Wisconsin Pool Services Agreement - Self-Employed

Description

How to fill out Pool Services Agreement - Self-Employed?

If you wish to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to sign up for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Wisconsin Pool Services Agreement - Self-Employed with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Obtain option to locate the Wisconsin Pool Services Agreement - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find alternative versions of the legal document format.

Form popularity

FAQ

Yes, independent contractors typically file taxes as self-employed individuals, meaning they report their income on Schedule C with their federal tax return. This status allows for certain tax deductions that traditional employees cannot claim. If you are entering into a Wisconsin Pool Services Agreement - Self-Employed, it's vital to understand your tax obligations and benefits to manage your finances effectively.

In Wisconsin, cleaning services are generally subject to sales tax, with some exceptions such as residential cleaning. It's important to thoroughly understand these regulations to avoid compliance issues. When preparing a Wisconsin Pool Services Agreement - Self-Employed, be sure to include any applicable tax considerations to safeguard your business interests.

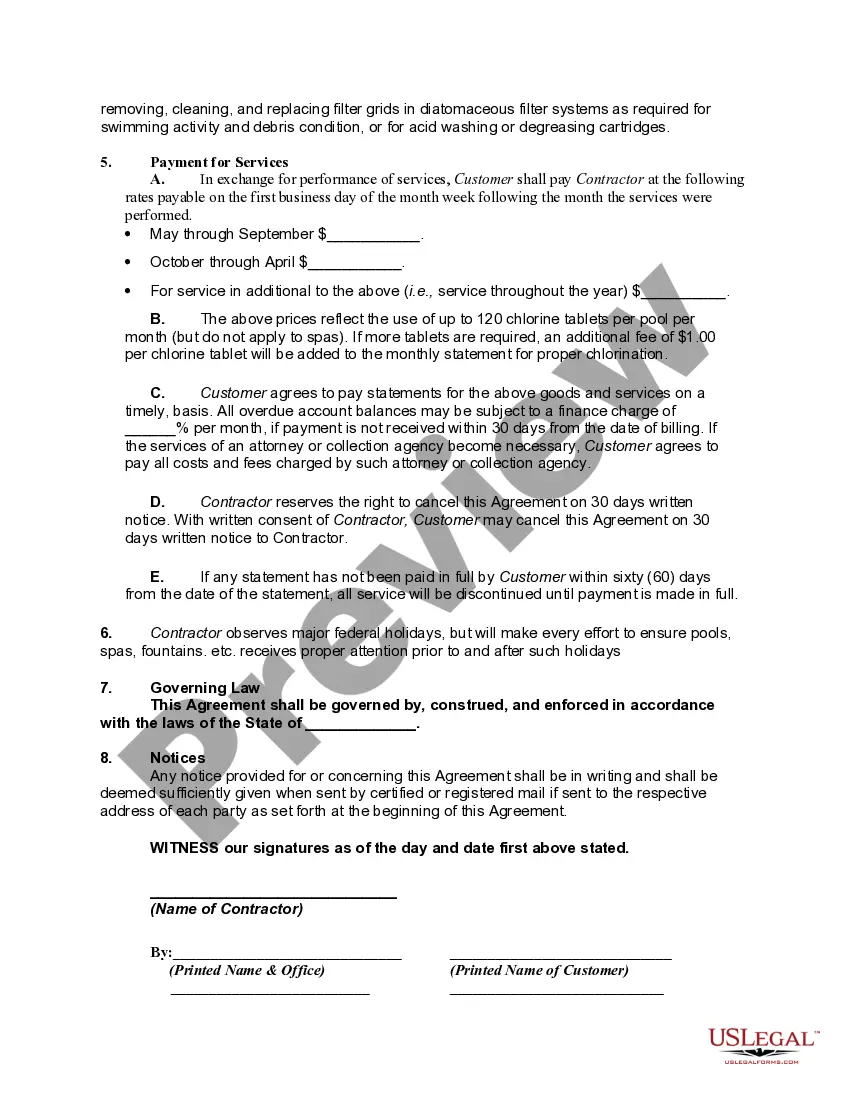

An independent contractor agreement in Wisconsin establishes the working relationship between a contractor and the hiring entity. This contract clarifies the terms of service, payment, and responsibilities without classifying the contractor as an employee. By including specific clauses in your Wisconsin Pool Services Agreement - Self-Employed, you can protect your rights and outline your obligations effectively.

Wisconsin does not impose sales tax on a variety of items, such as most food products, prescription drugs, and certain farm equipment. This creates potential savings for consumers and service providers alike. When outlining your Wisconsin Pool Services Agreement - Self-Employed, it's wise to consider these tax exemptions to ensure compliance and clarity.

In Wisconsin, certain services are exempt from sales tax, including services related to health, education, and specific government functions. Additionally, services directly related to the repair or maintenance of tangible personal property, like swimming pools, can also be exempt under specific conditions. Understanding these exemptions can be crucial when drafting your Wisconsin Pool Services Agreement - Self-Employed.

To attract pool service clients, focus on networking and marketing your services effectively. Utilize social media platforms, local advertising, and community events to spread the word. Offering a professional Wisconsin Pool Services Agreement - Self-Employed can add credibility, making potential clients more likely to choose your services.

Yes, you can self-contract a pool if you have the required skills and knowledge. However, it's vital to ensure you meet any licensing and insurance requirements applicable in Wisconsin. Utilizing the Wisconsin Pool Services Agreement - Self-Employed can help formalize your contract, ensuring you cover all necessary legal aspects.

To write off a swimming pool, you need to determine if it qualifies as a business expense. Keep records of all expenses related to the pool, including installation and maintenance costs. Consult a tax professional for specific guidance, and utilize the Wisconsin Pool Services Agreement - Self-Employed to substantiate these expenses if you use the pool for business purposes.

A comprehensive pool quote should detail all services offered, material costs, and labor fees. Additionally, include timelines for completion and any warranty information. This transparency helps build trust with clients and aligns with the standards found in the Wisconsin Pool Services Agreement - Self-Employed, ensuring everyone is on the same page.

Building a swimming pool generally requires a permit from your local authorities. Check with your municipality to understand specific requirements, such as zoning laws or safety standards. Obtaining the necessary permissions is crucial to avoid legal complications, and having a well-prepared Wisconsin Pool Services Agreement - Self-Employed can help in this regard.