Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

If you aspire to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms accessible online.

Make use of the site's straightforward and user-friendly search function to find the documents you need.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form type.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to create an account.

- Use US Legal Forms to find the Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- You can also access forms you've previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to browse through the form’s content. Don’t forget to look over the description.

Form popularity

FAQ

The HAMP program was designed to help homeowners by modifying their mortgage payments to more affordable rates. Under the Washington Request for Loan Modification RMA, borrowers could receive interest rate reductions or loan term extensions. This program aimed to stabilize homeownership and prevent foreclosure by enabling homeowners to stay in their homes while managing their debts. Understanding the specific terms and your eligibility is vital for making the most of any available assistance.

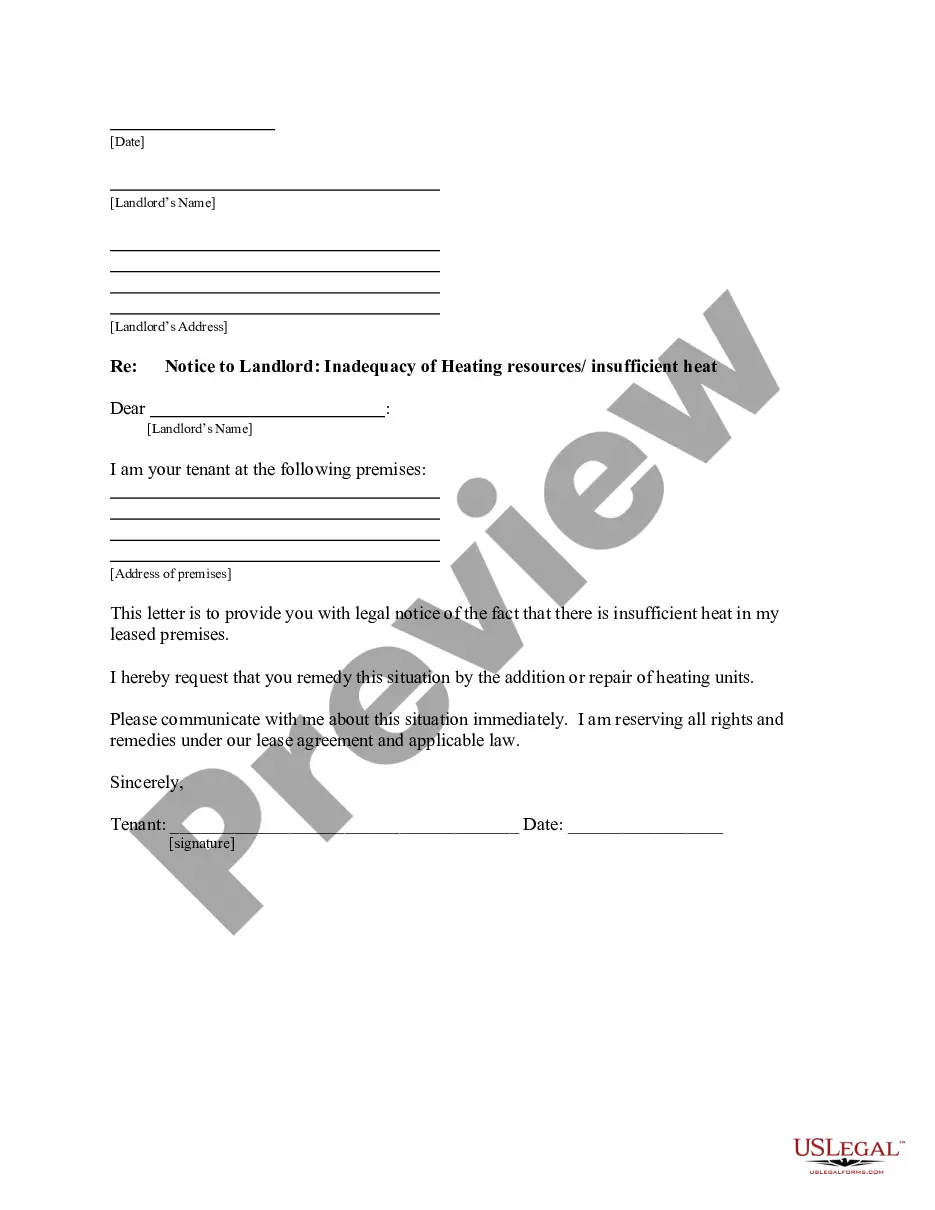

To apply for a loan modification, begin by preparing your financial documents, including income statements and expenses. Next, complete the Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP form accurately. Submit your request to your lender and be prepared to communicate regularly to provide any additional information they may need. Using platforms like uslegalforms can help you navigate the application process smoothly.

As of 2025, the Home Affordable Modification Program (HAMP) is no longer actively available since it officially ended in 2016. However, some similar programs may offer assistance for those seeking a Washington Request for Loan Modification RMA. It's critical to stay informed about available options through government programs or private lenders that continue to provide support to struggling homeowners. Always check with reliable resources for the most current information.

The RMA, or Request for Mortgage Assistance, is a key document used in the Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. This form allows borrowers to apply for assistance with their mortgage payments and provide essential financial information to lenders. Completing the RMA accurately can significantly impact the success of your loan modification request. Make sure to gather all necessary documentation before starting.

The primary downside of a loan modification under the Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is the potential impact on your credit score. While it may provide immediate relief, it can signal to future lenders that you were unable to meet your original loan terms. Additionally, some modifications extend the loan term, which can increase your overall interest payments. It’s essential to weigh these factors against your financial needs.

Yes, HAMP modifications are still available for eligible homeowners who meet specific criteria. Individuals looking to lower their mortgage payments can submit a Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Utilizing platforms like USLegalForms is beneficial as they provide essential resources and guidance to navigate the modification process effectively.

The Home Owners' Loan Corporation (HOLC) does not operate today, but its mission influenced many modern housing programs. While HOLC itself is not active, the principles of providing mortgage assistance continue through initiatives like the Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. This contemporary program aims to support homeowners and improve financial stability across the country.

Yes, Congress passed the Home Affordable Modification Program, commonly known as HAMP, to provide mortgage relief to homeowners facing financial challenges. This program allows eligible borrowers to submit a Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. It aims to help reduce monthly payments and keep families in their homes during tough economic times.

The HAMP loan modification program, or Home Affordable Modification Program, aims to assist homeowners struggling with their mortgage payments. The Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is a specific pathway for eligible borrowers to lower their monthly payments. Through this program, homeowners can achieve more affordable terms, ultimately helping them avoid foreclosure.

Applying for a loan modification begins with gathering the necessary documents, such as your mortgage statement, proof of income, and any financial hardship details. Next, fill out the Washington Request for Loan Modification RMA Under Home Affordable Modification Program HAMP application and submit it to your lender. Ensure you follow up promptly for any needed information, as this can expedite the process.