Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor

Description

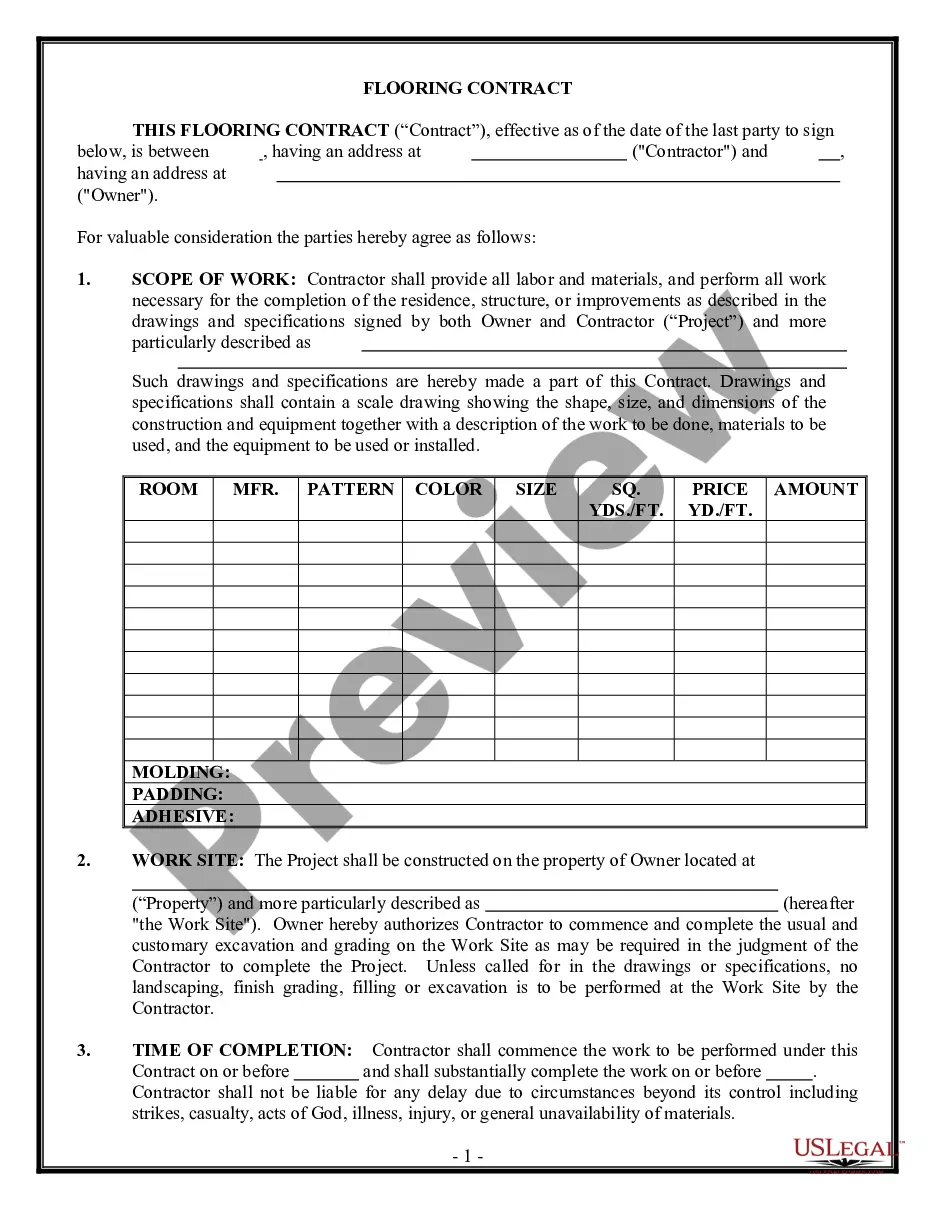

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the foremost collections of legal documents in the United States - provides a diverse selection of legal templates you can download or print.

By utilizing the website, you will access thousands of forms for commercial and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor in seconds.

Click on the Review button to examine the content of the form.

Check the form description to ensure that you selected the appropriate one.

- If you currently hold a membership, Log In and download the Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor from the US Legal Forms library.

- The Download option will appear on every form you see.

- You have access to all previously downloaded forms in the My documents tab of your account.

- If you want to start using US Legal Forms for the first time, here are simple instructions to get you going.

- Make sure you've selected the correct form for your city/state.

Form popularity

FAQ

In Wisconsin, self-employed independent contractors can perform work without a contractor license for projects valued at less than $1,000. This includes carpentry services under the Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor. However, it's important to ensure that the work you perform meets local regulations and safety standards. If your projects exceed this value, obtaining a contractor license becomes necessary to comply with state laws.

Yes, an independent contractor is considered a self-employed individual. This means that they operate their own business and are responsible for their own taxes, benefits, and expenses. When engaging in work via a Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor, it's crucial to understand that you are not an employee of a company but rather your own boss. Therefore, you have the flexibility to set your own hours and choose your clients, which can be very empowering.

The basic independent contractor agreement establishes the framework for the relationship between the contractor and the client. It typically includes elements like work descriptions, payment schedules, and conditions for termination. Using a Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor gives you a solid foundation for your agreements, promoting transparency and accountability in your business dealings.

Breaking an independent contractor agreement can lead to significant legal repercussions, including financial liabilities or lawsuits. Generally, the party who breaches the contract may be responsible for damages or lost profits. To avoid conflicts and misunderstandings, it's prudent to rely on a Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor, which lays out clear terms that both parties agree to and understand.

An independent contractor carpenter is a skilled tradesperson who operates under a contract rather than as an employee. They perform carpentry work for various clients and manage their own business operations. By utilizing a Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor, carpenters can clearly define the scope of work, thus enhancing their professional relationships and ensuring project success.

The independent contractor agreement in Wisconsin is a legal document outlining the terms and conditions between a contractor and a client. This document typically includes project specifics, payment terms, deadlines, and expectations from both parties. Utilizing a Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor can streamline this process, ensuring clarity and protection for both the contractor and the client.

Filling out an independent contractor form requires you to provide your name, address, and tax identification number, as well as details about the work arrangement. Clearly state the services to be rendered and the payment structure. Make sure you're aligning this process with your specific needs for a Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor. If you seek guidance, US Legal Forms offers resources to ensure you complete the form correctly.

Writing an independent contractor agreement involves clearly defining the scope of work, payment terms, and project duration. Begin with your information and that of the hiring entity, followed by a detailed description of the carpentry services you will deliver. It's essential to include provisions for dispute resolution and termination. For precision in your Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor, consider templates available through US Legal Forms, which streamline the writing process.

To fill out an independent contractor agreement, start by entering your personal information, including your name and address, along with the details of the hiring party. Specify the services you will provide, the compensation structure, and deadlines. Ensure you outline any terms and conditions that apply to your Wisconsin Carpentry Services Contract - Self-Employed Independent Contractor. Using a platform like US Legal Forms can help you customize this agreement accurately and efficiently.