Washington How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a variety of legal template options that you can download or print.

Using the site, you can access thousands of forms for business and personal purposes, organized by categories, jurisdictions, or keywords. You can obtain the latest updates of forms such as the Washington How to Request a Home Affordable Modification Guide in just a few minutes.

If you already have an account, Log In to retrieve the Washington How to Request a Home Affordable Modification Guide from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit. Fill out, modify, and print and sign the acquired Washington How to Request a Home Affordable Modification Guide. Each template you add to your account does not expire and is yours permanently. Therefore, if you wish to obtain or print another copy, simply visit the My documents section and click on the form you require. Access the Washington How to Request a Home Affordable Modification Guide with US Legal Forms, the largest collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements and needs.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview button to review the form's content.

- Check the form summary to confirm you have chosen the appropriate document.

- If the form does not suit your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, finalize your selection by clicking the Get now button.

- Then, choose the pricing plan you wish to subscribe to and provide your information to register for an account.

Form popularity

FAQ

HAMP stands for Home Affordable Modification Program. It is a program created to help homeowners in financial distress by modifying their mortgage loans to make payments more manageable. Through the Washington How to Request a Home Affordable Modification Guide, you can learn how to apply for a modification under HAMP. This resource is essential for anyone looking to reduce their monthly payments and avoid foreclosure.

HAMP stands for Home Affordable Modification Program, a federal initiative aimed at assisting homeowners in modifying their mortgage loans to prevent foreclosure. HAMP offers a systematic way to reduce mortgage payments and helps borrowers achieve long-term financial stability. For a step-by-step approach, consider using the Washington How to Request a Home Affordable Modification Guide.

The primary purpose of the Home Affordable Modification Program is to help homeowners avoid foreclosure by making mortgage payments more manageable. It aims to provide sustainable modifications that lower monthly payments and improve the overall affordability of loans. If you're seeking a clear path through this process, the Washington How to Request a Home Affordable Modification Guide is a helpful tool.

Qualifications for the Virginia Mortgage Relief Program typically hinge on specific financial criteria, including income levels, mortgage status, and the homeowner's hardship situation. The program seeks to assist those facing challenges in making their mortgage payments. For detailed information on eligibility and assistance options, refer to the Washington How to Request a Home Affordable Modification Guide.

The Homeowner Assistance Fund (HAF) program in Washington state supports homeowners facing financial difficulties due to the pandemic. It provides funds to help cover mortgage payments, property taxes, and other housing-related costs. To understand how you can benefit from this program, the Washington How to Request a Home Affordable Modification Guide can be an essential resource.

The Home Affordable Modification Program (HAMP) helps homeowners adjust their mortgage payments to make them more affordable. This program is designed to prevent foreclosure by providing financial relief to struggling homeowners. If you're interested in learning about the HAMP process, our Washington How to Request a Home Affordable Modification Guide offers useful insights to navigate your options effectively.

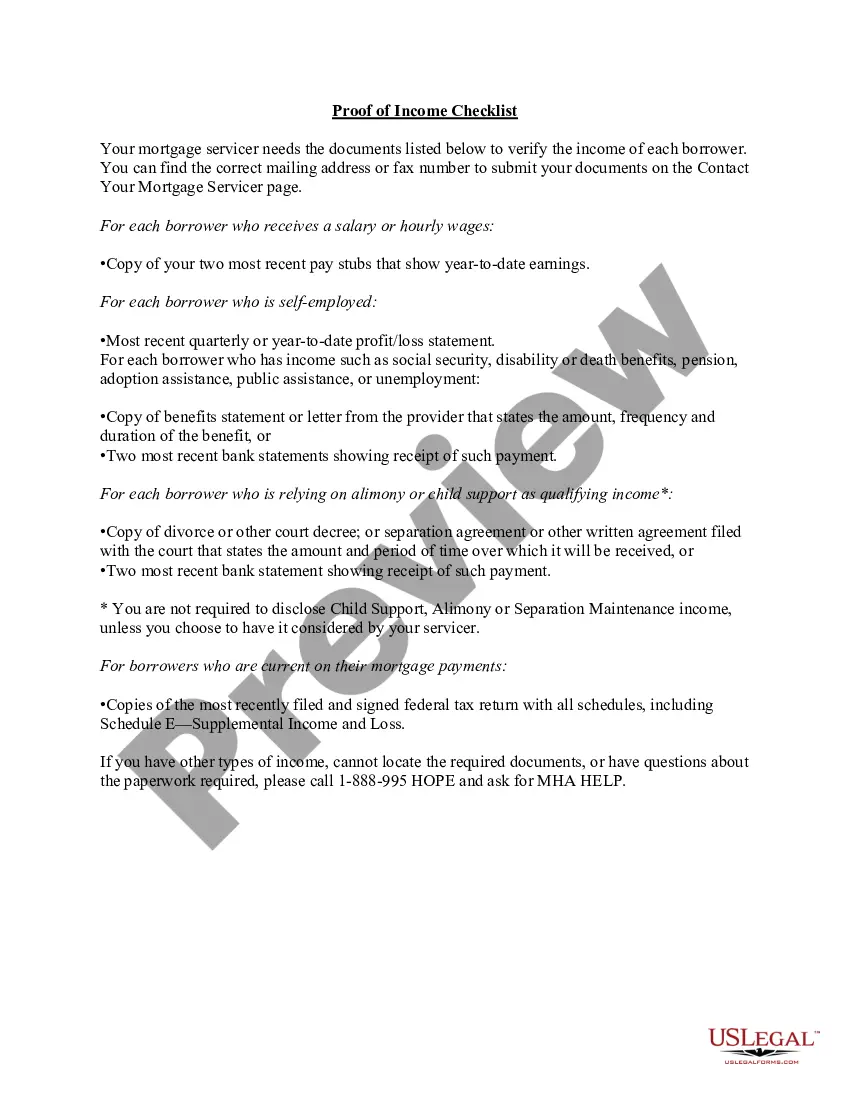

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

Why are only 20% of homeowners who apply getting approval for loan modifications? It's a staggering statistic, so lets look at why banks are denying this process in today's market.

The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay. Using an updated appraisal report the modification underwriter will confirm the current market value of the property as security for the loan.

To qualify for a loan modification under federal laws, the borrower's surplus income must total at least $300 and must constitute at least 15 percent of his or her monthly income.