Tennessee Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

Have you found yourself in a situation where you require documents for business or particular purposes nearly every day.

There are numerous legal document templates available online, but locating reliable versions can be challenging.

US Legal Forms offers a vast collection of form templates, such as the Tennessee Charitable Remainder Inter Vivos Annuity Trust, designed to meet both federal and state regulations.

Once you find the correct form, click Buy now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Tennessee Charitable Remainder Inter Vivos Annuity Trust template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

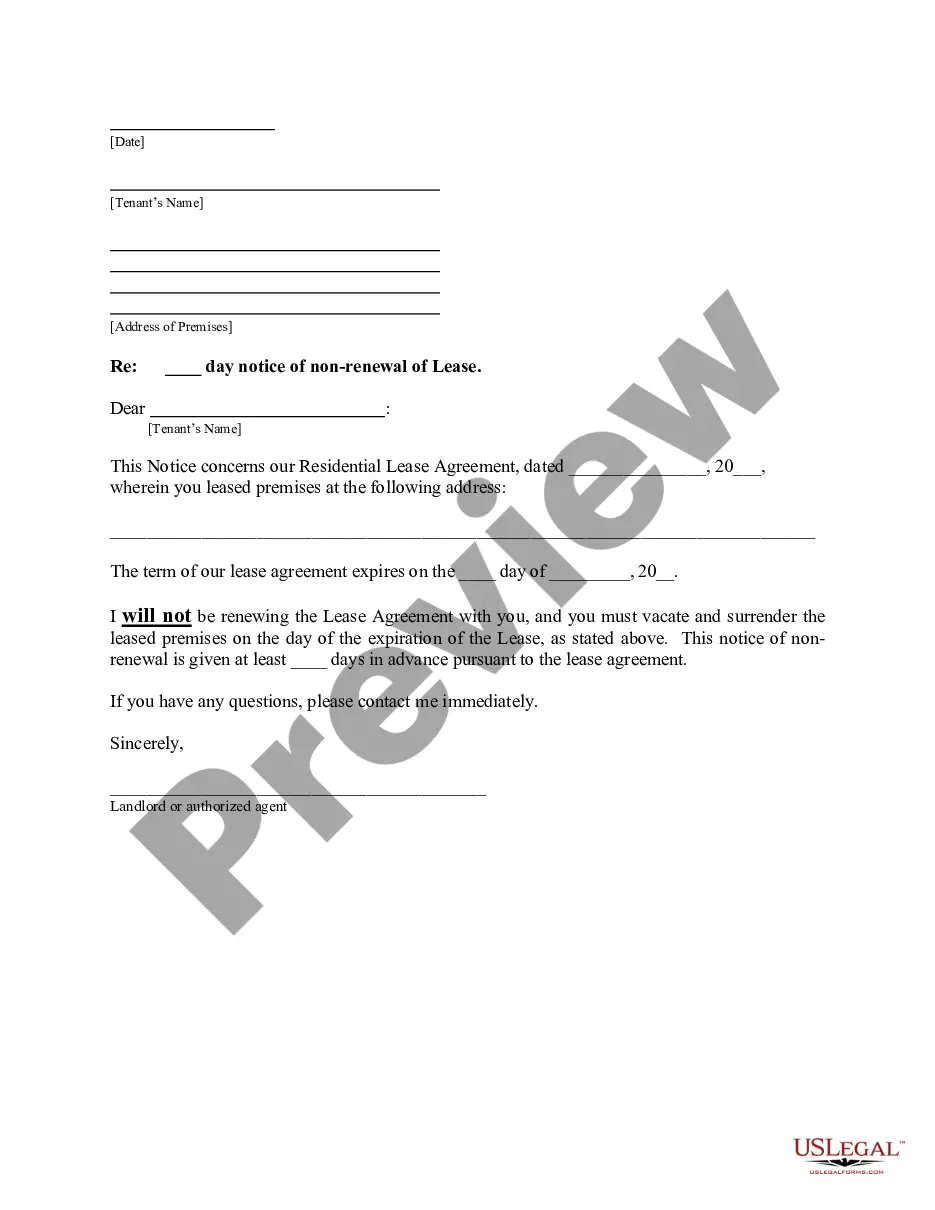

- Use the Review button to check the form.

- Look at the description to make sure you have chosen the right form.

- If the form isn't what you're looking for, utilize the Search area to find the form that fits your needs.

Form popularity

FAQ

To create a charitable remainder trust, including the Tennessee Charitable Remainder Inter Vivos Annuity Trust, start by consulting with a legal or financial expert who understands the process. You will need to choose the assets to contribute, select a charity as the beneficiary, and outline the income structure for yourself or your beneficiaries. Platforms like UsLegalForms provide templates and guidance, making the creation of your charitable remainder trust straightforward.

If a charitable remainder trust, like the Tennessee Charitable Remainder Inter Vivos Annuity Trust, does not fit your needs, consider other options such as setting up a donor-advised fund or simply making direct charitable donations. Donor-advised funds offer flexible giving options and allow you to retain control over the assets while distributing to charities over time. Each alternative has its own benefits, so evaluate your financial situation and philanthropic intentions.

While charitable remainder trusts, such as the Tennessee Charitable Remainder Inter Vivos Annuity Trust, offer great benefits, they do have some downsides. Once you place assets in the trust, you cannot regain control or access those assets. Additionally, setting up and maintaining the trust can incur legal and administrative fees, which can be a concern for some individuals. It's important to weigh these factors against your charitable goals.

The rules for a charitable remainder trust, including the Tennessee Charitable Remainder Inter Vivos Annuity Trust, specify that you must donate assets to the trust and designate a charitable organization as the beneficiary. You can receive income from the trust for a set period or for life, after which the remaining assets go to the charity. Make sure to comply with IRS regulations to benefit from tax deductions and maximize your philanthropic impact.

The 10 percent rule is a requirement for charitable remainder trusts to ensure that at least 10 percent of the trust's value goes to charity upon its termination. This rule helps maintain the charitable intent of a Tennessee Charitable Remainder Inter Vivos Annuity Trust. Adhering to this rule not only benefits the charity at the end of the trust but also allows for various tax advantages during the lifetime of the trust. Understanding this rule can guide you in establishing a trust that meets legal requirements while fulfilling your philanthropic goals.

When reviewing the benefits of a charitable remainder trust, it is important to understand that not every expected advantage holds true for everyone. For instance, while the potential for income tax deductions is significant, some may not qualify based on their financial situation. Additionally, the ability to provide for beneficiaries while benefiting a charity is a core advantage of a Tennessee Charitable Remainder Inter Vivos Annuity Trust. Therefore, it is vital to evaluate your individual circumstances.

Tennessee does not impose a state income tax on trust income, offering a favorable environment for establishing a Tennessee Charitable Remainder Inter Vivos Annuity Trust. This absence of a trust income tax can enhance the financial benefits of your charitable trust. However, federal tax rules still apply, so it's essential to consider those when setting up your trust. Consulting with experts can help ensure your trust aligns with your financial goals.

The two main types of Charitable Remainder Unitrust (CRUT) are the standard CRUT and the net income CRUT. In a standard CRUT, beneficiaries receive a fixed percentage of the trust's assets valued annually, while a net income CRUT pays out either the net income generated or the predetermined percentage—whichever is less. Both offer unique advantages depending on your financial goals and charitable intentions, including options available through the Tennessee Charitable Remainder Inter Vivos Annuity Trust.

To set up a Tennessee Charitable Remainder Inter Vivos Annuity Trust, start by choosing an experienced estate planning attorney who specializes in trusts. Next, identify the assets you wish to contribute and outline the terms, such as payment amounts and beneficiaries. It's helpful to use platforms like uslegalforms, which can simplify the process and provide you with the necessary documentation.

As previously mentioned, a Tennessee Charitable Remainder Inter Vivos Annuity Trust exemplifies how individuals can create charitable remainder trusts. For example, if someone contributes real estate to such a trust, they could receive annuity payments while ensuring that the property supports charitable initiatives after their passing. This dual benefit makes it an appealing option for donors.