Direct Deposit Agreement

What this document covers

The Direct Deposit Agreement is a legal document that enables funds to be electronically deposited into a designated bank account. It is commonly used by employees and government benefit recipients to facilitate the secure and timely transfer of payments. This form differs from traditional payment methods by eliminating the risks of lost checks and ensuring quicker access to funds.

Key parts of this document

- Authorization statement: Confirms consent for electronic debit and credit entries.

- Account information: Requires details such as routing and account numbers.

- Direct deposit amount: Specifies the amount to be deposited per pay period.

- Signature: The authorizing individual's signature is necessary for validation.

- Notification process: Describes how to terminate the agreement.

Common use cases

This form should be used when an employee or benefit recipient wants to set up direct deposits for their salary or benefit payments. It is especially useful for those who prefer to receive their payments electronically, thereby avoiding the hassle of physical checks and reducing the risk of loss or theft during the payment process.

Who this form is for

- Employees seeking direct deposit of their salary.

- Individuals receiving government benefits such as Social Security.

- Anyone wanting to set up recurring electronic payments into their bank account.

Completing this form step by step

- Enter the date of authorization at the top of the form.

- Provide the name of your employer and the financial institution's details.

- Fill in your bank account information, including routing and account numbers.

- Indicate the amount to be directly deposited each pay period.

- Sign the form and provide your Social Security number.

- Attach a voided check for verification of your checking account information.

Does this document require notarization?

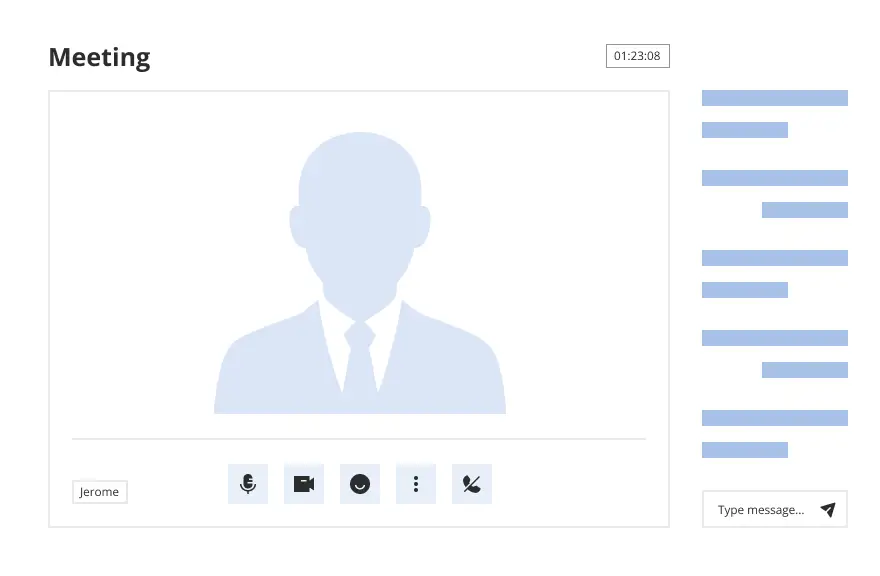

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

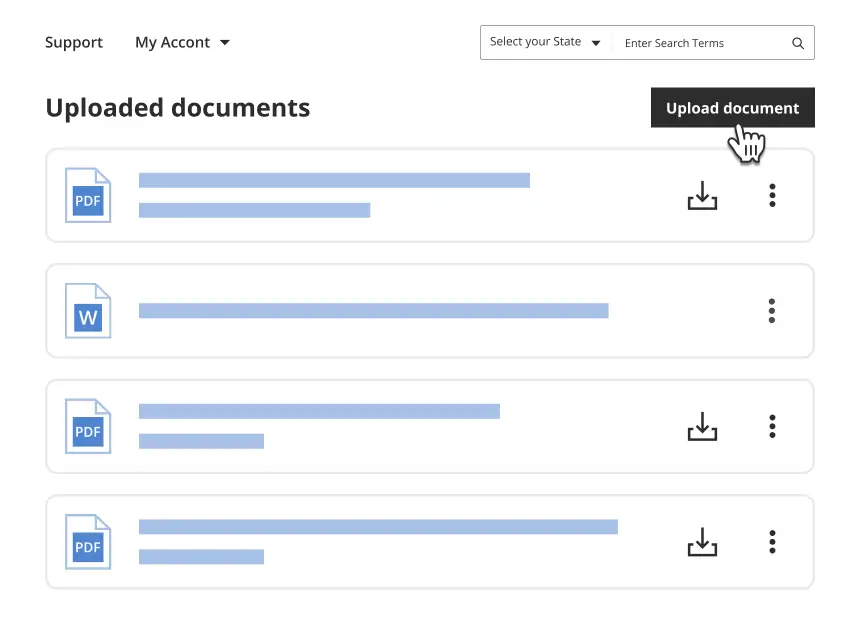

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not signing the form, which invalidates the agreement.

- Providing incorrect account or routing numbers, leading to failed deposits.

- Failing to notify the employer or bank in writing to terminate the agreement.

Why use this form online

- Convenient and easy to complete, saving time compared to paper forms.

- Editable fields that allow for accurate entry of necessary information.

- Secure handling of sensitive financial information.

Summary of main points

- The Direct Deposit Agreement streamlines payment processes.

- It reduces the risk of checks being lost or stolen.

- Understanding the completion steps ensures proper setup and use.

Looking for another form?

Form popularity

FAQ

Bank account number. Routing number. Type of account (typically a checking account) Bank name and addressyou can use any branch of the bank or credit union you use. Name(s) of account holders listed on the account.

Download our Direct Deposit Authorization form. Fill out the form and staple a voided Fifth Third check to it. For a voided check, write VOID across a blank check. Give the completed form to the company making the direct deposit. For payroll direct deposit, give the form to your HR contact.

Get a direct deposit form from your employer. Fill in account information. Confirm the deposit amount. Attach a voided check or deposit slip, if required. Submit the form.

Take an unused check from your checkbook for the account into which you want the funds deposited. Use a black pen or marker and write "VOID" in large letters across the front of the blank check. Submit your voided check, along with the completed direct deposit authorization form, to your employer.

Bank account number. Routing number. Type of account (typically a checking account) Bank name and addressyou can use any branch of the bank or credit union you use. Name(s) of account holders listed on the account.

How to set up direct deposit for your paycheck. Ask for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF). Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.

Choose a direct deposit payroll provider. You will need to set up a payroll service. Collect information from your employees. Add employees to the payroll system. Select your deposit schedule.

A direct deposit authorization form is a document that authorizes a third (3rd) party, usually an employer for payroll, to send money to a bank account by simply using the ABA routing and account numbers.

Get a direct deposit form from your employerAsk for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms.