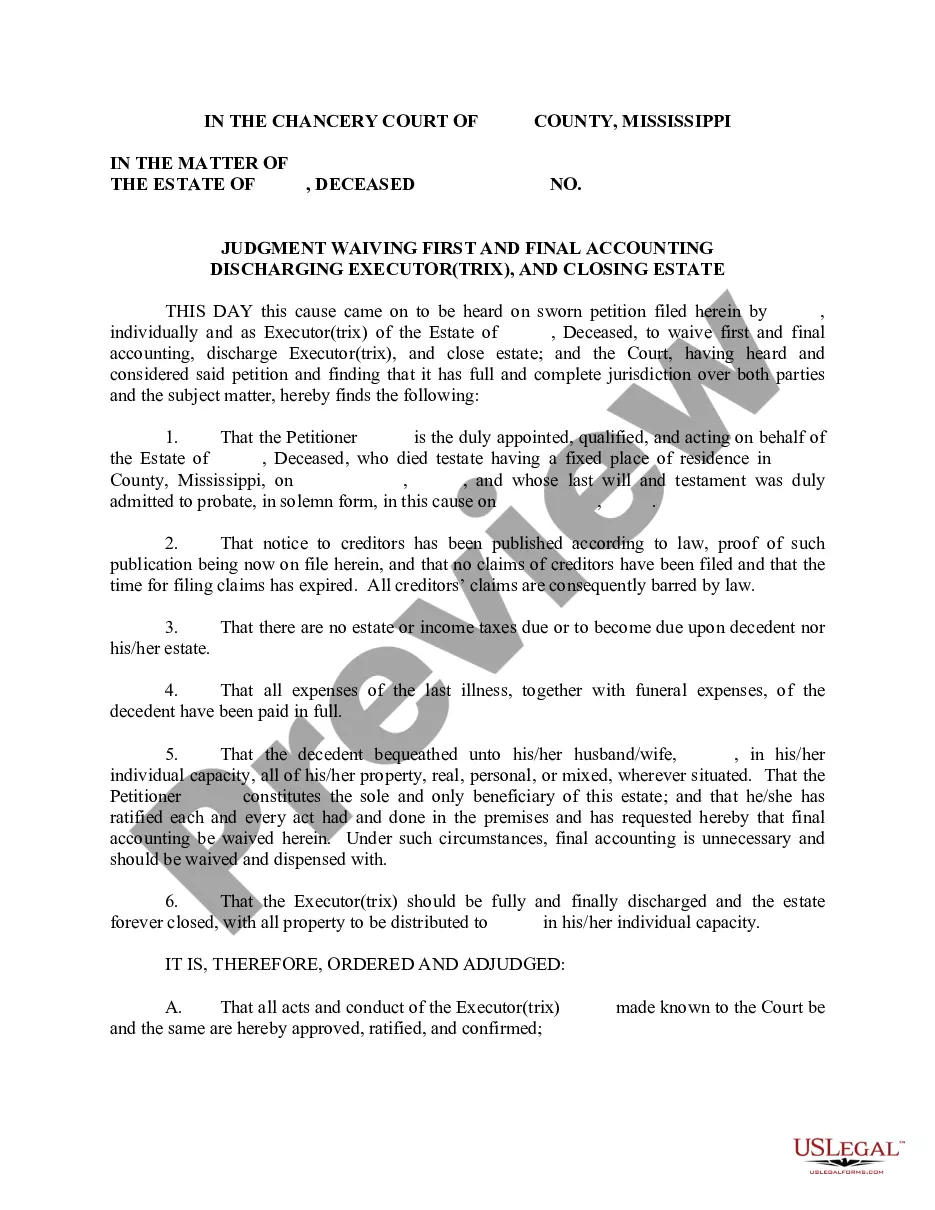

- Legal preferences concerning the creation of wills and trusts.

When this form is needed

This form is ideal for individuals preparing for a meeting with an attorney to discuss estate planning. It is useful when you want to clarify your estate distribution wishes, establish healthcare proxies, or create trusts. Using this form ensures that all critical aspects of your estate are considered, leading to a more efficient and focused strategy meeting.

Who can use this document

- Individuals beginning the estate planning process.

- Families looking to outline their asset distribution preferences.

- Anyone wanting to clarify their healthcare wishes in legally binding documents.

- New clients seeking legal advice on estate planning matters.

Steps to complete this form

- Provide your full name and contact information in the designated sections.

- List all assets and liabilities to give a complete picture of your financial situation.

- Answer questions regarding health care decisions as well as probate and distribution wishes.

- Indicate your preferred beneficiaries and any specific instructions for asset allocation.

- Review all provided information to ensure completeness and accuracy before submitting it to your attorney.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Neglecting to include all assets, especially less obvious ones like digital property.

- Failing to review information thoroughly before submission, which may lead to missed details.

- Not addressing healthcare preferences when they are a critical part of estate planning.

Benefits of completing this form online

- Convenience of completing the form at your own pace and from anywhere.

- Editability allows you to make changes easily before finalizing information.

- Secure storage and instant access to your documents whenever needed.

Looking for another form?

Form popularity

FAQ

Will. Revocable Trust. Financial Power of Attorney. Durable Power of Attorney for Healthcare.

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

There are four main elements of an estate plan; these include a will, a living will and healthcare power of attorney, a financial power of attorney, and a trust.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

Getting Started. Make a time when all affected parties are available, ideally long before there is any crisis or need to act (for example someone needs to move into long-term care, or is starting to show signs of cognitive impairment etc.) Looking Down the Road. Your Legacy. Paper Trails. Peace of Mind.