Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate

Understanding this form

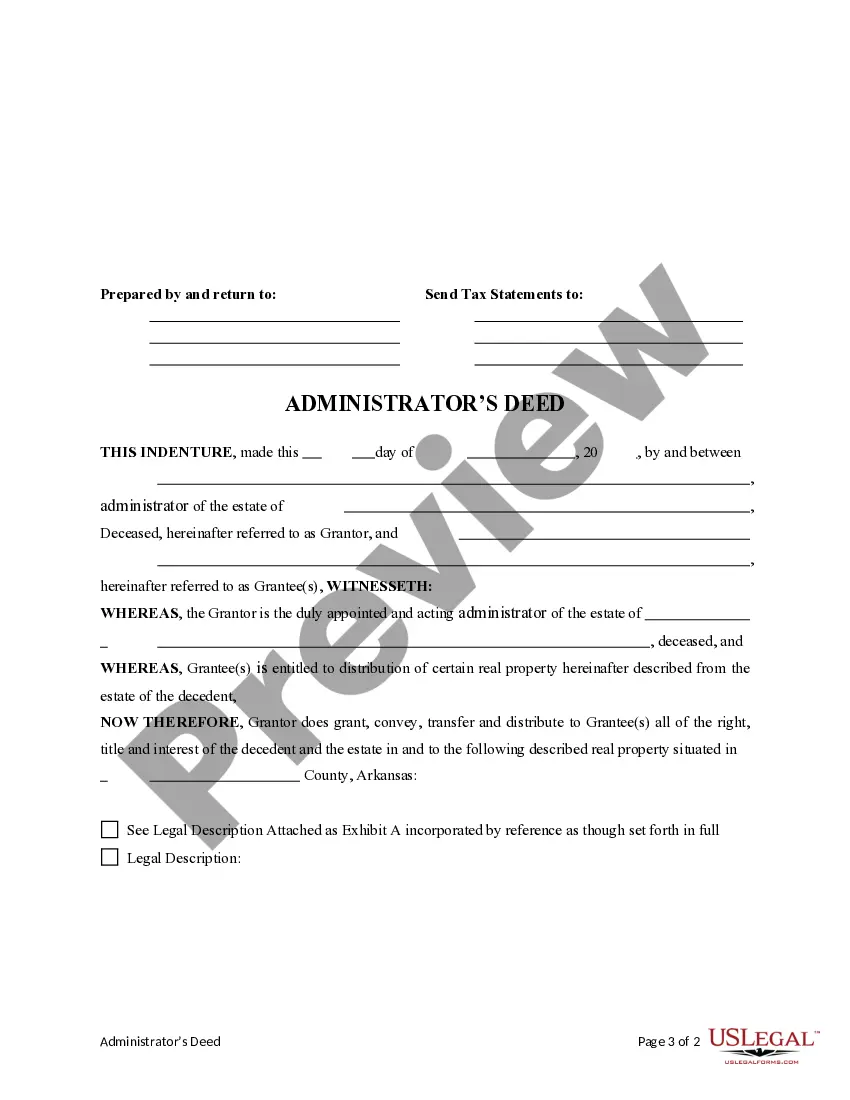

This Administrator's Deed Distributing Real Property to Beneficiaries of Estate is a legal document that enables the appointed administrator or administratrix of an estate to formally transfer property to the beneficiaries. This form is essential for ensuring that the property is distributed according to the wishes of the deceased and complies with state statutory laws, distinguishing it from other real estate transfer forms that do not involve estate distribution.

Main sections of this form

- Identification of the Grantor (administrator or administratrix) and Grantee(s) (beneficiaries).

- Description of the real property being transferred.

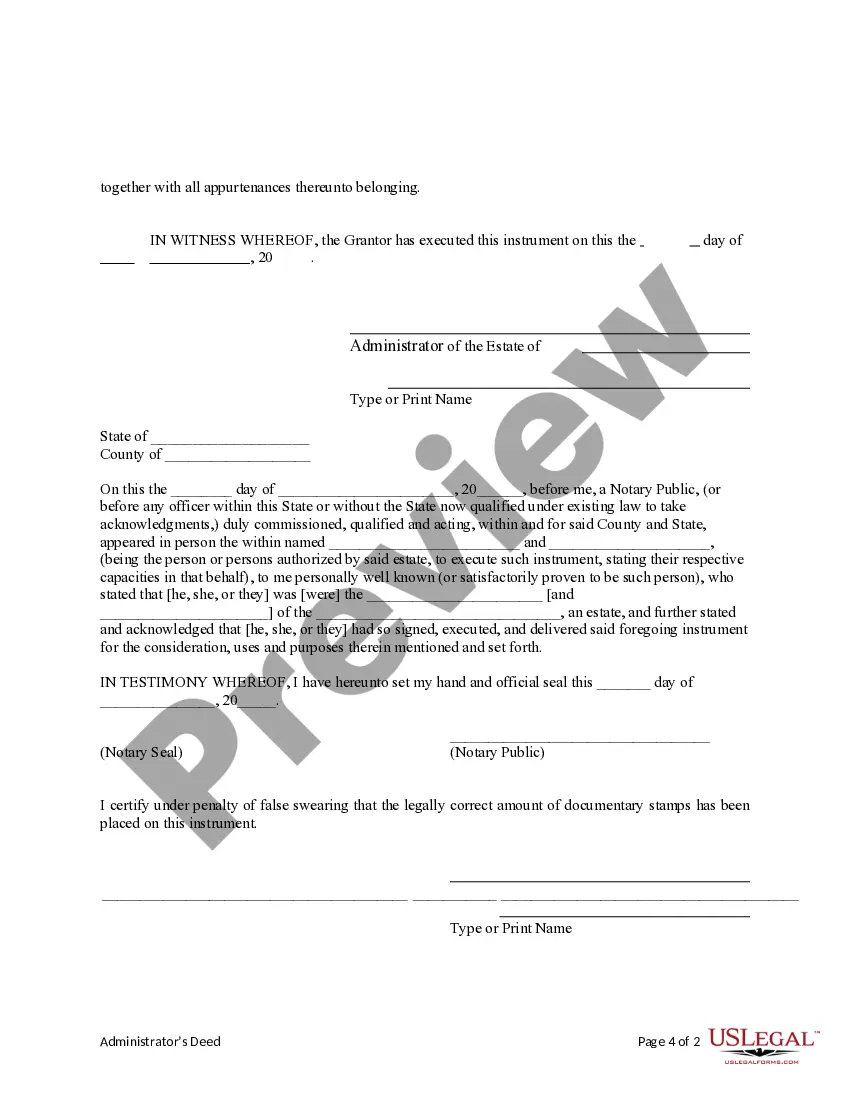

- Affidavit of acknowledgement by the Grantor.

- Signature lines for the Grantor and notary public.

- Date of the deed execution.

Common use cases

This form should be used when the administrator or administratrix of an estate needs to distribute real property to beneficiaries after the decedent's passing. It is particularly useful in cases where the property title needs to be officially transferred to those entitled per the terms of the will or state law when there is no will.

Intended users of this form

- Individuals appointed as administrators or executors of an estate.

- Beneficiaries of an estate who are receiving property distribution.

- Attorneys representing clients in estate matters.

- Property owners involved in the administration of an estate.

How to prepare this document

- Identify the parties involved: the Grantor (administrator) and the Grantees (beneficiaries).

- Provide a detailed description of the real property being transferred.

- Fill in the date of the deed execution and the county where the property is located.

- Have the Grantor sign the deed in the presence of a notary public.

- Ensure the notary public completes the acknowledgment section and affixes their seal.

Does this document require notarization?

Yes, this form must be notarized to be legally valid. U.S. Legal Forms offers integrated online notarization, available 24/7, allowing you to complete the notarization securely via video call without the need for travel.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include a complete description of the property.

- Omitting the date of execution.

- Not having the deed notarized when required.

- Misidentifying Grantor or Grantee information.

Benefits of completing this form online

- Convenient access to legal forms anytime, from anywhere.

- Editable fields allow you to customize the form easily.

- Instant downloads and the ability to save for future use.

Legal use & context

- This form serves as an official record of the transfer of property from the estate to the beneficiaries.

- It is enforceable and creates a legal chain of title.

- Users should be aware of the limitations and potential state-specific requirements that could influence its validity.

Looking for another form?

Form popularity

FAQ

Children (or grandchildren if children have died) Parents. Siblings (or nieces and nephews over 18 if siblings have died) Half-siblings (or nieces and nephews over 18 if half-siblings have died) Grandparents. Aunts or uncles.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.

The executor can sell property without getting all of the beneficiaries to approve.The administrator will come in with a buyer and a contract and if someone else in court wants to pay more for the property than that contract price then the judge will allow that.

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.

If there's enough money in the estate account, an interim payment can be made to beneficiaries, with executors holding back some money to cover potential costs. These payments should be recorded by asking the beneficiaries to sign a written receipt.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

What is probate?If no executors are named, or none of the executors is prepared to act, a beneficiary of the will can apply to the probate registry for a 'grant of letters of administration (with will annexed)'. If there is no will, a relative can apply for a 'grant of letters of administration'.