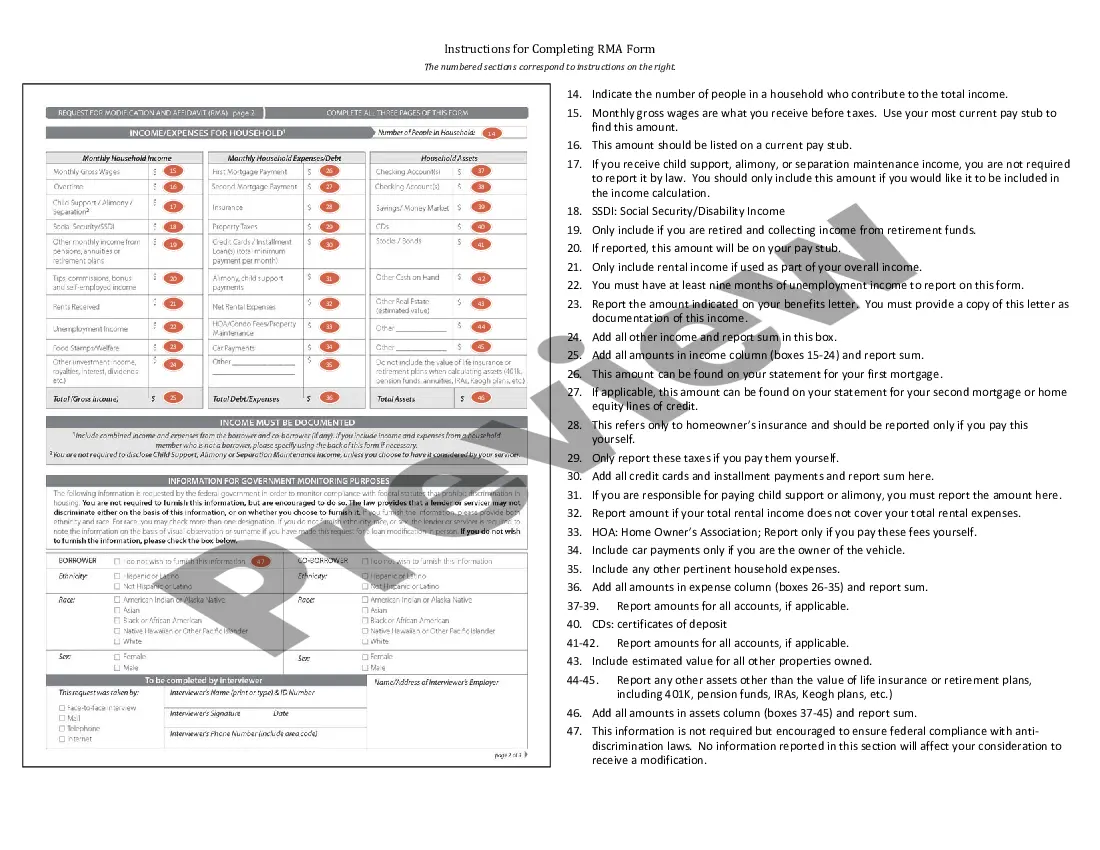

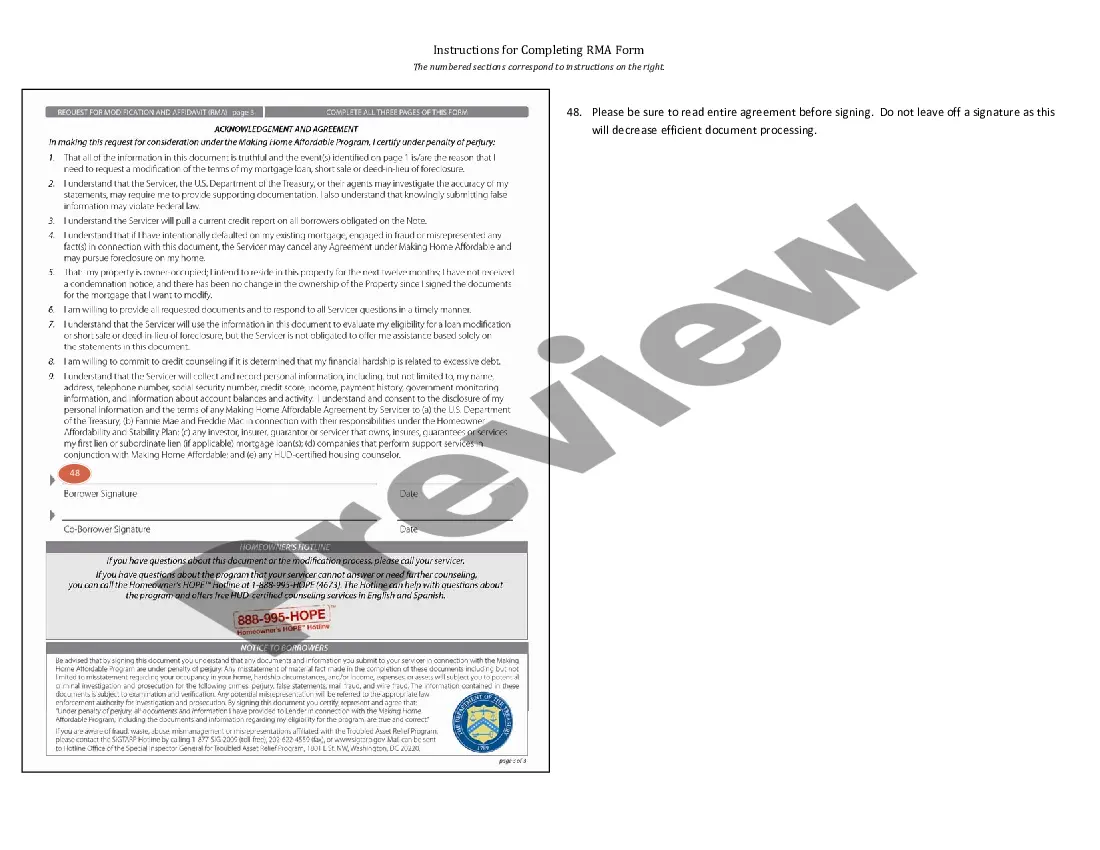

Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

If you need to obtain, download, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to find the documents you require.

Different templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you find the form you need, click the Get now button. Select the pricing plan you prefer and enter your credentials to set up an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to quickly acquire the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

- If you are already a US Legal Forms customer, Log In to your account and select the Download button to access the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

- You can also view forms you previously purchased in the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review button to examine the form's content. Make sure to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the page to find alternative versions of your legal form type.

Form popularity

FAQ

RMA in mortgage stands for Request for Mortgage Assistance. This specific form is part of the loan modification process, designed to help borrowers explain their financial difficulties to lenders. Utilizing the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form makes your request clearer and more organized. Successfully completing this form can facilitate a smoother dialogue with your lender.

Loan modification rules can vary by lender, but generally, they require financial documentation that demonstrates your need for assistance. Lenders often expect proof of hardship, such as job loss or medical expenses. By following the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you ensure that you meet all necessary criteria. Adhering to these rules can increase your chances of receiving favorable loan modifications.

A loan modification form is a document that homeowners fill out to request changes to their existing mortgage terms. This form outlines your current financial situation and desired modifications, such as lower interest rates or extended loan terms. Completing the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form streamlines this process, ensuring you provide all required information. Properly filling out this form can significantly impact your overall mortgage experience.

In real estate, RMA also refers to Request for Mortgage Assistance. This term connects to the broader process of loan modification, where homeowners seek help in managing their mortgage payments. Understanding the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form is essential for effectively communicating your needs to your lender. Using this form can lead to a more manageable loan scenario.

In the context of mortgage, RMA stands for Request for Mortgage Assistance. This form is crucial for homeowners seeking to modify their loan terms. By completing the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can formally request assistance from your lender. This assistance can help ease the financial burden you may be facing.

Several factors can lead to disqualification from a loan modification. Common reasons include failure to demonstrate financial hardship, a lack of sufficient income, or having a loan that does not meet specific modification criteria. By understanding the guidelines in the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can identify potential obstacles early. Engaging with platforms like US Legal Forms can provide you with the necessary tools to navigate these requirements effectively.

The full form of RMA is Request for Loan Modification and Affidavit. This document is essential in the loan modification process, providing necessary details to the lender. Utilizing the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can ensure that all required information is accurately submitted. This can significantly enhance your chances of receiving a positive outcome in your loan modification request.

The RMA mortgage form, or Request for Mortgage Assistance, is a crucial document used when seeking a loan modification. This form helps your lender understand your financial situation and your request for assistance. By utilizing the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can fill out the RMA form accurately, aligning your details with the necessary requirements.

Getting approved for a loan modification can vary based on your specific circumstances and lender requirements. However, providing all required documentation and following the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form can simplify the process. When you present a thorough case, demonstrating your hardship clearly, you increase your chances of a positive outcome.

A hardship Affidavit letter outlines your specific financial difficulties and why you cannot meet your mortgage obligations. It should clearly state your circumstances, such as a loss of income or unexpected expenses. When you follow the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you will find a structure that helps you convey your situation compellingly and effectively.