Washington Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

You might spend hours online trying to locate the legal document template that meets the federal and state requirements you need. US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can download or print the Washington Chef Services Contract - Self-Employed from the platform. If you already have a US Legal Forms account, you can Log In and hit the Acquire button. After that, you can complete, modify, print, or sign the Washington Chef Services Contract - Self-Employed.

Every legal document template you purchase belongs to you indefinitely. To obtain an additional copy of any purchased form, navigate to the My documents section and click the corresponding button.

Select the format of the document and download it to your device. Make changes to your document if necessary. You can complete, modify, sign, and print the Washington Chef Services Contract - Self-Employed. Obtain and print numerous document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for your state/city of choice. Review the form description to confirm you have chosen the correct form.

- If available, utilize the Review button to examine the document template as well.

- To find another version of the form, use the Search field to locate the template that suits your needs.

- Once you have found the template you require, click Buy now to proceed.

- Select the pricing plan you want, enter your credentials, and create your account on US Legal Forms.

- Finalize the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

Yes, a personal chef typically operates as an independent contractor. This means they manage their own business, set their hours, and determine how to fulfill their services. In this arrangement, a Washington Chef Services Contract - Self-Employed is essential to outline the expectations and responsibilities of both parties. This contract protects both the chef and the client by clarifying payment terms, service details, and more.

You can absolutely be a self-employed chef, which gives you the freedom to pursue your culinary passions on your terms. Many chefs find fulfillment in building their own brands and working directly with clients. By using a Washington Chef Services Contract - Self-Employed, you can set professional boundaries and enhance your business structure.

Yes, personal chefs are typically self-employed individuals who prepare meals for clients in their homes. This role offers flexibility, creativity, and the opportunity to build strong relationships with clients. A Washington Chef Services Contract - Self-Employed can help establish clear terms between you and your clients, ensuring everyone understands the services provided.

Yes, chefs often work as independent contractors, particularly in private service or project-based roles. This status allows them flexibility and autonomy over their work. Having a well-structured Washington Chef Services Contract - Self-Employed can define the terms of the working relationship and clarify expectations.

While you can refer to yourself as a chef, proving your skills and qualifications can enhance your credibility. Many clients prefer working with chefs who have formal training or significant experience. A Washington Chef Services Contract - Self-Employed can help establish your professionalism and define your services.

Certainly, a chef can be self-employed and run a successful culinary business. Self-employment allows chefs to control their menus, hours, and client interactions. To ensure smooth operations, you may want to consider a Washington Chef Services Contract - Self-Employed that formalizes your terms and protects your interests.

Yes, private chefs are typically self-employed. They offer personalized meal preparation services to clients in their homes or selected locations. A Washington Chef Services Contract - Self-Employed can streamline your business operations by clearly defining your offerings and client expectations.

Yes, you can cook meals to sell from home, but you must comply with local health regulations and licensing requirements. A Washington Chef Services Contract - Self-Employed can help you outline your services, clarify responsibilities, and keep you aligned with these regulations. It's essential to check with your local health department to ensure you're following all necessary guidelines.

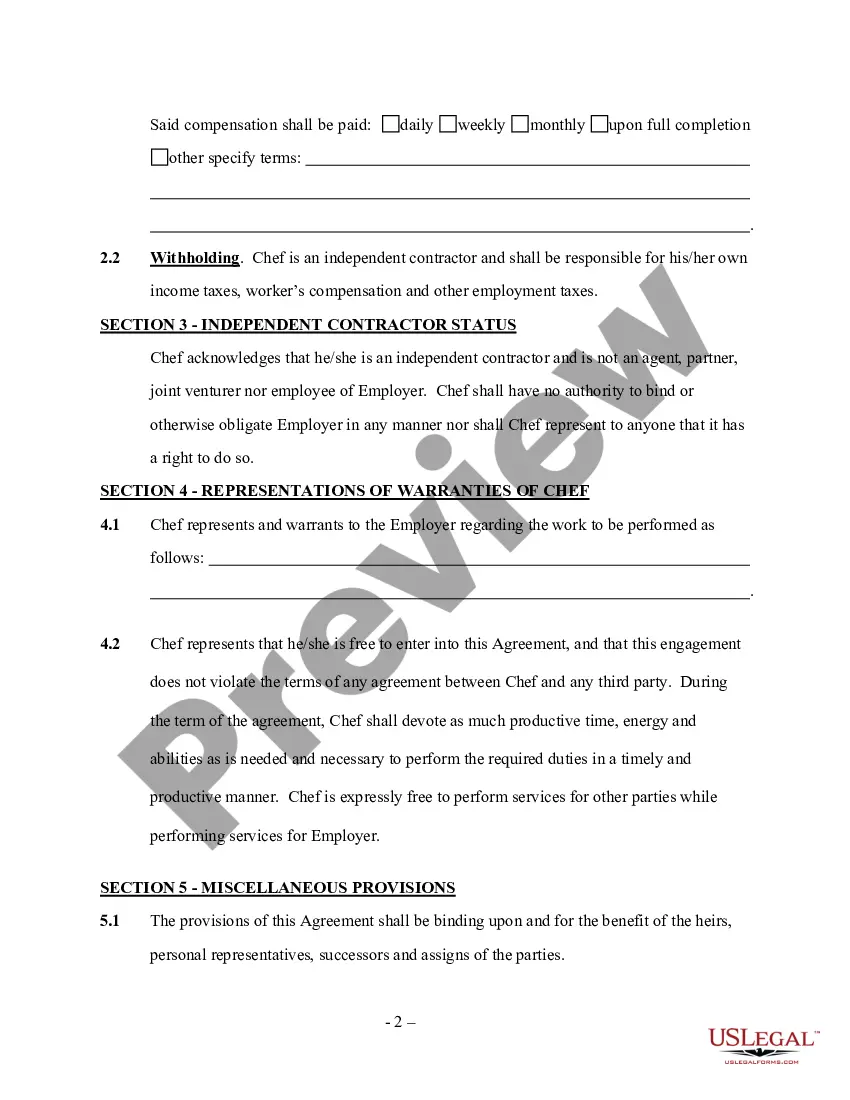

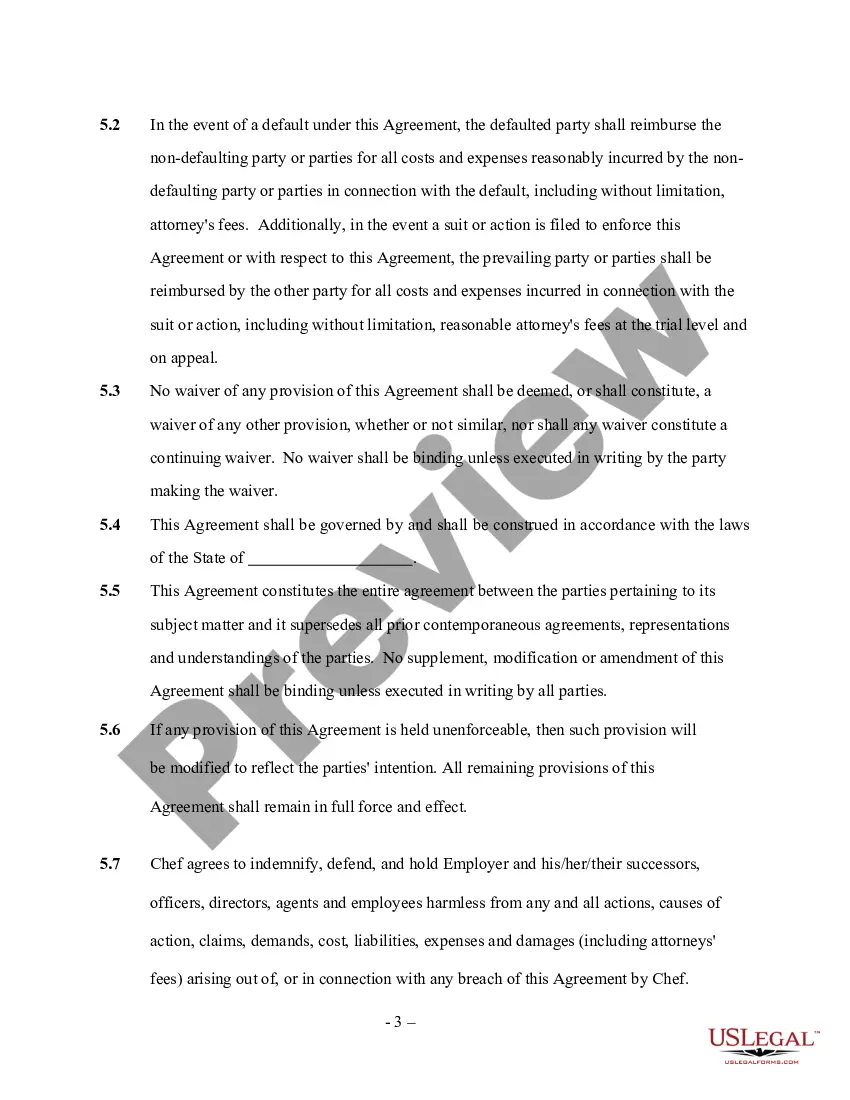

Writing a self-employment contract involves detailing your business relationship and responsibilities. Start by drafting sections for services rendered, payment arrangements, and termination clauses. Using the Washington Chef Services Contract - Self-Employed can streamline this process, ensuring that your contract is comprehensive and properly structured.

To write a self-employed contract, focus on clarity and precision. Include information about the services to be provided, payment details, and the duration of the agreement. Leveraging a template like the Washington Chef Services Contract - Self-Employed can help you cover all important aspects while adding professionalism to your agreement.