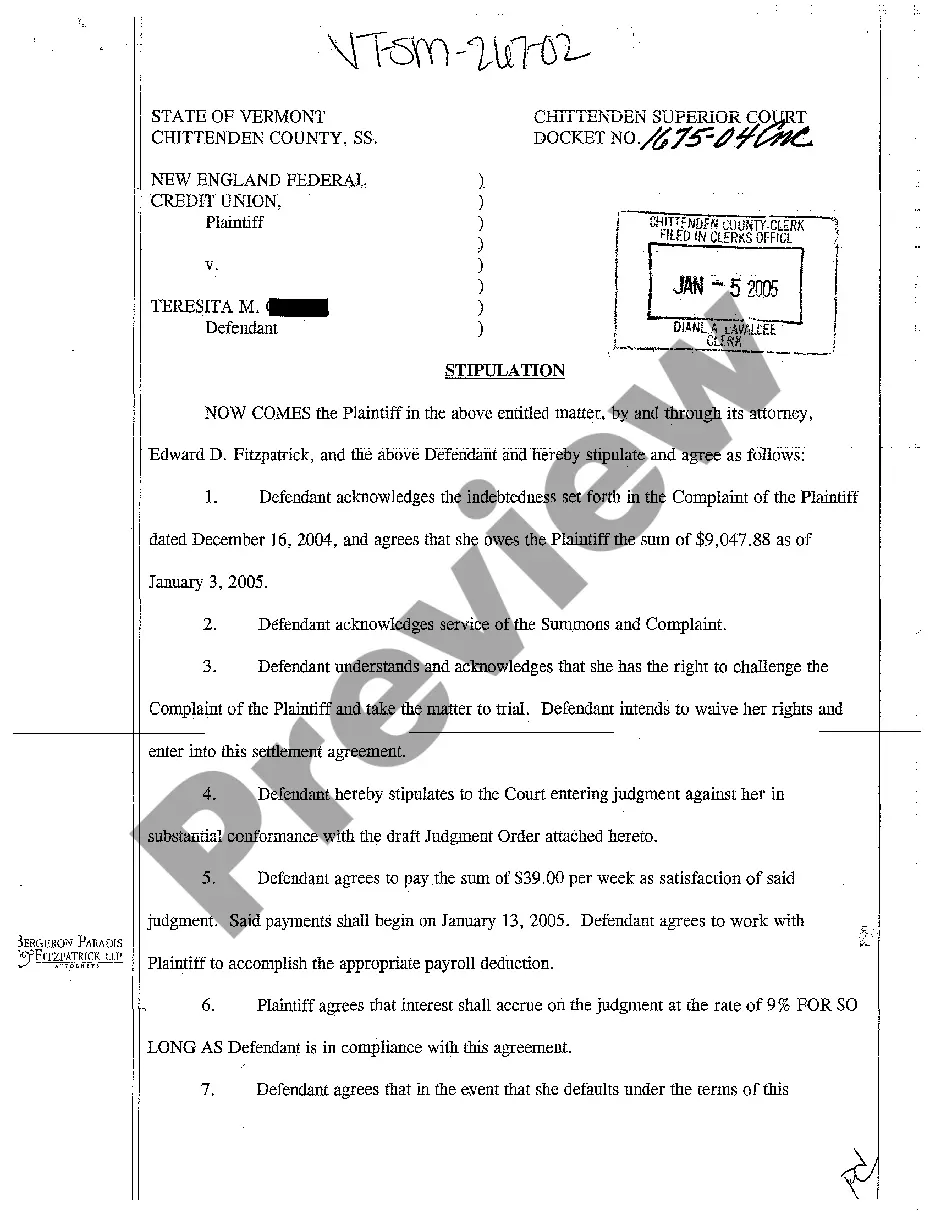

Vermont Stipulation By Debtor to Loan Amount and Interest Rate

Description

How to fill out Vermont Stipulation By Debtor To Loan Amount And Interest Rate?

Searching for a Vermont Stipulation By Debtor to Loan Amount and Interest Rate on the internet might be stressful. All too often, you see documents which you believe are ok to use, but find out later they are not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Get any document you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be added in in your My Forms section. In case you do not have an account, you should register and choose a subscription plan first.

Follow the step-by-step recommendations listed below to download Vermont Stipulation By Debtor to Loan Amount and Interest Rate from the website:

- Read the document description and click Preview (if available) to check whether the template suits your expectations or not.

- In case the document is not what you need, get others with the help of Search field or the provided recommendations.

- If it’s appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms library. Besides professionally drafted templates, users may also be supported with step-by-step instructions regarding how to get, download, and complete templates.

Form popularity

FAQ

With a longer duration comes a higher risk that the loan will not be repaid. This is generally why long-term rates are higher than short-term ones. Banks also look at the overall capacity for customers to take on debt.

Lenders charge interest on the money you borrow, and your rate determines how much extra you will need to pay back in addition to your loan principal. The lower your interest rate, the less money you owe over your loan's term length. Interest rates impact monthly payments far less than term lengths.

Usury is the act of lending money at an interest rate that is considered unreasonably high or that is higher than the rate permitted by law.Over time it evolved to mean charging excess interest, but in some religions and parts of the world charging any interest is considered illegal.

A. The Basic Rate: The California Constitution allows parties to contract for interest on a loan primarily for personal, family or household purposes at a rate not exceeding 10% per year.

Each state is allowed to dictate what type of loans the usury laws are applied to.Private student loans. 2022 Agricultural, investment, commercial, and business loans.

Credit Score. The higher your credit score, the lower the rate. Credit History. Employment Type and Income. Loan Size. Loan-to-Value (LTV) Loan Type. Length of Term. Payment Frequency.

The maximum legal interest rate is 8% per year, with different rates applicable if there is a written agreement. Specific provisions include those involving contract rates on home loans, high-cost home loans, savings and loan associations, bonds sold below par, loans for less than $300,000, and equity lines of credit.

5. Loan term. The term, or duration, of your loan is how long you have to repay the loan. In general, shorter term loans have lower interest rates and lower overall costs, but higher monthly payments.

Typically, long-term loans are considered more desirable than short-term loans: You'll get a larger loan amount, a lower interest rate, and more time to pay off your loan than its short-term counterpart.If you're in a time crunch, a short-term loan from an online lender might be the better option for you.