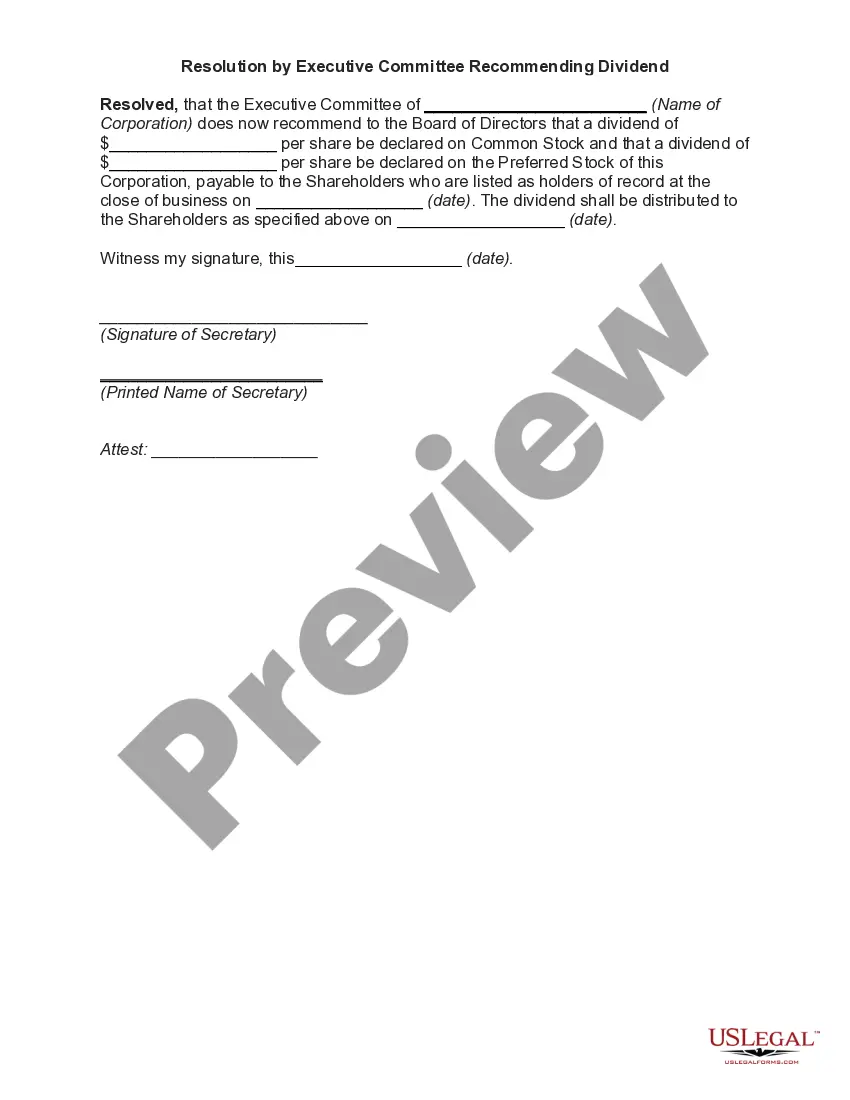

Resolution of Directors Approving Stock Dividend

Definition and meaning

The Resolution of Directors Approving Stock Dividend is a formal document used by a corporation's board of directors. This document outlines the decision to distribute a stock dividend to its shareholders. A stock dividend involves issuing additional shares to current shareholders instead of paying cash dividends, allowing the company to maintain its cash reserves while still rewarding its investors.

How to complete the form

Filling out the Resolution of Directors Approving Stock Dividend is straightforward. Follow these steps:

- Enter the amount of the stock dividend to be declared in the designated space.

- Insert the date on which the stock dividend will be issued.

- Specify the record date, which is the cutoff date for determining which shareholders are entitled to receive the stock dividend.

- Gather signatures from both the President and Secretary of the corporation to validate the resolution.

By accurately completing this form, corporations can ensure a clear, documented decision regarding the distribution of stock dividends.

Who should use this form

This form is ideal for the board of directors of any corporation considering the issuance of a stock dividend. It's particularly useful for businesses that aim to reward their shareholders while conserving cash for reinvestment or other operational needs. Individuals in leadership roles, including presidents, secretaries, and financial officers, should familiarize themselves with this document.

Key components of the form

The essential components of the Resolution of Directors Approving Stock Dividend include:

- The amount of the stock dividend being declared.

- The date of the stock dividend issuance.

- The record date for shareholder eligibility.

- Signature lines for the corporation's President and Secretary.

Each of these elements must be accurately completed to ensure clarity and legal validity.

Benefits of using this form online

Utilizing an online template for the Resolution of Directors Approving Stock Dividend offers several advantages:

- Accessibility: Users can access the form anytime and anywhere, facilitating timely completion.

- Convenience: Online forms often include guidance, making the filling process easier.

- Accuracy: Online templates minimize the risk of errors, ensuring that all necessary sections are addressed.

- Efficient Storage: Digital forms are easier to save, share, and retrieve when needed.

These benefits form a compelling case for using online legal form resources.

Common mistakes to avoid when using this form

When completing the Resolution of Directors Approving Stock Dividend, be mindful of common pitfalls:

- Failing to specify the exact amount of the stock dividend.

- Leaving the record date blank or incorrect.

- Not obtaining the required signatures from both the President and Secretary.

Avoiding these mistakes will help ensure the document's legality and effectiveness.

What documents you may need alongside this one

When preparing the Resolution of Directors Approving Stock Dividend, consider gathering the following documents:

- The corporation's bylaws, which outline the procedures for dividend declarations.

- Previous meeting minutes that may document the discussion around stock dividends.

- Financial statements to justify the dividend payment.

These documents can provide context and necessary support for the resolution.

Form popularity

FAQ

Directors will make a recommendation as to the amount of dividend, but they must seek approval from the members at a general meeting or via a written resolution. At this point, the shareholders can decide to reduce the level of dividend payment, but they cannot declare a higher amount.

XYZ CORPORATION RESOLVED: That the sum of is hereby set aside to be distributed to the common stockholders of the Corporation by a declaration of a dividend in the sum of $ per share for each and every share of common stock.

A company's accountants or comptroller recommends a dividend to the board of directors. The board reviews the company's financial statements and considers the dividend. If the board feels that a dividend is warranted, it votes to approve the payment. The declaration date is the day the approval is granted.

The directors make a recommendation to pay a dividend and this goes to shareholder approval via an ordinary resolution. Shareholders cannot increase the amount of dividend decided upon by the directors. Private companies don't have to vote on dividends at an AGM.

Hold the annual general meeting and pass an ordinary resolution declaring the payment of dividend to the shareholders of the company as per recommendation of the Board. The shareholders cannot declare the final dividend at a rate higher than the one recommended by the Board.

Cash dividends are declared by director resolution, which usually specifies a dollar amount per share and directs payment of the dividend to all shareholders entitled to receive it. Property dividends are less common, but are equally available for use by the board of directors.

A dividend declaration typically requires the board to adopt a resolution authorizing the dividend payment (although written consent from every member of the board to pay a dividend may take the place of a resolution).

Resolutions of the board of directors declaring a stock dividend. These resolutions can be used for either a private or public corporation. They are drafted as Standard Clauses to be inserted into board minutes or a resolution in writing of the board.