Wyoming Affidavit of Domicile for Deceased

Description

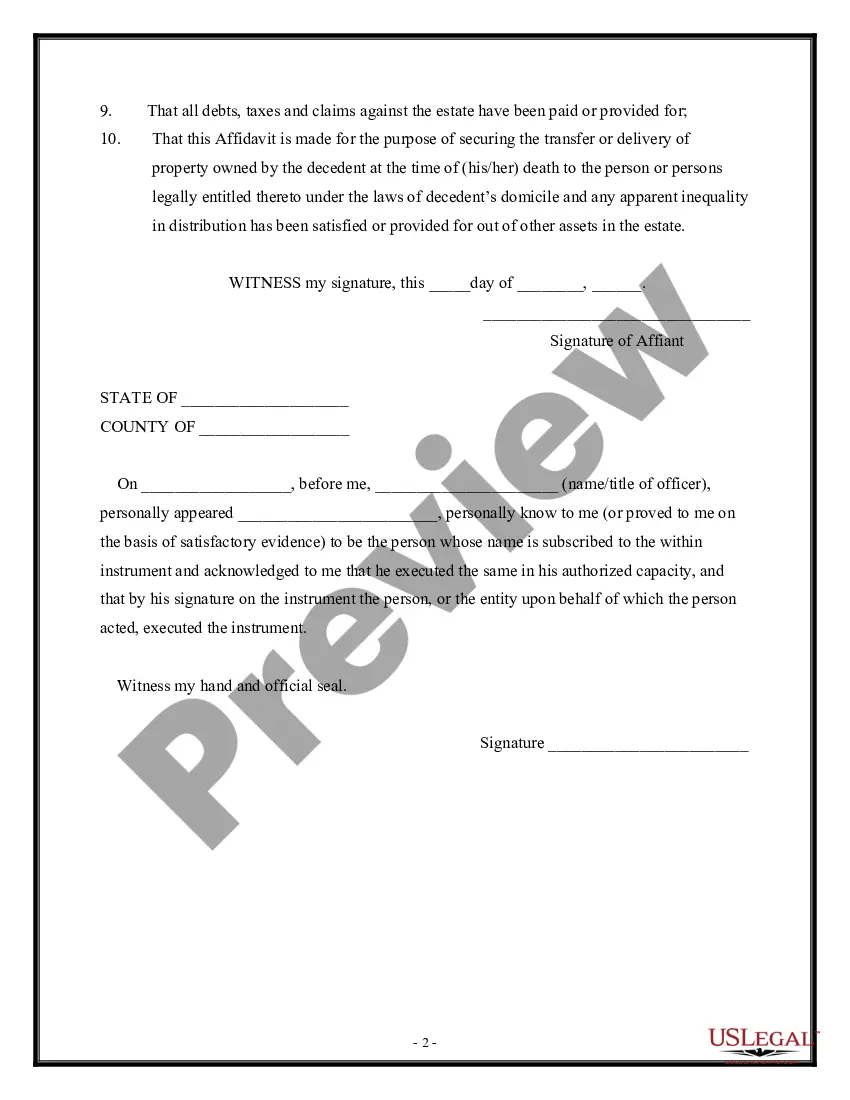

How to fill out Affidavit Of Domicile For Deceased?

Choosing the right legal file format could be a have difficulties. Of course, there are plenty of templates available on the net, but how will you find the legal kind you will need? Make use of the US Legal Forms website. The services gives a huge number of templates, like the Wyoming Affidavit of Domicile for Deceased, which you can use for business and private needs. All of the types are examined by specialists and meet up with state and federal needs.

If you are presently registered, log in to the profile and then click the Download option to find the Wyoming Affidavit of Domicile for Deceased. Use your profile to appear throughout the legal types you possess bought previously. Proceed to the My Forms tab of your own profile and have one more copy in the file you will need.

If you are a fresh end user of US Legal Forms, listed below are straightforward directions that you can adhere to:

- Very first, be sure you have selected the right kind for your personal town/area. You may look through the shape utilizing the Preview option and study the shape description to make sure this is the best for you.

- In case the kind is not going to meet up with your preferences, utilize the Seach industry to obtain the proper kind.

- When you are certain the shape would work, click the Get now option to find the kind.

- Opt for the prices strategy you desire and type in the needed information. Create your profile and purchase the order with your PayPal profile or charge card.

- Pick the document formatting and download the legal file format to the gadget.

- Complete, edit and print out and sign the attained Wyoming Affidavit of Domicile for Deceased.

US Legal Forms will be the most significant collection of legal types where you can see numerous file templates. Make use of the company to download professionally-made paperwork that adhere to express needs.

Form popularity

FAQ

Ownership by two or more persons with a right of survivorship. When one joint tenant dies, the other joint tenants automatically receive the deceased owner's share of the property.

In Wyoming, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

A probate will be necessary to transfer the decedent's estate to the heir if the decedent owned assets there were: Located in Wyoming. Worth more than $200,000 (as of the writing of this article, not counting mortgages and other encumbrances) Held in the decedent's sole name, rather than in a trust or joint tenancy.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

In Wyoming, a probate court will name an estate executor after a person passes without a will or a living trust. The executor must begin the probate process within 30 days of learning that the estate owner passed away. If they fail to file within 30 days, the court may establish a new executor.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

A Wyoming small estate affidavit, or 'Wyoming Affidavit of Collection of Estate Assets', is a form that may be used to shorten the process for settling the estate of a deceased resident (decedent). Thirty (30) days must pass after the death before the affidavit can be used.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.