Credit Memo Request Form

What this document covers

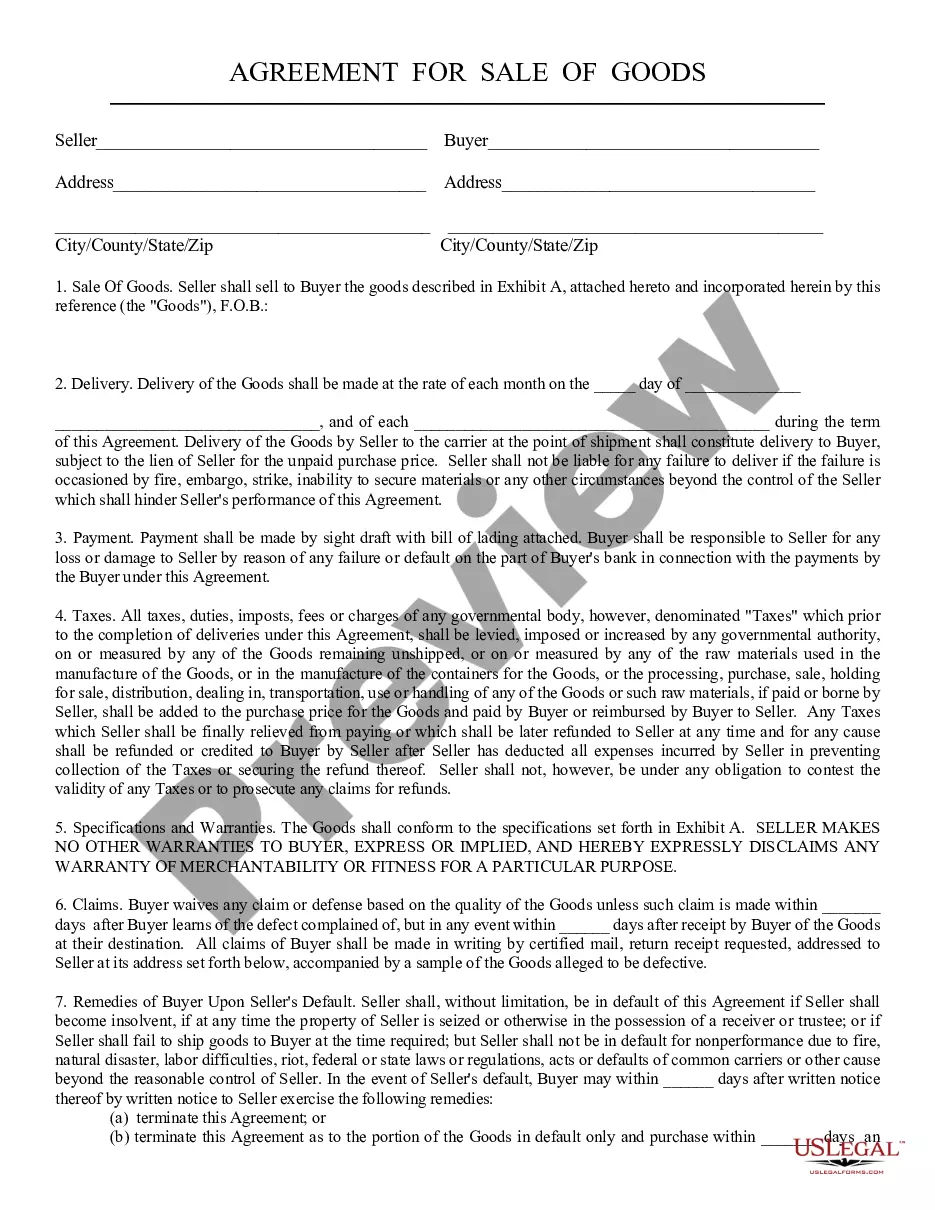

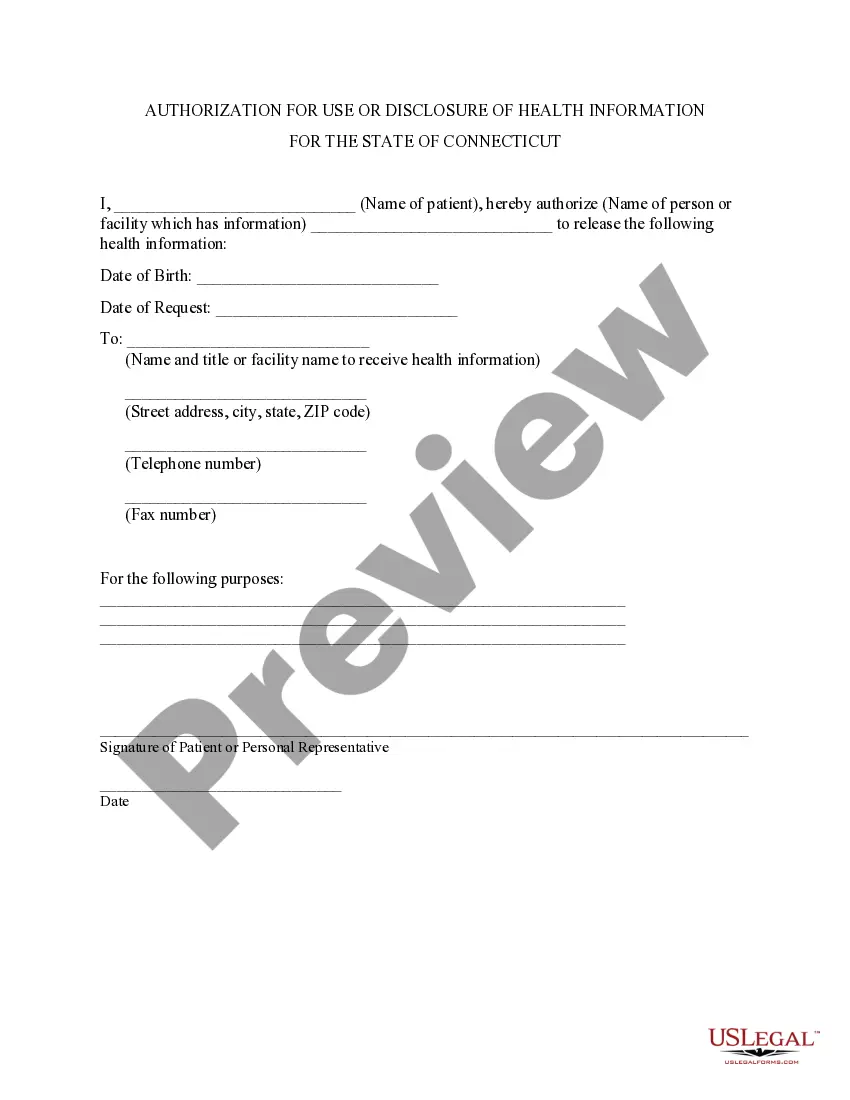

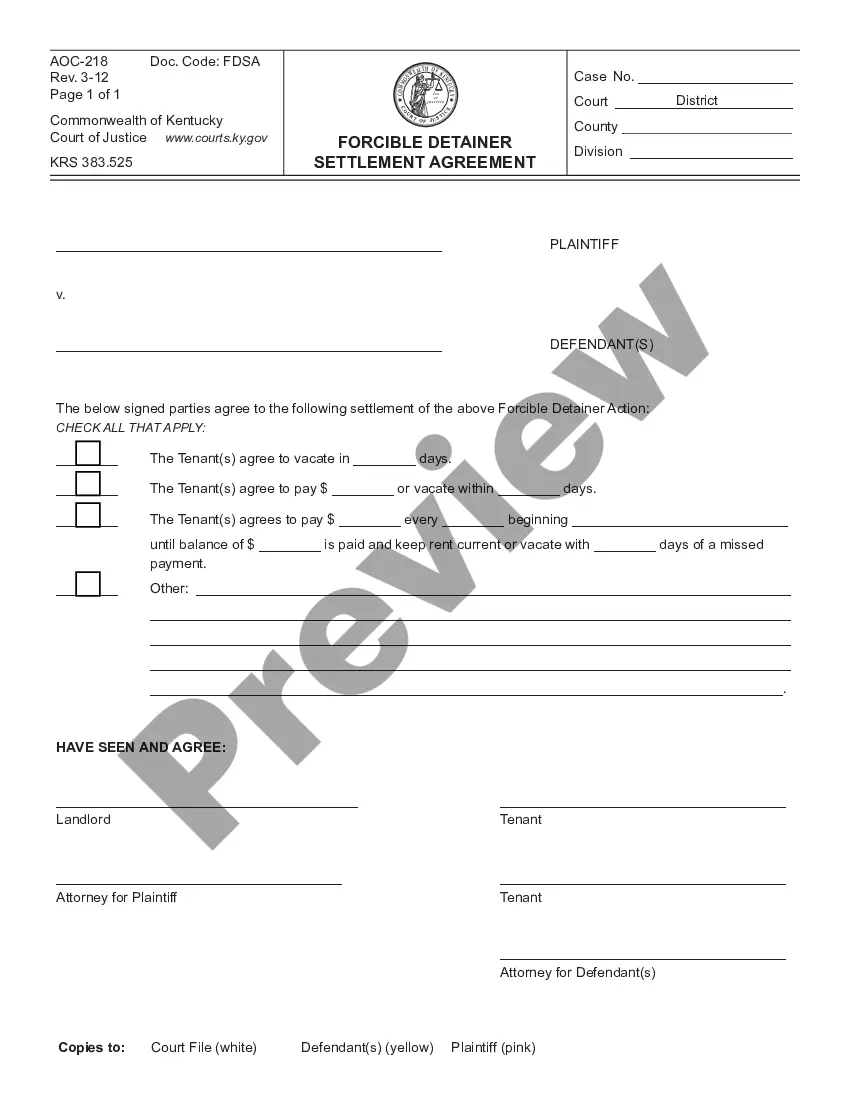

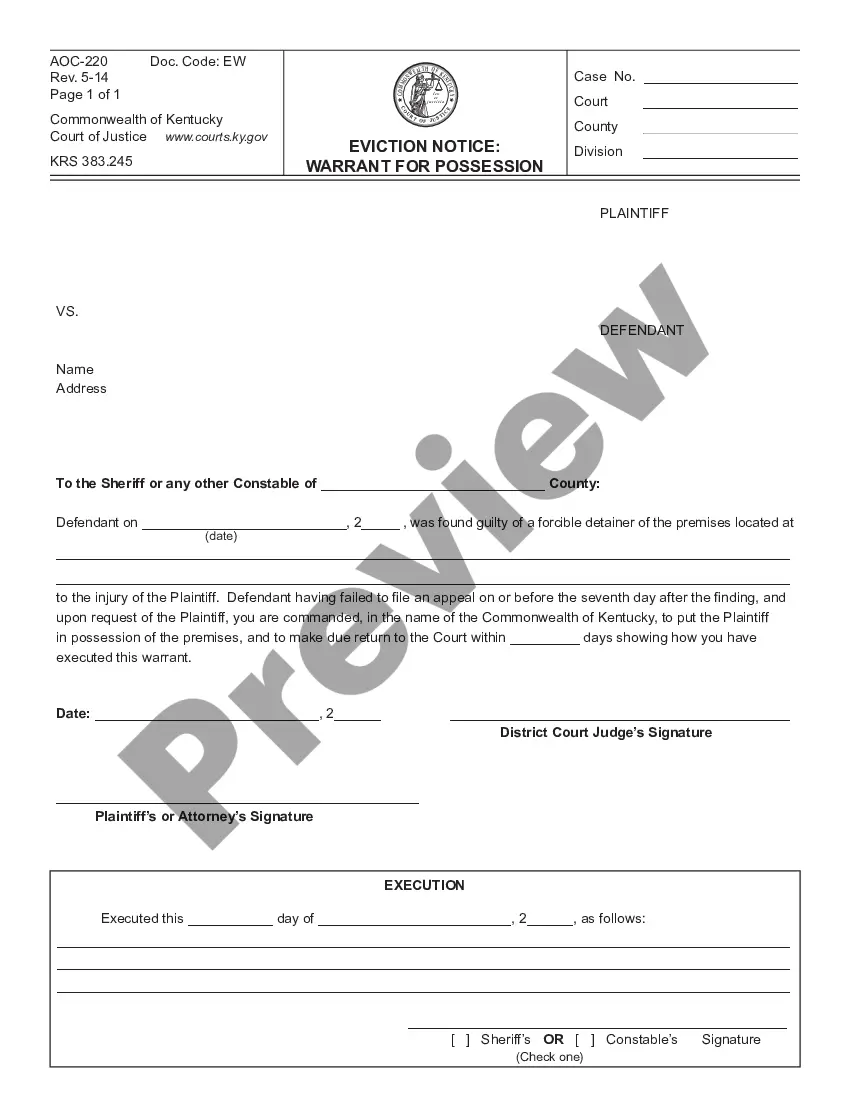

The Credit Memo Request Form is a business document used to request a credit memo and refund for merchandise or services that were not received as expected. This form helps businesses maintain accurate accounting records and facilitates refund processing. Unlike simpler refund requests, this form includes detailed information such as the customer's name, address, and the specific differences in pricing that warrant a credit. This ensures clarity and accountability in financial transactions.

Form components explained

- Customer name and address: Identifies the party requesting the refund.

- Refund method: Indicates how the refund will be issuedâeither by check or credit card.

- Receipt attachment: Requires a copy of the purchase receipt for verification.

- Part number and description: Details the item for which the credit memo is requested.

- Price difference: Specifies the amount that is eligible for a refund.

- Authorized signature: Requires a supervisor or manager's approval, ensuring the request is legitimate.

When this form is needed

This form should be used when a company needs to issue a credit to a customer due to discrepancies in pricing, a return of goods, or other billing errors. It is also necessary when a customer has been overcharged or when a refund is requested for returned merchandise. By using this form, businesses streamline their refund processes and maintain accurate records of financial transactions.

Who should use this form

- Business owners looking to process refunds to customers.

- Accounts receivable departments needing formal documentation for credit adjustments.

- Supervisors or managers responsible for authorizing credit memos.

- Employees tasked with maintaining financial records and ensuring accuracy in billing.

How to complete this form

- Identify the customer by filling in their name and address.

- Specify the method of refund, selecting either check or credit card.

- Attach a copy of the purchase receipt to the form.

- Provide details about the part number and a brief description of the item.

- Clearly state the price difference that is eligible for a refund.

- Ensure the form is signed by an authorized supervisor or manager for approval.

Is notarization required?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Forgetting to attach the required receipt, which can delay processing.

- Inaccurately calculating the price difference leading to incorrect refund amounts.

- Neglecting to obtain an authorized signature before submission.

- Failing to fully complete all fields, which may cause rejection of the request.

Why use this form online

- Convenience: Easily download the form at any time, from anywhere.

- Editability: Fill in the required fields digitally, ensuring clarity and accuracy.

- Reliability: Utilizes legally reviewed templates, ensuring compliance with business standards.

- Time-saving: Streamlines the refund process, allowing for faster issue resolution.

Looking for another form?

Form popularity

FAQ

Click the Plus (+) icon and select Credit Memo. Choose the customer name. Enter the Credit Memo Date. Fill in the necessary information. Click Save and close.

FB65- vendor credit memo Business scenario FB65 is used to create a vendor credit memo. This is when we owe the vendor money rather than the other way around. Menu Path-Accounting->Financial Accounting-Accounts Payable-Document Entry- FB65 Credit Memo. Or directly through the tcode FB65.

The contact information for your business (name, phone.nr, address, email) The contact information of your customer (name, phone.nr, address, email) Information from the original invoice including invoice nr, date and products/services. A new credit note number and date.

A few examples of a bank credit memo appearing in a company's bank account include: The bank adding interest that was earned for having money on deposit. The bank having collected a note for the company. A refund of a previous bank charge.

Enter T-code VA01 in command field. Enter order type field value as credit memo request . Enter order no in Order tab of Pop Up. Click on Copy Button. Enter Billing Block / Pricing Date / Order Reason and Billing Date in sales tab. Click on Save Button .

In regard to recording a credit memorandum, the buyer records the memo in its accounts payable. Accounts payables are balance as a reduction. The seller, then, must also record the memo as a reduction, but it is a reduction of its accounts receivable (money coming in).

The seller records the credit memo as a reduction of its accounts receivable balance, while the buyer records it as a reduction in its accounts payable balance.If the buyer has not yet paid the seller, the buyer can use the credit memo as a partial offset to its invoice-based payment to the seller.

To view this Go to VA02 > enter the credit memo request number > from menu > select sales document > output > preview. If its Credit memo, then its a billing document so you need to go to VF02/VF03 and from menu select > billing doc > issue ouput to > preview.