Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed

Description

How to fill out Sports Surfaces Installation And Services Contract - Self-Employed?

If you desire to finish, retrieve, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal uses are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Select the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, review, and print or sign the Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed. Every legal document template you purchase is yours for years. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Be proactive and download, and print the Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed with US Legal Forms. There are many professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to get the Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

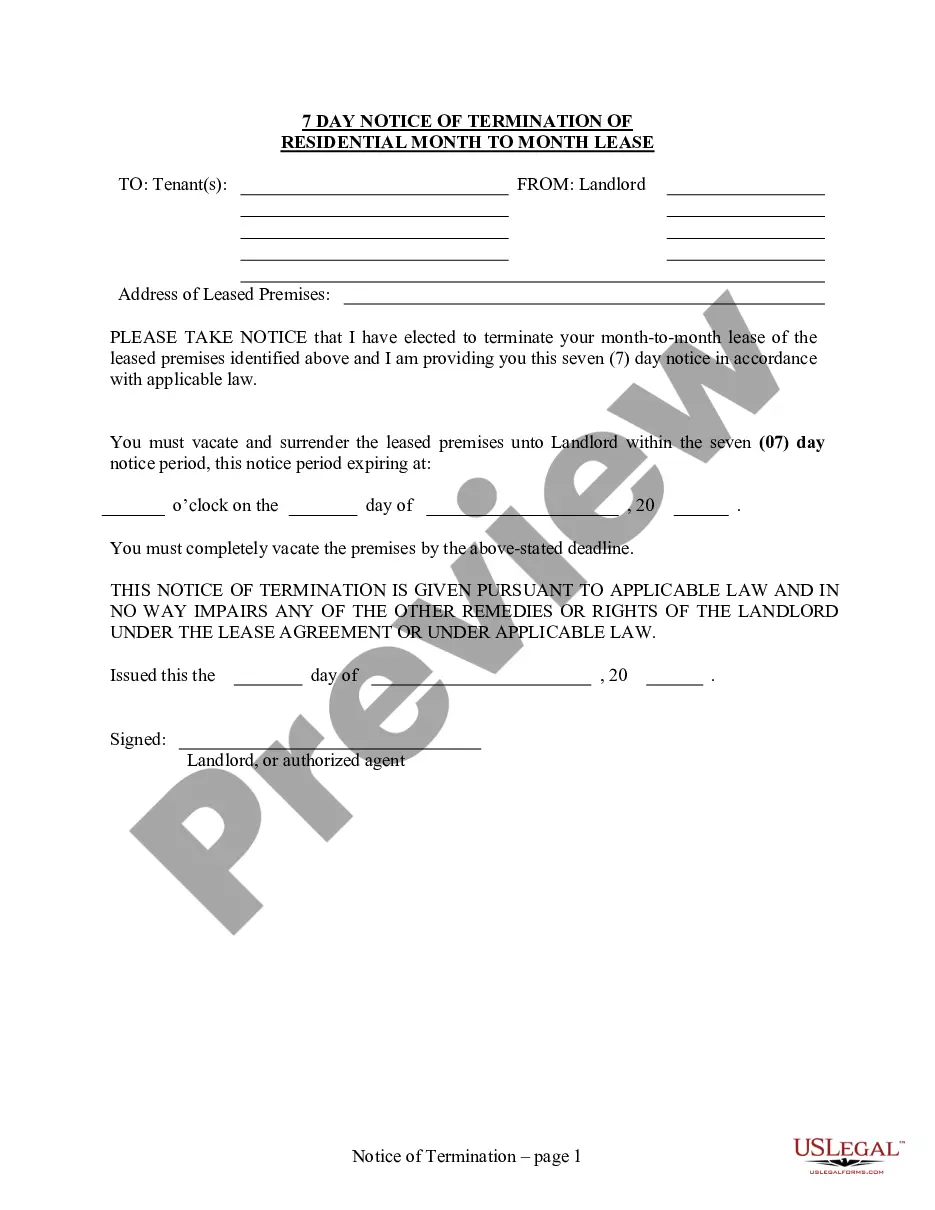

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To set yourself up as an independent contractor in the realm of Wisconsin Sports Surfaces Installation and Services, you need to follow several steps. First, obtain the necessary licenses and permits according to Wisconsin state regulations for your specific services. Then, consider creating a business entity, like an LLC, to protect your personal assets. Finally, draft a Wisconsin Sports Surfaces Installation and Services Contract - Self-Employed to outline your services and agree on terms with your clients.

The IRS outlines specific requirements for independent contractor status, primarily focusing on the degree of control and independence in your work. You must offer your services to the general public and maintain a business-like manner. When engaging in activities under a Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed, meeting these criteria ensures proper classification and compliance with tax regulations.

To establish yourself as an independent contractor, start by choosing a business name and structure. You must also register for an Employer Identification Number (EIN) with the IRS. In the context of a Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed, consider creating a professional website and utilizing platforms like uslegalforms to obtain necessary contracts and forms that can help formalize your business.

The tax rate for independent contractors in Wisconsin varies based on your income. Generally, you will be subject to both state and federal income tax. Additionally, self-employment taxes, which fund Social Security and Medicare, come into play, making it crucial to understand how all these factors affect your overall tax obligations as an independent contractor in the Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed sector.

Legal requirements for independent contractors vary by state, including Wisconsin. Essential elements often include tax obligations, insurance needs, and compliance with labor laws. For anyone entering a Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed, understanding these requirements is vital. Utilizing platforms like uslegalforms can help you navigate these complexities, ensuring you have a comprehensive agreement that meets all legal standards.

In Wisconsin, an independent contractor agreement is a legal document that clarifies the terms under which a self-employed individual provides services to a client. This agreement must comply with state laws, including those specific to the sports industry, like a Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed. Properly drafted agreements protect both parties by ensuring they understand their roles and obligations, fostering a smooth working relationship.

A basic independent contractor agreement sets the foundation for a working relationship between a contractor and a client. It outlines the scope of work, payment terms, and responsibilities while clearly defining the self-employed status of the contractor. In the context of a Wisconsin Sports Surfaces Installation And Services Contract - Self-Employed, it is crucial to specify details related to the installation and maintenance of sports surfaces to prevent misunderstandings.