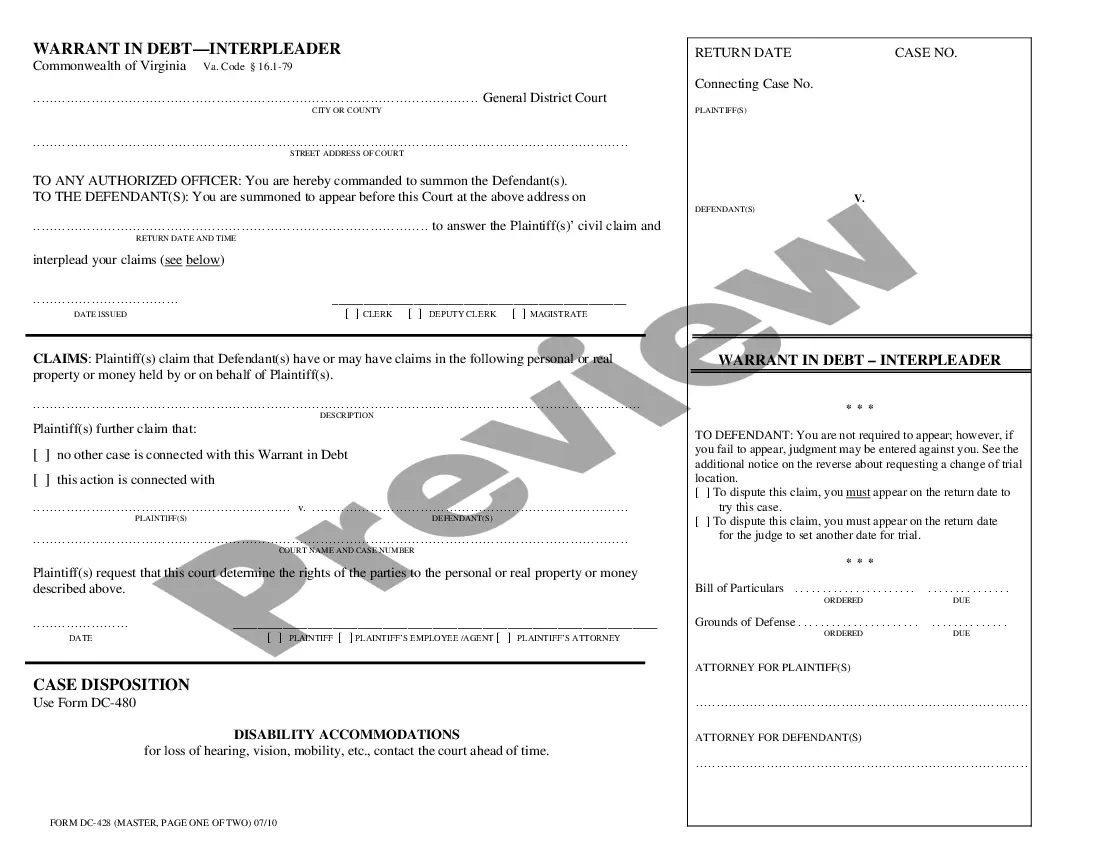

Virginia Warrant In Debt

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

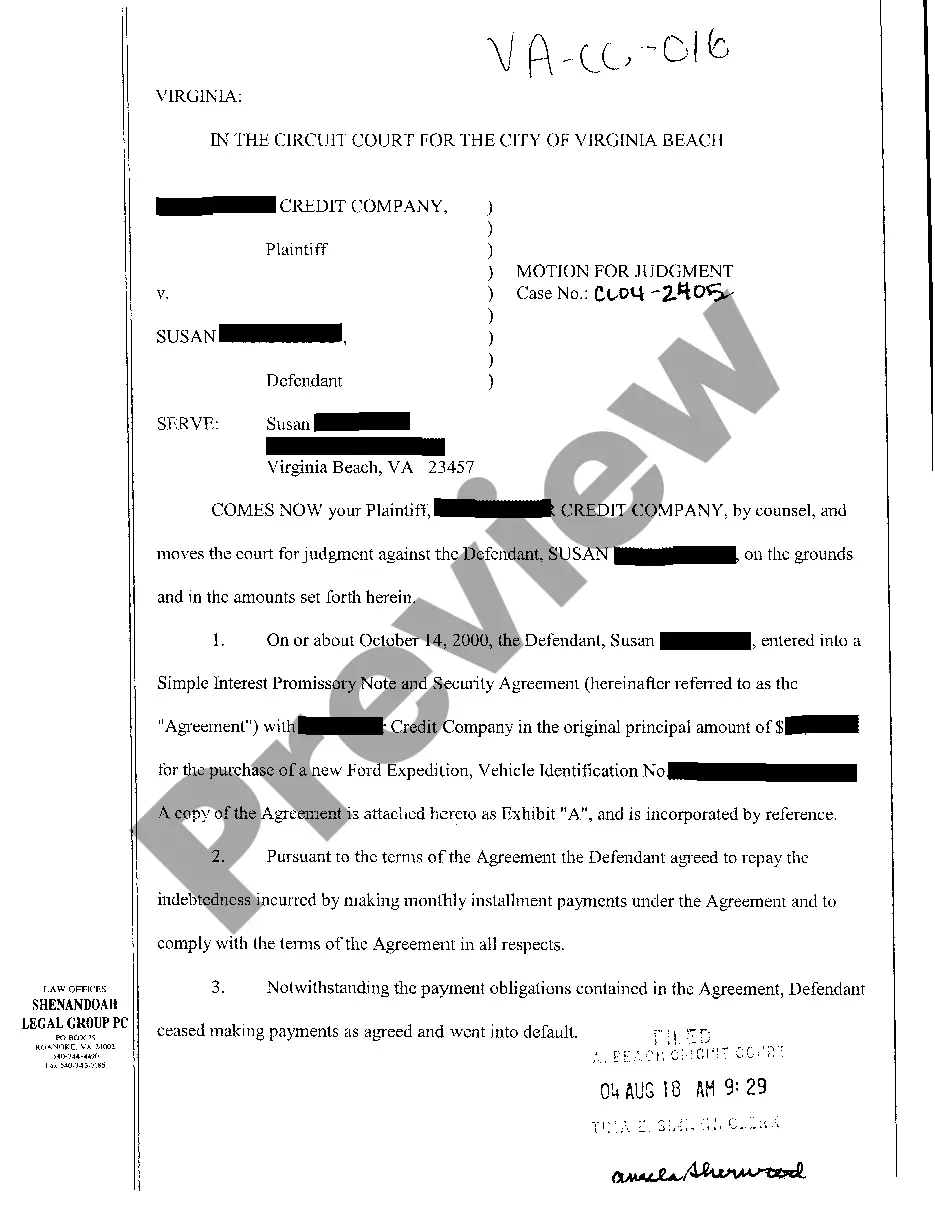

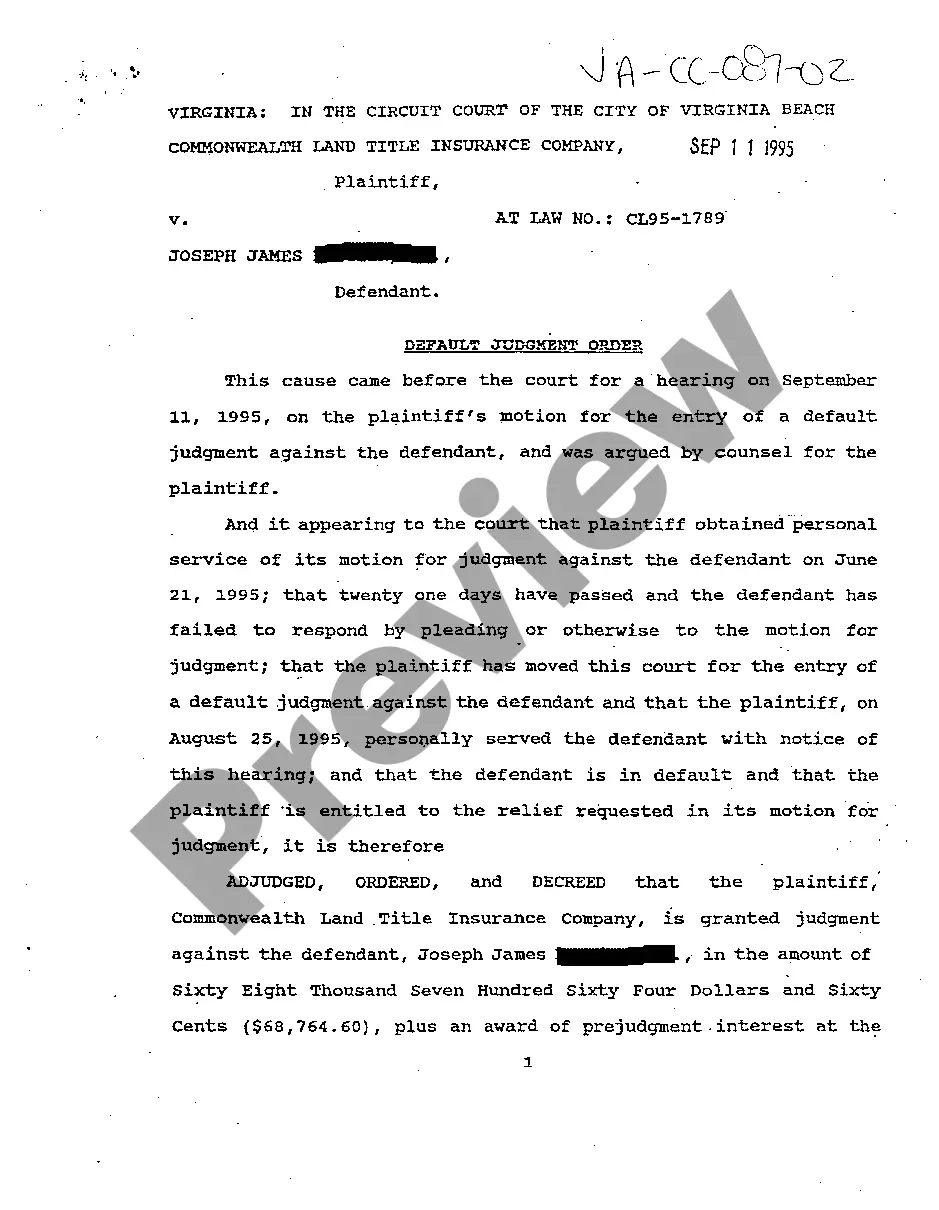

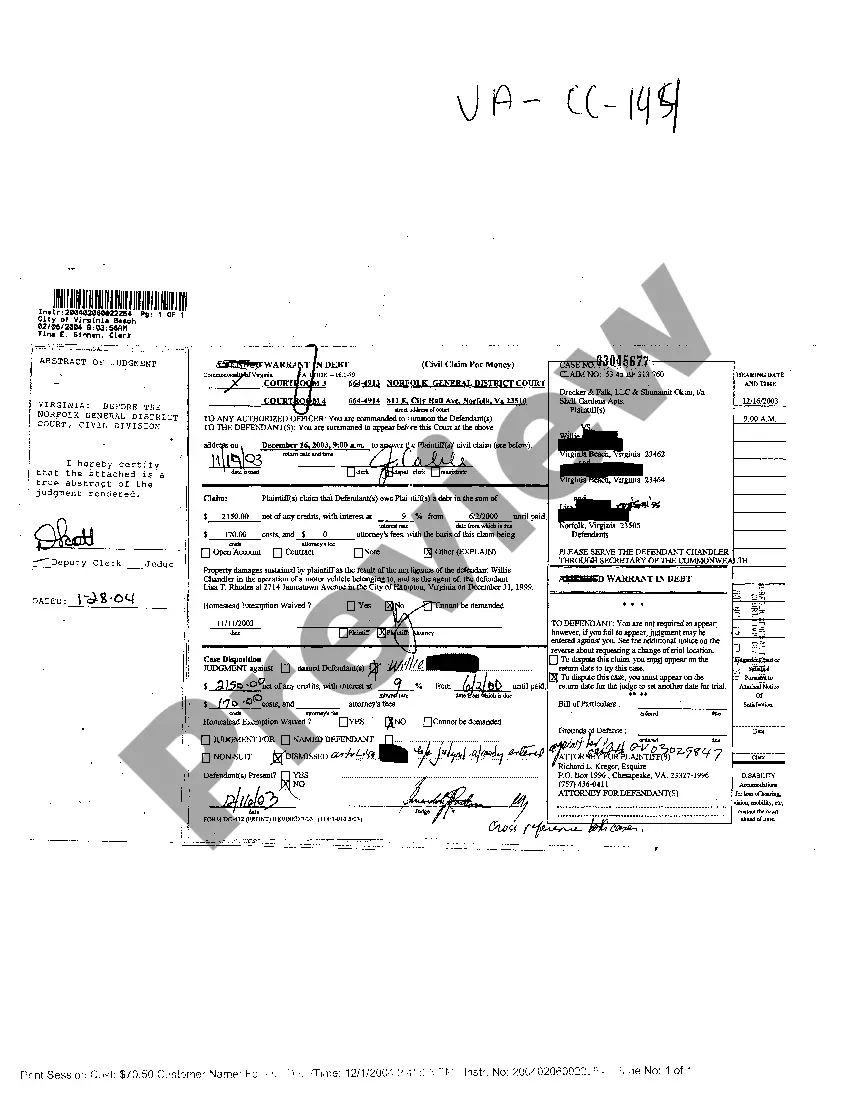

Warrant in Debt: A legal document issued by a court that initiates the process to demand payment of a debt. This typically involves a court date where the debtor needs to appear to respond. Default Judgment: If the debtor fails to respond or appear in court, a default judgment may be entered, empowering the creditor to seek various forms of debt recovery.

Lawsuit Defense: Strategies employed by a debtor to contest a warrant in debt during a court hearing.

Step-by-Step Guide

- Receive Notification: Understand that receiving a warrant in debt means you are being formally notified of a legal action for the debt owed.

- Respond to the Warrant: Do not ignore the warrant. Respond by the specified date to avoid a default judgment.

- Prepare for Court: Collect all necessary documents and evidence for your lawsuit defense. Consider consulting with an attorney experienced in consumer law.

- Appear in Court: Appear in court on the designated date. Non-appearance can lead to an automatic loss of the case via default judgment.

- Consider Resolution Options: If facing potential judgment, explore options like filing bankruptcy to determine if it could viably protect your assets.

Risk Analysis

Ignoring a warrant in debt can lead to severe consequences, including a default judgment. This may result in wage garnishment, asset seizure, and a negative impact on credit scores. Proactive handling by either disputing the debt or settling can mitigate these risks. Filing bankruptcy should be considered carefully, as it has long-term financial and legal implications.

Best Practices

- Timely Response: Always respond to a warrant in debt before the court date to possibly negotiate or dismiss the case.

- Legal Consulting: Consulting with a consumer law attorney can provide valuable insights and effective defense strategies.

- Documentation: Gather all relevant financial documents and correspondence related to the debt to support your case in court.

- Consider Settlement: In some cases, creditors may accept a negotiated settlement for less than the owed amount, which can be beneficial compared to a court ruling.

Frequently Asked Questions

What happens if I don't appear in court?

If you fail to appear in court, the court may issue a default judgment against you, which allows the creditor to take further collection actions.

Can bankruptcy stop a warrant in debt?

Filing for bankruptcy may halt the process temporarily due to the automatic stay provision, which stops most collection activities while bankruptcy proceedings are ongoing.

How to fill out Virginia Warrant In Debt?

Searching for a Virginia Warrant In Debt on the internet can be stressful. All too often, you find files that you believe are fine to use, but discover afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional lawyers according to state requirements. Get any form you are searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added in to your My Forms section. If you don’t have an account, you should sign-up and pick a subscription plan first.

Follow the step-by-step guidelines below to download Virginia Warrant In Debt from our website:

- See the document description and press Preview (if available) to check whether the form meets your expectations or not.

- If the form is not what you need, get others using the Search engine or the provided recommendations.

- If it’s right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- After getting it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms library. Besides professionally drafted samples, users are also supported with step-by-step guidelines on how to get, download, and fill out templates.

Form popularity

FAQ

Welcome to Warrant In Debt Info A warrant in debt is the paper you get when a bill collector is suing you in the Virginia General District Court. Warrant might sound like it's a criminal law problem. It's not: you can't go to jail; but if you ignore it, your pay and bank account can get garnished.

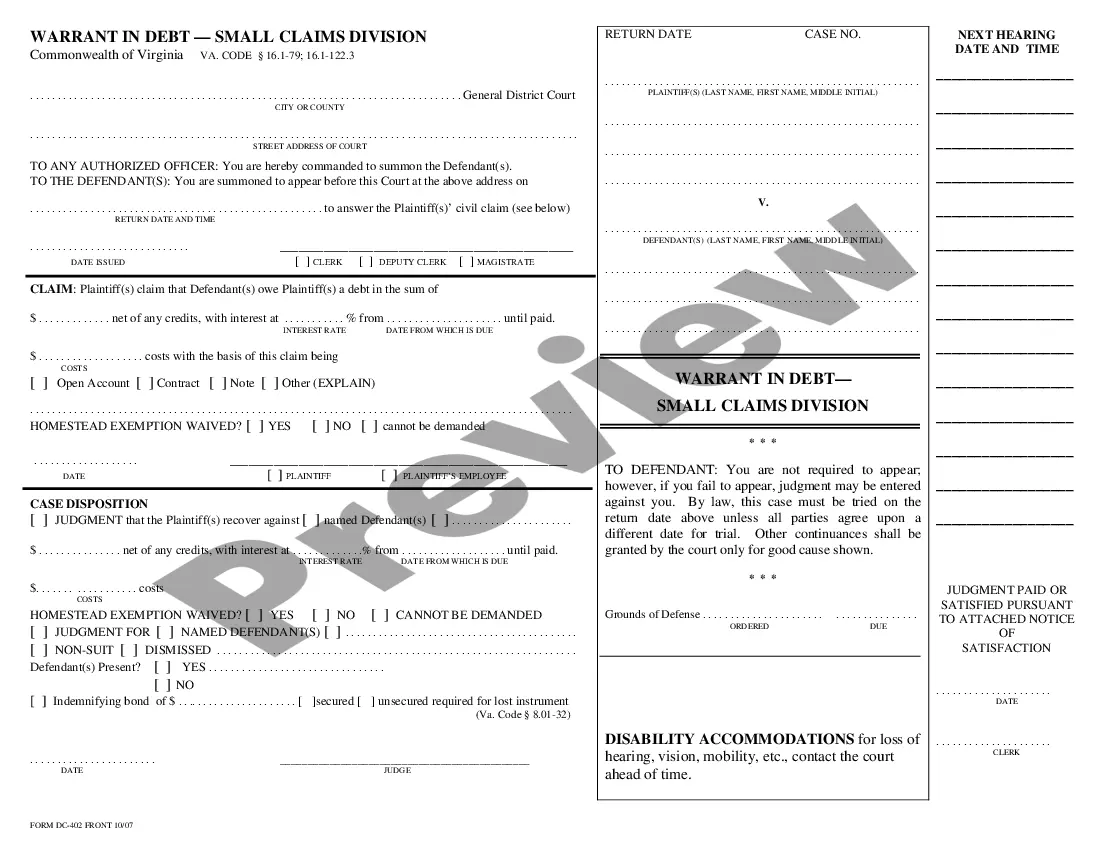

The small claims court is a special division of the general district court. The small claims court has jurisdiction (the authority to hear and decide a particular type of case) over civil cases in which the plaintiff is seeking a money judgment up to $5,000 or recovery of personal property valued up to $5,000.

It basically means someone, a person or a company, is claiming you owe them money. The purpose is of the Warrant in Debt is to get a judgment. A judgment, on its most basic level, is a court order that says you owe them money.

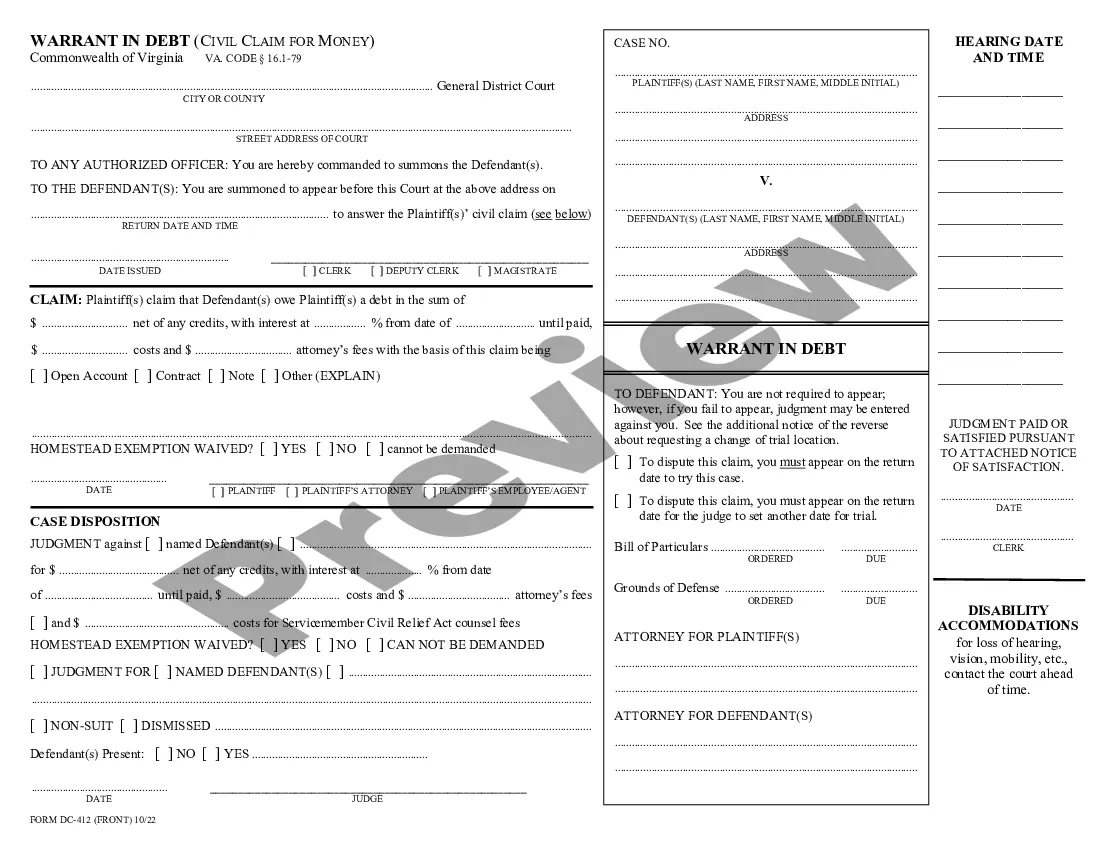

A warrant in debt serves as an expedited motion for judgment in Virginia and acts as (1) a summons appear before the appropriate GDC on the date listed to dispute the claim and/or (2) notice that if you do not appear, formal judgment may be entered against you in the amount claimed.

Virginia has a statute of limitations of six years for nearly all debts, including written contracts, oral contracts and open-ended accounts such as credit cards. That means that once such a debt is six years overdue, creditors can no longer attempt to collect the owed money.

Service of the warrant must be performed by a proper individual. The plaintiff may not properly serve the civil warrant. You may have a copy of the civil warrant served by the Sheriff's office by paying an additional fee at the time (or when) you file the civil warrant. In most Virginia jurisdictions the fee is $12.00.

To file this lawsuit, you must go to the General District Court Clerk's office. Ask for the proper court form. To sue for money, fill out a "Warrant in Debt." Even though this court form is called a "warrant," it is not used in a criminal case. It is used in a civil (non-criminal) case.