Delaware Renunciation And Disclaimer of Property received by Intestate Succession

Understanding this form

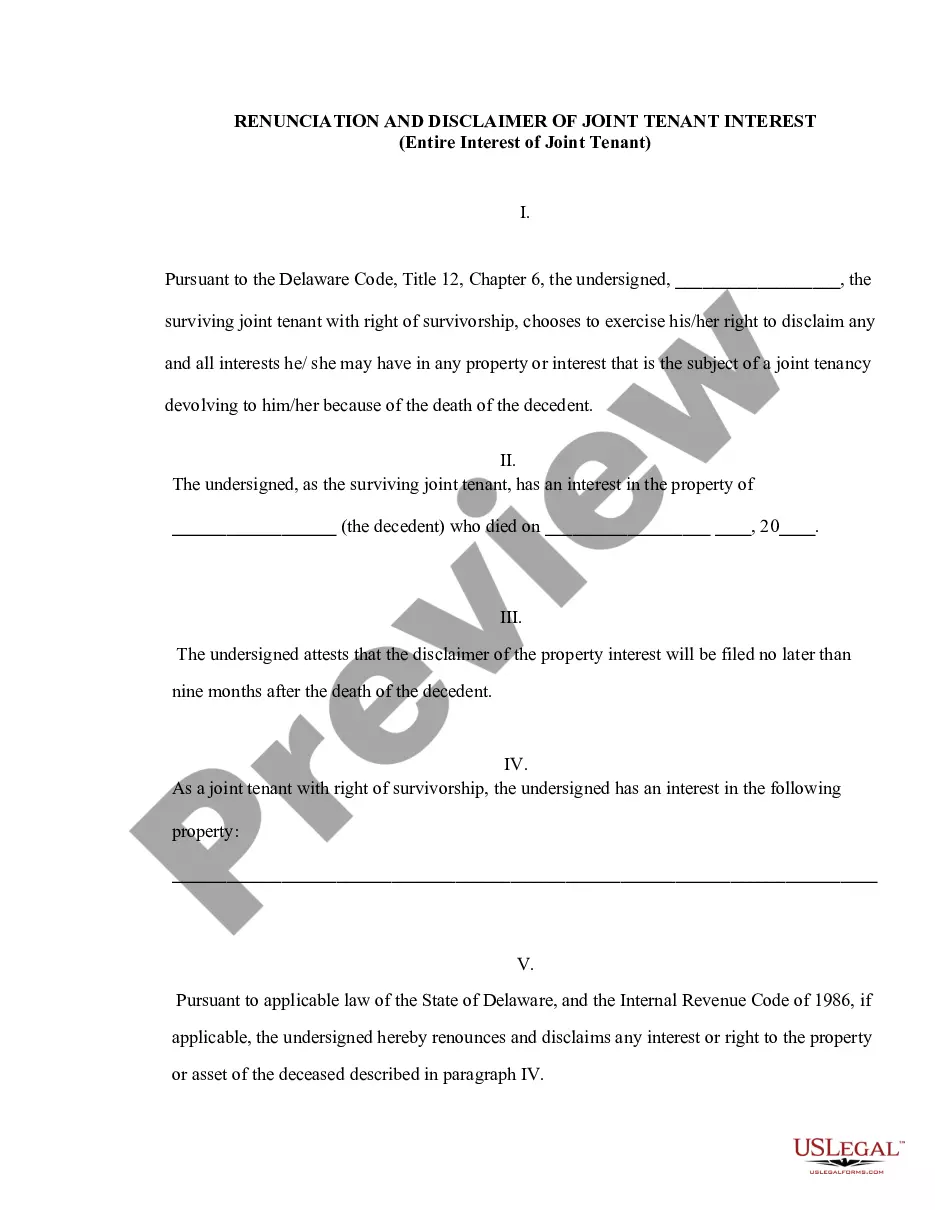

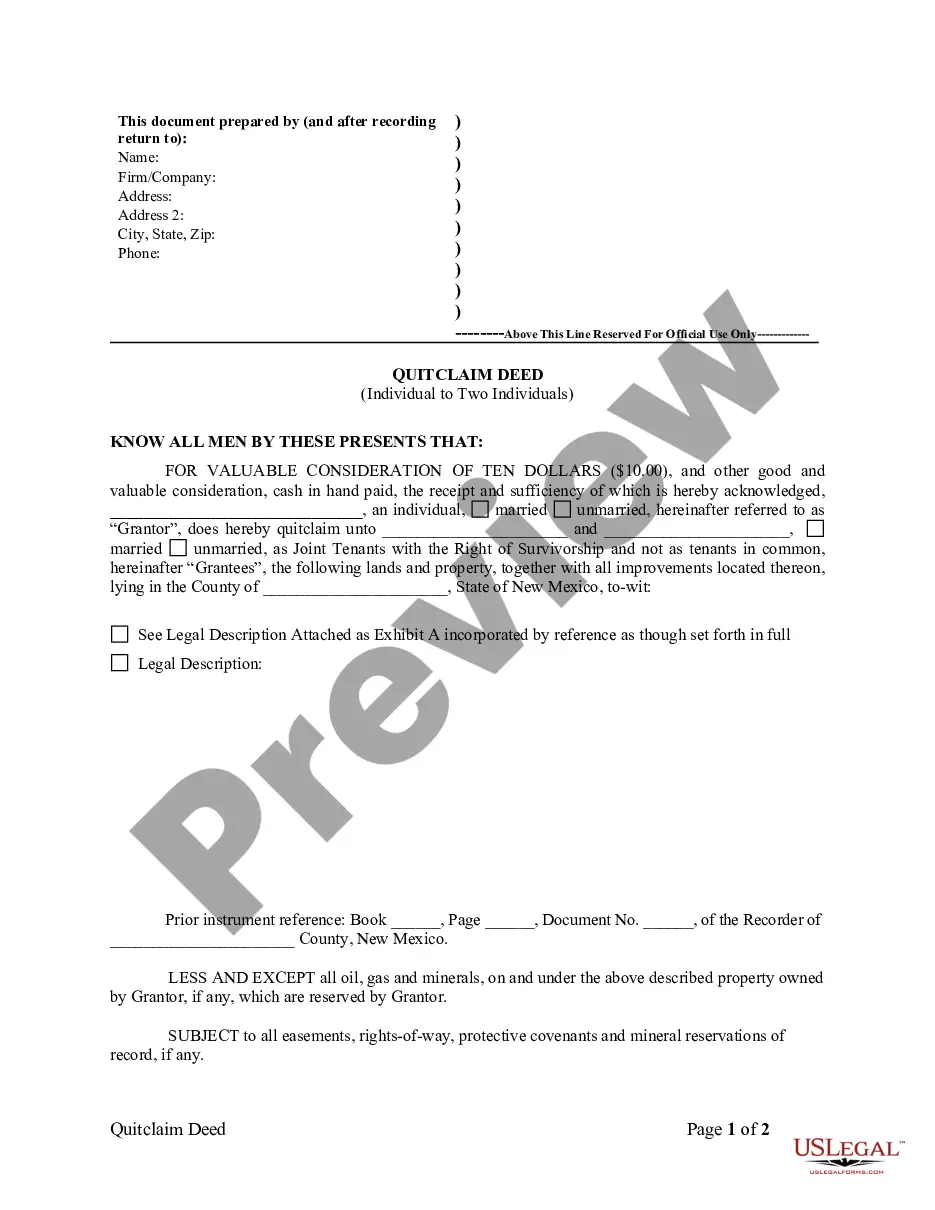

The Delaware Renunciation and Disclaimer of Property received by Intestate Succession is a legal document that allows a beneficiary to renounce their interest in property inherited from a decedent who died intestate (without a will). This form is distinct from other estate planning documents as it specifically addresses the disavowal of inherited property rights, enabling assets to be passed on to alternate beneficiaries under Delaware law.

Key parts of this document

- Declaration of the beneficiary's choice to disclaim a partial or entire interest in the property.

- Details regarding the decedent's death, confirming they died intestate.

- Description of the property in question.

- Affirmation that the disclaimer will be filed within nine months of the decedent's death.

- Statement that the disclaimer relates back to the date of death and is irrevocable.

- Acknowledgment by the personal representative of receipt of the executed form.

When to use this form

This form should be used when a beneficiary wishes to refuse the inheritance of property or assets from a decedent's estate due to intestate succession. Situations include when accepting the property could result in tax liabilities or when the beneficiary has a personal preference to renounce their rights in favor of another potential heir.

Intended users of this form

- Beneficiaries who have inherited property from a decedent who died without a will.

- Individuals who wish to renounce their rights to property for personal or financial reasons.

- Heirs looking to redirect property to other beneficiaries under Delaware intestacy laws.

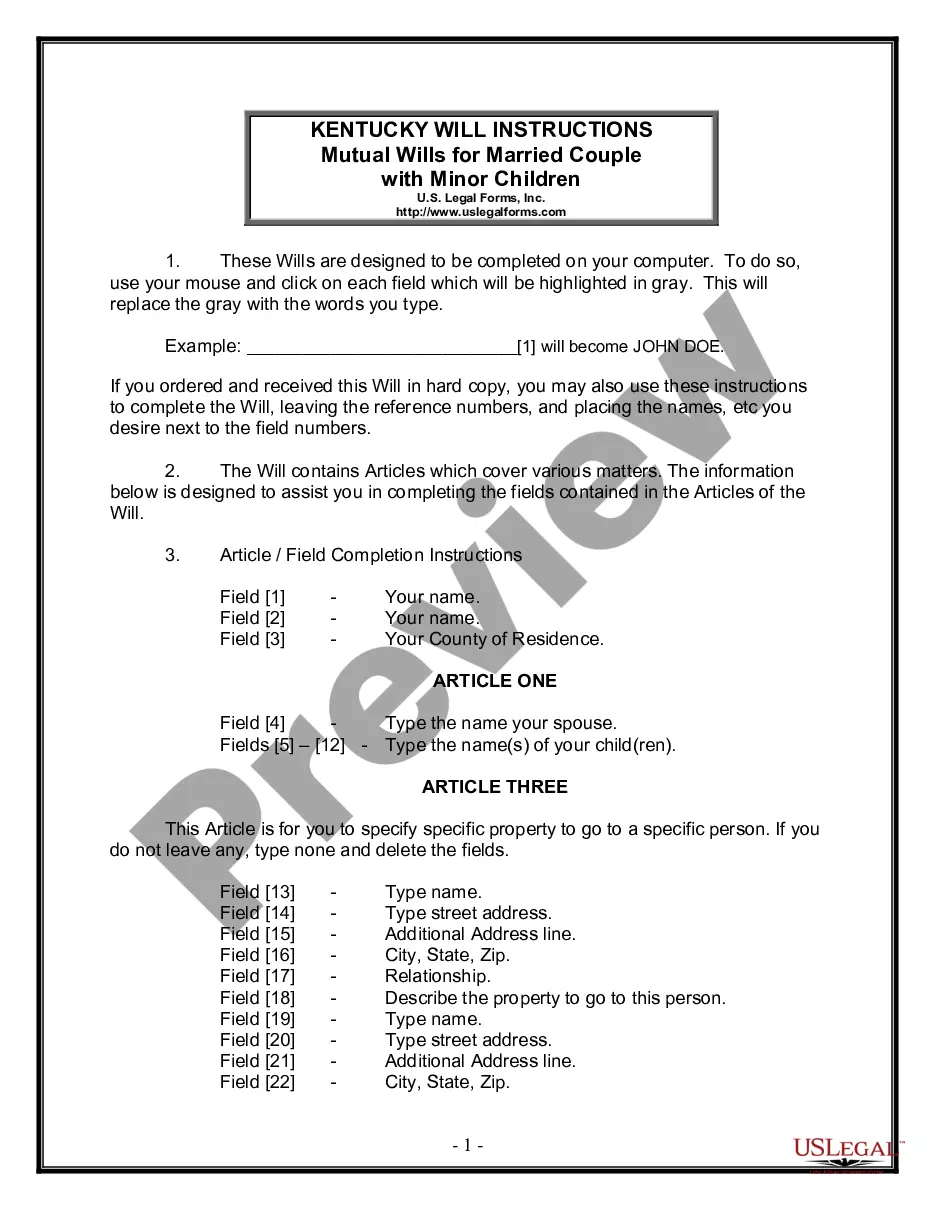

How to prepare this document

- Identify the parties involved, specifically the beneficiary and the decedent.

- Specify whether you are disclaiming a partial interest or the entire interest in the property.

- Provide the details about the decedent's date of death.

- Clearly describe the property interest you are renouncing.

- Sign and date the form, ensuring to acknowledge receipt by the personal representative.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to file the disclaimer within the required nine-month time frame.

- Not providing the full and accurate description of the property being disclaimed.

- Omitting the necessary signatures from all parties involved.

- Not having the document notarized if local laws require it.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Editability to ensure all details are customized to your specific situation.

- Reliable access to templates drafted by licensed attorneys to meet legal standards.

- Quick turnaround time to prepare and file than traditional methods.

Looking for another form?

Form popularity

FAQ

The rules for disclaiming an inheritance under Delaware law require that the disclaimer be made in writing and filed within a specific time period after the inheritance is received. The Delaware Renunciation And Disclaimer of Property received by Intestate Succession stipulates that the disclaimer must be absolute and unconditional. Additionally, you cannot change your mind after you submit the disclaimer, so think carefully about your decision. Utilizing resources like USLegalForms can help you navigate these rules effectively.

The primary document that serves as proof of inheritance is typically a copy of the death certificate accompanied by either the will or the court’s order of intestate succession. This documentation validates your claim to inherit property under the Delaware Renunciation And Disclaimer of Property received by Intestate Succession. If you are unsure about your documents, you can use the USLegalForms platform to obtain templates and additional support for your situation. It can simplify the process and ensure you have the necessary paperwork.

In many cases, a disclaimer of inheritance does not need to be notarized, but it is beneficial to have it done to ensure its credibility. The Delaware Renunciation And Disclaimer of Property received by Intestate Succession allows for a formal process where notarization can strengthen your claim. By notarizing your disclaimer, you can help prevent potential disputes in the future. Make sure to verify any specific requirements related to your situation.

To write a disclaimer letter for inheritance, begin by clearly stating your intent to disclaim the inheritance received through intestate succession. Include your name, contact information, and a description of the property you are renouncing. Be sure to mention that the disclaimer is made under the Delaware Renunciation And Disclaimer of Property received by Intestate Succession statute. Finally, sign and date the letter, and consider consulting with a legal professional for additional guidance.

Writing a disclaimer of inheritance sample involves clearly stating your intent to renounce the property while including specific details such as your name, the decedent's name, and a description of the property. This written document should meet Delaware's legal requirements to ensure it is valid. For your convenience, USLegalForms offers sample templates that can be tailored to your unique circumstances, making the process simpler and more efficient.

In Delaware, you typically have nine months from the date of the decedent's death to submit a disclaimer of inheritance. However, timelines may differ if a federal tax return is involved. It is crucial to act promptly to ensure your rights are protected under the Delaware Renunciation and Disclaimer of Property received by Intestate Succession. Consulting with USLegalForms can help you understand and adhere to these deadlines.

To disclaim an inherited property in Delaware, you must file a written disclaimer that clearly states your intention to renounce the property. This document should describe the property and be delivered to the appropriate parties, such as the executor or administrator of the estate. Following proper formalities ensures your renunciation aligns with Delaware law regarding the Renunciation and Disclaimer of Property received by Intestate Succession. USLegalForms provides templates to simplify this process.

In Delaware, a disclaimer of inheritance does not necessarily need to be notarized; however, it is highly recommended. Proper documentation ensures that your intention to renounce property received via intestate succession is clear. It can help prevent potential disputes among heirs or claimants. Using a reliable service like USLegalForms can guide you through the process to ensure compliance with Delaware laws.

Writing a disclaimer of inheritance in Delaware involves creating a written document that clearly states your intention to refuse any inheritance. This document should specify the property being disclaimed and must be signed and dated by the disclaiming party. Utilizing tools from platforms like UsLegalForms can streamline the process of creating a Delaware Renunciation And Disclaimer of Property received by Intestate Succession, ensuring legal compliance and clarity in your intentions.

In Delaware, a spouse does not automatically inherit everything if the deceased has children. If there are children, the spouse may inherit a portion of the estate, while the remainder will go to the children. To navigate these rules effectively, individuals might consider utilizing resources like the Delaware Renunciation And Disclaimer of Property received by Intestate Succession for guidance on estate distribution and protection of family interests.