Recapitalization may be effected by the issuance of new shares, an exchange of new shares for old, or the retirement of existing shares.

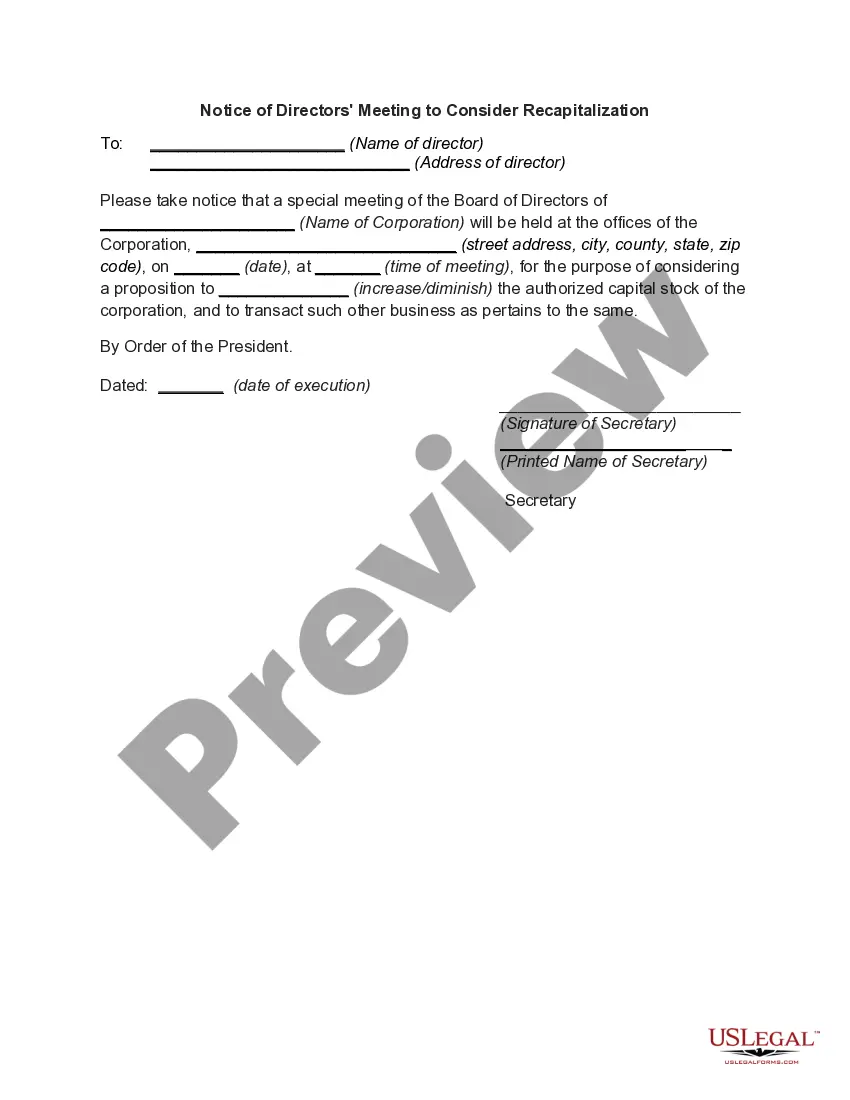

Directors' Resolution Authorizing Recapitalization is a resolution passed by a company's Board of Directors that permits the recapitalization of the company. Recapitalization is a corporate restructuring process in which the capital structure of a company is restructured for the purpose of improving the company's financial position and overall performance. The resolution usually outlines the details of the recapitalization, such as the number of new shares to be issued, the new capital structure, and the new voting rights of shareholders. The two main types of Directors' Resolution Authorizing Recapitalization are the Reverse Stock Split and the Stock Consolidation. A Reverse Stock Split reduces the number of outstanding shares of a company while increasing the par value of each share. This type of recapitalization is often used to improve a company's market capitalization and stock market performance. A Stock Consolidation, on the other hand, is a process where the company's shares are consolidated into a smaller number of shares. This type of recapitalization is used to reduce the company's number of outstanding shares, improve its capitalization structure, and increase its market value.