Massachusetts Closing Statement

About this form

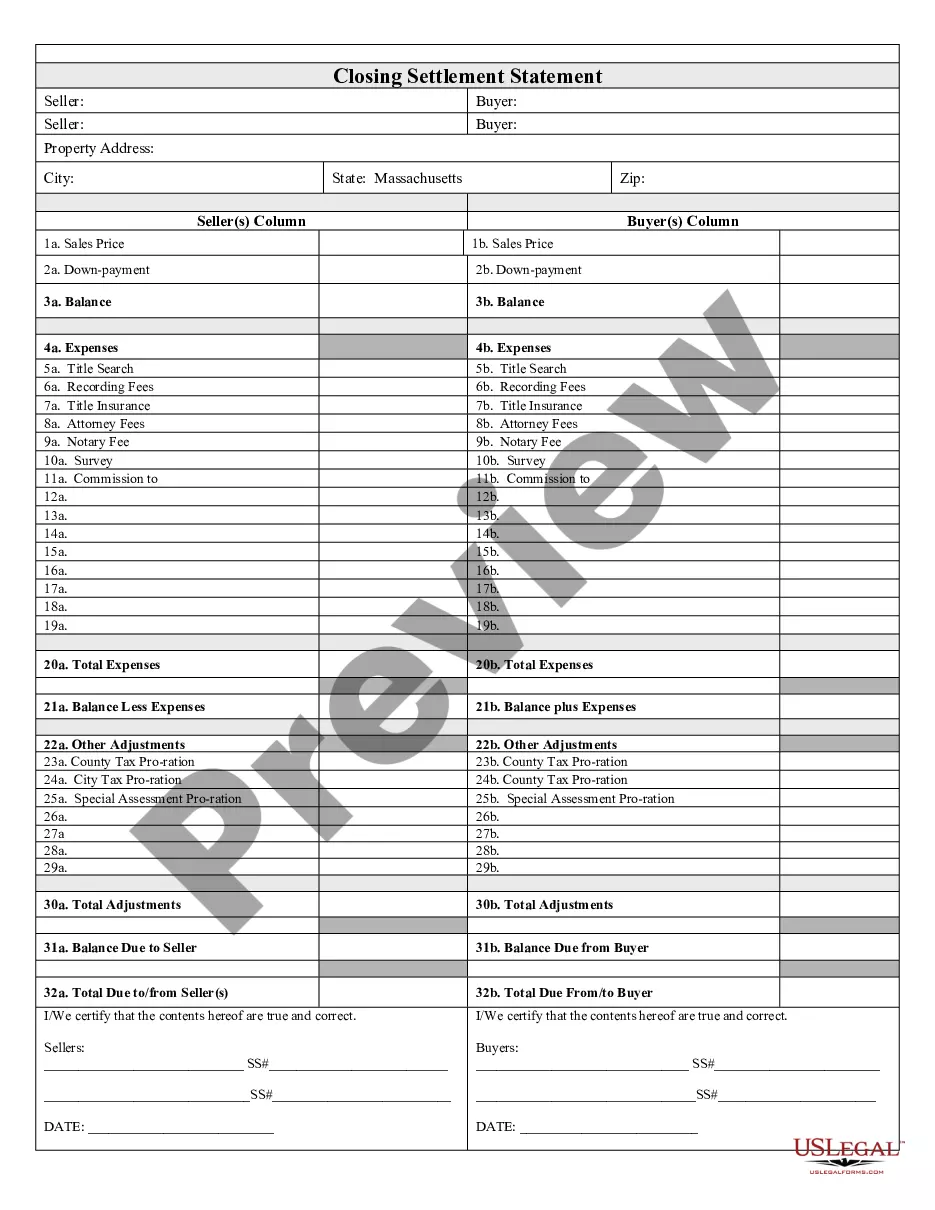

The Closing Statement is a key document used in real estate transactions, particularly for cash sales or owner financing. It provides a detailed account of the financial aspects of the sale, including expenses, adjustments, and the final amounts owed by both buyer and seller. Unlike other generic closing documents, this statement is verified and signed by both parties, ensuring accuracy and clarity in the transaction's financial details.

Key components of this form

- Balance calculations: Sections to assess total expenses and balances due to/from the seller and buyer.

- Expense breakdown: Detailed listings of fees including title searches, recording fees, title insurance, attorney fees, notary fees, and survey costs.

- Adjustments: Includes county and city tax prorations and other financial adjustments relevant to the transaction.

- Certification: Space for signatures from both seller and buyer, certifying that the information presented is accurate.

When to use this document

This Closing Statement is necessary when finalizing a real estate transaction involving a cash sale or owner financing. It ensures that all monetary aspects are clearly documented and understood by both the buyer and seller, avoiding any misunderstandings regarding costs and payments at the time of closing.

Who needs this form

This form is intended for:

- Real estate sellers and buyers engaged in a cash sale or owner-financed transaction.

- Real estate agents and attorneys involved in closing the sale of property.

- Individuals handling their own property transactions and seeking to ensure legal compliance and clarity.

How to prepare this document

- Identify the parties involved: Enter the names of both the seller and the buyer at the top of the document.

- Specify the property details: Include the property address and any identifying information relevant to the transaction.

- List all expenses: Fill out sections for each expense, including title search fees, recording fees, and attorney fees.

- Calculate total adjustments: Add any necessary tax prorations and adjustments for a comprehensive final balance.

- Certify the statement: Ensure that both parties sign and date the document, confirming that the information is accurate.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to list all expenses can lead to disputes or unexpected costs.

- Not having both parties sign the document, which can invalidate the statement.

- Incorrectly calculating total balances or adjustments, leading to financial discrepancies.

Why use this form online

- Convenience of downloading and filling out at your own pace.

- Editability to customize the document specific to your transaction needs.

- Immediate access to legally vetted forms created by licensed attorneys.

Legal use & context

- The Closing Statement is an important legal document that outlines the details of financial transactions in real estate.

- It provides transparency and accountability to both parties and can be used as a reference in case of disputes.

- Ensure that all entries are accurate to maintain the enforceability of the document.

Key takeaways

- The Closing Statement is essential for documenting the financial details of a real estate transaction.

- Accuracy in completing the form is crucial for avoiding disputes and ensuring compliance.

- Both the seller and buyer must review and sign the statement to validate it.

Looking for another form?

Form popularity

FAQ

Informal probate is handled by a magistrate, not a judge. There are no hearings. It is a simple, straightforward, expedited process. In fact, informal probate can be completed in as little as seven days after a loved one's death.

Complete a final Inventory of Assets. Using the Inventory of Assets in the final accounting, complete the final accounting.

Select this box if you assent (agree) to the content of the pleading being filed with the Court and you agree to waive any legal right to notice to which you are entitled, related to that specific pleading.

Informal probate is an administrative proceeding, which means that it is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. The court doesn't allow hearings for this process.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

Filing An Informal Probate It is relatively easy to file for informal probate in the state of Massachusetts. A beneficiary needs to file a petition with the court to proceed with the informal probate. The court will name them as an executor, provided all other beneficiaries agree with this decision.

Typically, it takes anywhere from nine to 12 months to probate a will in most cases when represented by a probate attorney, though some probate cases can take up to two years to settle an estate. To understand how long it takes to probate a will, it's critical to dissect the process and review each step.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.