South Carolina Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

Are you currently in the situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast selection of form templates, including the South Carolina Charitable Remainder Inter Vivos Annuity Trust, designed to comply with state and federal regulations.

When you find the appropriate form, click Buy now.

Choose the payment plan you prefer, fill in the required information to set up your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Carolina Charitable Remainder Inter Vivos Annuity Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the appropriate city/state.

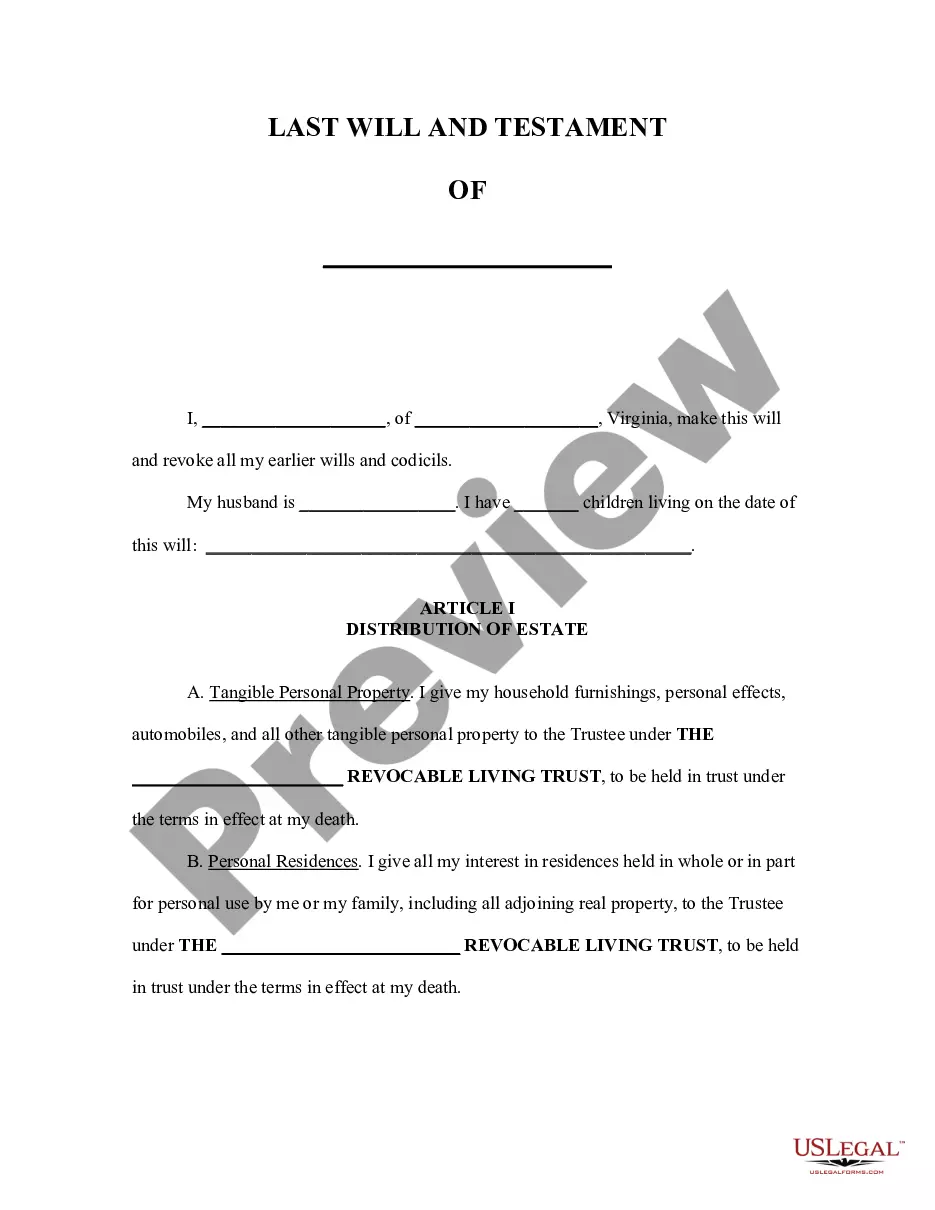

- Use the Preview button to review the form.

- Check the summary to confirm you have chosen the correct form.

- If the form is not what you are looking for, utilize the Search area to find the document that meets your needs.

Form popularity

FAQ

Setting up a living trust in South Carolina involves several key steps. Start by drafting a trust agreement that outlines the terms and appoints a trustee to manage the trust. Next, transfer your assets into the trust to make it effective. For additional assistance, consider using uslegalforms, which offers resources to help you establish a South Carolina Charitable Remainder Inter Vivos Annuity Trust efficiently.

To file a living trust in South Carolina, you must first create the trust document and gather necessary information about your assets. Next, transfer ownership of the assets into the trust, which may involve changing titles and designations. Filing doesn't typically require submission to a court, but you should keep the document in a safe location. Platforms like uslegalforms can provide templates and step-by-step instructions to simplify this process.

While it is not legally required to hire a lawyer to set up a South Carolina Charitable Remainder Inter Vivos Annuity Trust, it is highly recommended. A lawyer can help you navigate the legal complexities and ensure the trust complies with state laws. Using a professional also minimizes errors and maximizes the benefits of your trust. Consider platforms like uslegalforms to guide you through the process.

The easiest way to set up a trust is to use a reliable legal service like uslegalforms. They provide straightforward resources and templates for creating a South Carolina Charitable Remainder Inter Vivos Annuity Trust. You'll find clear instructions for drafting your trust document and guidance on how to fund it. This approach simplifies the process while helping you achieve your financial and charitable objectives.

To set up a trust fund in South Carolina, start by defining your goals for the trust. Many individuals find that a South Carolina Charitable Remainder Inter Vivos Annuity Trust aligns with their philanthropic desires while also providing income. Consult with a legal expert to draft your trust document and select a trustee who can manage the trust effectively. Your next step is to fund the trust with desired assets, ensuring that it complies with South Carolina laws.

Creating a charitable remainder trust involves several key steps. First, you must decide on the type of trust; a South Carolina Charitable Remainder Inter Vivos Annuity Trust may be a great option for you. Next, you will need to work with a professional to draft the trust document, defining the terms and beneficiaries. It's crucial to ensure that all legal requirements are met, especially in South Carolina, to safeguard your intentions and benefits.

Yes, you can place an annuity within a charitable remainder trust. The South Carolina Charitable Remainder Inter Vivos Annuity Trust allows you to fund the trust with an annuity, which can provide you with steady income during your lifetime. The remaining assets then go to your chosen charity after your passing, fulfilling both your financial and philanthropic goals. This method combines financial security with charitable giving.

Trusts in South Carolina may be subject to federal and state income tax. The taxation of a South Carolina Charitable Remainder Inter Vivos Annuity Trust depends on the income generated and the distributions made to beneficiaries. It’s essential to consult a tax advisor familiar with South Carolina law to ensure compliance and optimize your tax obligations, allowing you to maintain the benefits of your trust.

Yes, a trust generally avoids probate in South Carolina. This process allows your assets to be managed and distributed without the need for court involvement, providing privacy and efficiency. A South Carolina Charitable Remainder Inter Vivos Annuity Trust is an excellent strategy for asset management, as it helps your heirs access resources faster and reduces the complexities of probate.

In South Carolina, a certificate of trust is not required to be recorded. However, it can be beneficial in certain situations, as it provides evidence of the trust's existence and conveys the powers of the trustee to third parties. To ensure that your South Carolina Charitable Remainder Inter Vivos Annuity Trust is properly authenticated, consider consulting with a legal professional familiar with state trust laws.