Wisconsin Industrial Contractor Agreement - Self-Employed

Description

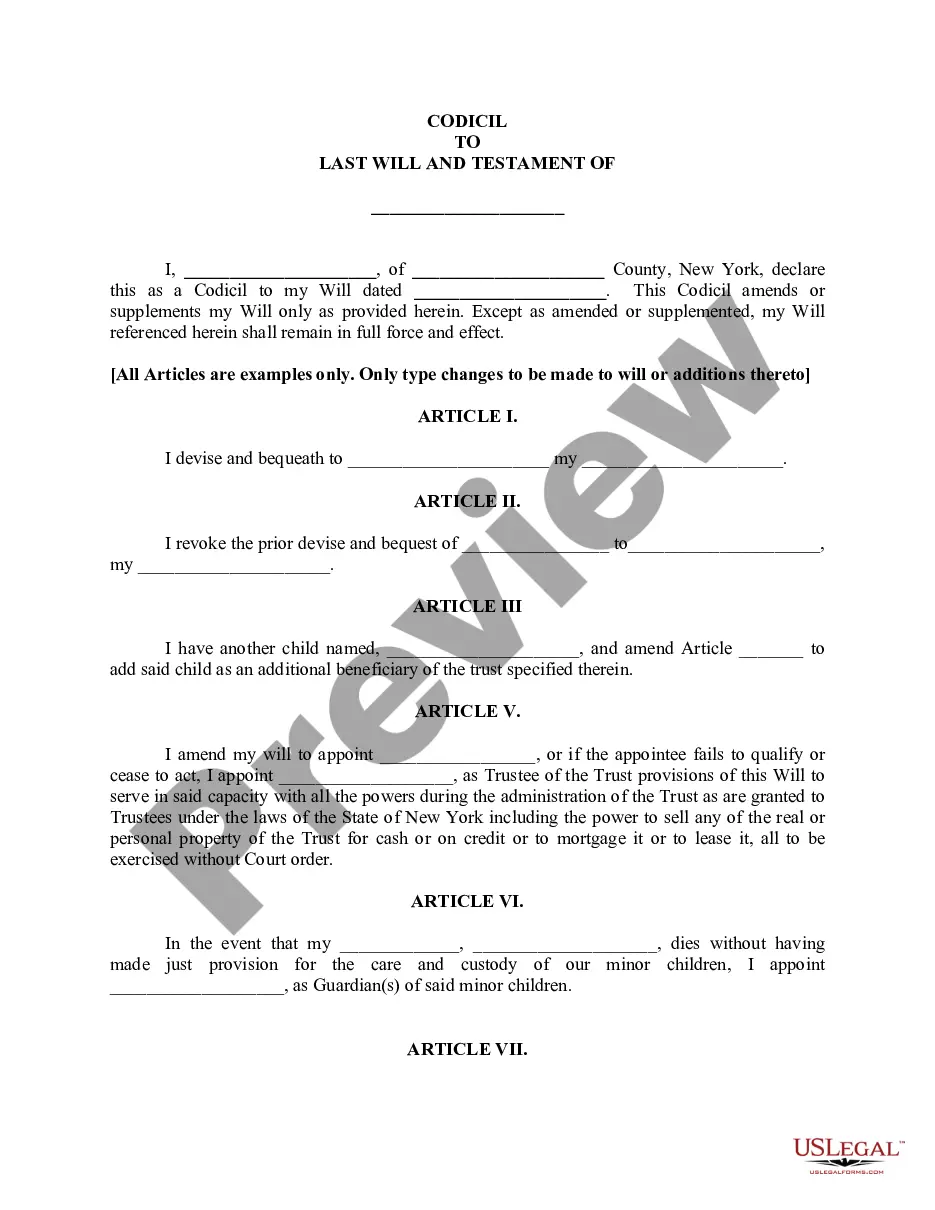

How to fill out Industrial Contractor Agreement - Self-Employed?

If you need to compile, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms accessible online. Benefit from the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to acquire the Wisconsin Industrial Contractor Agreement - Self-Employed in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Wisconsin Industrial Contractor Agreement - Self-Employed. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have chosen the form for the correct city/state. Step 2. Utilize the Preview option to review the form's content. Remember to read the details. Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template. Step 4. Once you have located the form you need, select the Buy now button. Choose the payment plan you prefer and provide your information to register for the account. Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Wisconsin Industrial Contractor Agreement - Self-Employed.

- Every legal document format you acquire is yours permanently.

- You have access to every form you downloaded within your account.

- Click the My documents section and select a form to print or download again.

- Complete and download, and print the Wisconsin Industrial Contractor Agreement - Self-Employed with US Legal Forms.

- There are thousands of professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

To fill out an independent contractor agreement, carefully read through the sections provided. Input the information about services rendered, payment schedules, and any special clauses that apply to your agreement. Utilizing the Wisconsin Industrial Contractor Agreement - Self-Employed from US Legal Forms can simplify this process, ensuring you don't overlook essential details that could protect both parties.

Filling out an independent contractor form requires you to enter specific information about both parties involved. Start by providing the names and addresses of the contractor and the client, followed by any relevant project details. Make sure to review the Wisconsin Industrial Contractor Agreement - Self-Employed on the US Legal Forms platform to understand the necessary fields and how to complete them effectively.

To write an independent contractor agreement, begin by defining the scope of work clearly. Include details such as project timelines, payment terms, and the responsibilities of each party. Use the Wisconsin Industrial Contractor Agreement - Self-Employed template from US Legal Forms to ensure that you cover all necessary legal elements and make the agreement enforceable.

To create an independent contractor agreement, begin by defining the scope of work and responsibilities. Include essential details such as payment terms, deadlines, and any applicable regulations. It is vital to ensure that the agreement aligns with local laws, particularly when crafting a Wisconsin Industrial Contractor Agreement - Self-Employed. Utilizing platforms like US Legal Forms can simplify this process by providing templates that can be customized to meet your specific needs.

Independent contractors in Wisconsin must comply with various legal requirements, including proper licensing, tax obligations, and adherence to labor laws. Additionally, they should recognize the distinction between independent contractors and employees to avoid misclassification issues. A well-drafted Wisconsin Industrial Contractor Agreement - Self-Employed can safeguard your rights while ensuring you meet all legal standards applicable to your work.

A basic independent contractor agreement includes fundamental elements such as project description, payment details, deadlines, and confidentiality clauses. This type of contract establishes a clear understanding between both parties, minimizing potential conflicts. Creating a Wisconsin Industrial Contractor Agreement - Self-Employed ensures that all necessary terms are documented, promoting a healthy working relationship.

Breaking an independent contractor agreement can lead to serious consequences, including financial penalties or legal action. Moreover, it could damage your professional reputation and future opportunities. It is important to adhere to the terms laid out in your Wisconsin Industrial Contractor Agreement - Self-Employed to maintain a good standing with your clients and protect your business interests.

Yes, independent contractors generally file as self-employed individuals. They report their income on a Schedule C form when filing their federal taxes. Using a Wisconsin Industrial Contractor Agreement - Self-Employed can help clarify the nature of the work performed and assist in proper income reporting, ensuring you remain compliant with tax regulations.

An independent contractor agreement in Wisconsin is a legal document outlining the terms of the working relationship between a contractor and a client. This type of agreement specifies duties, payment terms, timelines, and other essential aspects of the project. By utilizing a Wisconsin Industrial Contractor Agreement - Self-Employed, both parties can clearly understand their expectations, which helps prevent misunderstandings and disputes.

Yes, an independent contractor is typically considered self-employed. This means they run their own business and are responsible for managing their own taxes, insurance, and business expenses. When working under a Wisconsin Industrial Contractor Agreement - Self-Employed, the independent contractor has the flexibility to negotiate terms that suit their individual needs. It's important to understand the legal implications of this status to ensure compliance with local regulations.