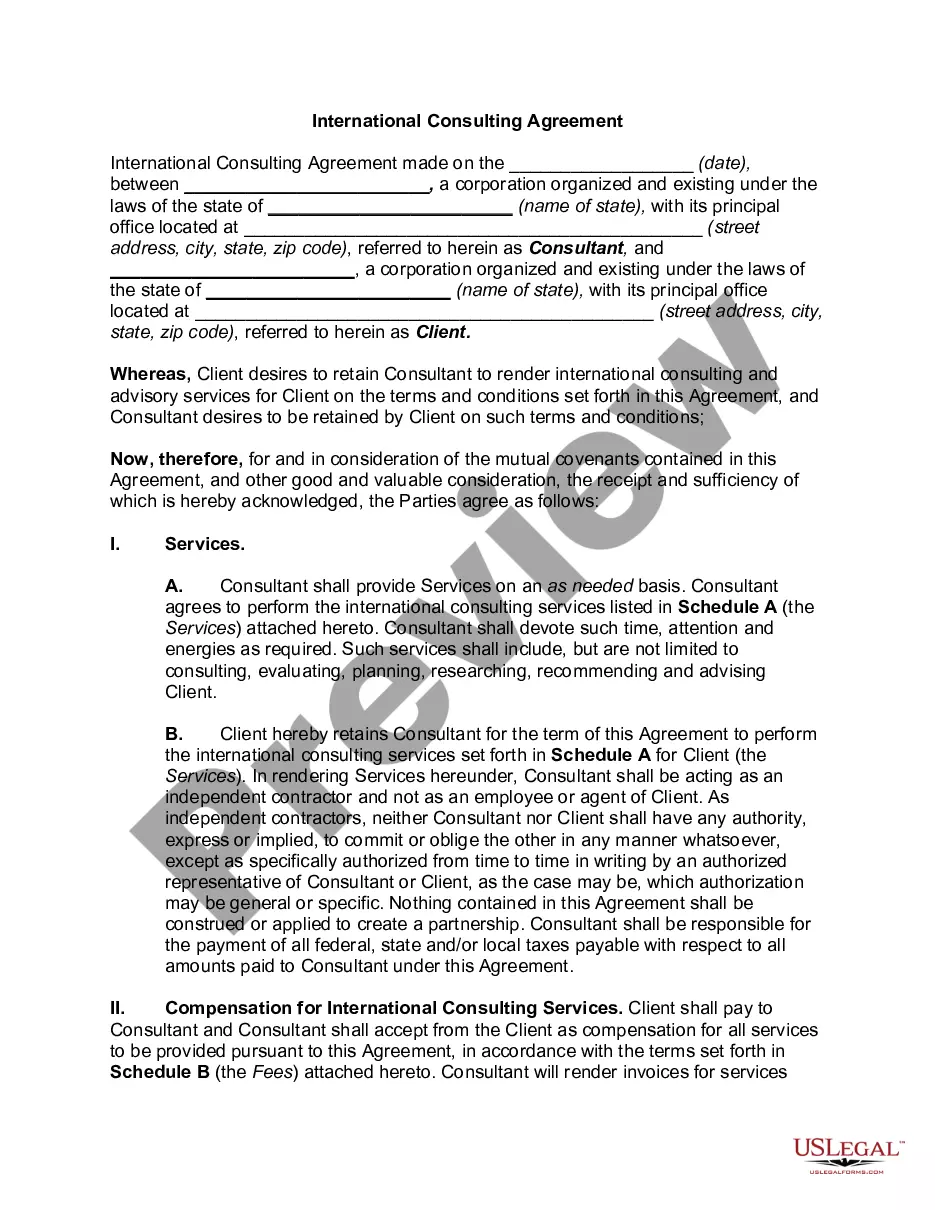

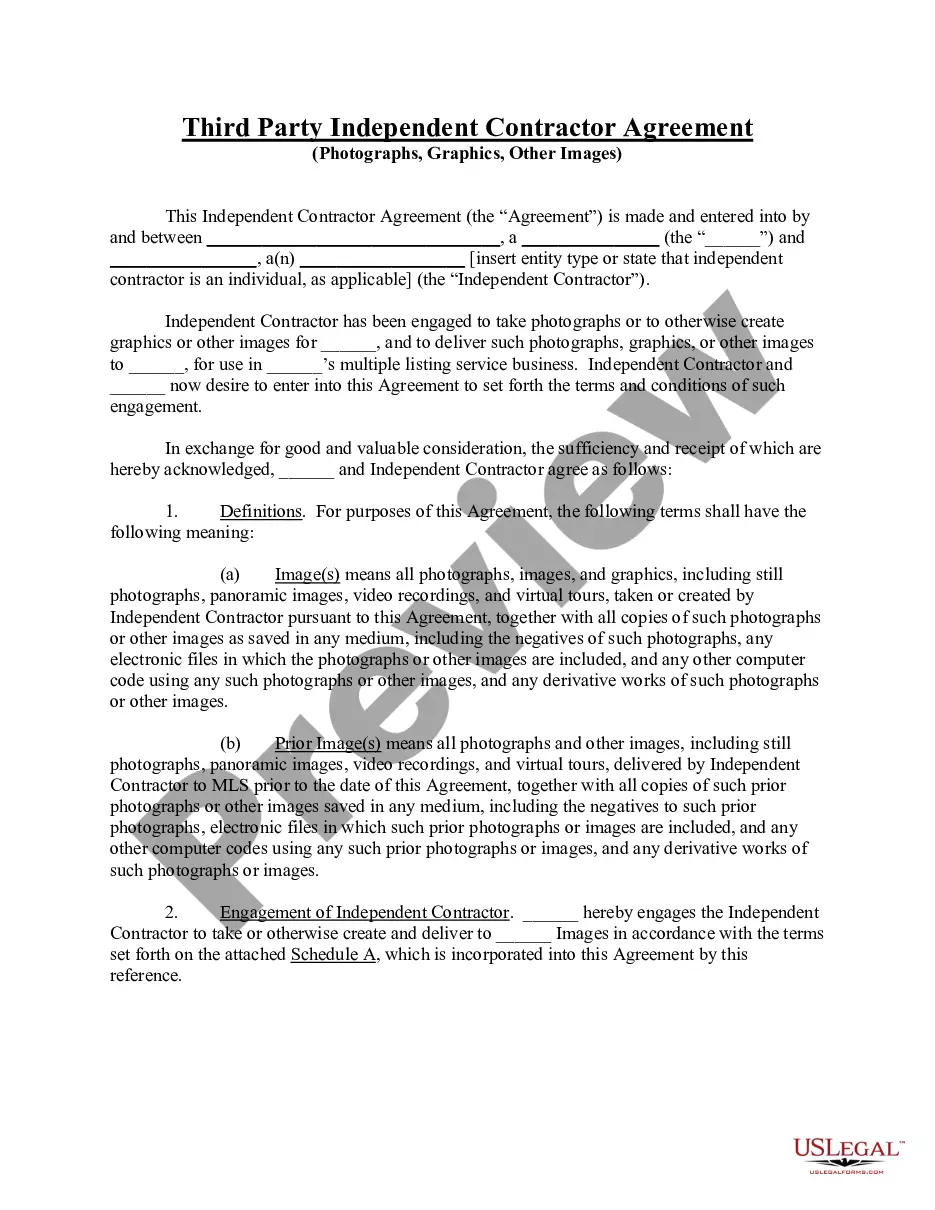

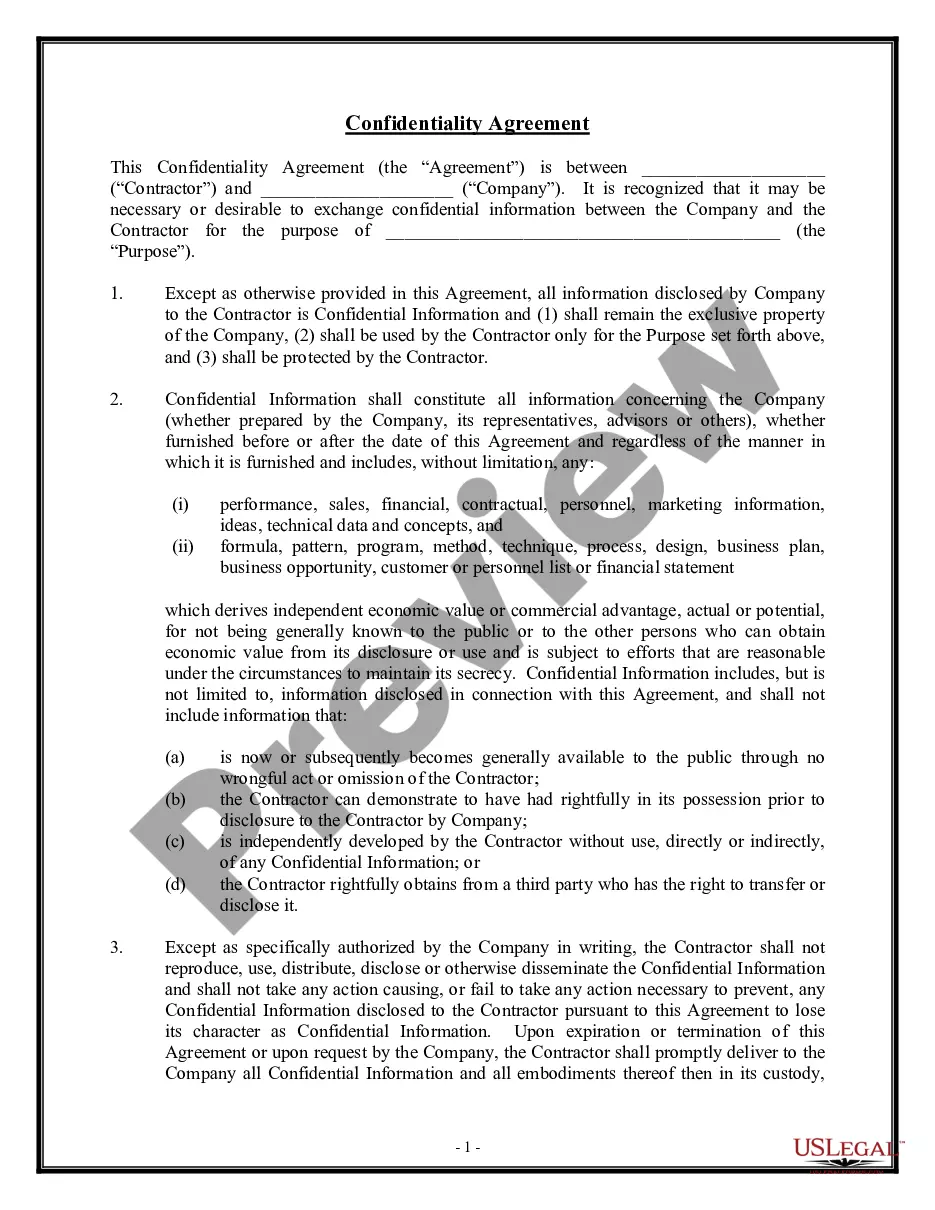

International Independent Contractor Agreement

Description

How to fill out International Independent Contractor Agreement?

Aren't you sick and tired of choosing from hundreds of templates each time you need to create a International Independent Contractor Agreement? US Legal Forms eliminates the wasted time millions of American people spend browsing the internet for suitable tax and legal forms. Our skilled crew of attorneys is constantly updating the state-specific Templates collection, so that it always offers the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have an active subscription need to complete simple actions before being able to get access to their International Independent Contractor Agreement:

- Make use of the Preview function and read the form description (if available) to be sure that it’s the correct document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper template for the state and situation.

- Utilize the Search field on top of the page if you have to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your document in a convenient format to finish, print, and sign the document.

After you have followed the step-by-step guidelines above, you'll always have the ability to sign in and download whatever document you will need for whatever state you need it in. With US Legal Forms, completing International Independent Contractor Agreement samples or other legal files is not hard. Get started now, and don't forget to double-check your samples with certified lawyers!

Form popularity

FAQ

There is no requirement for U.S. companies to file an IRS 1099 Form to pay a foreign contractor. But as noted above, the company should require the contractor file IRS Form W-8BEN, which formally certifies the worker's foreign status.

1099 Contractors and Freelancers The IRS taxes 1099 contractors as self-employed. If you made more than $400, you need to pay self-employment tax. Self-employment taxes total roughly 15.3%, which includes Medicare and Social Security taxes. Your income tax bracket determines how much you should save for income tax.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Backup withholding rules apply, currently 24% (28% in 2017). Compensation payments of U.S. source income made to nonresident aliens are subject to 30% federal withholding (unless exemption exists) and are reported on Form 1042-S, Foreign Person's U.S. Source Income Subject to withholding, not a Form 1099.

However, the IRS has special rules for a business hiring contractors from foreign countries. Such businesses will not have any tax withholding or reporting obligations in most cases where a foreign contractor performs service outside of US.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

The self-employment tax rate is 15.3%, consisting of 12.4% for Social Security and 2.9% for Medicare. Unless you pay yourself as a W-2 employee, you'll need to pay the self-employment tax and your income tax directly to the IRS. Typically, you'll do this when you make quarterly estimated tax payments.

Generally, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. You do not generally have to withhold or pay any taxes on payments to independent contractors.