Wisconsin Self-Employed Paving Services Contract

Description

How to fill out Self-Employed Paving Services Contract?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous templates available online, but how do you find the legal form that you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Wisconsin Self-Employed Paving Services Agreement, which you can employ for both business and personal purposes. All forms are reviewed by experts and meet federal and state regulations.

If you are already registered, sign in to your account and then click on the Download button to obtain the Wisconsin Self-Employed Paving Services Agreement. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account to get another copy of the document you need.

Select the file format and download the legal document template onto your device. Fill out, modify, and print as well as sign the acquired Wisconsin Self-Employed Paving Services Agreement. US Legal Forms represents the largest repository of legal forms where you can find various document templates. Utilize this service to obtain properly designed documents that comply with state regulations.

- First, ensure you have chosen the right form for your locality.

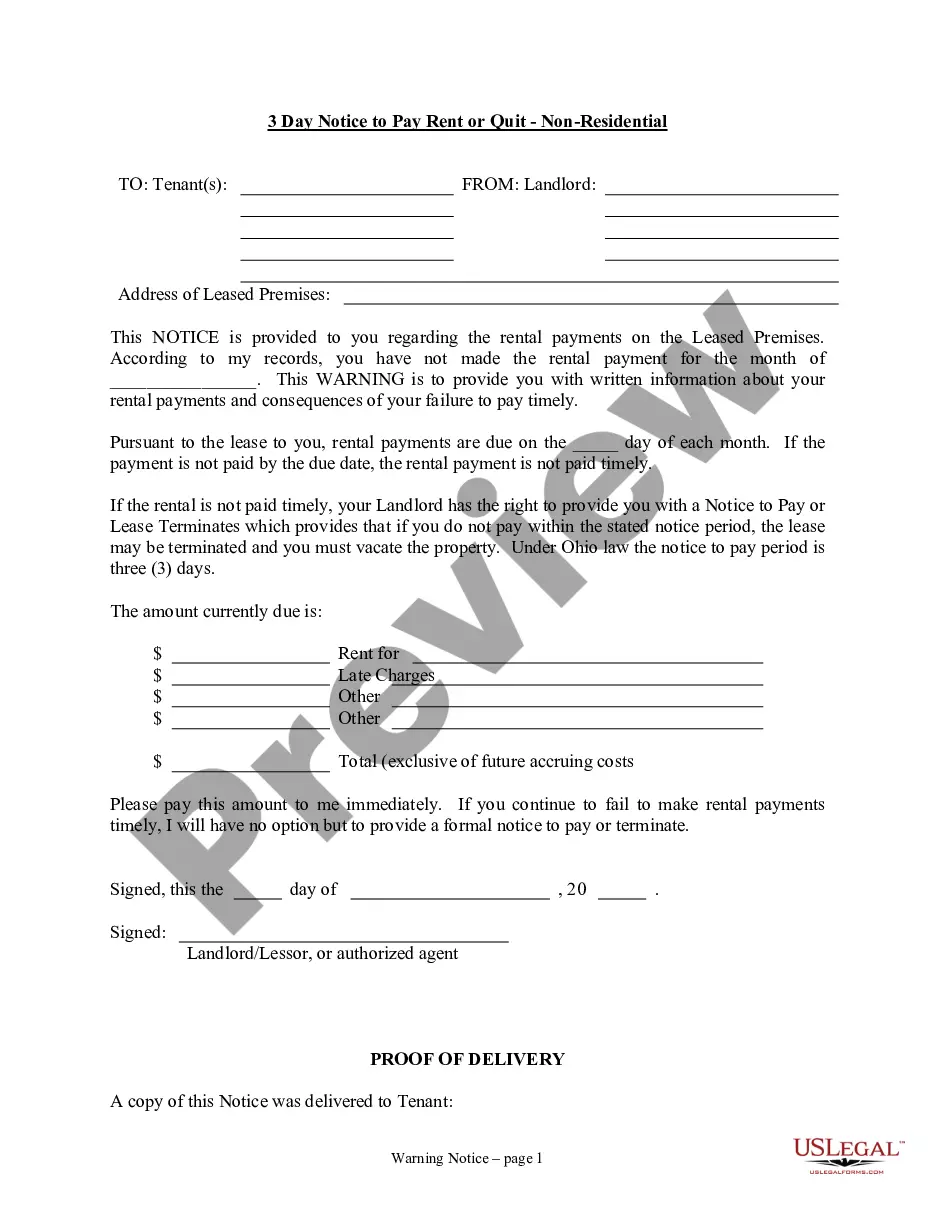

- You can preview the form by using the Review button and examine the form details to make sure it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the right form.

- Once you are confident the form is correct, click the Buy Now button to purchase the form.

- Select your preferred payment plan and enter the necessary details.

- Create your account and complete the payment via your PayPal account or credit card.

Form popularity

FAQ

Review any contract the contractor provides to you make sure it is clear and complete. consider hiring a professional to review the plans and specifications. consider hiring an attorney to review and explain the contract to you, and. most importantly, do not be afraid to negotiate the contract with the contractor.

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

What is a Contract?The contract should describe, in detail, the products to be used and how the work will be performed, i.e., size, color, who will be doing what work, amounts of materials provided, manufacturer model number, etc.There must be a detailed, written payment schedule in the contract.More items...

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

Nine Requirements Test - Independent ContractorRequirement One - Maintain a Separate Business.Requirement Two - Obtain a FEIN or Have Filed Business or Self-Employment Tax Returns.Requirement Three - Operate Under Specific Contracts.Requirement Four - Responsible For Main Expenses.More items...

Per Wisconsin law, if a contractor purchases construction materials for use in a real property construction project or repair, the contractor is considered the end user of those materials. That means the contractor must pay sales or use tax on those purchases, and the contractor's sale to their customer is not taxable.

Elements of a Construction ContractName of contractor and contact information.Name of homeowner and contact information.Describe property in legal terms.List attachments to the contract.The cost.Failure of homeowner to obtain financing.Description of the work and the completion date.Right to stop the project.More items...