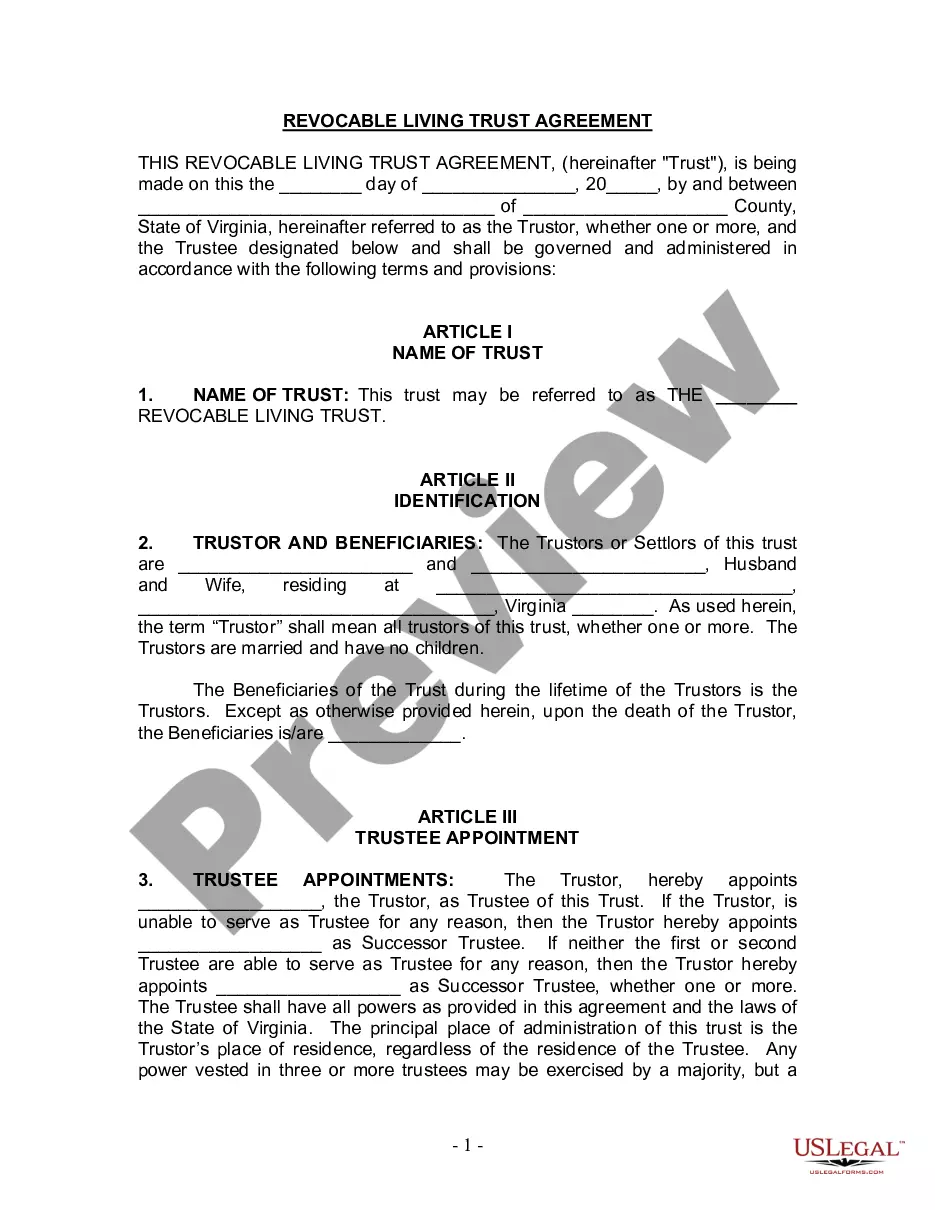

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Virginia Living Trust for Husband and Wife with No Children

Description

How to fill out Virginia Living Trust For Husband And Wife With No Children?

Looking for a Virginia Living Trust for Husband and Wife with No Children on the internet might be stressful. All too often, you see documents that you simply think are alright to use, but discover later they’re not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Have any form you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will instantly be included to your My Forms section. If you don’t have an account, you must register and select a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Living Trust for Husband and Wife with No Children from our website:

- Read the document description and click Preview (if available) to check if the template suits your expectations or not.

- In case the document is not what you need, get others using the Search engine or the listed recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms library. In addition to professionally drafted samples, customers will also be supported with step-by-step guidelines on how to get, download, and fill out forms.

Form popularity

FAQ

To inherit under Virginia's intestate succession statutes, a person must outlive you by 120 hours. So, if you and your brother are in a car accident and he dies a few hours after you do, his estate would not receive any of your property. (Virginia Code § 64.2-2201.) Half-relatives.

The term usually means your nearest blood relative. In the case of a married couple or a civil partnership it usually means their husband or wife. Next of kin is a title that can be given, by you, to anyone from your partner to blood relatives and even friends.

Heirs/Heirs at Law: the persons who would inherit the decedent's estate if the decedent died intestate, as determined by law at the time of the decedent's death.

Virginia is a common law property state. This means that in cases of intestacy, the estate is automatically inherited by the spouse.Therefore, if there is a surviving spouse, the spouse will receive the deceased's portion of all marital properties.

If a person does not have a will and they die, their assets pass according to Virginia's laws of intestate succession. If a person does not have any children, all of the assets pass to the spouse.If the person does not have a spouse or children, the assets pass to the decedent's parents.

Next of kin under Virginia law generally means the closest living relatives of the decedent. The Virginia Supreme Court has stated that the term next of kin is a nontechnical term whose commonly accepted meaning is 'nearest in blood. ' Elmore v. Virginia Nat'l Bank, 232 Va.

WHO INHERITS THE PROPERTY OF AN INTESTATE? someone other than the surviving spouse in which case, one-third goes to the surviving spouse and the remaining two-thirds is divided among all children. f0a7 if no surviving spouse, all passes to the children and their descendants.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.